Summary

Table of Content

Underwater Camera Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Underwater Camera Market Size

Underwater Camera Market size exceeded USD 4.5 billion in 2019 and is poised to grow at 15% CAGR between 2020 and 2026. The global industry shipments are anticipated to reach 5 million units by 2026. The market growth is attributed to the demand for high-performance underwater cameras for subsurface observing missions.

The development of the travel & tourism sector is expected to drive the underwater camera market revenue. Adventure tourism has gained high popularity over the past several years, with rise in trend for scuba diving among sports enthusiasts. Egypt, Maldives, and Indonesia have been preferred destinations among divers due to attractive coral reef system and enhanced diving conditions.

To get key market trends

The integration of AI into underwater cameras has minimized distortions in the pictures captured, providing an innovative solution for conducting ocean research. In March 2020, Alphabet Inc. launched Tidal, an AI camera system that leverages computer vision to monitor fish populations. The company’s X experimental division’s Tidal team focuses on making fish farming more sustainable by efficiently inspecting fish population and identifying & monitoring individual fish in the huge population of fish farm. The system uses a combination of underwater camera technology and machine learning to track environmental conditions, fish behaviors and health of salmon over time.

Underwater Camera Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | USD 4.5 Billion |

| Forecast Period 2020 to 2026 CAGR | 15% |

| Market Size in 2026 | USD 8 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The ongoing coronavirus (COVID-19) pandemic will negatively impact the underwater camera market size on account of disrupted tourism industry. According to the United Nations World Tourism Organization (UNWTO), international tourist arrivals globally is estimated to decline by 20–30% in 2020. This will lead to declining the demand for underwater cameras among travelers. In addition, stringent lockdowns imposed during the first quarter of 2020 that impacted the manufacturing and R&D capabilities of players, limiting the market growth. However, with the gradual reopening of facilities following the relaxations in lockdown rules, the market will regain traction.

Underwater Camera Market Analysis

The mirrorless underwater camera market will observe growth rate of around 17% through 2026. The absence of mirrors in these cameras enables them to be much lighter and compact compared to DSLRs. The small size of the cameras enhances their portability as travelers can use them conveniently without the hassle of carrying bulky DSLRs. Their small size also creates less drag in the water, enabling to effectively capture fast marine creatures such as marlin. Mirrorless underwater cameras are cheaper than DSLRs, making them a preferred choice for beginner divers searching for budget-friendly and high-quality camera options.

The incorporation of advanced features, such as auto focus systems, high resolution, live preview option, and electronic viewfinder, will fuel the product adoption. Players are focusing on launching advanced underwater mirrorless cameras for allowing users to shoot high-quality pictures and attract large customer base in the market. For instance, in August 2019, Sony Corporation launched its a6100 and a6600 mirrorless digital cameras and interchangeable lens that offer autofocus speed and accuracy solutions for underwater photographers. The ability of mirrorless cameras to capture clear and crisp images even in poor lighting conditions will further support the underwater camera market expansion.

Learn more about the key segments shaping this market

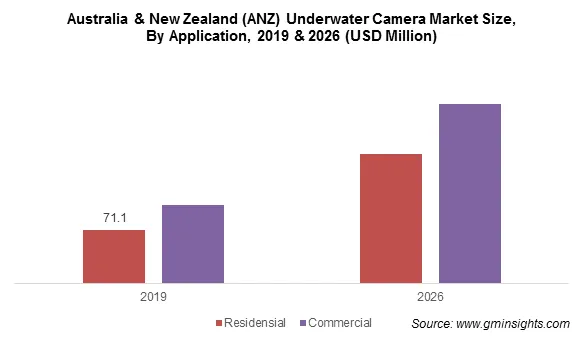

The Australia & New Zealand (ANZ) underwater camera market for the education & research application is estimated to expand at 18% CAGR during the forecast timeframe. As human beings have explored only about 5% of the global oceans, accurate analysis, mapping of underwater habitat, and geological variations have become crucial to researchers over the recent years. They are deploying advanced cameras deep inside the ocean in areas that are difficult to access manually and for consistent monitoring. They can be used to study the behavior of underwater species over a long period of time as well as address phenomena such as volcanic eruptions in the sea.

The Nature Conservancy Australia has installed Reef Cam for monitoring the health of Port Phillip Bay for collecting water quality data in real time. The camera is used for promoting education and awareness about marine life. It supports the annual Great Victorian Fish Count run by the Victorian National Park Association’s Reef Watch Program where remote schools in regions, such as Mildura and Albury, can participate in the event by viewing Reef Cam to educate students about marine life. The increased adoption of innovative cameras for education & research of marine life will propel the underwater camera market demand.

The Europe underwater camera market sales though offline distribution channel will register over 14% growth till 2026. Although there is a sharp rise in online retailing over the recent years, professionals still prefer to buy high-end gadgets from offline stores to ensure product quality and reliability. Specialty stores focusing solely on underwater cameras help consumers to buy products that perfectly suit their individual requirements. They offer personalized services through sales staff appointed in the store that enable consumers to assess a wide range of cameras available. Products sold at proprietary stores also eliminate the risk of fraudulent or duplicate products sold through online retailers, ensuring product durability and reliability.

Learn more about the key segments shaping this market

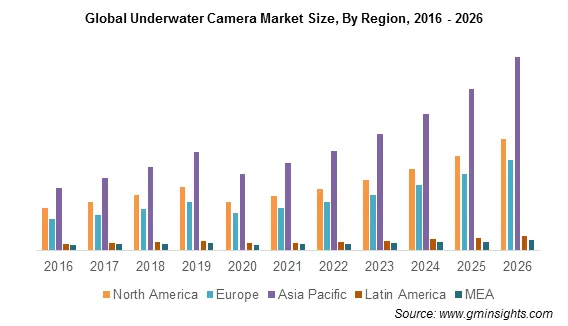

North America underwater camera market accounted for over 25% of the global revenue share in 2019 owing to the advanced technology landscape in the region, supporting R&D and deployment of high-quality cameras. The U.S. is amongst the earliest adopters of the latest technologies. The acoustic underwater cameras developed by researchers in San Diego, California tracks the remains of vaquita porpoise in the sea of Cortez.

Increasing installations in aquariums as well as natural water bodies will impel the underwater camera market size in North America. The Seattle Aquarium uses the Splashcam range of underwater cameras to educate students. Its six-gill shark research program observes the shark activity in the wild off the Seattle waterfront. The camera provides insights on the behavior of the rare species. Similarly, Ocean Networks Canada’s (ONC) underwater cameras continuously monitor the deep-sea hydrothermal vents, a submarine canyon in the Northeast Pacific Ocean, coastal environments of British Columbia, and the Arctic.

Underwater Camera Market Share

The underwater camera market players are focusing on offering differentiated underwater cameras to strengthen their product portfolio and industry position. In June 2019, Olympus Corporation launched its TG 6 compact digital camera that can shoot underwater up to 15-meter-deep and a newly developed circular fisheye converter. Similarly, in February 2020, Ricoh Company Limited introduced its rugged WG 70 underwater camera with built-in digital microscope that enables users to get a magnified view of underwater creatures. Intense competition amongst players to develop high-quality products will support the industry growth.

Key companies operating in the market include:

- Brinno Inc

- Canon Inc

- Fujifilm Holdings Corporation

- Garmin Ltd

- GoPro Inc

- Nikon Corporation

- Ocean Systems, Inc

- Olympus Corporation

- Panasonic Corporation

- Ricoh Company Ltd

- Sony Corporation

- Steinsvik

- Subsea Tech

The underwater camera market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD and shipments in units from 2016 to 2026 for the following segments:

Market, By Product

- Digital Single Lens Reflex (DSLR)

- Mirrorless

- Compact

Market, By Application

- Personal

- Commercial

- Education & Research Institutes

- Media & Entertainment

- Underwater Sport

- Others

Market, By Distribution Channel

- Online

- Offline

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand (ANZ)

- Southeast Asia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

How is global underwater camera market estimated to perform through 2026?

The market size of underwater camera crossed USD 4.5 billion in 2019 and is expected to surpass 5 million units in terms of global shipments by 2026, depicting a CAGR of 15% during the forecast period.

Why will mirrorless underwater cameras depict sizable expansion?

Global mirrorless underwater camera segment share may exhibit 17% CAGR through 2026, since the lack of mirrors in these products helps them to be much more compact & lighter than DSLRs and enhances their portability.

What factors will push ANZ underwater camera industry share from education & research applications?

The Australia & New Zealand industry size from education & research application segment may showcase 18% CAGR through 2026, given that researchers in the region are consistently deploying advanced cameras in the ocean to study underwater species

Which distribution channel will prove lucrative for Europe underwater camera market size growth?

The European market size from offline distribution channel may grow at 14% CAGR through 2026, driven by the fact that a certain section of professionals still prefers shopping from offline stores to ensure product reliability & quality.

Where will global underwater camera industry share depict massive increase?

The business will depict massive traction in North America driven by the well-established technology proliferation in the region and deployment of high-quality cameras. North America held 25% of the global industry share in 2019.

Underwater Camera Market Scope

Related Reports