Summary

Table of Content

Ultra-High-Definition Panel 4K Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Ultra-High-Definition Panel 4K Market Size

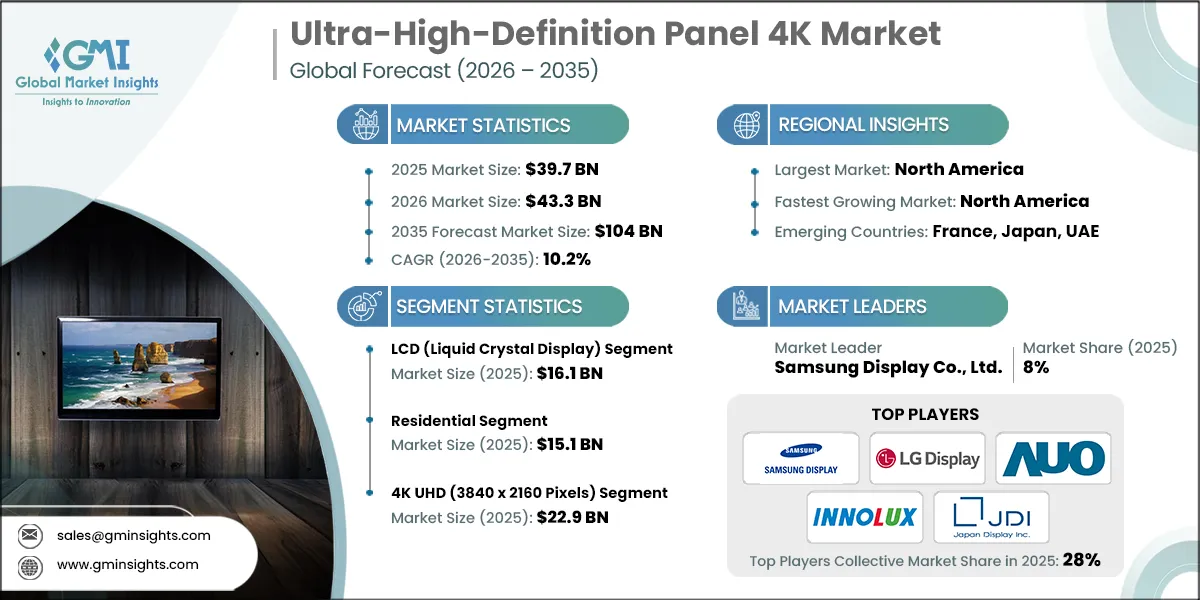

The global Ultra-High-definition panel 4k market was estimated at USD 39.7 billion in 2025. The market is expected to grow from USD 43.3 billion in 2026 to USD 104 billion in 2035, at a CAGR of 10.2%, according to latest report published by Global Market Insights Inc.

To get key market trends

Demand for ultra-high definition (UHD) 4K panels worldwide is being reshaped by consumer demand for immersive visual experiences and technological advancements, resulting in a surge in demand for high-resolution and visually superior display products. To meet the installation demand for their customers with a quick turnaround and customized solutions, especially for new display form factors, more panel manufacturers and device assemblers are turning into large-scale fabrication facilities as well as specialized local workshops.

To support the rapid custom fabrication that these facilities will have to deal with in large volumes, it is thus increasingly necessary to have specialized manufacturing equipment such as advanced deposition systems, robotic inspection tools, and high-precision laser cutting equipment. The quick transfer of modular display units from production to assembly sites will be a competitive advantage for companies, thus, it will lead to increased demand for advanced manufacturing and logistics in the display industry supply chain.

Ultra-High-Definition Panel 4K Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 39.7 Billion |

| Market Size in 2026 | USD 43.3 Billion |

| Forecast Period 2026 - 2035 CAGR | 10.2% |

| Market Size in 2035 | USD 104 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Proliferation of 4K/UHD Content & Streaming Services | The increasing availability of native 4K content from streaming platforms (Netflix, Disney+, YouTube) and next-generation gaming consoles (PS5, Xbox Series X) accelerate consumer device upgrades, making a 4K panel the baseline standard for mid-to-high-end TVs and monitors. |

| Rapid Growth in Premium and Large-Format Displays | Consumers are demanding larger screen sizes (65-inch and above) and are willing to pay a premium for advanced technology (OLED, QD-OLED, Mini-LED), which inherently requires and drives the volume of UHD 4K panel production. |

| Expansion of the Gaming and eSports Market | The demand for high-performance 4K panels with high refresh rates (120Hz, 144Hz+) and low response times fuels innovation and adoption in the specialized monitor and TV segments, pushing panel manufacturers like AUO and Samsung Display to invest in cutting-edge technology. |

| Integration of Smart Home & AI Features | The increasing adoption of smart features, including AI-driven upscaling and display integration with IoT platforms, necessitates high-resolution 4K panels to deliver enhanced visual quality and functionality expected by tech-savvy consumers. |

| Pitfalls & Challenges | Impact |

| High Capital Expenditure (Capex) for Advanced Fabs | Building and maintaining high-generation fabrication plants (Gen 10.5 or OLED Gen 8.5) require multi-billion-dollar investments, concentrating production among a few giants (BOE, TCL/CSOT, Samsung Display, LG Display) and creating high barriers to entry. |

| Excess Capacity and Price Erosion in Commodity LCD | Overinvestment in older-generation LCD fabs, particularly in China, leads to periods of surplus panel supply, causing volatile and often sharp price declines for basic 4K LCD panels and pressuring manufacturers profitability. |

| Opportunities: | Impact |

| Advanced Panel Technologies (OLED, QD-OLED, Mini-LED) | Continued maturity of premium technologies enhances performance, widening the price/value gap over standard LCD. LG Display and Samsung Display lead this, cementing 4Ks position at the high-end and driving higher average selling prices (ASPs). |

| New Application Verticals (Automotive, IT) | Rapid growth in non-TV applications, especially large, multi-screen automotive dashboards and high-end IT products (laptops, tablets), opens new, high-margin markets for 4K panels, diversifying revenue streams for companies like AUO and Tianma. |

| Market Leaders (2025) | |

| Market Leaders |

8% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | North America |

| Fastest growing market | North America |

| Emerging countries | France, Japan, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Besides that, as excellent display performance has been embraced by the panel industry, for example, through OLED (organic light emitting diode) and QLED (quantum dot LED) technologies, mini-LED backlighting, and high-performance driver ICs, the demand for the specialized components and manufacturing will skyrocket. Companies are persistently investing in automated assembly and testing machines through which they lessen their dependence on manual labor, achieve better precision, and increase the use of the more complex materials, which will affect the productivity of large-scale panel fabricators in industrial and technology hubs.

The upgrading of advanced computer-aided design (CAD) and process simulation systems by companies results in 4K panels being the most suitable elements for seamless integration, high-dynamic-range (HDR) performance tracking, and enhanced color accuracy features, thus, they are becoming an indispensable part of the modern digital environment in today's economy. The combination of high-fidelity visual quality and content availability will be instrumental in sustaining the market growth of UHD 4K panels for the next several years.

According to recent industry analysis, the share of consumers adopting 4K UHD TVs in emerging markets has risen substantially, reaching a significant percentage of new TV sales, which is the highest level in the post-content-proliferation period. This aggressive adoption of affordable 4K models (with average panel sizes continually increasing and integration with streaming services reported by most brands) is a direct measure to counter the reduced demand for lower-resolution models caused by increasing content availability and falling component costs.

While consumer electronics spending has some recent fluctuations, these pricing tactics are successfully bringing the reluctant buyers back to the market. As the price difference decreases, the number of new display devices sold will be the main factor for the demand for 4K panels to increase, as UHD displays are the most basic yet indispensable components of any new high-end consumer electronic device, thus, the gaming monitor, large-screen TV, and commercial signage market segments will be the ones that benefit from this affordability-driven surge in buyer activity.

The smart display movement is an important factor in the changing of display component supply chains that are happening in the electronics industry due to the digital enhancement of 4K panels. By employing such technologies as internet of things (IoT) sensors, artificial intelligence (AI) for image upscaling and motion smoothing, and wireless connectivity for integration into smart ecosystems, the ability to monitor the condition of the installed panels in real-time, implement predictive maintenance for display uniformity, and optimize usage based on the content data will result in less energy waste, more vibrant visuals, and a higher level of convenience, which will lead to substantial cost savings for the end users over time. What is more, smart UHD panel systems will deliver real-time data to content delivery networks (CDNs) on viewing patterns, security, and operational efficiency to facilitate the creation of a totally interconnected ecosystem that is consistent with the principles of immersive and flexible home entertainment management.

In addition, the possibility of employing digital fabrication technology along with the capability to interconnect different display components conforms to a wide range of new trends in the sphere of advanced manufacturing and digital supply chain technology that are unfolding. Automated testing systems and machine learning algorithms will be the foundation for production planning that is done autonomously, thus, quality control issues which are the main concern at present will be solved indirectly while at the same time precision will be raised and manufacturing error will be lowered.

While high-fidelity visuals and operational resilience are becoming the primary concerns of all electronics companies, 4K panels enabled with smart display technology provide both manufacturers and integrators with a great opportunity to meet the demands of a constantly changing global market with increasing competition driven by technological advances.

Ultra-High-Definition Panel 4K Market Trends

The ultra-high definition panel 4K industry is experiencing major changes in its technological environment as the products are being altered in terms of their design, manufacturing, and utilization one after another. Pixel density improvements set higher visual standards, familiar new trends like immersive gaming, professional content creation, and personalized viewing modules appear, and regulations are introduced to ensure energy efficiency. While companies are eager to offer displays that have high performance and a low environmental impact in order to comply with energy efficiency codes (e.g., Energy Star) and, at the same time, to be able to enhance the visual fidelity and responsiveness of the display, digitization through artificial intelligence (AI) algorithms and smart display technologies is changing product specification, manufacturing, and integration processes at a fast pace.

- Shift to advanced panel technologies and energy efficiency: The UHD panel market is very clear about its next step, which is the utilization of energy-efficient and high-fidelity panel materials as one of the global initiatives to reduce the power consumption of devices, as well as, the continuous observance of strict regional electronic waste and efficiency codes, is being made possible through advanced products. One of the major factors that device manufacturers have massively adopted these technologies is that such technologies as OLED (organic light emitting diode), quantum dot (QD) integration, and mini-LED backlighting provide them with higher contrast, less energy consumption, and long-term colour stability.

- Additionally, sustainability, driven by more consumer preference for eco-friendly electronics and ESG commitments from major brands, is facilitating the transition to high-efficiency panels and thus the eventual predominance of energy-rated display products as the industry standard.

- Advanced manufacturing and process automation: These technologies are fast turning into the central factors of the supply chain of UHD panel production in today's world. Fabrication facilities and assembly lines are largely changing over to the use of robotic handling systems and high-precision photolithography equipment technology. The major advantage of these technologies is that they allow for non-stop operations with very high precision and with very little manual input, thus very low defect possibilities, at the same time they help to raise the quality standards for very small pixels.

- The entire production process will be managed in real-time because most repetitive tasks, usually performed by humans, are completed by automated guided vehicles (AGVs), automated optical inspection (AOI) machines, and the integration with manufacturing execution systems (MES), hence the speed and the quality of the panels made are increased. Besides that, as panel specifications become increasingly personalized and just-in-time delivery is employed for device assembly, automation will probably be at the heart of most panel manufacturing fleets in the future.

- Digitalization and smart display integration: A major change in the use of UHD panels caused by digitalization is the conversion of these components into smart, connected assets, which is great both for the owners of the devices and the managers of the content delivery systems. Via onboard processing units and remote connectivity, users get from their panels the most valuable, real-time information necessary for their security and performance that, besides the mentioned, also include AI-driven upscaling quality, pixel refresh rates, and integration with home automation hubs.

- Automation of software updates and real-time availability of security patches, which are very helpful in giving the users of the devices more convenience and safety, are the direct outcomes of this. Furthermore, due to the unlimited availability of connectivity and IoT technology, it is very simple for the companies to link the remote monitoring of their panel performance with their cloud service platforms, thus creating a smart ecosystem that is interconnected.

The main reason for the considerable growth in the demand for UHD panels that optimize visual clarity and make efficient use of screen real estate with the added requirement of not compromising responsiveness has been the high-resolution content, immersive gaming, and professional workflows. This phenomenon has led to a greater demand for large-format commercial displays and high-refresh-rate gaming monitors, as well as for the directions of the development of new panel products suitable for portable devices and virtual/augmented reality applications.

To meet this demand, manufacturers have decided to implement narrow-bezel designs for better aesthetic appeal, and, using advanced local dimming zones and factory-calibrated colour profiles, they provide enhanced picture quality and uniformity. Most of these tricks not only increase the companies' ability to deliver maximum visual performance and a seamless aesthetic but also make the integration process in complex electronic devices easier.

Ultra-High-Definition Panel 4K Market Analysis

Learn more about the key segments shaping this market

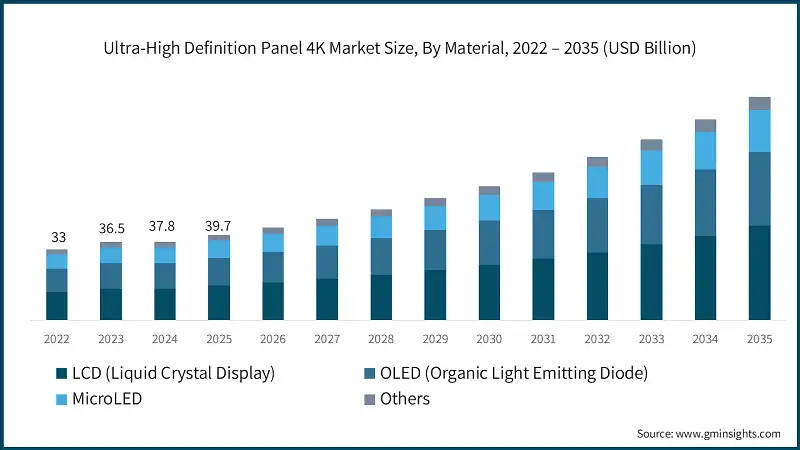

Based on technology, the market is segmented into LCD (liquid crystal display), OLED (organic light emitting diode), MicroLED, and others. The LCD segment is projected to hold the largest share in 2025, generating a revenue of USD 16.1 billion, reflecting its position as a dominant, balanced solution.

- Traditionally used to balance cost-effectiveness with performance, LCD and its technology derivatives (mini-LED and QD-LCD) have become a main source for high-volume residential and commercial projects. These technologies often have excellent manufacturing scalability and high brightness capabilities because of their mature fabrication and ability to maintain strong visual performance under diverse size requirements for extended periods. For industries such as mass television manufacturing, desktop monitors, and large-scale affordable digital signage, being able to provide a highly efficient, high-volume product while meeting tight budgets makes LCD invaluable for their business.

- In addition to providing many of the same size advantages as basic materials, OLED technology excels at operating in aesthetically driven and premium viewing environments. As the use of LCD continues to increase, OLED remains the primary choice for users who prioritize perfect black levels, infinite contrast ratios, and exceptional color fidelity. Additionally, high-end variants like QD-OLED continue to be an attractive choice for users who desire long-term reliability and less overall complexity when compared to mini-LED backlights, while still meeting high performance standards.

- Technology diversification offers a great deal of flexibility in meeting different industry demands all over the world. The flexibility that high-performance technology like MicroLED provides allows it to achieve extreme brightness levels, operate in harsh outdoor conditions, and be very reliable in different geographical conditions. Therefore, display technology is increasingly being used by large commercial developers and global architects for their custom-sized video wall and high-end automotive operational needs. Additionally, there is a vast supply chain and fabrication network around the world; consequently, these technologies can provide consistent performance and service both in established and emerging economies.

Learn more about the key segments shaping this market

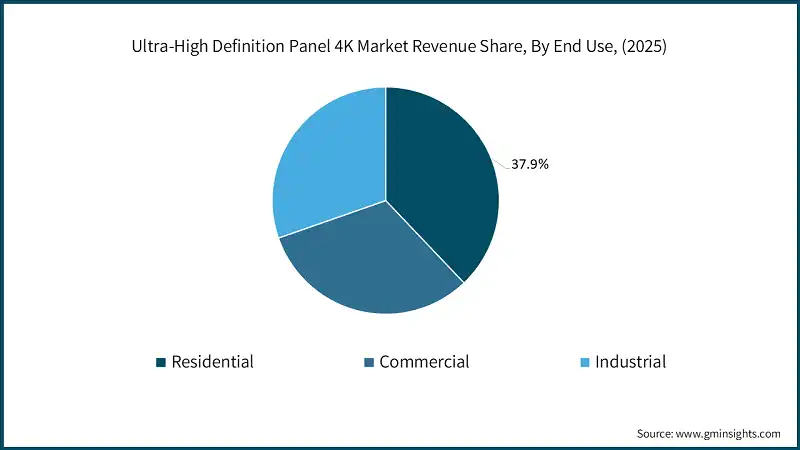

Based on end-user, the Ultra-High-Definition panel 4K market is functionally segmented by residential, commercial, and industrial sectors. In 2025, the residential segment is projected to hold the major market share, generating a revenue of USD 15.1 billion.

- Residential consumption stands out as a critical growth engine. This sub-segment encompasses all consumer purchases of 4K UHD TVs, gaming monitors, and personal devices that allow property owners to enhance the visual experience, gaming performance, and home aesthetics without structural overhaul. These products use innovative features, including high refresh rates (120Hz+), advanced AI-driven upscaling, and wide color gamut support, to meet the specific needs of modern home entertainment. The residential market benefits directly from the proliferation of 4K content and an aging display inventory, positioning it for resilient, stable growth.

- Many businesses are adopting high-quality replacement units because they immediately improve information delivery, customer engagement, and operational efficiency. By replacing old units with modern, high-resolution displays, companies are reducing the opportunity for poor visual presentation, decreasing the risk of customer disengagement, and allowing viewers to enjoy continuous, high-fidelity content. This is particularly important for high-traffic Commercial spaces and specialized Industrial uses like medical imaging and control rooms. This is important for high-cost-of-living and climate-sensitive regions.

- Residential and commercial/industrial panel products continue to evolve rapidly due to the advances made in panel efficiency, smart sensor integration, and durability standards. With the integrated ability to detect viewing conditions, dynamically control local dimming zones, and withstand 24/7 operation, modern-day UHD panels offer superior long-term performance. The shift toward Net-Zero Energy Buildings (via power-efficient displays) and environmentally conscious product design has increased the number of companies looking for high-performance display systems to be fully integrated, thus supporting the continued growth of all end-user segments.

Based on resolution, the Ultra-High-Definition panel 4K market is segmented into 4K UHD (3840 x 2160 pixels) and 8K UHD (7680 x 4320 pixels). The 4K UHD segment is projected to hold the largest value in 2025, generating a revenue of USD 22.9 billion, reflecting its position as the current mainstream, high-volume standard.

- Traditionally, 4K UHD has been the foundational display standard, balancing high pixel density with manageable data bandwidth and processing costs. This resolution is the primary focus for many consumer electronics, including streaming devices, gaming consoles, and IT monitors. The 4K segment benefits from near-universal content availability and economies of scale in panel production, which helps maintain strong market share and makes it the default choice for mass-market adoption and high-volume manufacturing. For industries focused on maximizing sales volume and providing affordable premium visuals, the maturity and efficiency of 4K are invaluable.

- In addition to providing the current standard of visual quality, the emerging 8K UHD resolution excels at operating in the most premium viewing environments and specialized commercial applications. As the use of 4K becomes ubiquitous, 8K remains the primary choice for users and businesses who prioritize maximum possible detail, immersive viewing on ultra-large screens (85" and above), and professional applications (e.g., medical imaging, high-end content creation, and broadcast). This segment benefits from a higher compound annual growth rate (10.7%) than 4K (9.9%), reflecting the trend of users seeking continuous improvement in pixel density.

- The continued co-existence of these two resolutions offers flexibility in meeting different performance and budget demands all over the world. The shift towards 8K is driven by the industry's desire to push technological boundaries and establish a new premium tier, while 4K provides the accessible, performance-driven core market. Consequently, manufacturers are heavily investing in AI-driven upscaling technology to ensure all lower-resolution content looks superb on 8K panels, and in the necessary HDMI 2.1 or DisplayPort 2.1 infrastructure to support the massive bandwidth required for both high-framerate 4K and 8K.

Looking for region specific data?

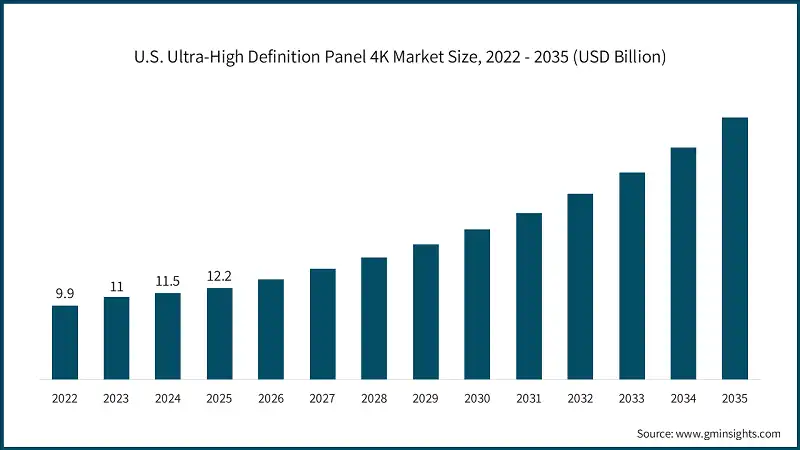

North America Ultra-High-Definition Panel 4K Market In 2025, the U.S. will dominate the North America market, accounting for 83% of the regional share and generating around USD 12.2 billion in revenue in the same year. The region is projected to grow at the highest CAGR of 11% globally 2026-2035. Europe's market will account for 22.5% of the global share in 2025 and is expected to grow at a CAGR of 4.6% during the forecast period. Europe's UHD panel (4K) market will account for 27.2% of the global share in 2025 USD 10.8 billion and is expected to grow at a CAGR of 10% during the forecast period. The Asia Pacific market value is projected at USD 8.7 billion in 2025 and is expected to grow at a regional CAGR of 9.6% from 2022 to 2035. China is leading the region with a market share of 32.5% in 2025. The Latin America UHD panel (4K) market is projected to reach USD 2.9 billion in 2025 and grow at a CAGR of 10.3% during the forecast period. Samsung Display Co., Ltd. is leading with 8% market share. Samsung Display Co., Ltd., LG Display Co., Ltd., BOE Technology Group Co., Ltd., Sharp Corporation, AU Optronics Corp. (AUO), Innolux Corporation, and Japan Display Inc. collectively hold around 28%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position. Samsung Display Co., Ltd. is a global leader in the UHD Panel market, providing a wide variety of high-performance display solutions, from advanced QD-OLED and Mini-LED panels to mass-market LCD displays. It has established itself as an innovator in the areas of display technology and color science and is a recognized leader in developing and delivering products that align with timeless design trends, along with advanced systems used in ensuring high resolution, deep contrast ratios, and modern aesthetics, while promoting the principles of energy-saving, and good practice when it comes to display manufacturing. Samsung Display's extensive global presence and massive production capacity also make it a benchmark for premium and mainstream UHD panel solutions across various applications. LG Display Co., Ltd. has been at the forefront of the introduction of new display technology. As one of the largest manufacturers of OLED, P-OLED, and LCD panels, LG Display continues to be an industry leader with respect to the use of new technologies within the display sector and supply chain integration. In addition to providing high-efficiency, self-emissive display solutions, LG Display also provides extensive customization options for all TV, mobile, and commercial projects. As a company committed to technological leadership through transparent manufacturing processes, LG Display is well positioned to support high-quality UHD panel solutions for customers worldwide. BOE Technology Group Co., Ltd. is known for manufacturing durable and reliable LCD and next-generation display profiles for a massive range of devices that have been specifically designed for use in consumer electronics, industrial applications, and automotive displays. All the BOE products incorporated high pixel densities, excellent refresh rates, and design flexibility, which will enhance visual performance and user experience while providing maximum reliability in rigorous and harsh operating environments, making them a crucial supplier for high-volume 4K panels in the global market. Major players operating in the ultra-high-definition panel 4K industry are: AU Optronics Corp. (AUO) is a key player in the high-value segment of the UHD Panel market, primarily focused on delivering differentiated and innovative display solutions beyond standard mass-market TV panels. AUO is known for its leadership in specialized areas, including high-refresh-rate gaming monitors (4K ,144Hz+), automotive displays, and professional/industrial-grade panels. The company actively invests in next-generation technologies like Ink Jet Printing (IJP) OLED, Mini-LED backlighting, and Micro LED, which drive demand for advanced UHD fabrication. By focusing on high pixel density, unique form factors, and superior visual technologies (like their Advanced Reflectionless Technology - A.R.T.), AUO serves as a critical supplier to brands seeking cutting-edge performance in niche and premium electronics. TCL Technology (via its display subsidiary CSOT - China Star Optoelectronics Technology) has rapidly emerged as a dominant force in the mass production of UHD 4K panels, securing a top-tier position in global TV shipments. The company has made strategic, massive investments in advanced generation LCD fabrication plants (Gen 10.5+), allowing it to efficiently produce large-format UHD panels (especially 85-inch and above) at competitive costs. TCL is a global leader in the adoption and mass production of QD-Mini LED technology for 4K displays, driving the trend of high-contrast, high-brightness picture quality in the mainstream TV market.Europe Ultra-High-Definition Panel 4K Market

Asia Pacific Ultra-High-Definition Panel 4K Market

Latin America Ultra-High-Definition Panel 4K Market

Ultra-High-Definition Panel 4K Market Share

Ultra-High-Definition Panel 4K Market Companies

Ultra-High-Definition Panel 4K Market News

The ultra-high-definition panel 4K market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Million Units) from 2022 to 2035, for the following segments:

Market, By Application

- Consumer electronics

- Televisions

- Monitors

- Laptops

- Smartphones

- Tablets

- Commercial

- Digital signage

- Display walls

- Advertising displays

- Healthcare

- Medical imaging displays

- Education

- Interactive whiteboards

- Projectors

- Automotive

- In-car displays

- Infotainment systems

- Others

Market, By Technology

- LCD (liquid crystal display)

- LED-backlit LCD

- Quantum dot (QLED)

- OLED (organic light emitting diode)

- Flexible OLED

- Rigid OLED

- MicroLED

- Direct-view LED

- Mini LED

- Others

Market, By Resolution

- 4K UHD (3840 x 2160 pixels)

- 8K UHD (7680 x 4320 pixels)

Market, By Size

- Below 40 inches

- 40-60 inches

- Above 60 inches

Market, By End Use

- Residential

- Commercial

- Industrial

Market, By Distribution Channel

- Online

- Offline

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- Italy

- France

- Russia

- Belgium

- Poland

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the Ultra-High-Definition 4K panel market?

Key players include AU Optronics Corp. (AUO), BOE Technology Group Co., Ltd., Changhong Electric Co., Ltd., CSOT (China Star Optoelectronics Technology Co., Ltd.), Haier Group, Hisense Group, Innolux Corporation, Japan Display Inc., LG Display Co., Ltd., Panasonic Corporation, Philips (TPV Technology), and Samsung Display Co., Ltd.

What are the upcoming trends in the Ultra-High-Definition 4K panel market?

Key trends include the shift to energy-efficient panel technologies, advancements in OLED, Quantum Dot, and Mini-LED backlighting, and the integration of AI-driven smart display technologies for enhanced visual fidelity and energy efficiency.

What was the valuation of the 4K UHD resolution segment in 2025?

The 4K UHD segment is expected to generate USD 22.9 billion in 2025, reflecting its status as the mainstream, high-volume standard.

Which region leads the Ultra-High-Definition 4K panel market?

The United States is projected to dominate the North American market in 2025, accounting for 83% of the regional share and generating approximately USD 12.2 billion in revenue. North America is expected to grow at the highest CAGR of 11% globally from 2026 to 2035.

How much revenue will the residential segment generate in 2025?

The residential segment is projected to generate USD 15.1 billion in 2025, holding the largest share among end-user segments.

What is the projected size of the LCD segment in 2025?

The LCD segment is expected to generate USD 16.1 billion in revenue in 2025, maintaining its position as a dominant and balanced solution in the market.

What was the market size of the Ultra-High-Definition 4K panel market in 2025?

The market size was USD 39.7 billion in 2025, with a CAGR of 10.2% projected through 2035, driven by advancements in display technologies and increasing demand for energy-efficient solutions.

What is the projected value of the Ultra-High-Definition 4K panel market by 2035?

The market is expected to reach USD 104 billion by 2035, fueled by the adoption of OLED, Quantum Dot, and Mini-LED technologies, alongside growing applications in residential and commercial sectors.

Ultra-High-Definition Panel 4K Market Scope

Related Reports