Helicopter Blades Market Size to exceed $685mn by 2025

Published Date: May 2019

Helicopter Blades Market size is estimated to surpass USD 685 million by 2025; according to a new research report by Global Market Insights Inc.

Rising helicopter demand from transportation and tourism industry will drive the helicopter blades market size over the forecast period. Industry participants are taking initiatives to promote urban air mobility solutions. In February 2018, Airbus and Fly Blade signed strategic partnership to provide on-demand premium helicopter flight service for 22 core routes in 7 U.S. states. Growing vertical flight mobility services will propel the industry growth.

Increasing rotorcraft demand for operation in remote areas will escalate the helicopter blades market share. Rotorcrafts have ability to travel laterally and backward along with vertical landing and takeoff operation. Rising offshore crude oil exploration projects will increase the helicopters demand, thereby driving the industry size. In December 2018, the number of exploration and production wells rose to 260 as compare to 211 in December 2017.Ongoing advancements in fabrication technology including 3D printing and rapid prototyping to reduce the overall manufacturing cost will support the helicopter blades market growth. The advantages offered by this technology including rapid prototyping and additive manufacturing techniques further accentuates the market demand. Most manufacturers are also opting for lower weight materials including composites and aluminum for enhancing the blade durability.

Get more details on this report - Request Free Sample PDF

Government regulations mandate the stringent testing and compliance of the blades for ensuring flight safety. Regulatory bodies including the Federal Aviation Administration (FAA) mandates the stringent fatigue and performance tests for ensuring material and performance safety. Moreover, the blades undergo multiple tests for determining cracks. Additionally, the regulations also mandate periodic maintenance and repair of such blades to maintain airworthiness, thereby expanding the helicopter blades market size.

Browse key industry insights spread across 300 pages with 613 market data tables & 11 figures & charts from the report, “Helicopter Blades Market, By Application (Military, Civil), By Blade Location (Main Rotor Blade, Tail Rotor Blade), By Material (Carbon Fiber Reinforced Plastic (CFRP), Glass Fiber Reinforced Plastic (GFRP), Others), By Distribution Channel (OEM, Aftermarket) Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/helicopter-blades-market

Military segment will showcase significant growth in the helicopter blades market share over the projected timeframe. This can be attributed to the rising military budget globally. Major economies are increasing their military spending every year to procure advanced new aircrafts and helicopters for enhancing their national combat forces. For instance, in March 2019, the U.S. government proposed a budget of around USD 720 billion for the Department of Defense for FY 2020.

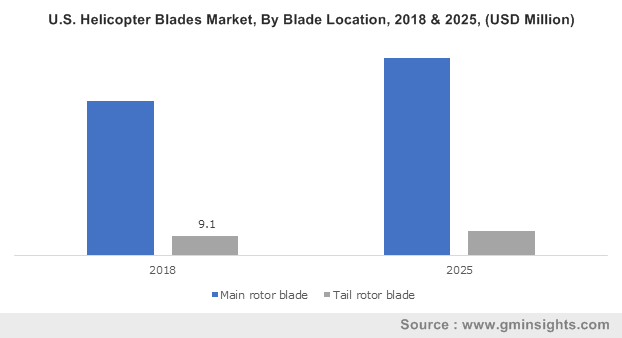

Main rotor blade will account for a significant revenue share in the helicopter blades market. This can be credited to the requirement for these blades for lifting and balancing the entire weight of the helicopter. The usage of ultrasonic profiling for producing sectioned and shaped blades with a focus on improving aerodynamics and flight performance further accentuates the segment share. Advent of five-blade rotor systems for helicopters with a focus on improving helicopter vibrations and harshness along with improving overall flight performance are expected to further boost the market size.

Carbon fiber reinforced plastic will account for a considerable volume share in the helicopter blades market. This can be attributed to the benefits offered by the material including higher stiffness, lower weight and superior strength to weight ratio. Industry players are continuously adopting the material across their products to minimize the cost and improve their operational margins.

OEMs accounted for the majority share in the helicopter blades industry size. This can be credited to the increasing helicopter production globally. Industry participants are continuously engaged in long term agreements and partnerships with manufacturers for maintaining a continuous supply of blades for catering to the rising helicopter demand. For instance, Kaman Corporation serves as an OEM manufacturer of composite helicopter blades for the SH-2G and K-MAX helicopters.

North America will hold a significant share in the helicopter blades market share. This can be attributed to the increasing prominence of on-demand and application-based helicopter services. For instance, in April 2017, Vroom initiated its commercial helicopter rental services with the capability of booking through mobile website and applications. Rising defense budget across the region is expected to positively influence the regional share.

Few of the major market participants include Airbus S.A.S., Van Horn Aviation, LLC, Bell Helicopter Textron, Boeing, Lockheed Martin Corporation, and Hindustan Aeronautics Limited. Industry players are continuously investing in R&D for developing advanced blades for improving their market share. For instance, in 2018, Kaman launched its advanced intermeshing rotors for its K-Max helicopters, that enables for precision placing and lifting operations with improved hovering capabilities.

Helicopter blades market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in units and revenue in USD million from 2013 to 2025, for the following segments:

By Application

- Military

- Civil

By Blade Location

- Main rotor blade

- Tail rotor blade

By Material

- Carbon fiber reinforced plastic (CFRP)

- Glass fiber reinforced plastics (GFRP)

- Others (Stainless steel, titanium)

By Distribution Channel

- OEM

- Aftermarket

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Poland

- Sweden

- Asia Pacific

- China

- India

- Japan

- South Korea

- Singapore

- Australia

- Latin America

- Mexico

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- Qatar

- UAE

- South Africa