Summary

Table of Content

Medical Wearable Injector Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Medical Wearable Injector Market Size

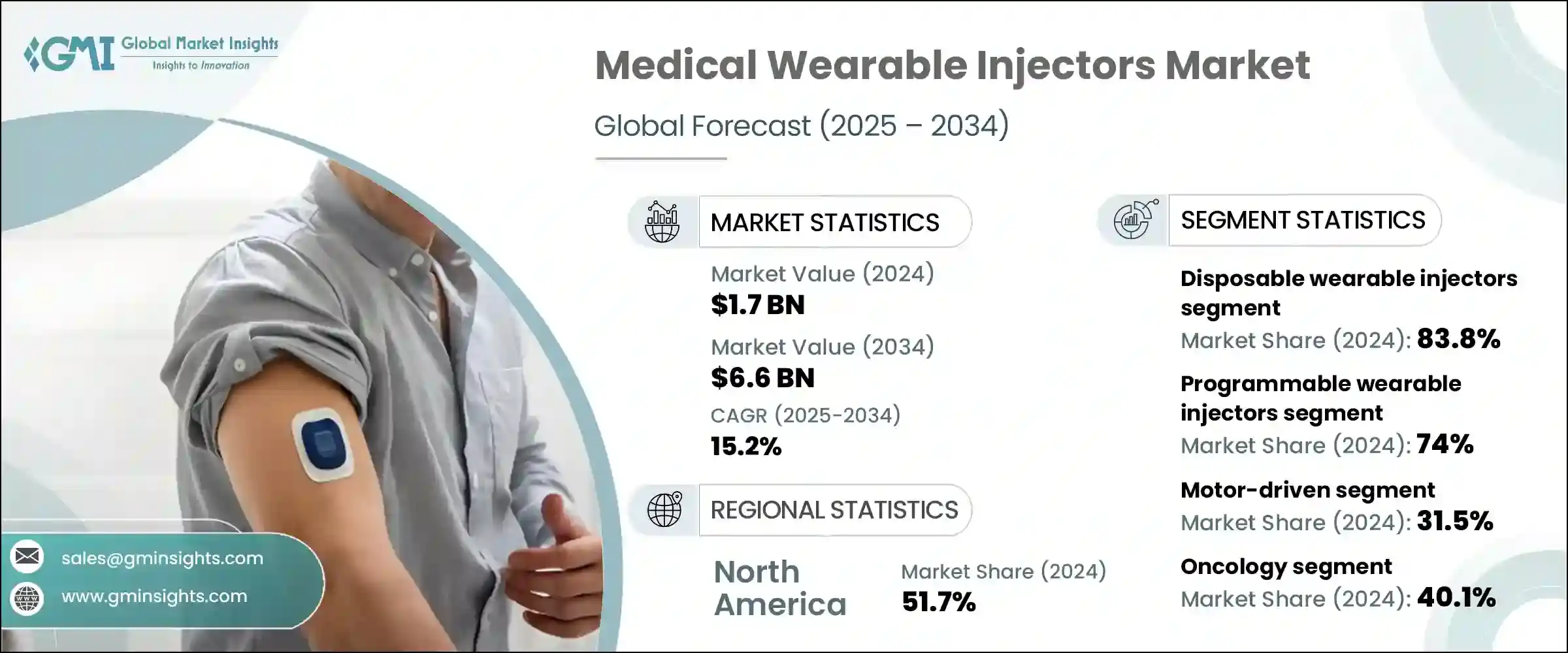

The global medical wearable injector market was estimated at USD 1.7 billion in 2024. The market is expected to grow from USD 1.9 billion in 2025 to USD 6.6 billion in 2034, growing at a CAGR of 15.2%. This high growth is attributed to several factors including rising prevalence of chronic diseases such as diabetes and cancer, increasing demand for home-based healthcare, and growing adoption of self-administration drug delivery technologies. Advancements in wearable technology and biologics are further fueling market expansion positively.

To get key market trends

A wearable injector is a smart medical device designed to deliver high-volume drugs subcutaneously over an extended period, typically worn on the body. Major players in the industry include Amgen, Bayer, Becton Dickinson (BD), Enable Injections, Ypsomed, Enable Injections, and Gerresheimer. Typically, biologics or large-volume injectables such as monoclonal antibodies, which cannot be administered using standard syringes or auto-injectors.

Medical Wearable Injector Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.7 Billion |

| Forecast Period 2025 - 2034 CAGR | 15.2% |

| Market Size in 2034 | USD 6.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing incidence of chronic conditions | Increasing use of wearable injectors for managing chronic diseases, improving adherence and reducing hospital visits. |

| Shift towards home-based healthcare | Growing adoption of wearable injectors for at-home treatment is easing pressure on clinical settings. |

| Increasing demand for biologics | Wearable injectors support convenient, patient-friendly subcutaneous delivery of biologics that require specialized administration. |

| Patient preference for minimally invasive devices | Patients favor wearable injectors for their discreet, needle-free-like experience and ease of use, enhancing adherence and satisfaction. |

| Global aging population | Surging elderly population with chronic conditions is propelling the demand for self-administered treatment solutions through medical wearable injectors. |

| Pitfalls & Challenges | Impact |

| High cost of wearable injectors | High costs limit adoption in price-sensitive markets and smaller healthcare settings. |

| Technical and design challenges | Design limitations affect usability, reliability, and safety, lowering confidence and increasing failure rates. |

| Opportunities | Impact |

| Growth in biologics and large- molecule drugs | Fuels innovation in on-body systems, positioning wearable injectors as the go-to for chronic and specialty biologics. |

| Rising preference for at-home care & remote monitoring | Enables integration with digital platforms for real-time monitoring and proactive care. |

| Market Leaders (2024) | Market Leader |

|

| Top Players |

Top Players Collective Market Share 85% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | North America |

| Emerging Countries | India, Brazil, Mexico, Indonesia, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

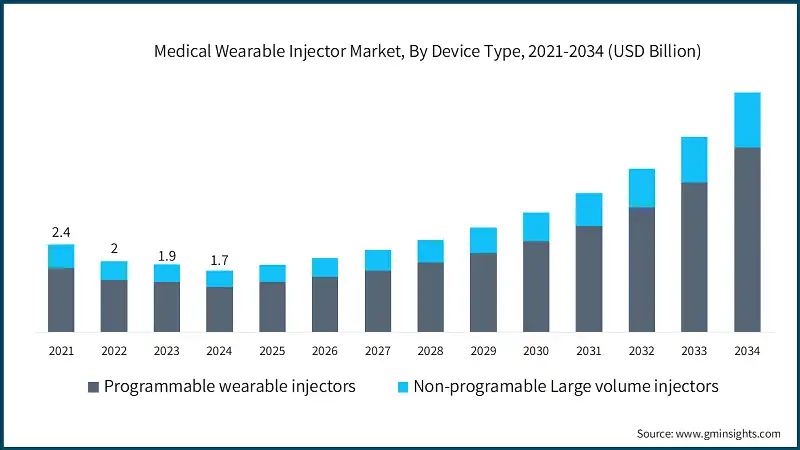

The market declined from USD 2.4 billion in 2021 to USD 1.9 billion in 2023, registering a negative CAGR of -11.1% during this period. This decline was primarily driven by the loss of Neulasta’s patent exclusivity, which led to a significant drop in prices due to the widespread availability of biosimilars. However, the market has since experienced a rebound, supported by several key growth drivers, including a notable shift towards subcutaneous drug delivery, which has emerged as the preferred route due to its patient-friendly nature and its ability to reduce dependency on clinical settings for chronic disease management.

Subcutaneous delivery enables the administration of high-viscosity biologics in a controlled and sustained manner, making it well-suited for wearable injector platforms. The U.S. FDA approval of wearable injection systems has further reinforced this trend. For instance, Amgen’s Neulasta Onpro received FDA approval in April 2017 for the subcutaneous delivery of pegfilgrastim to reduce infection risk in cancer patients. Similarly, Amgen’s Repatha (evolocumab) Pushtronex System, and BD Libertas a wearable injector by Becton Dickinson have also received regulatory approval. These innovations were designed to enhance the self-administration experience for patients managing cardiovascular and other chronic conditions.

However, it is important to note that Repatha Pushtronex was voluntarily withdrawn from the market in Q1 2025, with Amgen transitioning to prefilled pen devices for Repatha delivery. Accordingly, for Amgen, our market forecast includes only Neulasta Onpro during the forecast period. Such regulatory endorsements have increased confidence among both patients and companies, driving greater investment in wearable drug delivery technologies.

Additionally, the pharmaceutical industry’s growing focus on large-molecule biologics is further propelling market growth. Biologics often require high-volume subcutaneous delivery, which can be challenging with conventional devices such as syringes and pens. Wearable injectors address this need by enabling convenient and patient-friendly administration of complex therapies. For instance, in February 2024, LTS Lohmann Therapie-Systeme AG introduced a large-volume wearable injector with a capacity ranging from 1 mL to over 50 mL, designed to support the self-administration of biologics such as UDENYCA. Such innovations are advancing the shift toward home-based treatment and improving adherence among patients undergoing long-term biologic therapy.

Medical wearable injectors are body-worn devices designed for the subcutaneous delivery of high-volume or viscous drugs, typically biologics, over a set duration. This definition excludes insulin pumps, including tubeless systems like Omnipod, which are sometimes included in broader market assessments.

Medical Wearable Injector Market Trends

The global market experiences dynamic transformation driven by both macro and micro-level trends. On the macro level, the rising prevalence of chronic diseases such as cancer, cardiovascular conditions, and autoimmune disorders is fueling demand for advanced drug delivery solutions that support self-administration and reduce dependence on hospital-based care.

- With the rise of biologics, there is a growing need for wearable injectors capable of delivering high-viscosity drugs in large volumes over extended periods via the subcutaneous route. Regulatory bodies such as the FDA and EMA are increasingly supportive of on-body delivery systems, streamlining approval processes and enhancing patient safety, compliance, and ease of use.

- At the micro-trend level, product evolution is rapid and is now a key driver of market growth. Device advancements include improvements in reusability, customization, and volume capacity. In February 2024, LTS Lohmann Therapie-Systeme AG launched a non-programmable, large-volume wearable injector for UDENYCA, with a delivery range from 1 mL to over 50 mL to support complex biologics. Similarly, Enable Injections’ enFuse and Gerresheimer’s Gx SensAir offer programmable, customizable systems capable of delivering up to 25 mL and 20 mL, respectively. Expanding battery technologies further enable stable and controlled drug delivery, contributing to more flexible, patient-centric solutions.

- Technological advancement remains central to the market’s trajectory. Next-generation devices, such as West’s SmartDose and Amgen’s Neulasta Onpro, utilize motor-driven or spring-based mechanisms for enhanced dosing precision and user convenience. Integration with Bluetooth and mobile apps for dose monitoring as well as the use of AI-assisted analytics represents the next frontier in connected drug delivery systems.

- From a manufacturing perspective, companies are increasingly investing in modular and scalable production lines to meet the growing demand for prefilled, disposable, and reusable devices. Automation and 3D printing are being adopted to enhance precision and cost-efficiency.

- Overall, the market is evolving rapidly with the convergence of biologics, wearable technology, and personalized medicine. Backed by strong R&D investments, growing regulatory clarity, and increasing acceptance among patients and healthcare providers, wearable medical injectors are poised to become a standard in chronic disease management and specialty drug delivery.

Medical Wearable Injector Market Analysis

Learn more about the key segments shaping this market

The global market declined from USD 2.4 billion in 2021 to USD 1.9 billion in 2023, primarily due to Neulasta’s patent expiry and the entry of biosimilars. While this impacted overall market value, other players have continued to grow year-on-year.

Based on the device type, the market is segmented into programmable wearable injectors and non-programmable large volume injectors. The programmable wearable injectors segment accounted for 74% of the market in 2024 due to their precise dosing capabilities, customizable features, and ability to support complex biologics. The segment is expected to exceed USD 5.1 billion by 2034, growing at a CAGR of 15.6% during the forecast period. On the other hand, non-programmable large volume injectors segment is expected to grow with a CAGR of 13.8%. The growth of this segment can be attributed to their cost-effectiveness, ease of use, and rising demand for prefilled, disposable systems for high-volume delivery.

- The programmable wearable injectors segment holds a dominant share in the medical wearable injector market, primarily driven by its advanced technology and patient-centric features. These devices are perfect for treating chronic conditions like cancer, heart disease, and autoimmune disorders because they are specifically made to deliver large volumes of viscous biologics subcutaneously. Important products that provide controlled and adjustable dosing over long periods of time, such as the Repatha Pushtronex System, SmartDose, enFuse, Libertas, Gx SensAir, YpsoDose, and Symbioze, are prime examples of the benefits of programmable injectors.

- A major driver for this segment is its ability to improve treatment adherence through tailored drug delivery schedules and consistent dosing accuracy. Wireless connectivity, app-based interfaces, and real-time monitoring give patients and healthcare professionals greater control and visibility over the course of their treatments.

- Programmable wearable injectors are becoming more and more popular as digital health solutions continue to be incorporated into patient care because of their accuracy, adaptability, and ability to support individualized treatment plans.

Based on the usage type, the medical wearable injector market is segmented into disposable wearable injectors and reusable wearable injectors. The disposable wearable injectors segment accounted for the highest market share of 83.8% in 2024 due to their ease of use, reduced risk of cross-contamination, and high patient compliance for single-use biologic therapies.

- This dominance is driven by strong user preference for ease, safety, and convenience. Products that provide single-use, prefilled, and automated delivery of high-viscosity biologics, like Neulasta Onpro, Repatha Pushtronex System, Libertas, YpsoDose, Felice Dose, and UDENYCA, are prime examples of this preference.

- These devices remove the need for recharging, cleaning, or maintenance, making them ideal for patients and providers alike. Their hands-free, user-friendly interface and skin-safe adhesive patches facilitate self-administration, particularly for autoimmune and cancer treatments. Disposable injectors also benefit from advantageous regulatory pathways because they pose fewer safety risks, which results in quicker approval cycles.

- On the other hand, the market for reusable wearable injectors is expected to expand more quickly due to growing consumer demand for affordable and environmentally friendly solutions. For long-term treatments, reusable injectors such as enFuse and Gx SensAir provide programmable features and adjustable dosage, making them attractive to tech-savvy patients and healthcare professionals concerned with overall cost of care.

Based on technology, the medical wearable injector market is segmented into motor-driven, spring-based, expanding battery, rotary pump, and other technologies. The motor-driven segment accounted for the highest market share of 31.5% in 2024 to its precision in drug delivery, compatibility with high-viscosity biologics, and integration in programmable systems.

- The segment is gaining significant traction due to its superior ability to deliver biologics with consistent, controlled, and programmable flow rates. Motor-driven devices, as opposed to spring-based or rotary pump, ensure precise delivery regardless of drug volume or viscosity, making them ideal for administering complex, high-viscosity biologics frequently used in the treatment of rare diseases, autoimmune disorders, and oncology.

- In 2024, this segment dominated the global wearable injector market, driven by increasing demand for long-duration, patient-friendly delivery options. Prominent products with exceptional dosing accuracy and user confidence, such as BD's Libertas, West's SmartDose, and CC Biotech's Quick Dose and Felice Dose, offer exceptional dosing accuracy and are specifically designed to enhance ease of use and confidence among elderly or mobility-limited patients.

- The second-largest segment, spring-based injectors, held a market share of 29.2% in 2024, and are preferred for routine subcutaneous delivery of less viscous medications due to their low cost and simplicity of use.

- The rotary pump segment, though smaller with a market share of 12.5%, is expected to grow at a CAGR of 16.2%, due to its capacity to deliver high dosing accuracy and consistent flow rates across a broad range of viscosities. These systems are being used more often in autoimmune and oncology treatments, especially for biologics that need to be infused subcutaneously under strict control.

- The expanding battery segment accounted for 18.9% of the market in 2024 and is accelerating because of improvements in programmable flow profiles, dose tracking capabilities, and battery life. This trend is best illustrated by devices such as Sencoboz’ LVI-V & LVI-P and Enable Injections' enFuse, which support volumes of up to 20 mL and enable extended infusion durations with little patient involvement.

Learn more about the key segments shaping this market

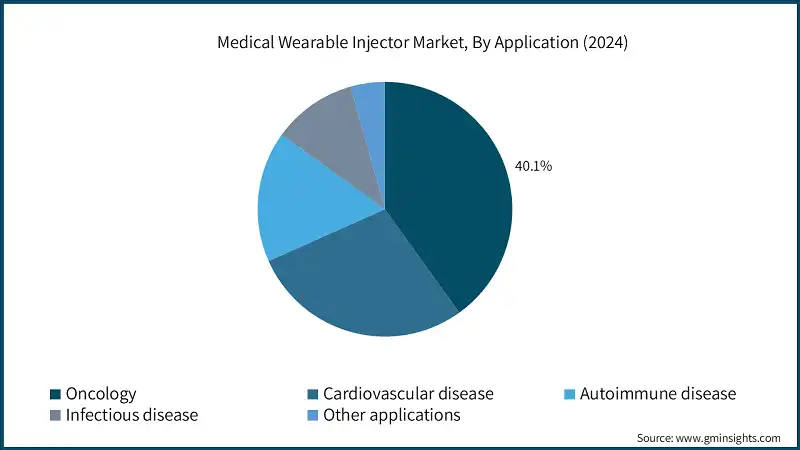

Based on the application, the medical wearable injector market is segmented into oncology, cardiovascular disease, autoimmune disease, infectious disease, and other applications. The oncology segment accounted for the highest market share of 40.1% in 2024 owing to the rising incidence of cancer, increased adoption of biologics, and demand for home-based chemotherapy alternatives.

- The top three application segments represent 85% of total market value. Among them, oncology dominates due to the increasing global cancer burden and the need for convenient, patient-centric delivery of large-volume biologics. Devices such as Neulasta Onpro, YpsoDose, Gx SensAir, UDENYCA, and SmartDose enable subcutaneous administration of oncology drugs, reducing the need for frequent hospital visits and supporting the shift toward home-based care.

- Biosimilar-compatible injectors, such as UDENYCA, which provide therapeutic equivalency at a lower cost, are also being adopted by price-sensitive markets. Additionally, product development has accelerated due to regulatory support for subcutaneous administration and the healthcare system's transition to value-based care.

Looking for region specific data?

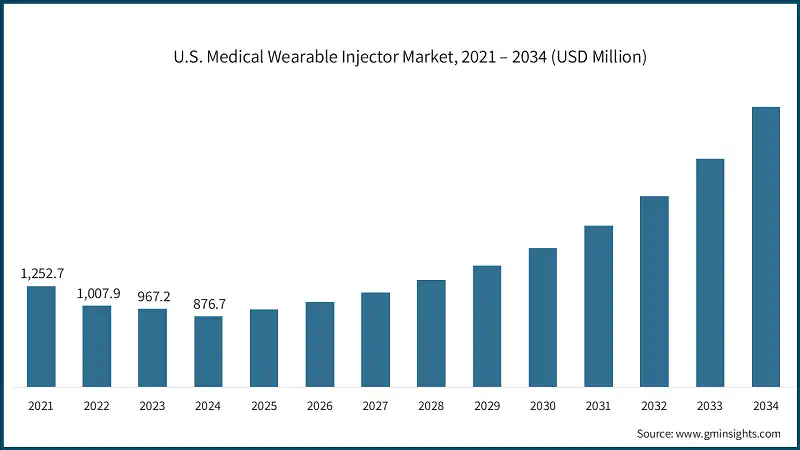

North America dominated the global medical wearable injector market with the highest market share of 51.7% in 2024.

- The U.S. market was valued at 1.2 billion and USD 1 billion in 2021 and 2022, respectively. In 2024 the market size declined to USD 876.7 million from USD 967.2 million in 2023. This decline is primarily attributed to the loss of exclusivity for Neulasta. Excluding Neulasta, other key players in the market have demonstrated positive growth during this period.

- North America’s dominance in the market is driven by several region-specific factors, most notably the high prevalence of chronic diseases like diabetes, cancer, and cardiovascular disorders in the U.S. and Canada. These conditions often require long-term treatment plans, making wearable injectors a practical solution to enhance patient convenience and support better medication adherence.

- For example, Enable Injections’ enFuse, approved in September 2023, supports patients in self-administration for rare conditions such as paroxysmal nocturnal hemoglobinuria.

- Lastly, North America benefits from a robust healthcare system, favorable reimbursement policies, and the presence of leading pharmaceutical and MedTech innovators such as West Pharmaceutical Services, BD, and Amgen. The region is also experiencing increased regulatory support from the FDA for innovative biologic delivery platforms.

Europe medical wearable injector market accounted for USD 595.5 million in 2024.

- Europe's favorable regulatory framework, particularly under the EU Medical Device Regulation (MDR), has reinforced safety and efficacy standards, building confidence among healthcare providers and patients.

- Germany is expected to experience significant growth over the forecast period due to its strong manufacturing base, aging population, and increased investment in digital therapeutics.

- The European medical wearable injector market is also experiencing robust growth, due to the rising chronic disease prevalence, particularly diabetes, cardiovascular disorders, and cancer, which demand regular, precise, and patient-friendly drug delivery. France, the UK, and the Nordic countries are also emerging as high-opportunity markets, supported by progressive reimbursement policies and rising awareness of wearable therapies.

- In addition, Eastern European nations are demonstrating greater potential as a result of advancing their infrastructure and expanding access to healthcare. Strategic actions like the acquisition of Eitan Medical's Sorrel device by LTS Lohmann Therapie-Systeme AG and the biologics partnerships of Enable Injections are reshaping the European market and increasing wearable injector accessibility and use.

The rest of the world medical wearable injector market is anticipated to witness high growth over the analysis timeframe.

- The wearable injector market in the RoW region is experiencing growth due to demographic shifts, healthcare reforms, and the growing use of self-administered biologics. In China and Japan, aging populations, government support for home-based care, and favorable reimbursement policies have facilitated the uptake of advanced devices such as YpsoDose and Libertas.

- The need for effective, patient-friendly delivery systems is being driven by China's expanding biologics market and Japan's robust innovation ecosystem. South Korea, a key emerging market, benefits from a growing middle class, better healthcare facilities, and government programs that facilitate access to reasonably priced treatment.

- Strategic health transformation initiatives and infrastructure improvements in the Middle East, especially in Saudi Arabia and the United Arab Emirates, are driving up demand for advanced injectors like Gx SensAir and Symbioze. The FDA's 2023 approval of enFuse confirms the product's potential for a worldwide market. These patterns highlight the MEA region's shift to cutting-edge, in-home care options.

Medical Wearable Injector Market Share

Leading companies like Amgen, Becton Dickinson (BD), Ypsomed, and Gerresheimer together hold between 75 - 80% of the market share in the moderately consolidated global market. These businesses keep their dominance by combining strong product lines, business alliances, legal clearances, and ongoing innovation. Amgen holds a strong competitive advantage with its Neulasta Onpro device, widely adopted in oncology for post-chemotherapy.

Ypsomed, well-known for its YpsoDose injector, uses its adaptable spring-based delivery system and alliances with biopharma companies to meet the demands of large-scale subcutaneous drug delivery. In the meantime, Gerresheimer's Gx SensAir, which was introduced in collaboration with Sensile Medical, offers a programmable and reusable solution, placing it firmly in the market for reusable injectors, particularly for oncology biologics.

Companies are using competitive pricing strategies for biosimilar-compatible injectors, like UDENYCA by LTS Lohmann Therapie-Systeme AG, which is intended to provide a more affordable option, in an effort to increase their market share. Players are also addressing market gaps by launching injectors capable of delivering up to 50 mL subcutaneously, a significant advantage as treatment plans evolve and biologics become more concentrated.

New companies like Enable Injections are also disrupting the market with products like enFuse, a wearable injector that can be customized and runs on batteries to deliver large amounts of biologics at home. Enable Injections established itself as a powerful competitor in the home-based care market after receiving FDA approval in September 2023.

Medical Wearable Injector Market Companies

Few of the prominent players operating in the medical wearable injector industry include:

- Amgen

- Becton Dickinson (BD)

- CCBio

- Enable Injections

- Gerresheimer

- LTS Lohmann Therapie-Systeme AG

- Nemera

- Sencoboz

- Stevanato Group

- West Pharmaceutical Services

- Ypsomed

- Amgen

Amgen’s strength in the market lies in its biologics portfolio and patient-centric delivery solutions. While the company previously offered both the Onpro and Pushtronex systems, it has since discontinued the Pushtronex device as of Q1 2025, shifting Repatha delivery to prefilled pens. Amgen continues to lead in this space with the Neulasta Onpro system, which integrates high-volume drug delivery with wearable convenience enhancing patient compliance and supporting home-based administration for chronic therapies.

- Becton Dickinson (BD)

BD’s USP in the wearable injector market centers on its engineering expertise and robust device manufacturing capabilities. Through its Libertas platform, BD offers customizable, subcutaneous delivery systems for high-viscosity biologics, addressing the growing demand for self-administered chronic care treatments. BD’s strength lies in its ability to collaborate with pharmaceutical partners to develop scalable, safe, and user-friendly wearable injectors that meet stringent regulatory and clinical standards.

- Ypsomed

Ypsomed stands out in the medical wearable injector market with its YpsoDose platform, a prefilled, large-volume, spring-based injector designed for ease of use and patient comfort. Its strong partnerships with pharmaceutical companies and a focus on customizable drug delivery solutions allow it to cater to high-volume biologics. Ypsomed’s reliable, user-friendly design supports self-administration, aligning with trends in home healthcare.

- Gerresheimer

Gerresheimer’s key strength lies in its Gx SensAir platform a programmable, reusable wearable injector designed for precise, large-volume subcutaneous drug delivery. The company offers full-service integration, from device design to drug containment systems, giving it a competitive manufacturing edge. Its emphasis on innovation, digital connectivity, and sustainability makes it a preferred partner for biopharma companies seeking next-generation delivery systems.

Medical Wearable Injector Industry News:

- In May 2023, Enable Injections, Inc. collaborated with Viridian Therapeutics, Inc. which specializes in developing advanced biologics for chronic conditions, making it a strong complement to Enable's wearable injector technology. This partnership can lead to the creation of tailored drug delivery solutions that are optimized for specific therapeutic areas.

- In January 2023, Tandem Diabetes Care, Inc. announced the acquisition of AMF Medical SA. The acquisition enhances Tandem's product portfolio by integrating the Sigi Patch Pump, a novel and innovative insulin delivery device designed for ease of use and patient comfort.

- In May 2021, Gerresheimer’s SensAIR platform advances the wearable injector market by offering an on-body, subcutaneous delivery system capable of administering up to 20 mL of high-viscosity biologics. This ready-to-use device supports patient self-administration at home and can be tailored to drug viscosity, volume, and connectivity needs.

The medical wearable injector market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 – 2034 for the following segments:

Market, By Device Type

- Programmable wearable injectors

- Non-programmable wearable injectors

Market, By Usage Type

- Disposable wearable injectors

- Reusable wearable injectors

Market, By Technology

- Motor-driven

- Spring-based

- Expanding battery

- Rotary pump

- Other technologies

Market, By Application

- Oncology

- Cardiovascular disease

- Autoimmune disease

- Infectious disease

- Other applications

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Rest of the World

Frequently Asked Question(FAQ) :

Which device type dominated the medical wearable injector market?

Programmable wearable injectors held a 74% market share in 2024, supported by their customizable dosing features, and precision drug delivery.

What share did disposable wearable injectors hold?

Disposable injectors accounted for 83.8% of the market in 2024 due to their ease of use, lower infection risk.

Which technology led the market for wearable injectors?

Motor-driven systems held the largest share at 31.5% in 2024, thanks to their superior control for delivering high-viscosity biologics in precise volumes over extended periods.

Who are the key players in the medical wearable injector market?

Key players include Amgen, Becton Dickinson (BD), Ypsomed, Gerresheimer, Enable Injections, West Pharmaceutical Services, Stevanato Group, Sencoboz, CCBio, and LTS Lohmann Therapie-Systeme AG.

Which region leads the medical wearable injector market?

North America led with 51.7% market share in 2024, valued at USD 876.7 million, backed by biologics adoption, FDA support, and presence of major players like Amgen and BD.

Which application segment had the highest market share in 2024?

Oncology accounted for 40.1% of the global market in 2024, driven by rising cancer cases.

What are the primary growth drivers of the medical wearable injector industry?

Key growth drivers include the rising incidence of chronic conditions, increased patient preference for home-based care, and demand for automated, hands-free delivery systems.

What is the projected value of the medical wearable injector market by 2034?

The market is expected to reach USD 6.6 billion by 2034, fueled by increased biologic drug approvals, smart injector innovation, and personalized drug delivery trends.

What is the market size of the medical wearable injector market in 2024?

The market size was USD 1.7 billion in 2024, with a CAGR of 15.2% expected through 2034 driven by rising chronic disease burden, demand for at-home care, and adoption of self-injection technologies.

What is the expected market value of medical wearable injectors in 2025?

The global medical wearable injector industry is projected to reach USD 1.9 billion in 2025, with growth driven by the increasing preference for subcutaneous drug administration.

Medical Wearable Injector Market Scope

Related Reports