Summary

Table of Content

Osseointegration Implants Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Osseointegration Implants Market Size

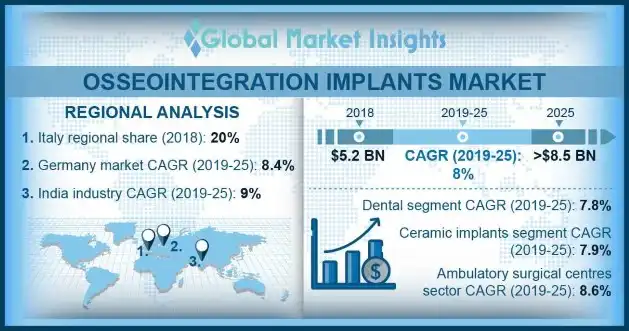

Global Osseointegration Implants Market size exceeded USD 5.0 billion in 2018 and is projected to witness 8.0% CAGR from 2019-2025.

To get key market trends

Increasing incidence of dental disorders and growing government funding for research and development of osseointegration implants will positively affect the global market growth over the forecast period. Rising geriatric population base, inadequate exposure to fluoride and poor hygiene maintenance further escalates the patient population suffering from dental disorders, stimulating the osseointegration implants industry growth.

Osseointegration implants is the most preferred technique as compared to other traditional methods due to its multifactorial benefits and reduced side-effects. It improves primary stability as well as reduces post-surgical healing time. Increasing number of people suffering from spinal cord disorders, growing number of trauma incidents and favourable reimbursement scenario will drive the osseointegrated prosthesis market.

According to the WHO, around 5 million people suffer from dental caries globally. In low income countries, the incidence rate of dental disorders is very high and around 90% of these conditions remain untreated. However, rising awareness among people about advanced methods developed for dental treatment will result in industry growth over the forecast timeline.

Osseointegration Implants Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 5 Billion (USD) |

| Forecast Period 2019 - 2025 CAGR | 8% |

| Market Size in 2025 | 8.5 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Osseointegration implants for prosthetic attachment is gaining popularity worldwide as amputees are seeking alternatives to conventional sockets. With growing demand for advanced technological devices, osseointegration implants market is estimated to grow lucratively owing to innovative and flexible socket designs offered by these implants.

Osseointegration Implants Market Analysis

Dental segment is projected to witness considerable progress at 7.8% CAGR over the forecast period. Growing prevalence of dental conditions and rising government funding for advancing dental implant research has augmented the market growth. Moreover, increasing number of dental practitioners probing for better healthcare infrastructure will positively augment the market size. According to the American Dental Association (ADA), in 2018 there were nearly 199,486 dentists practicing in the U.S.

Bone anchored prothesis market accounted for over USD 800.0 million in 2018. The segment growth is strengthened by increasing prevalence of orthopaedic disorders and rising awareness about osseointegration implants as an alternative to other traditional methods including sockets.

Stainless steel implants accounted more than 15.0% revenue share in 2018 due to biocompatibility, desirable structural properties, easy fixation and successful load bearing characteristics offered by these implants leading to high adoption among orthopaedic surgeons. Easy availability and cost-effective nature of these implants positively impacts the industry expansion.

Ceramic implants market will expand at 7.9% CAGR during the forecast period. Owing to enhanced aesthetic appearance, tribological properties and improved compatibility with the body tissues, the ceramic implants market is projected to experience robust growth over the analysis period.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

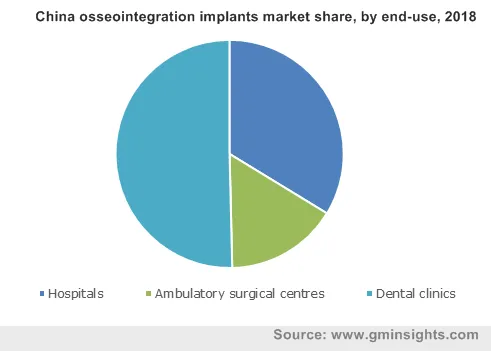

Dental clinics segment accounted for USD 2.6 billion in 2018. Availability of cost-effective treatment coupled with technologically advanced equipment in the dental clinics will drive the segmental growth. Rising awareness about dental implants and growing demand of cosmetic dental procedures contribute to lucrative growth of dental clinics segment in the future.

Ambulatory surgical centres are expected to grow at 8.6% during the forecast period. Rising incidence of dental and orthopaedic disorders will play a substantial role in ambulatory surgical centres segment growth. Shorter surgeries, faster recovery and reduced infection rate after the procedure will escalate the preference for ambulatory surgical centres in upcoming years.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

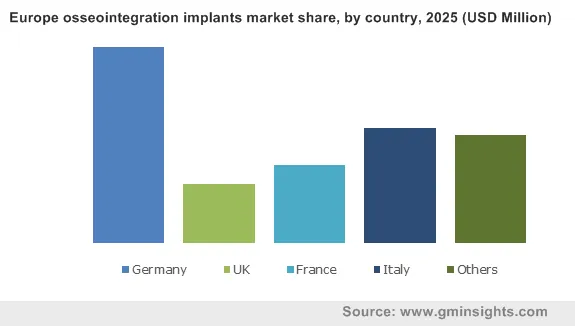

Italy accounted for around 20% revenue share of Europe osseointegration implants market in 2018. Adoption of advanced dental procedures and high investment in osseointegration implant research will spur the market growth over the foreseeable period. Nearly 60,000 people suffer from spinal cord injury (SCI) in Italy. Increasing cases of spinal cord injuries and easy access to advance medical facilities will provide lucrative opportunities for the Italy osseointegration implant market growth.

Indian market is estimated to witness considerable progress at 9.0% CAGR over the forecast period. Rising geriatric population base, growing prevalence of dental and orthopaedic disorders along with increasing disposable income will drive the Indian market growth.

Osseointegration Implants Market Share

Some of the major players functional in global osseointegration implants market are

- Institut Straumann

- Zimmer Biomet Holdings

- Camlog Implant Systems

- Dentsply Sirona

- Bicon

- Danaher Corporation

- Osstem Implant Co

- Integrum

New product launch and strategic alliances are the key strategies adopted by these companies.

Recent industry developments:

- In March 2019, Zimmer Biomet Dental with Zfx announced product launch of GenTek, a restorative digital product line for expanding company’s dental implant systems portfolio as well as strengthening its position in the market

- In December 2018, the Straumann Group partnered with Z-Systems, a Swiss company to expand Z-System’s production capability and product pipeline to gain significant share of growing ceramic implants market

Osseointegration Implants Industry Background

History of osseointegration can be traced back during 1960s that brought a defining moment in the field of implants. Prior to osseointegration there were various alternatives for dental implants to support dentures. Materials such as cobalt-chromium, porcelain and iridio-platinum were earlier used in implants, which was further advanced by the discovery of titanium. However, recent studies indicate that use of zirconium for dental implants are more feasible and offer soft tissue response, superior to that of titanium implants. Osseointegration implants were initially used for bone and joint replacement. Further research activities enabled its application in dentistry with the development of trans-oral titanium implants acting as anchorage for dental prothesis. Such technological advancements will provide lucrative growth opportunities to the dental implants market in the upcoming period. For instance, Promimic introduced a new set of implant coatings developed with the help of nano technology that provides mechanical stability to implant coatings with no risk of delamination. Thus, growing demand and adoption of advanced technology with high-end research will lead to osseointegration implant industry expansion.

Frequently Asked Question(FAQ) :

How much size did the global osseointegration implants market register in 2018?

The market size of osseointegration implants exceeded USD 5 billion in 2018.

How much will the osseointegration implants industry share grow during the forecast timeline?

The industry share of osseointegration implants is projected to witness 8 % CAGR from 2019-2025.

Osseointegration Implants Market Scope

Related Reports