Summary

Table of Content

Specialty Crop Propagation Materials Market

Get a free sample of this report

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Specialty Crop Propagation Materials Market Size

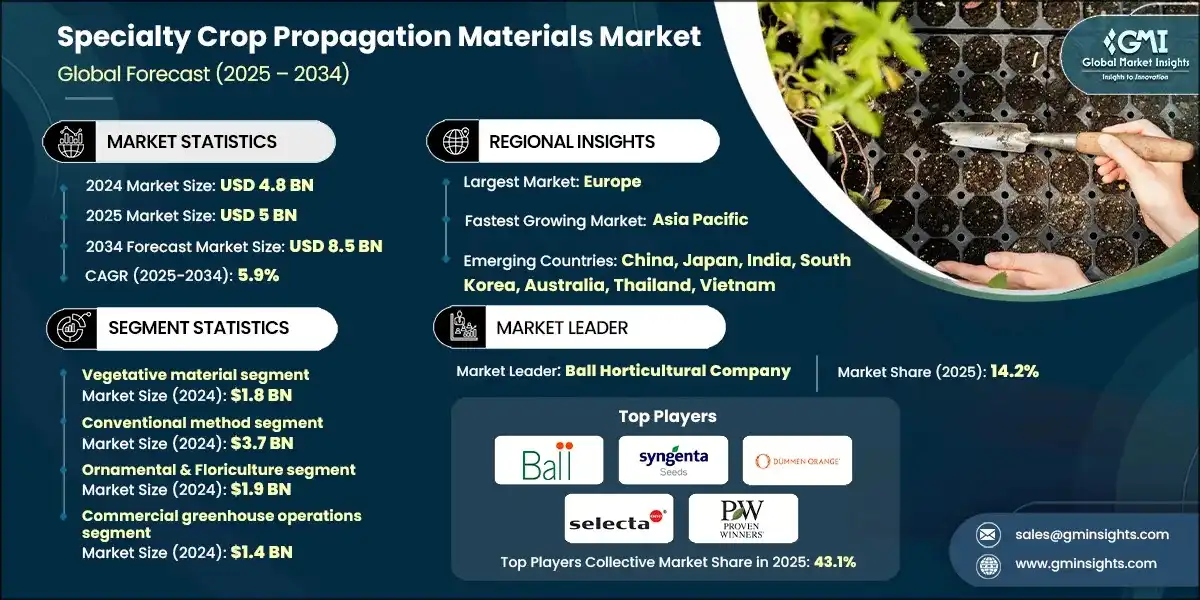

The global specialty crop propagation materials market was valued at USD 4.8 billion in 2024, according to the latest report published by Global Market Insights Inc. The market is expected to grow from USD 5 billion in 2025 to USD 8.5 billion in 2034, at a CAGR of 5.9%.

To get key market trends

- Propagation material is concerned with the tools and inputs and methods used to propagate specialty crops, which include fruits, vegetables, flowers, nuts, and medicinal plants, as opposed to the staple grains. The materials include seeds, cuttings, grafts, tubers, and plant parts, which are used by farmers for multiplying their plants with desired qualities in an efficient manner.

- The market for these materials is growing due to the increasing demand of the consumers for a wide variety of fruits and vegetables of qualifying nutrition and value. The second major cause is awareness about sustainable farming. People are into the healthy food options and the uniqueness of plants. This has vigorously pushed farmers and producers to innovate and invest in better propagation technologies for growing consumer demand.

- Ornamental plants and flowers among segments that can be grown are the most conspicuous, especially in the regions having favourable climates and the potential for good exports. Among vegetative propagation methods, grafting and cuttings are becoming very popular because they provide better quality and faster growth in comparison to traditional seed propagation making them marketable for growers that are focused on efficiency as well as consistency.

- Technology is catering to the growth of the market further. Precision agriculture tools, nursery automation, and digital platforms connecting growers with agronomists help in better monitoring of crops in the field resource use, and overall crop health. These innovations allow for more reliable and sustainable growth methods, encouraging increased adoption of specialty crops.

Specialty Crop Propagation Materials Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 4.8 Billion |

| Market Size in 2025 | USD 5 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.9 % |

| Market Size in 2034 | USD 8.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for certified and organic propagation inputs | The growth of organic and specialty crop markets is driving demand for certified propagation materials such as organic seeds, cuttings, and plantlets. Producers transitioning to organic systems require inputs that meet certification standards, creating a steady need for verified materials. |

| Automation and smart propagation technologies | The propagation sector is increasingly adopting automation technologies to enhance efficiency and consistency. Greenhouses and nurseries are integrating tools such as automated seeding systems, robotic transplanting, and precision irrigation. |

| Focus on plant health and disease-free materials | There is growing emphasis on the health and cleanliness of propagation materials. Disease resistance and pathogen-free standards are now critical, especially in response to stricter organic certification protocols and heightened consumer expectations. |

| Pitfalls & Challenges | Impact |

| High cost and accessibility of advanced technologies | While automation and climate-controlled systems offer significant benefits, their high initial costs and technical complexity can be prohibitive—especially for small and mid-sized growers. Many producers lack the capital or expertise to adopt these innovations. |

| Vulnerability to regulatory shifts and certification complexity | The increasing demand for organic and certified propagation materials brings with it complex and evolving regulatory requirements. Navigating organic certification, disease-free protocols, and plant health documentation can be resource intensive. |

| Opportunities: | Impact |

| Expansion of organic and sustainable propagation materials | With rising consumer demand for organic and eco-friendly products, there is a significant opportunity to develop and supply certified organic propagation materials, biodegradable substrates, and sustainable packaging. |

| Advancement in biotechnology and tissue culture | Emerging biotechnologies such as tissue culture, micropropagation, and genetic improvements offer the chance to produce high-quality, disease-free, and uniform propagation materials at scale. |

| Integration of digital and precision agriculture tools | The increasing use of sensors, AI-driven monitoring, and automation in propagation offers opportunities to optimize resource use, improve quality control, and reduce labor costs. |

| Market Leaders (2024) | |

| Market Leaders |

14.2% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, Japan, India, South Korea, Australia, Thailand, Vietnam |

| Future Outlook |

|

What are the growth opportunities in this market?

Specialty Crop Propagation Materials Market Trends

- An emerging trend is the shift of production from traditional outdoor propagation into more controlled environment systems is undergoing rapid development. Growers are now changing their methods and schedules according to demands posed by increasing climate variability and extremes in weather that have rendered the dependence on outdoor conditions riskier. Controlled environments allow for steady production regardless of unpredictable seasonal changes.

- Investment in climate-resilient propagation techniques is also on the rise. Subsequently, more nurseries and greenhouses are availing themselves of facilities for climate control that allow temperature, humidity, and light to be properly manipulated. This allows the grower to insulate crops from weather-induced strain and to guarantee uniform quality and timing throughout the entire year.

- Increased demands for certified and organic propagation materials is due to farmers shifting towards sustainable organic farming. The demand for propagation materials is increasing, and producers are now looking for the sources that meet stringent certifications to produce organic crops because of favoring consumer preference for eco-friendly and healthy products.

- The world is shifting towards productively transforming propagation systems through precision process automation. Intelligent propagation systems include super-efficient automated seeding technology, robotic transplanting capabilities, and sensor-driven irrigations, which are common among growers in narrowing down labor costs and diffusing their scale of production while making resource use more efficient.

- Another trend concerns the increasing emphasis on disease resistance and plant health in propagation material. There is an increased demand for pathogen-free, disease-resistant types influenced by even more stringent standards for organic certification as well as consumers seeking healthy and reliable plants.

- The plant health and materials free from diseases boosting strength passionately continue to be focused on due to prospective minimal losses to crops and compliance with regulations. Advanced screening methods, clean stock programs, and breeding disease-resistant traits are becoming important ways to guarantee propagation materials that are free from pathogens of high quality in accordance with both market and certification demands.

Specialty Crop Propagation Materials Market Analysis

Learn more about the key segments shaping this market

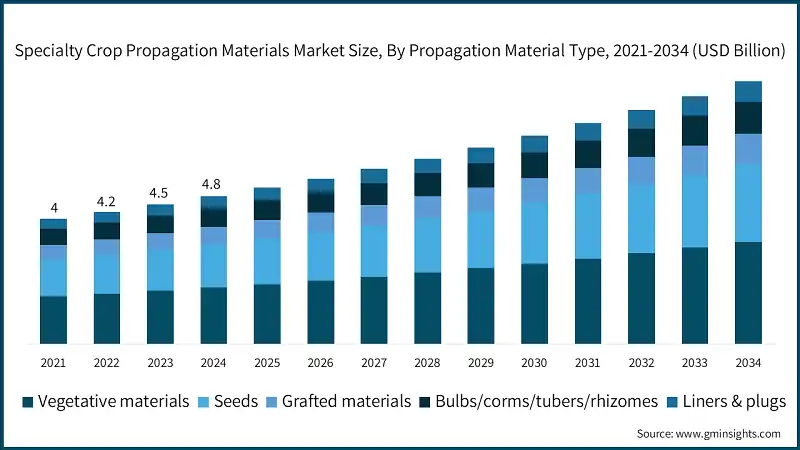

The market by propagation material is segmented into vegetative materials, seeds, grafted materials, bulbs/corms/tubers/rhizomes and liners & plugs. Vegetative material holds the largest market size USD 1.8 billion in 2024.

- Vegetative materials hold the highest percentage share of the market, with 37.7%, which reflects the adoption of cuttings-based propagation methods in the entire ornamental and specialty crop sectors. This category comprises rooted and unrooted cuttings, tissue culture plantlets, and specialized vegetative propagation materials that offer genetic consistency and rapid multiplication capabilities.

- Seeds account for 29.1% of the market and are basically traditional methods of propagation still relevant for many specialty crop categories. Both conventional and hybrid varieties fall under the category of seed segment, with increasing attention on attributes such as resistance against diseases, prolonged shelf life, and unique aesthetic characters. As regulatory requirements and consumer preferences are increasing, certified organic products, organic seeds continue to be in high demand.

- Grafted materials accounts for 11.5% of the market share, indicating an increased trend toward the use of grafting techniques for disease resistance or improving plant performance. The scion types chosen for grafting usually demonstrate high quality, but the rootstock has a more desirable combination of characters and can even be produced in more difficult soil conditions, as well as an extended growing season. This technique is highly popular among such high-value crops as tomatoes, peppers, and specialty melons.

- Bulbs/corms/tubers/rhizomes account for 12.6% of market share. This segment caters to high-end applications that require genetic purity and that should be pathogen-free. Although tissue culture facilities require huge levels of initial capital investment, they tend to have better advantages over other propagation methods in terms of quality control and scale of production.

- Liners and plugs material hold 7.9% of market share and these are considered intermediate products in propagation in between first propagation and final transplanting. They provide convenience to greenhouse operators and commercial growers who require ready-to-transplant materials with established root systems and standardized sizing.

The specialty crop propagation materials market by production method is segmented into conventional, organic certified, biotechnology-enhanced, precision/automated. Conventional method holds the largest market size USD 3.7 billion in 2024.

- Conventional production methods hold 70% market share. These methods are cost-effective for large-volume production and thus cater for price-sensitive market segments effectively.

- Organic-certified production constitutes 15% of the market, thereby increasing demand for sustainably produced specialty crops. Organically grown crops require certified organic seeds, approved growing media, and traceable production processes, all of which must adhere to the National Organic Program standards as outlined in USDA organic certification requirements.

- Biotechnology-enhanced production accounts for 10% of market share. Technologies such as advanced breeding techniques including genetic markers and molecular biology tools for developing improved varieties. Development of crops with resistance to diseases, better nutrition, and top performance characteristics has enabled these methods.

- Precision and automation production methods account for 5% of the market share and are the fastest-growing sections cater by technological innovation and demand for labor efficiency. These methods include automated seeding systems, robotic transplanting apparatus, and computer-controlled environmental management systems. Precision production allows for consistency of quality, reduced labor costs, and higher resource utilization efficiency.

Learn more about the key segments shaping this market

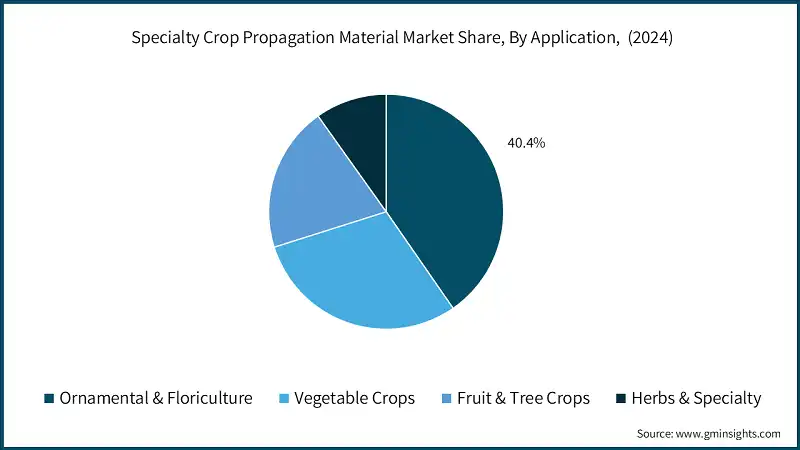

Based on application, the specialty crop propagation materials market is segmented into ornamental & floriculture, vegetable crops, fruit & tree crops, herbs & specialty. Ornamental & Floriculture holds highest of the market value of USD 1.9 billion in 2024.

- The ornamental and floriculture market, with a 40.4% of market share in 2024. This segment is inclusive of bedding plants, potted flowers, cut flowers, and landscape ornamentals serving both commercial and consumer markets. Demand from consumers for decorative plants, seasonal display plants, and betterment of landscapes sustains demand for ornamental propagation materials.

- Vegetable crops account for 30% of market share in 2024 and thus reflect growing consumer interest in fresh locally grown produce and specialty vegetable varieties. This segment includes consumers that are interested in traditional vegetables, specialties, and premium varieties that results higher market prices. The trend of farm-to-table dining, community-supported agriculture, and home gardening, increases the demand for vegetable crop propagation materials.

- Fruits and tree crops account for the remaining 20% of market share in 2024 involving both traditional orchard crops and specialty fruit kinds. This segment includes berry crops, tree fruits, and specialty varieties that cater to premium market segments. This category demands high-quality propagation.

- Herbs and specialty crops are 10% of market share in 2024, representing high-value niche markets with requirements regarding quality and variety. This segment involves culinary herbs, medicinal plants, and specialty crops. Premium price and special growing requirements allow for differentiated propagation material suppliers.

Based on end use industry, the specialty crop propagation materials market is segmented into commercial greenhouse operations, nursery & garden center, landscape contractor segment, horticultural distribution centers, specialty crop growers. Commercial greenhouse operations accounts for USD 1.4 billion in 2024.

- Commercial greenhouse accounts for 30% of share in 2024 reflecting shift towards controlled environment agriculture and intensive production systems. Commercial greenhouse operations require large volumes of propagation materials that is of high quality and ensure reliability in performance under controlled environments.

- Nursery and garden center operations constitute about 24% of the market share in 2024. These operations cater to differing channels of wholesale and retail distribution. The segment is challenged by online retailing but is also aided by consumer preference for local shopping and consulting experts.

- Contractors for landscaping hold 20% of the market share that support projects for both commercial and residential landscaping. Their customers demand great quantities of standardized materials that meet their project specifications and timelines for installation. This segment benefits from developments in urban areas, infrastructure projects, and remodelling within the commercial property sector.

- Horticultural distribution centers hold 16% of the market share, acting as intermediaries between producers of propagation materials and final users. These facilities provide logistics for transportation of material, inventory management, and market access services which facilitate the smooth distribution of propagation material across many geographical areas.

- Specialty crop growers constitute 10% of the market share, indicating the demand of increasing specialization and premium crop production. These producers focus on high-value crops that have been developed for niche markets and therefore fetch high prices. The specialty propagation materials needed by them possess very specific performance characteristics and quality attributes.

Looking for region specific data?

North America Specialty Crop Propagation Materials Market The U.S. specialty crop propagation materials industry accounted for USD 1.1 billion in 2024. The market in the Germany is expected to experience significant and promising growth from 2025 to 2034. The specialty crop propagation materials industry in China is expected to experience significant and promising growth from 2025 to 2034. UAE market is expected to experience significant and promising growth from 2025 to 2034. Brazil is expected to experience significant and promising growth from 2025 to 2034. Specialty crop propagation materials markets are moderately consolidated with players like Ball Horticultural Company, Syngenta Seeds, Dümmen Orange, Selecta One, Proven Winners, holding 43.1% market share. Major players operating in the specialty crop propagation materials industry are: Ball Horticultural Company is one of the worldwide producers of horticultural products, with core competence in the development, marketing, and distribution of seeds, plants, and growing media. The company's full-line product portfolio caters to professional growers globally, blending innovation in plant breeding, propagation technology, and sustainable growing practice. Syngenta is identified as a major global player in high agricultural-technology seeds, biotechnology innovations, etc. Its specialty becomes the extra-quality commercial varieties for diverse applications to fit into different regional climates under a variety of growing conditions. Dümmen Orange carries out a broad array of operations in the ornamental propagation material industry in a cut flowers, potted plants, and innovation in breeding. It has an international network for production and distribution solidly established in premium ornamental segments. Selecta One specializes in vegetative propagation materials, especially in the ornamental and floral bedding plant categories. The great advantage of Selecta One is its exclusive varieties and the premium quality of its products. Proven Winners deals in ornamental plants, concentrating on tested high-performance, consumer-friendly varieties. Through extensive branding and consumer education programs, Proven Winners has established a high level of brand recall while also fueling demand at the retail and garden center levels. It is the company's dedication to quality, innovation, and support and focus that reserves for it a competitive edge in the field of specialty crop propagation.Europe Specialty Crop Propagation Materials Market

Asia Pacific Specialty Crop Propagation Materials Market

Middle East and Africa Specialty Crop Propagation Materials Market

Latin America Specialty Crop Propagation Materials Market

Specialty Crop Propagation Materials Market Share

Specialty Crop Propagation Materials Market Companies

Specialty Crop Propagation Materials Industry News

The specialty crop propagation materials market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and volume in terms of kilo tons from 2021–2034 for the following segments:

Market, By Propagation Material Type

- Vegetative materials

- Unrooted cuttings

- Ornamental cuttings (petunias, geraniums, impatiens, etc.)

- Herb cuttings

- Fruit crop cuttings

- Rooted cuttings

- Pre-finished liners

- Direct-stick rooted cuttings

- Tissue culture plantlets

- Ornamental tissue culture

- Fruit crop micropropagation

- Herb and specialty micropropagation

- Seeds

- Vegetable seeds

- Ornamental seeds

- Herb seeds

- Grafted materials

- Fruit tree grafts

- Vegetable grafts (tomato, cucumber)

- Ornamental grafts

- Bulbs, corms, tubers, rhizomes

- Flower bulbs (tulips, lilies, daffodils)

- Tubers (dahlias, begonias)

- Rhizomes (iris, canna)

- Liners & plugs

- Ornamental plugs

- Vegetable transplants

- Herb plugs

Market, By Production Method

- Conventional production

- Traditional greenhouse propagation

- Field-based propagation

- Organic-certified production

- USDA organic certified

- EU organic certified

- JAS organic certified (Japan)

- Biotechnology-enhanced production

- Marker-assisted selection (MAS)

- Gene editing (CRISPR applications)

- Genomic selection breeding

- Precision/automated production

- Robotic cutting systems

- Automated tissue culture scaling

- AI-driven phenotyping and selection

Market, By Application

- Ornamental & floriculture

- Bedding plants propagation

- Petunias

- Geraniums & pelargoniums

- Impatiens & begonias

- Calibrachoa & million bells types

- Verbena & bacopa

- Other bedding annuals

- Perennials propagation

- Lavender & salvia

- Ornamental grasses

- Hardy perennials

- Cut flower production materials

- Rose cuttings

- Chrysanthemum cuttings

- Carnation propagation

- Other cut flower propagation

- Foliage plant propagation

- Flowering shrubs & trees

- Bedding plants propagation

- Vegetable crops

- Tomato transplants

- Pepper transplants

- Cucumber & squash

- Leafy greens

- Other vegetables

- Fruits & tree crops

- Berry propagation (strawberry, blueberry)

- Fruit tree grafts

- Citrus rootstocks

- Grape propagation

- Herbs & specialty crops

- Culinary herbs

- Medicinal plants

- Specialty ornamentals

Market, By End Use Industry

- Commercial Greenhouse Operations

- Large-scale propagators (>5 ha)

- Integrated propagation-finishing operations

- Specialized cutting producers

- Nursery & garden centers

- Wholesale nurseries

- Retail garden centers

- Mail-order/e-commerce nurseries

- Landscape contractors

- Commercial landscaping

- Residential landscaping

- Municipal and public landscaping

- Horticultural distribution centers

- Plant brokers

- Auction houses (e.g., FloraHolland)

- Logistics and fulfillment centers

- Specialty crop growers

- Organic growers

- Heirloom variety specialists

- Direct-to-consumer growers

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Netherlands

- Germany

- United Kingdom

- France

- Italy

- Spain

- Poland

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Ecuador

- Brazil

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kenya

- Ethiopia

- Rest of MEA

Frequently Asked Question(FAQ) :

Who are the key players in the specialty crop propagation materials market?

Major players include Ball Horticultural Company, Syngenta Seeds, Dümmen Orange, Selecta One, Proven Winners, Sakata Seed Corporation, and High Mowing Seeds. These companies focus on innovation, sustainability, and expanding certified product portfolios.

How much share did the seeds segment account for in 2024?

The seeds segment accounted for 29.1% of the market in 2024. Demand remains strong due to continued use of conventional and hybrid seeds, along with rising preference for certified organic and disease-resistant varieties.

Which application segment leads the specialty crop propagation materials market?

Ornamental and floriculture applications led the market with a value of USD 1.9 billion in 2024, driven by high demand for bedding plants, cut flowers, potted plants, and landscape ornamentals in both commercial and consumer markets.

What are the key trends shaping the specialty crop propagation materials industry?

Key trends include expansion of controlled-environment propagation, increasing use of automation and precision technologies, rising demand for certified organic materials, and growing emphasis on disease-resistant and pathogen-free propagation inputs.

What was the market size of the U.S. specialty crop propagation materials industry in 2024?

The U.S. specialty crop propagation materials industry accounted for USD 1.1 billion in 2024, driven by strong demand for high-value crops such as fruits, vegetables, ornamentals, and organic produce, along with rapid adoption of certified and disease-free propagation materials.

Which propagation material segment dominated the market in 2024?

Vegetative materials dominated the market with a 37.7% share in 2024, supported by strong adoption of cuttings, tissue culture plantlets, and pre-finished liners that offer genetic consistency and faster crop establishment.

What is the specialty crop propagation materials market size in 2025?

The market size for specialty crop propagation materials is valued at USD 5 billion in 2025. Growth is supported by rising demand for certified and organic propagation inputs, expanding specialty crop cultivation, and increasing adoption of controlled-environment agriculture.

What was the market size of the specialty crop propagation materials industry in 2024?

The global market size for specialty crop propagation materials was valued at USD 4.8 billion in 2024, reflecting steady demand from ornamental, vegetable, fruit, and specialty crop growers worldwide.

What is the projected value of the specialty crop propagation materials market by 2034?

The market is expected to reach USD 8.5 billion by 2034, growing at a CAGR of 5.9%. This expansion is driven by organic farming adoption, advancements in tissue culture and biotechnology, and increased focus on disease-free planting materials.

Specialty Crop Propagation Materials Market Scope

Related Reports