Aerial Refueling System Market size worth $5 Mn by 2026

Published Date: June 2020

Aerial Refueling System Market size is set to exceed USD 5 Million by 2026, according to a new research report by Global Market Insights Inc.

Aerial refueling systems enables in-flight refueling, where fuel is transferred from one aircraft i.e., tanker to another i.e., receiver during flight. Aerial refueling is among the key technologies that has gained wide attention among several developed and developing countries to maintain air supremacy over the recent years.

Multi-functional tanker transport aircrafts to drive product demand

Increasing adoption of multi role tanker transport aircrafts that perform dual operations including air-to-air refueling and transportation operations will primarily drive the aerial refueling system market growth. The aircrafts are equipped with a combination of the military aerial refueling boom system, under wing refueling pods and Fuselage Refueling Unit (FRU) for refueling other aircrafts. The aircrafts also include Universal Aerial Refueling Slipway Installation (UARRSI) for self-in-flight refueling.

Industry participants are actively working on introducing innovative technologies in multi role tanker transport aircrafts for increasing its adoption for military purposes. For instance, in 2017, Boeing introduced its KC-46A MRTT with advanced technologies including electromagnetic pulse hardened for nuclear missions, chemical-biological protective systems, ability to refuel both boom receptacle and probe & drogue receiver aircrafts. The advanced tactical situational awareness system along with lower maintenance will support the market growth.

In 2019, the Multinational Multi-Role Tanker Transport Fleet (MMF) project under the European Defense Agency including nations such as Norway, Germany, Netherlands, Luxembourg, and Belgium ordered a fleet of eight multi role tanker aircrafts for coordinating between the nations in the field of air-to-air refueling providing a positive outlook for the industry.

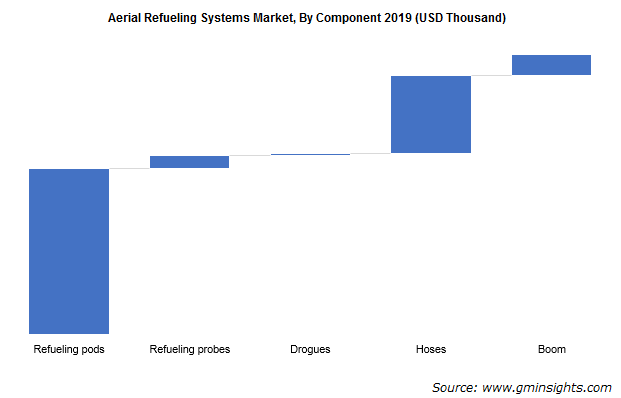

Browse key industry insights spread across 350 pages with 633 market data tables & 18 figures & charts from the report, “Aerial Refueling System Market Size By Application (Military Aircraft, Helicopters, Commercial Aircraft, UAV), By Component (Refueling Pods, Refueling Probes, Drogues, Hoses, Boom), By System (Probe and Drogue, Flying Boom), By Distribution Channel (OEM, Aftermarket), Industry Analysis Report, Regional Outlook, Application Potential, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/aerial-refueling-systems-market

Helicopter aerial refueling system market will foresee a steady growth of over 7.5% through 2026 owing to its application to overcome the need of refueling stops. The helicopters perform multiple tasks including transportation, military operations and delivering humanitarian aid. Countries are performing tests to increase Helicopter Air to Air Refueling (HAAR). For instance, in June 2020, U.S. Air Force conducted tests for HH-60G Pave Hawk.

High performance capabilities to support boom segment growth

Get more details on this report - Request Free Sample PDF

Boom component segment accounts for around 10% of the overall market in 2019 due to its usage in flying boom systems for transferring the fuel from the carrier to the supplier. Further, high component life, low maintenance, and ability to transfer fuel at faster rate i.e., approximately 6,000 lbs. per minute will fuel the product penetration.

Flying boom segment will witness significant growth during the forecast period, as it provides fuel flow rate up to 1,000 gallon per minute owing to large diameter of transfer pipe. The system is controlled by operator and less susceptible to pilot error. Further, ability to convert into multisystem refueling methods and working in adverse weather conditions will boost the market revenue.

Rising aerial combat operation to escalate Europe penetration

Europe aerial refueling system market is estimated to expand at significant CAGR between 2020 and 2026 with deployment of AAR systems to enable sustained air combat operations. The region is adopting pooling technique to acquire multirole tankers. In 2018, Belgium signed Memorandum of Understanding (MoU) with Airbus for the acquisition of A330 multirole tankers. In 2019, the MoU was amended with inclusion of Czech Republic. Growth in AAR capability across the region will fuel industry growth over the projected timeline.

Geographic expansion by manufactures to enhance competition

Major manufactures in the aerial refueling system market include, Lockheed Martin, Boeing, Cobham, Zodiac Aerospace, Eaton Corporation, GE Aviation System, Engineering Corporation, Northstar and Omega Aerial Refueling Services. The industry players are primarily focusing on merger, acquisition and expansion activities to attain competitive edge in the industry.