Summary

Table of Content

Post-Surgical Recovery Protein Hydrolysates Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Post-Surgical Recovery Protein Hydrolysates Market Size

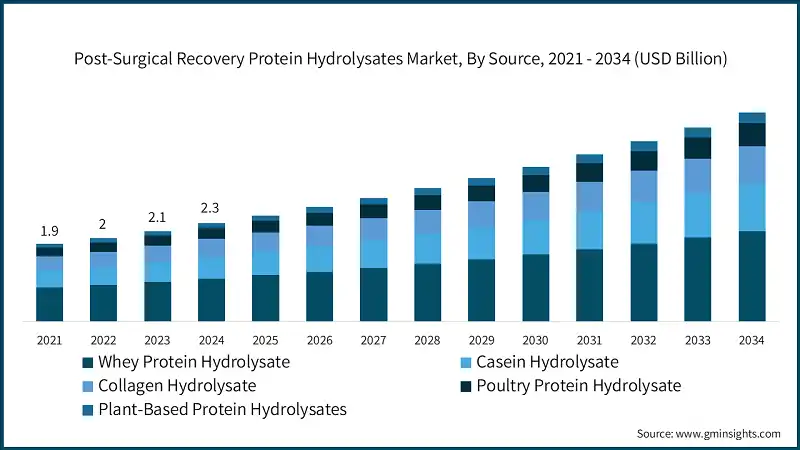

The global post-surgical recovery protein hydrolysates market size was estimated at USD 2.3 billion in 2024. The market is expected to grow from USD 2.5 billion in 2025 to USD 5 billion in 2034, at a CAGR of 7.8% according to latest report published by Global Market Insights Inc. This growth trajectory reflects the convergence of demographic shifts, evidence-based clinical practice evolution, and technological innovation in protein processing and delivery systems for surgical nutrition support.

To get key market trends

The market is estimated to grow exponentially, reflecting continued enormous year-on-year growth due to ongoing growth in surgical volume, particularly among aging populations, and the expanding reach of evidence-based protocols in clinical nutrition fiscal practice across global hospitals. This near-term growth of the market demonstrates restoration of elective surgical procedures that were impacted by the COVID pandemic in 2020-2021.

According to JAMA Network Open, there were 678,348 fewer surgical procedures in the United States in 2020 compared with 2019, which is a decrease of about 10.2% in surgical procedures reported. Following the pandemic, we have seen the return to normal surgical volumes and a backlog with new surgical procedure cases to experience growth in 2024-2026 periods.

The projected growth is tied to several structural conditions inclusive of demographic aging, which will likely continue to drive increased surgical demand over time; continued changes in clinical guidelines toward more aggressive nutritional support; continued advancements in protein hydrolysate technology that improves efficacy and compliance; and geographic expansion to developing markets with surgical nutrition infrastructure. The market growth rate is heavily skewed in comparison to the projected growth for standard oral nutritional supplements at 4-5% CAGR, which we feel demonstrates both the specialized nature and clinical validation of surgical nutritional products within the surgical nutrition classification.

Market size estimates by value chain show that the hospital and institutional channels have approximately higher market value, while retail and home healthcare channels account for the remaining revenue of market value. The institutional channel has a larger share of the market, as there is concentrated protein hydrolysate use in the immediate perioperative period when hospitalized, as well as hospital formularies and clinical protocols driving the selection of nutritional support products.

Post-Surgical Recovery Protein Hydrolysates Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.3 Billion |

| Market Size in 2025 | USD 2.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 7.8% |

| Market Size in 2034 | USD 5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Surgical Volumes & Aging Population | Expands the addressable patient population requiring post-operative nutrition. |

| Evidence-Based Clinical Guidelines (e.g., ESPEN, ERAS) | Boosts institutional adoption of protein hydrolysate formulations. |

| Technological Advancements in Hydrolysis & Peptide Profiling | Enables customized formulations with faster absorption and targeted outcomes. |

| Pitfalls & Challenges | Impact |

| High Product Cost & Limited Reimbursement | Restricts access in cost-sensitive or uninsured markets. |

| Palatability & Compliance Issues | Impacts patient adherence, especially in home or outpatient settings. |

| Regulatory Differentiation Between Medical Food & Supplement | Delays new product launches in multi-country marketing strategies. |

| Opportunities: | Impact |

| Expansion into Home Healthcare & Outpatient Recovery Settings | Drives adoption beyond hospital use, increasing recurring revenue potential. |

| Growth in Emerging Markets (Asia, LATAM, MEA) | Untapped demand from expanding surgical infrastructure and chronic illness burden. |

| Development of Condition-Specific Formulations | Enables premium pricing and targeted nutrition for specific surgeries or patient types. |

| Market Leaders (2024) | |

| Market Leaders |

Approximately 25% market share in 2024 |

| Top Players |

Collectively 50% market share in 2024 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, Vietnam, Indonesia, Brazil |

| Future Outlook |

|

What are the growth opportunities in this market?

Post-Surgical Recovery Protein Hydrolysates Market Trends

- Transition Towards Immunonutrition: The most significant change in the protein hydrolysates space in the post-surgical recovery market is the move away from basic protein supplementation and introduction of full immunonutrition strategies that utilize bioactive nutrients to influence wound healing, inflammation, and antioxidant status. Immunonutrition approaches are emerging because of strong clinical measures showing formulas with protein hydrolysates containing immune-modulating nutrients outperform standard nutritional support.

- The immunonutrition approach to recovery centers around bespoke formulations containing L-arginine (conditional amino acid substrate for nitric oxide synthesis and fetal immune cell function), omega 3 fatty acids EPA and DHA which modulate inflammatory responses via the eicosanoid pathway, nucleotides (rapidly dividing immune) support, and antioxidants including vitamins C and E and selenium.

- Clinical trials have shown that immunonutrition formulations can lead to a 51% reduction in infectious illness post-operative complications, up to 2-3 days shorter length of stay in the hospital, and total healthcare costs ranging from USD 3,000 - 5,000 lower, per patient. These demonstrated outcomes have contributed to the movement of utilizing immunonutrition as part of evidence-based clinical guidelines, with ESPEN recommending immunonutrition for patients undergoing significant invasive surgery, particularly gastrointestinal and oncologic surgical procedures.

- Incorporation of AI in Clinical Nutrition Planning: The major trend involves the incorporation of artificial intelligence (AI), machine learning, and digital health technologies in clinical nutrition planning and protein hydrolysate prescribing. This trend marks a departure from standardized, protocol-based nutritional support to personalized, data-based optimization of protein hydrolysate interventions as a result of the individual patient, real-time assessment, and predictive analytics.

- AI-based clinical decision support tools are being developed to analyze many patient-specific factors, such as the type and complexity of surgery, pre-hospital nutritional status, body composition, metabolic rate, comorbidities and medications, and recovery trajectory, to formulate recommendations specific to type of protein hydrolysate, dosing, timing, and duration of administration. These systems have the potential to integrate data from health records, lab results, bioimpedance analysis, indirect calorimetry, and PROMs to continuously optimize nutrition support throughout the continuum perioperatively.

- Expanding Protein Hydrolysate Use in Home Care: The major trend is the use of protein hydrolysates in expanded home care and post-discharge recovery services beyond hospitals. This trend is initiated by the healthcare system's desire to reduce hospital length of stay, push care to less expensive settings, and enhance the patient experience of earlier discharge with care continuing at home. Enhanced Recovery After Surgery (ERAS) protocols specifically include earlier discharge to home as an important goal, and nutritional support continues for 2-4 weeks after surgery.

- The trend toward home healthcare is manifesting in multiple ways. First, the product format is changing with more focus on convenience, portability, and ease of self-administration with an increase in ready-to-drink formats, single-serve packaging, and shelf-stable formats that do not require refrigeration. Second, distributions channels for products are increasing away from the hospital pharmacies and into retail pharmacies, e-commerce, and direct to consumer to the home.

- Third, patient education and support programs are being created to improve adherence in the home where there isn't as much supervision. Home healthcare is growing at an 8.5% CAGR greater than the institutional channel and is expected to become 30% of market value by 2034.

Post-Surgical Recovery Protein Hydrolysates Market Analysis

Learn more about the key segments shaping this market

Based on source, the post-surgical recovery protein hydrolysates market is divided into whey protein hydrolysate, casein hydrolysate, collagen hydrolysate, poultry protein hydrolysate, plant-based protein hydrolysates. Whey protein hydrolysate segment generated a revenue of USD 1 billion in 2024 and is expected to generate revenue of USD 2.1 billion in 2034 at a CAGR of 7.7% in the forecasted period.

- Whey protein hydrolysate leads the category with a 43.8% market share in 2024 and is expected to grow at a CAGR of 7.7% until 2034. Whey protein is commonly referred to as the gold standard for surgical nutrition applications due to its superior amino acid profile, especially in terms of leucine content (about 11% of total amino acids), an important amino acid for stimulating muscle protein synthesis via the mTOR pathway.

- Whey protein hydrolysate has rapid digestion and absorption kinetics, with peak plasma amino acid concentrations occurring within 30 to 60 minutes of ingestion and is an ideal protein source for postoperative patients with impaired digestion. There have been clinical studies published in peer-reviewed journals that demonstrate whey protein supplementation preserves lean body mass during recovery from surgery, reduces the incidence of muscle waste, and hastens functional recovery.

- The hydrolysis process breaks down the whey proteins into smaller peptides that are hypoallergenic and more easily digested than intact whey proteins, which means use of whey protein is no longer restricted for those with dairy allergies but still highly nutritious.

The post-surgical recovery protein hydrolysates market is segmented by surgery type: gastrointestinal surgery, oncologic surgery, orthopedic surgery, cardiac surgery, trauma and burns, and general and mixed surgery. Each surgery type is distinguished based on surgical volume, malnutrition risk, metabolic stress and clinical evidence for nutritional intervention in surgical specialty.

- Gastrointestinal surgery represents the largest application segment at 32.1% market share in 2024 and 7.8% CAGR in the forecasted period. Gastrointestinal surgery includes surgical procedures involving the esophagus, stomach, small intestine, colon and rectum, liver, pancreas and biliary system. Consequently, patients with gastrointestinal surgery have the highest risk of malnutrition due to pre-existing nutritional deficits from underlying disease (cancer, inflammatory bowel disease, obstruction), perioperative fasting requirements, and postoperative digestive dysfunction.

- Oncologic surgery constitutes about 26% of the post-surgical recovery protein hydrolysates market share in 2024 and is anticipated to grow at 7.6% CAGR through 2034, based on the high number of cancer surgeries and cancer patients’ vulnerability to malnutrition and surgical complications. Cancer patients often present with cachexia, involuntary weight loss, and/or diminished immune competence that raises surgical risk and promotes recovery. Protein hydrolysates containing components of immunonuturition are specifically indicated for oncologic surgery patients and supported by clinical evidence to reduce infection complications and improve tolerance to subsequent cancer therapy including chemotherapy and radiation therapy.

Learn more about the key segments shaping this market

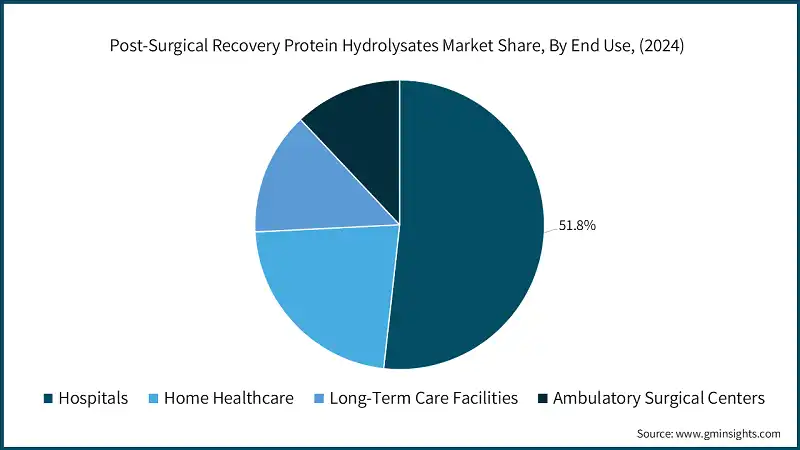

Based on end user, the post-surgical recovery protein hydrolysates market is divided into hospitals, home healthcare, long-term care facilities, ambulatory surgical centers. In 2024, hospitals segment held major revenue which accounted for 51.8% market share and is forecasted to hold a 7.7% CAGR from 2025 to 2034.

- Hospitals are the primary setting of protein hydrolysates consumption during the immediate perioperative period, from the preoperative loading days (5-7 days before surgery) to postoperative recovery days (3-7 days after surgery). Hospital content consumption is driven by the medical protocol, formulary choice, and other quality metrics that incentivize nutritional support to avert complications and length of stay.

- The hospital setting has reimbursement structures for enteral nutrition products delivered during their hospital stay, clinical oversight and involvement to ensure adequate use, and alignment of protein hydrolysates with standardized care pathways. The hospital care setting is also growing slower than alternative care settings for a large part due to overall trends within health systems for shorter hospitalizations and earlier discharge with continued recovery at home.

Looking for region specific data?

- North America is anticipated to lead the post-surgical recovery protein hydrolysates market with 33.2% of the market share in 2024 and its projected CAGR through 2034 is 7.7%.

- North America's dominance in the market is due to various factors including high surgical volumes associated with the large aging population (by 2040, the US population aged 65+ will be 80 million), strong acceptance of evidence-based clinical nutrition guidelines including ERAS protocols in more than 60% of major hospitals, a favorable reimbursement environment for enteral nutrition products in hospitals through Medicare and private insurance, presence of large manufacturers such as Abbott Nutrition and Nestlé Health Science including extensive distribution networks, and established healthcare systems with sophisticated clinical nutrition departments.

- Europe has 31.6% of the market share in 2024 and the CAGR is projected around 7.6% by 2034. Europe is a mature market with a strong tradition of clinical nutrition and established protocols. Europe is the origin for the ESPEN clinical nutrition guidelines which has contributed to the global acceptance of evidence-based clinical nutrition in surgical patients. The European market is heterogeneous in terms of country-level healthcare systems, reimbursement policies, and clinical practice patterns.

- The Asia Pacific region constitutes 22.6% of the market share in 2024 but also shows the highest growth rate regionally at 8.5% CAGR – making this the fastest growing market in the world. The region's quick growth is being experienced due to multiple converging factors including extreme population aging, particularly in Japan where 29% of the population is already aged 65+, China with 280 million people aged 60+ and projected to be 400 million by 2035, South Korea, expanding healthcare infrastructure and surgical capacity as developing economies, rising middle-class population and increasing healthcare expenditure capacity, increasing adoption of Western clinical practices and evidence-based guidelines, and an increasing realization of the importance of clinical nutrition among healthcare providers and patients.

- Latin America has 7.8% market share and 7.4% CAGR by 2034 and is an emerging market with high potential for growth but faced with challenges at this time. Brazil represents almost 50% of the Latin American market value and is the dominant market in the region, trailed by Mexico, Argentina, and Colombia.

- Middle East & Africa (MEA) has 4.7% market share and 7.2% CAGR by 2034 and has the smallest and slowest growth regional market. The MEA region is very heterogeneous, and Gulf Cooperation Council (GCC) countries - United Arab Emirates, Saudi Arabia and Qatar - have relatively advanced healthcare systems and higher market penetration, while many Sub-Saharan African countries suffer from significant healthcare infrastructure and affordability issues.

Post-Surgical Recovery Protein Hydrolysates Market Share

Top 5 companies in the post-surgical recovery protein hydrolysates industry are Nestlé Health Science, Fresenius Kabi, Danone Nutricia, Abbott Nutrition, and B. Braun Melsungen. At moderate concentration, the post-surgical recovery protein hydrolysates market in 2024 accounted for about 50% of the total revenue. The leftover market revenue is shared amongst various smaller manufacturers, regional manufacturers, and private-label companies.

The concentrated structure is due to the niche areas for surgical nutrition products that must demonstrate evidence for use in clinical settings, furnish regulatory bodies with evidence for product approval, and receive hospital formulary acceptance which creates barriers for entry but also allows smaller niche companies to service certain areas or markets.

Post-Surgical Recovery Protein Hydrolysates Market Companies

Major players operating in the post-surgical recovery protein hydrolysates industry are:

- Abbott Nutrition

- Ajinomoto Co.

- B. Braun Melsungen

- Baxter International

- Cambrooke Therapeutics

- Danone Nutricia

- Fresenius Kabi

- Kate Farms

- Laboratorios Ordesa

- Mead Johnson Nutrition

- Medline Industries

- Meiji Holdings

- Nestlé Health Science

- Nutricia Advanced Medical Nutrition

- Otsuka Pharmaceutical

- Real Food Blends

- Solace Nutrition

- Targeted Medical Pharma

- Victus

- Vitaflo International

Nestlé Health Science: Nestlé Health Science continues to lead the market with an approximate 25.3% market share in 2024 based on its Impact product line, which is the most clinically validated immunonutrition formula in the industry. The Impact Advanced Recovery product contains 18 grams of protein per serving, 4.2 grams of L-arginine, 1.1 grams of EPA and DHA omega-3 fatty acids, and nucleotides. Nestlé Health Science has over 60 randomized controlled trials to provide clinical evidence, finding a 51% reduction in post-operative infections. The company's leadership in the market is fanned with a strong presence in hospital formularies, a wealth of clinical evidence backing the product, marketing staff as dedicated medical affairs staff engaging with healthcare professionals, and a solid distribution infrastructure globally.

Abbott Nutrition: Abbott Nutrition occupies the second-place position with a market share at about 14.2% in 2024, and they can take advantage of their Ensure Surgery product in addition to their wide array of clinic-based nutrition products. Abbott's competitive edge rests on their extensive route to market, as they can reach hospitals, long-term care facilities, and the retail pharmacy channel; their high brand recognition level among healthcare providers and consumers; their integration with Abbott's overall medical devices and diagnostics business; as well as their diverse line of products across multiple clinical nutrition-based applications. Ensure Surgery contains 18 grams of protein, 4.2 grams of the amino acid L-arginine, and 1.1 grams of both EPA and DHA per serving - with somewhat similar formulation to Nestlé's Impact product but at a slightly lower price. Abbott's strategy focuses on the ability to provide access, brand quality, and breadth of portfolio to provide solutions for multiple types of customers.

Fresenius Kabi: Fresenius Kabi had market share of about 4.8% in 2024, and they focus on going after the enteral nutrition products and ultimately the hospital distribution channel. Fresenius Kabi's competitive position rests on clinical nutrition and IV therapies expertise, strong position in hospital pharmacy, especially in Europe, offering value-tier products, and an ability to integrate with the Fresenius Group's additional healthcare services, specifically with watershed focused on dialysis and hospital management. The company's strategy focuses on affordability as a value proposition and building and maintaining relationships within the hospital distribution channel.

Danone Nutricia: Danone Nutricia has about 3.2% of market share in 2024 through Nutricia Advanced Medical Nutrition and it is particularly strong in European markets. Danone has a specialized focus in medical nutrition with significant resources in research and development, a strong presence in European markets with mature distribution, its condition specific nutritional product portfolio, and corporate commitment to nutrition focused on health outcomes. The company strategy focuses on innovation in its specialized formulations and being the leader in European markets.

Baxter International: Baxter International has about 2.5% in market share in 2024 with positioning in clinical nutrition as part of its overall hospital products portfolio. Baxter's competitive advantages include relationships with vast number of hospitals through its IV solutions business, global distribution channels, focus on institutional channels, and compatibility with hospital inventory and supply chain systems. The company strategy focuses on developing a vaccine through its inherited legacy from its hospital product relationships.

Post-Surgical Recovery Protein Hydrolysates Industry News:

- In December 2024, Abbott Nutrition extended the distribution of its Ensure Surgery product into five more Asian markets, including Vietnam, the Philippines, and Indonesia. This move illustrates the company's strategy to capitalize on growth in high-potential emerging markets, where surgical capacity is increasing and healthcare costs are rising.

- In November 2024, with response to the growing demand for vegan and allergy-free options, Kate Farms announced the release of a new plant-based protein hydrolysate formula created especially for surgical recovery. This is the first major manufacturer to release a plant-based surgical nutrition product.

- In February 2024, Ajinomoto Co. indicated the expansion of amino acid production capacity in Thailand to meet the growing demand for protein hydrolysate ingredients for clinical nutrition; an indication of upstream supply chain growth to continue to evolve a growing market.

- In January 2024, Baxter International completed the acquisition of a regional clinical nutrition company in Eastern Europe, expanding their geographic expansion and portfolio additions in the surgical nutrition category.

The post-surgical recovery protein hydrolysates market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) & volume (Tons) from 2021 to 2034, for the following segments:

Market, By Source

- Whey Protein Hydrolysate

- Casein Hydrolysate

- Collagen Hydrolysate

- Poultry Protein Hydrolysate

- Plant-Based Protein Hydrolysates

Market, By Formulation Type

- Standard Peptide-Based Formulations

- Immunonutrition Formulations

- High Protein/Low Carbohydrate Formulations

- Glutamine-Enriched Formulations

- MCT-Enhanced Formulations

- Wound Healing Specific Formulations

Market, By Surgery Type

- Gastrointestinal Surgery

- Colorectal Surgery

- Bariatric Surgery

- Hepatobiliary Surgery

- Pancreatic Surgery

- Upper GI Surgery

- Oncologic Surgery

- Head and Neck Cancer Surgery

- Esophageal and Gastric Cancer Surgery

- Gynecologic Oncology Surgery

- Bladder Cancer Surgery

- Colorectal Cancer Surgery

- Orthopedic Surgery

- Joint Replacement Surgery (Knee, Hip)

- Spinal Surgery

- Trauma Reconstruction Surgery

- Cardiac Surgery

- Coronary Artery Bypass Grafting (CABG)

- Valve Replacement Surgery

- Heart Transplant Surgery

- Trauma & Burns

- Blunt or Penetrating Trauma

- Polytrauma

- Partial Thickness Burns

- Full Thickness Burns

- High TBSA Burns

- General & Mixed Surgery

- Hernia Repair

- Appendectomy

- Cholecystectomy

- Exploratory Laparotomy

Market, By End Use

- Hospitals

- Home Healthcare

- Long-Term Care Facilities

- Ambulatory Surgical Centers

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the post-surgical recovery protein hydrolysates industry?

Major players include Abbott Nutrition, Ajinomoto Co., B. Braun Melsungen, Baxter International, Danone Nutricia, Fresenius Kabi, Kate Farms, Laboratorios Ordesa, Mead Johnson Nutrition, Medline Industries, and Meiji Holdings.

What is the growth outlook for the home healthcare segment from 2025 to 2034?

The home healthcare segment is anticipated to observe around 8.5% CAGR till 2034, led by the shift toward earlier discharge and continued nutritional support at home.

What are the upcoming trends in the post-surgical recovery protein hydrolysates market?

Key trends include growing immunonutrition strategies, AI-driven clinical nutrition planning, expanding home healthcare solutions, and the rise of convenient, portable product formats.

Which region leads the post-surgical recovery protein hydrolysates sector?

North America leads the market with a 33.2% share in 2024, supported by high surgical volumes, widespread adoption of evidence-based clinical nutrition guidelines, and a favorable reimbursement environment.

What was the market share of the gastrointestinal surgery application segment in 2024?

The gastrointestinal surgery segment held a 32.1% market share in 2024 and is set to expand at a CAGR of 7.8% during the forecast period.

How much revenue did the whey protein hydrolysate segment generate in 2024?

The whey protein hydrolysate segment generated USD 1 billion in 2024 and is expected to witness over 7.7% CAGR through 2034.

What is the market size of the post-surgical recovery protein hydrolysates in 2024?

The market size was estimated at USD 2.3 billion in 2024, with a CAGR of 7.8% expected through 2034. Growth is driven by demographic shifts, advancements in clinical practices, and innovations in protein processing and delivery systems.

What is the expected size of the post-surgical recovery protein hydrolysates industry in 2025?

The market size is projected to reach USD 2.5 billion in 2025.

What is the projected value of the post-surgical recovery protein hydrolysates market by 2034?

The market is poised to reach USD 5 billion by 2034, fueled by the adoption of immunonutrition strategies, AI-driven clinical nutrition planning, and the expansion of home healthcare services.

Post-Surgical Recovery Protein Hydrolysates Market Scope

Related Reports