Summary

Table of Content

Veterinary Imaging Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Veterinary Imaging Market Size

The global veterinary imaging market size was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 6.6% from 2025 to 2034. The growth of the market is driven by several factors, including the increasing prevalence of animal diseases and the rising demand for accurate, non-invasive diagnostic tools in veterinary care.

To get key market trends

Advancements in imaging technologies, such as digital radiography, ultrasound, CT, and MRI, have improved diagnostic accuracy, enabling faster and more reliable treatment plans. Further, the growing focus on pet care, particularly in developed markets, has fueled the adoption of veterinary imaging, as pet owners seek better healthcare for their animals.

Veterinary Imaging Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.1 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.6% |

| Market Size in 2034 | USD 4 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Additionally, expanding animal healthcare infrastructure, coupled with rising awareness of veterinary imaging's benefits, contributes to market growth. Veterinary imaging's crucial role in early disease detection, especially in oncology and orthopedic conditions, further supports the market's expansion. Furthermore, the increasing use of imaging in veterinary research and education enhances the demand for advanced imaging systems.

Veterinary imaging refers to the use of advanced imaging technologies to create visual representations of the internal structures of animals' bodies for diagnostic and treatment purposes. It encompasses a variety of techniques, including X-rays (radiography), ultrasound, computed tomography (CT), magnetic resonance imaging (MRI), and endoscopy. These tools are employed by veterinarians to diagnose diseases, injuries, and abnormalities in animals, providing critical insights into their health.

Veterinary Imaging Market Trends

Increasing pet ownership and rising expenditure on pets are significant drivers of the market.

- The 2024 global pet parent study estimates the global pet population at around 1 billion. Approximately 66% of U.S. households own at least one pet, with dogs and cats being the most common companions.

- As more households adopt pets, there is a growing demand for advanced veterinary care, including diagnostic imaging to ensure pets' health and well-being.

- Pet owners are increasingly willing to invest in high-quality treatments and diagnostic services, including X-rays, ultrasounds, CT scans, and MRIs, to detect and treat conditions early. This trend is further fueled by the rising awareness of pet health, the availability of advanced imaging technologies, and the growing adoption of preventative healthcare practices.

- As a result, the market continues to expand, driven by both the increasing number of pets and the higher spending power of pet owners.

Veterinary Imaging Market Analysis

Learn more about the key segments shaping this market

Based on product, the market is segmented into veterinary imaging instruments, veterinary software, and veterinary imaging reagents. The veterinary imaging instruments segment accounted for the highest market share and was valued at USD 1.2 billion in 2024. The segment is further categorized into radiography (X-ray) systems, ultrasound systems, computed tomography systems, magnetic resonance imaging systems, video endoscopy imaging systems, nuclear imaging scanners, and other imaging systems.

- Veterinary imaging instruments are widely used to diagnose various conditions in animals, ranging from musculoskeletal issues to internal organ diseases and cancer.

- Additionally, growing awareness of the importance of early detection, along with advancements in imaging technologies that offer higher resolution and faster results, has further fueled the adoption of these instruments in veterinary practices.

- Further, the rise in pet ownership, the expanding number of veterinary clinics and hospitals, and a greater emphasis on animal welfare have contributed to the segment's strong market share.

Learn more about the key segments shaping this market

Based on animal type, the veterinary imaging market is categorized into small companion animals, large animals, and other animals. The small companion animals segment dominated the market with a 49% share in 2024. The segment includes dogs, cats, and other small companion animals.

- Factors such as rising pet ownership, increased focus on the health and well-being of pets, coupled with rising focus on providing optimum veterinary care services is largely driving the market growth for companion animals.

- Additionally, the increasing penetration of pet insurance products increases the spending capacity of pet owners by reducing the out-of-pocket veterinary expenses. wing to such aforementioned factors, the small companion animals’ segment is anticipated to register a significant growth throughout the forecast period.

Based on application, the market is categorized into orthopedics and traumatology, oncology, cardiology, neurology, and other applications. The orthopedics and traumatology segment dominated the market and is anticipated to reach 1.4 billion by 2034.

- The orthopedics and traumatology segment holds a significant market share in the veterinary imaging market due to the increasing demand for diagnostic tools to assess musculoskeletal injuries and disorders in animals.

- With a growing focus on early detection and treatment of fractures, joint diseases, and bone abnormalities, veterinary practices are increasingly relying on advanced imaging technologies like X-ray, CT, and MRI. These technologies provide detailed insights, enabling precise diagnosis and treatment planning, driving the segment's strong market presence.

- Additionally, the rising adoption of minimally invasive surgical techniques further contributes to the segment's growth in the market.

Based on end use, the veterinary imaging market is classified into veterinary hospitals and clinics, diagnostic imaging centers, and other end users. In 2024, the veterinary hospitals and clinics segment held highest market share and is expected to showcase growth at 6.4% CAGR over the analysis period.

- Veterinary hospitals and clinics are noted to possess a higher spending capacity and hence can readily procure, install and main multiple veterinary imaging equipment.

- Additionally, increasing government focus towards establishing advanced, well-equipped medical infrastructure with optimum facilities is another factor driving the segmental growth.

- Furthermore, hospitals and clinics have historically represented a relatively higher adoption rate towards novel technologies, including those of veterinary imaging. Hence, these factors are essentially noted to drive the market growth throughout the forecast period.

Looking for region specific data?

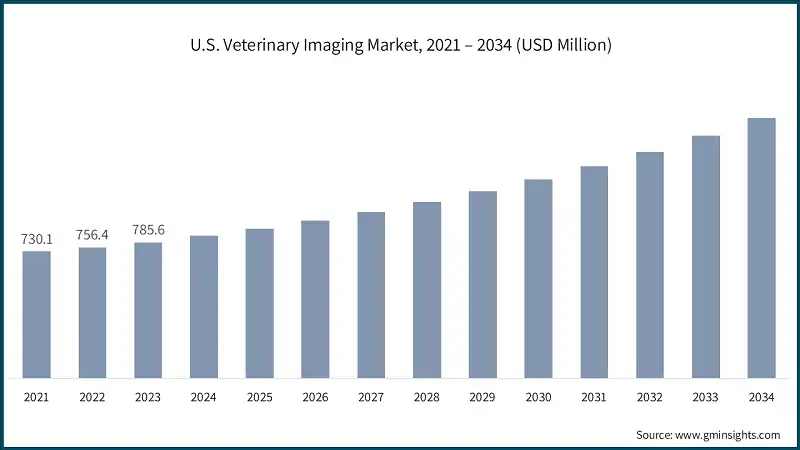

The U.S. veterinary imaging market in 2024 was valued at USD 818 million.

- The U.S. holds a significant market share in the market, driven by advanced healthcare infrastructure, a high demand for innovative diagnostic tools, and the presence of major industry players.

- Growing focus on pet healthcare, alongside an increasing number of veterinary practices adopting advanced imaging technologies such as MRI, CT scans, and ultrasound, further contributes to the market's expansion.

- Additionally, rising pet ownership, particularly in urban areas, along with increasing awareness of animal health, is propelling the demand for precise and early diagnostic imaging in veterinary care.

Germany veterinary imaging market is anticipated to witness considerable growth over the analysis period.

- The country is home to a large number of veterinary clinics, hospitals, and research institutions that utilize high-quality diagnostic imaging tools such as X-ray, ultrasound, CT, and MRI.

- The rising awareness about animal health, combined with the demand for precise diagnostics and treatment, has further driven the growth of this market in Germany.

- Additionally, the presence of leading market players and continuous innovations in veterinary imaging technologies contribute to its strong position.

The Asia Pacific region demonstrates significant growth potential in the veterinary imaging market, driven by increasing pet ownership, rising awareness of animal health, and advancements in veterinary care.

- Expanding economies, such as China and India, are investing heavily in healthcare infrastructure, including veterinary clinics and animal hospitals, which boosts demand for advanced imaging technologies.

- Moreover, the growing focus on companion animals and the rising need for accurate diagnostics in both small and large animals further contribute to the market's expansion.

- The region's increasing adoption of digital technologies in veterinary diagnostics also positions it for sustained growth in the coming years.

India veterinary imaging market is predicted to grow significantly over the forecast period.

- India market growth is driven by increasing spending on pets, rising awareness about animal health, and the expansion of veterinary clinics and animal hospitals.

- As pet ownership grows, owners are more inclined to invest in advanced diagnostic tools to ensure their pets receive the best care.

- Thus, with technological advancements and rising investments, India is well-positioned for substantial growth in this sector.

Brazil veterinary imaging market is expected to showcase lucrative growth over the analysis period.

- The country's improving veterinary healthcare infrastructure, along with increasing awareness of the benefits of early disease detection and treatment, is contributing to the market's growth.

- Further, the rising focus on animal health, economic growth, increased adoption of pet insurance and introduction of advanced and accessible technologies further fosters the growth of this market.

Saudi Arabia veterinary imaging market is poised to grow during the forecast period.

- The expansion of veterinary services, coupled with advancements in animal husbandry and pet care, is driving the need for high-quality imaging solutions in the country.

- This, alongside a favorable economic environment and healthcare reforms, positions Saudi Arabia for strong growth in the market.

Veterinary Imaging Market Share

The competitive landscape of the market is characterized by the presence of a mix of established players and emerging companies offering a range of diagnostic imaging solutions for animal healthcare. Key players include manufacturers of X-ray, ultrasound, MRI, and CT imaging equipment, who focus on innovation, product quality, and customer support.

The market is increasingly driven by advancements in imaging technologies, such as portable devices and artificial intelligence, which enhance diagnostic accuracy and efficiency. Companies are also expanding their geographic reach and forming strategic partnerships to increase market share. Additionally, the growing demand for veterinary care and the adoption of advanced imaging solutions for accurate diagnosis contribute to the competitive dynamics in this market.

Veterinary Imaging Market Companies

Few of the prominent players operating in the veterinary imaging industry include:

- Agfa-Gevaert Group

- BCF

- Canon Medical Systems Corporation

- Carestream Health

- Epica International

- Esaote

- E.I. Medical Imaging

- Fujifilm Holdings Corporation

- GE Healthcare

- Heska Corporation

- IDEXX Laboratories

- IMV imaging

- Konica Minolta

- Shenzhen Mindray Animal Medical Technology

- Siemens Healthineers

Veterinary Imaging Industry News

- In June 2023, Esaote S.p.A. launched the MyLab X90VET ultrasound system, which features its patented augmented insight technology. This innovative system is designed specifically for veterinary applications and aims to enhance diagnostic imaging through advanced artificial intelligence capabilities.

- In March 2022, Canon Medica Systems Corporation acquired Nordisk Rontgen Teknik, a Danish medical equipment manufacturer. This strategic initiative is expected to strengthen the company’s business in Europe and accelerate revenue growth.

- In February 2021, Fujifilm Healthcare portfolio introduced its first VXR Veterinary X-Ray Room, providing prime quality of images with easy to use and install systems. This strategy enabled the company to cater large customer base and strengthen its market position.

The veterinary imaging market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 – 2034 for the following segments:

Market, By Product

- Veterinary imaging instruments

- Radiography (X-ray) systems

- Ultrasound systems

- Computed tomography systems

- Magnetic resonance imaging systems

- Video endoscopy imaging systems

- Nuclear imaging scanners

- Other imaging systems

- Veterinary software

- Veterinary imaging reagents

- Ultrasound contrast reagents

- MRI contrast reagents

- X-ray/CT contrast reagents

- Nuclear imaging reagents

Market, By Animal Type

- Small companion animals

- Dogs

- Cats

- Other small companion animals

- Large animals

- Cattle

- Horses

- Other large animals

- Other animals

Market, By Application

- Orthopedics and traumatology

- Oncology

- Cardiology

- Neurology

- Other applications

Market, By End Use

- Veterinary hospitals and clinics

- Diagnostic imaging centers

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Who are some of the prominent players in the veterinary imaging industry?

Key players in the veterinary imaging industry include Agfa-Gevaert Group, BCF, Canon Medical Systems Corporation, Carestream Health, Epica International, Esaote, E.I. Medical Imaging, and Fujifilm Holdings Corporation.

How big is the veterinary imaging market?

The global veterinary imaging industry was valued at USD 2.1 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2034.

What is the market share of the small companion animals segment in veterinary imaging?

The small companion animals segment accounted for a 49% share of the veterinary imaging industry in 2024.

How much is the U.S. veterinary imaging market worth?

The U.S. veterinary imaging industry was valued at USD 818 million in 2024.

Veterinary Imaging Market Scope

Related Reports