Summary

Table of Content

STEM Toys Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

STEM Toys Market Size

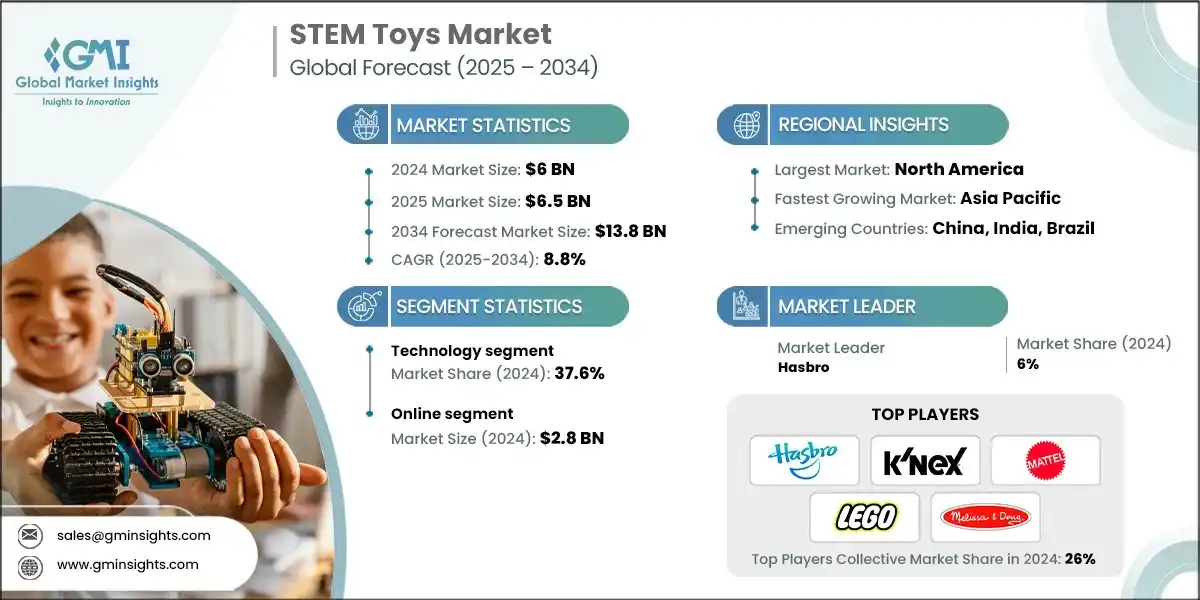

The global STEM toys market was estimated at USD 6 billion in 2024. The market is expected to grow from USD 6.5 billion in 2025 to USD 13.8 billion in 2034, at a CAGR of 8.8%, according to latest report published by Global Market Insights Inc.

To get key market trends

The globalization of new STEM toys also increases interest and buying power for those related products. Toys that foster children's critical and creative thinking are highly sought after by parents and educators. Numerous manufacturers of recreational goods, such as games and toys, are expanding their range of STEM items. They can supply the demand for both traditional toys and educational toys by doing this. Additionally, by placing STEM toys alongside video games and action figures, those firms may expand the market for children's toys since parents will value the items' educational value. This enables leisure product makers to increase sales volume and profit margins.

STEM toys help develop skill at a young age and differ from normal toys which help increase leisure activities video game. Robots and science toy offer children new ways to spend their free time which allow them to be more active. Organizations have shifted their focus to creating toys that appeal to children irrespective of their gender, ethnicity or socio-economical background to further inclusivity in STEM education. These collaborations between STEM educational providers and manufacturers of recreational products have resulted in the blending of entertainment and learning towards themed products. The US Department of Commerce estimated a 10.5 percent growth for STEM occupations from 2020-2034 compared to 7.5 percent in non-STEM fields.

The global STEM toys market is witnessing significant growth driven by a prominent factor which is an increase in urbanization. The urban population is considered highly educative, due to which they seek toys or plays that can foster learning among their children in a fun way. The major restraint for the market is the safety regulations, as it can hamper the entrance of the SMEs in the market, due to the long certification processes. The market is witnessing significant growth driven by a prominent factor which is an increase in urbanization. The urban population is considered highly educative, due to which they seek toys or plays that can foster learning among their children in a fun way. The major restraint for the market is the safety regulations, as it can hamper the entrance of the SMEs in the market, due to the long certification processes.

Apart from this, some of the trends that have been analyzed are the incorporation of AR and VR into STEM toys, as this integration helps provide an enhanced and practical learning experience to the children. Another trend is the rise in the sustainability and the eco-friendliness of the consumer these days. Due to this, the manufacturers are crafting toys that are sustainable and eco-friendly in nature. Another trend is the rise in the sustainability and the eco-friendliness of the consumer these days. Due to this, the manufacturers are crafting toys that are sustainable and eco-friendly in nature.

This surge is fueled by parents and educators seeking toys that combine entertainment with skill building in science technology engineering, and mathematics. North America currently dominates the market holding around 35% share while Asia Pacific is the fastest growing reason due to rising disposable income and government backend stem initiative. Popular product category include robotic gates coding games and construction sets with companies increasing integrating AI and AI technology to enhance engagement. This trend towards team toy which add an art component reflect a holistic approach to child development blending creativity with technical skills

Many STEM toys incorporate advanced technology and materials, making them relatively expensive compared to traditional toys. The higher price point may limit accessibility for lower-income families. Additionally, despite growing awareness of the importance of STEM education, not all parents fully understand the benefits of STEM toys or how to integrate them into their children's learning experiences. Educating parents about the value of STEM toys and providing resources for effective implementation can be a challenge. Despite efforts to create inclusive STEM toys, there's still a prevalence of gender stereotypes in toy marketing and design. This can discourage children, especially girls, from engaging with STEM toys, leading to a narrower market segment.

Hasbro has evolved to become one of the largest companies in the toy industry. This is due to its vast range of products. Moreover, it is expanding to the stem dolls segment via its several educational toy lines. Some of the brands under Play-Doh and NERF which have associated learning components, such as creativity and problem solving, are on the STEM related list. Even though Hasbro's market share in this section is much weaker than that of big players like LEGO, the company’s extensive distribution and strong branding allows it to have a considerable impact in the global educational toy market, which is enabling it to strengthen its position in STEM toys.

K’NEX is known around the world for its construction toys which enable children to build complex structures and models. As K’NEX has achieved significant growth in the STEM toys segment, K’NEX’s focus is on STEM construction doll products that teach engineering skills, spatial reasoning, and creativity to children. K’NEX is popular among parents and teachers looking for constructive educational toys. K’NEX may be a smaller player among household names like LEGO but it enjoys a dominant niche in the stem market, particularly in construction and engineering toys. All demonstrated in the market signs of growing further as technology develops and the respective demand continues.

STEM Toys Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 6 Billion |

| Market Size in 2025 | USD 6.5 Billion |

| Forecast Period 2025 – 2034 CAGR | 8.8% |

| Market Size in 2034 | USD 13.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing Parental Emphasis on Early Education | Parents are increasingly viewing STEM toys as essential tools for developing critical thinking, problem-solving, and future-ready skills from a young age, significantly boosting consumer spending. |

| Integration of Advanced Technology (AI/ML/AR) | Smart toys that offer personalized learning, immediate feedback, and interactive experiences are driving innovation and commanding premium pricing across the market. |

| Government Initiatives and Curriculum Alignment | Government mandates and funding promoting STEM education create a favorable environment for integrating these toys into school curricula, expanding the market beyond in-home use. |

| Pitfalls & Challenges | Impact |

| High Cost of Advanced Robotics and Coding Kits | The advanced components and technology involved lead to a high price point, which restricts adoption by lower- and middle-income families, especially in price-sensitive regions. |

| Competition from Screen-Based Digital Entertainment | STEM toys must constantly innovate to compete for childrens limited attention and engagement time against highly immersive and easily accessible digital games and video content. |

| Opportunities: | Impact |

| Untapped Markets in Emerging Economies | New Customer Base: Rising disposable incomes, increasing urbanization, and expanding middle classes in regions like APAC and Latin America offer significant potential for market penetration and sales growth. |

| Convergence of Physical and Digital Play (STEAM) | Product Diversification: Developing products that seamlessly blend physical construction with digital coding/AR/Art (STEAM) appeals to a broader consumer base and creates opportunities for subscription services and content sales. |

| Market Leaders (2024) | |

| Market Leaders |

6% market share |

| Top Players |

Consolidate share of 26% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | Largest market |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

STEM Toys Market Trends

STEM toys combine play and education. They enable children to learn while they enjoy themselves. This is the reason why many parents prefer toys which serve a dual purpose of fun and education. This integration of recreation and learning gave rise to the STEM approach in the design of leisure products like board games, puzzles, and even sports which, in turn, contributed to the expansion of the entire recreational products industry.

- In March 2024, Playtime Engineering MyTracks, a kid-friendly electronic music creation tool that makes beat-making easier for kids, is the newest product. With an anticipated retail price of USD 500, the device—which incorporates a drum machine, synthesizer, microphone for audio sample, and sequencer—was unveiled through a Kickstarter campaign in April. MyTracks' large control knobs, levers, and randomized function were designed to make music discovery more approachable for children.

- The product was devoid of BPA and choking dangers since it complied with strict kid safety regulations. From 2025 to 2034, the demand for mathematical STEM toys is predicted to increase because they develop important abilities like problem-solving, logical reasoning, and hand-eye coordination in an entertaining and engaging way, mathematical toys are advantageous.

- Thus, a new market was created as STEM educators joined forces with recreational manufacturers to design themed products that were both entertaining and educational. Some of these products include board games for scientific discovery, construction sets for engineering, and math puzzles. Such products delight children and help stimulate their curiosity and STEM knowledge.

- Breakthroughs in artificial intelligence (AI) and machine learning have led to the development of smart STEM toys that provide personalized learning experiences for children. The National Science Foundation (NSF) claims children who have contact with STEM reasoning early on develop greater problem solving and critical thinking skills necessary for their future jobs. With the ability to capture such a vast audience, the market for STEM toys has expanded the range of target consumers to include children, teenagers, adults and even non-educational marketers. Furthermore, the growth trend enables manufacturers to reach out to new demographics, developing products that interest and appeal to specific skill sets.

STEM Toys Market Analysis

Learn more about the key segments shaping this market

Based on type, the market is divided into science, technology, engineering and mathematics. The technology segment held the largest share, accounting for 37.6% of the global STEM toys industry in 2024.

- Engineering toys help children learn by enabling them to actively build, create, and experiment. This is especially valuable for teaching STEM because this form of instruction is multi-sensory, active, and problem-centered.

- Furthermore, these toys often facilitate group work, as children can attempt to build structures or complete various engineering challenges collaboratively, which also develops their communication and cooperative skills.

- Along with helping children socially, many engineering toys involve construction, assembly, and other manipulative activities which encourage the development of children’s spatial skills. These abilities are important for geometry and even more advanced fields like architecture and mechanical engineering.

Learn more about the key segments shaping this market

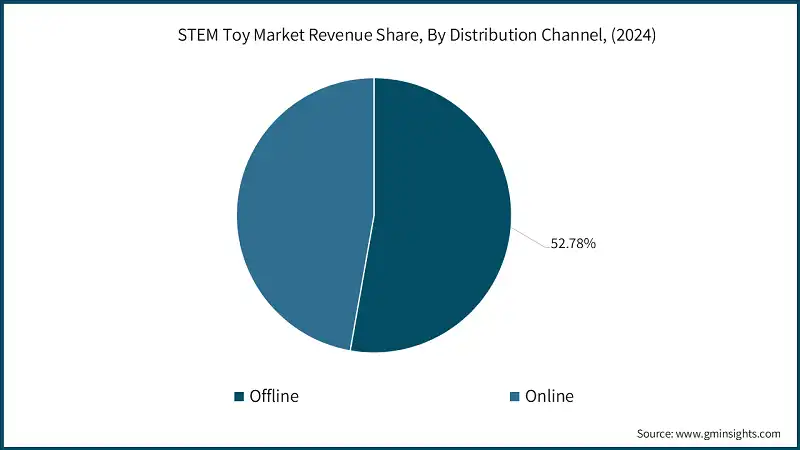

Based on the distribution channel, the STEM toys market is segmented into online and offline. In 2024, online held a major market share, generating a revenue of USD 2.8 billion.

- STEM toys sales traditionally favor online sales, which represent most of the market today. Online sales allow the manufacturer to control the relationship with the customer, thereby customizing solutions for customers while also providing a complete service package. Online sales are growing at a significant rate because of increased customer demand for an integrated package including equipment, finances, service, and telematics platforms.

- Online sales allow manufacturers to use their relationships to gain market intelligence and stay connected to the customer regarding product services and inspections and maximize customer lifetime value based on service contracts and parts related to toy operations.

- Offline sales are comprised of dealers and distributors (sometimes referred to as the VAR channel), primarily used in market segments where a local presence and immediate availability is required. Offline channels primarily serve small and medium enterprises that are primarily purchasing standard configurations.

- Dealers play an important role in providing customer services and options. The impact of distribution channels on sales has increased pressure on dealers and other parts of the distribution channels from manufacturers that are now involved in most of the purchasing process.

Looking for region specific data?

North America STEM Toys Market

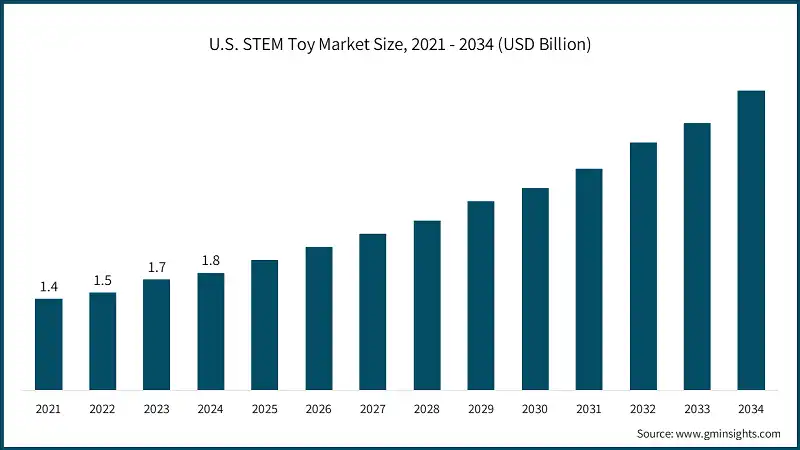

In 2024, the U.S. dominated the North America industry, accounting for around 84.5% and generating around USD 1.8 billion revenue in the same year.

- North America represents a large portion of the global market share and has fared well for consistent growth on the premise of its established logistics network and widespread acceptance of technical innovation.

- The region remains at the forefront of consumers of Toys sales comprising a large portion of total seat belt exports. Additionally, government mandates, especially in states like California will continue to facilitate the transition of smart and integrated child seat belt.

- In North America, education is highly valued and parents along with educators work towards preparing children for careers in technology and innovation by emphasizing on STEM subjects. STEM toys are viewed as instruments for propelling learning even at an early age.

- Moreover, Governments and educational institutions in North America tend to fund projects that increase the popularity of science, technology, engineering, and mathematics education. Such funding includes allotments for STEM programs in schools and campaigns seeking the production and use of STEM toys.

- The United States, in particular, is known for its large economy and high rates of disposable income making them the largest market for educational toys and materials. However, in North America, some major companies in the toy industry, which include stem focused toy manufacturers, have already established themselves and started funding STEM toy marketing in the region for a percentage of the market share.

Europe STEM Toys Market

Europe market, Germany leads the market 24.1% share in 2024 and is expected to grow at 9.1% during the forecast period.

- The German parents, educators and politicians are increasingly realizing the importance of developing critical thinking, problem solving, and digital skills in children as early as possible, and consider STEM toys as an aid towards achieving this goal.

- In Germany, where advanced manufacturing, automotive, and engineering are central to the economy, STEM’s ability to teach coding, robotics, engineering, and other technical disciplines in an interesting way makes these toys very attractive.

- STEM toys further prepare children for careers in these sectors by providing them with some hands-on experience in applying STEM concepts and nurturing an interest in technology at a young age positions it as a leader in the sustainable educational transformation of Europe.

- The larger European market benefits from sustainability initiatives and Industry 4.0 initiatives to drive operational efficiency, minimize environmental impact, and promote innovation. These initiatives position Europe as a competitive market for advanced technologies and sustainable industrial practices.

Asia Pacific STEM Toys Market

The Asia Pacific leads the market. China holds a market share of around 32.5% in 2024 and is anticipated to grow with a CAGR of around 8.6% from 2025 to 2034.

- As China continues to prioritize innovation and technological advancement as pillars of its future economic success, there has been a growing recognition of the importance of early STEM education. Parents, educators, and policymakers are placing increasing importance on fostering critical thinking, creativity, and problem-solving skills in children from an early age. STEM toys are viewed as an ideal tool to achieve these educational goals, offering children the opportunity to explore scientific concepts, engineering principles, and technology in a playful, engaging, and hands-on way.

- China, representing the largest market in the region, is benefitting from a national plan called "Made in China 2030." The focal points of automation in combination with intelligent manufacturing systems will improve their competitive position and produce significant market growth.

- Rising awareness and costs to produce, surging demand for high-quality products, and the desire for improved operational efficiency are key factors contributing to growth in the Asia Pacific manufacturing market, driving innovation and competitiveness across the region.

Latin America STEM Toys Market

Latin America represents over 7.7% of global STEM toys revenue, with an estimated market size of USD 0.5 billion by 2025. The region is expected to grow at around 6.3% from 2025 to 2033. The Latin America STEM (science, technology, engineering, and mathematics) toys market is a rapidly growing segment within the broader toy and educational products industry, driven by increasing parental emphasis on early childhood development and skill-building.

- Brazil and Argentina lead the Latin American market, a significant and growing demand for educational and STEM toys as parents increasingly prioritize cognitive development, critical thinking, problem-solving, and future-ready skills for their children

- Robotics kits and coding-focused toys are among the fastest-growing sub-segments globally, a trend that is also being adopted in Latin America to prepare children for technological advancements .

- The market is evolving with increased urbanization and rising disposable incomes, creating demand for premium and multifunctional seats. Parents are prioritizing safety and convenience, boosting the adoption of advanced models.

STEM Toys Market Share

- Hasbro is leading with 6% market share. Hasbro, K’NEX, LEGO Group, Mattel, & Melissa and Doug collectively hold around 26%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- LEGO is one of the top brands in the toy market and perhaps the most powerful. They are well-known for their construction blocks, LEGO has successfully branched out into STEM-based products including LEGO Mindstorms which gets children interested in coding and robotics as well as LEGO Boost, which enables children to build and program with motors. With the strong educational and international presence, plus its focus on creativity, engineering, and technology, the company has been able to seize great share of the market. The comprehensive product offering and LEGO’s status as a leader in educational play provides the company with unparalleled market share in the STEM segment.

- The top toy company in the world, Mattel, and Microsoft formed a strategic alliance to incorporate Microsoft's AI technology into Mattel's line of STEM toys, improving its interactive features and educational value.

STEM Toys Market Companies

Major players operating in the STEM toys industry are:

- BanBao

- Bandai

- Gigotoys

- Goldlok Toys

- Guangdong Loongon

- Guangdong Qman Culture Communication

- Hasbro

- K’NEX

- LEGO Group

- Mattel

- Melissa and Doug

- ShanTou LianHuan Toys and Crafts

- Spin Master

- TAKARA TOMY

- Vtech

STEM Toys Industry News

- In 2024, Spin Master, a global children's entertainment company and a major toy manufacturer, completed the acquisition of Melissa & Doug, a renowned brand specializing in open-ended, educational, and developmental toys, including a large portfolio of wooden and hands-on activity sets which heavily overlap with the educational and STEM segments. This strategic acquisition significantly expands Spin Master's presence and market share in the growing preschool and early childhood educational toy category, diversifying its portfolio beyond its traditional strength in entertainment franchises. The move positions the company as a more formidable player in the long-term, non-licensed play space, directly competing in the core learning and educational toy segments.

- In 2025, Mattel, the owner of iconic brands like Barbie and Hot Wheels, announced a significant partnership with OpenAI to integrate artificial intelligence into their products and creative development process. While the partnership is broad, it is focused on leveraging advanced AI tools, such as ChatGPT, to enhance product development and create interactive digital experiences for their intellectual properties (IPs). This move represents a major technological expansion, signaling Mattel's intent to evolve its brands from traditional toys into multi-platform entertainment and potentially intelligent, interactive STEM-adjacent learning tools, aligning with the industry trend of merging physical and digital play.

- In 2025, Mattel announced a multi-year licensing agreement with Teacher Created Materials (TCM), a leading educational publisher. This collaboration is designed to launch a new line of curriculum-aligned, skill-building workbooks and supplemental materials for young learners aged three to eight, featuring Mattel's iconic franchises like Barbie and Hot Wheels. The launch, expected to begin in Spring 2026, is a key expansion effort by Mattel to firmly place its brands within the structured educational market in the United States and Canada, directly addressing the growing demand from parents and educators for branded learning resources that support literacy, math, and content knowledge.

- In 2025, LEGO Group announced plans to further invest in digital gaming and collaborations with major non-toy brands such as Nike and Formula One. This strategy is an expansion of its existing model to merge physical construction play with digital interaction and highly relevant cultural partnerships. For the STEM market specifically, this investment bolsters the ecosystem of its existing engineering and coding lines like LEGO Technic and LEGO Education, providing more immersive and current-world-relevant themes that capture children's interest in engineering and mechanics through licensed concepts like high-performance racing.

The STEM toys market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Type

- Science

- Technology

- Engineering

- Mathematics

Market, By Age Group

- 0–3 years

- 3–8 years

- 8–12 years

- 12+ years

Market, By Distribution Channel

- Online

- Offline

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the STEM toys market?

Major players include Hasbro, K’NEX, LEGO Group, Mattel, Melissa & Doug, Spin Master, BanBao, Bandai, VTech, TAKARA TOMY, and Goldlok Toys. These companies are expanding portfolios through acquisitions, technology integration, and curriculum-aligned product launches.

What are the upcoming trends in the STEM toys industry?

Key trends include integration of AI/ML/AR in interactive toys, the rise of sustainable and eco-friendly materials, and increasing adoption of hybrid physical-digital STEAM products. These advancements enhance hands-on learning and align toys with modern education standards.

How much revenue did the online distribution channel generate in 2024?

Online distribution channels generated USD 2.8 billion in 2024. Online platforms dominate the market as they enable personalized product offerings and integrated service packages for buyers.

What was the valuation of the U.S. STEM toys market in 2024?

The U.S. market generated around USD 1.8 billion in 2024, accounting for nearly 84.5% of the North America market. Growth is supported by high disposable incomes, strong emphasis on early STEM learning, and government-backed educational initiatives.

What is the current market size of the STEM toys industry in 2025?

The market size is projected to reach USD 6.5 billion in 2025. Rising focus on skill-building toys and integration of advanced technologies continues to support steady growth.

What is the projected value of the STEM toys market by 2034?

The market size for STEM toys is expected to reach USD 13.8 billion by 2034. The industry outlook is driven by AI-enabled interactive toys, curriculum-aligned products, and the convergence of physical and digital play.

What is the market size of the STEM toys industry in 2024?

The market size was USD 6 billion in 2024. The industry is expanding due to growing parental emphasis on early education and increasing demand for learning-focused play.

STEM Toys Market Scope

Related Reports