Summary

Table of Content

Non-GMO Protein Hydrolysates Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Non-GMO Protein Hydrolysates Market Size

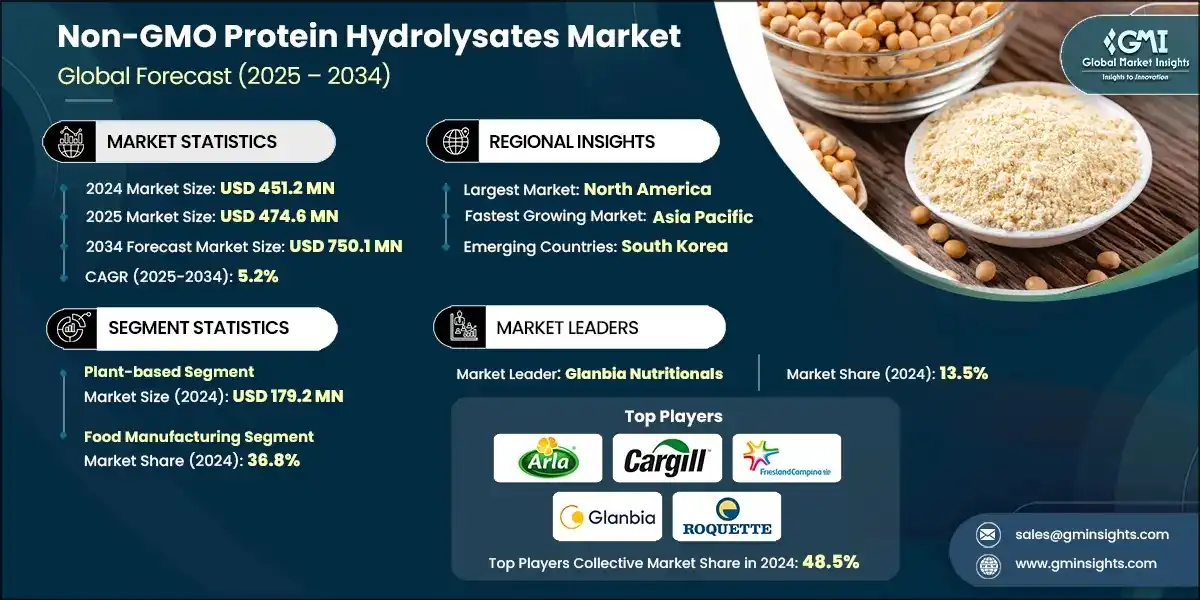

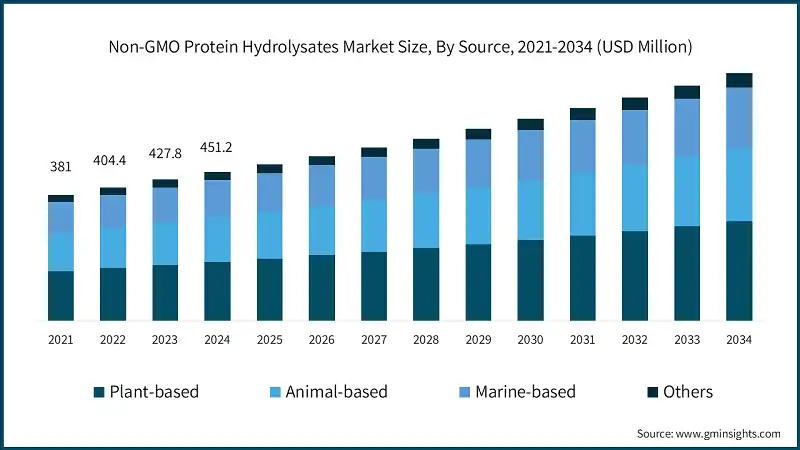

The global non-GMO protein hydrolysates market was valued at USD 451.2 million in 2024. The market is expected to grow from USD 474.6 million in 2025 to USD 750.1 million in 2034, at a CAGR of 5.2%, according to latest report published by Global Market Insights Inc.

To get key market trends

- Non-GMO protein hydrolysates are specialty protein ingredients derived from non-genetically modified organisms that go through hydrolysis for improved digestibility and functional properties. The growing awareness among consumers for clean-label, non-GMO products has also increased the uptake of these hydrolysates by food and beverage sector as well as the dietary supplements and sports nutrition sectors.

- The North American market is the largest market since the stringent regulations supporting the use of non-GMO ingredients within this well-established manufacturing infrastructure for high-quality hydrolysates. Also, the Asia pacific is fastest growing region due to increasing urbanization, rising disposable income and growing trend towards health and wellness products. Provisions are also in place under the policies of respective governments such as in India and China to promote sustainable agriculture and safety in food consumption. This has indirectly favored the acceptance of protein hydrolysates as non-GMO ingredients.

- In addition, growing prevalence of food allergies and intolerances around the globe motivates the producers to develop hypoallergenic and easy digestible products that are dependent on non-GMO protein hydrolysates. The trend is most prominent in sports nutrition and active lifestyles, where consumers purchase products with health-promoting performance benefits, free from artificial or genetically modified components.

- The growing concerns about sustainability and environmental impact favors the non-GMO sourced and produced products. Therefore, the demand from health-driven consumers, regulatory frameworks favoring adoption, and technological advancements in manufacturing ensure a favorable growth for the non-GMO protein hydrolysates market.

Non-GMO Protein Hydrolysates Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 451.2 Million |

| Market Size in 2025 | USD 474.6 Million |

| Forecast Period 2025 - 2034 CAGR | 5.2% |

| Market Size in 2034 | USD 750.1 Million |

| Key Market Trends | |

| Drivers | Impact |

| Rising consumer demand for clean-label & non-GMO products | This demand is likely to increase market adoption and sales of Non-GMO Protein Hydrolysates as consumers seek transparency and natural ingredients, thereby expanding market size |

| Increasing prevalence of food allergies & intolerances | The rise in allergies and intolerances will drive demand for hypoallergenic and easily digestible protein sources like Non-GMO Protein Hydrolysates, boosting market growth |

| Growing sports nutrition & active lifestyle market | The expanding sports nutrition sector will enhance the application of Non-GMO Protein Hydrolysates as a functional ingredient, leading to increased market demand |

| Pitfalls & Challenges | Impact |

| High production costs & premium pricing | Elevated production costs and premium pricing may limit broader market penetration and restrict consumer access, potentially restraining overall market growth |

| Limited raw material availability for non-GMO sources | Limited availability of non-GMO raw materials can constrain supply, hamper production scalability, and impact market expansion |

| Opportunities: | Impact |

| Expansion in animal feed applications | Utilizing Non-GMO Protein Hydrolysates in animal feed presents an opportunity to diversify revenue streams and increase overall market adoption |

| Emerging applications in personalized nutrition | The rise of personalized nutrition offers avenues for tailored Non-GMO Protein Hydrolysates products, fostering innovation and opening new market segments |

| Market Leaders (2024) | |

| Market Leaders |

13.5% market share |

| Top Players |

Collective market share in 2024 is 48.5% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | South Korea, |

| Future Outlook |

|

What are the growth opportunities in this market?

Non-GMO Protein Hydrolysates Market Trends

- Clean-label and transparency have become fundamental consumer expectations, prompting manufacturers to prioritize clear ingredient lists and natural sourcing. Consumers are no longer accepting products with vague components and are driving demand for claims that include proof of being non-GMO and minimally processed ingredients that are safe on labels.

- Bioactive peptides and functional protein ingredients are on the rise through their health claims, which include boosting the immune system; ensuring proper digestion; and aiding in muscle recovery. They are being integrated among the plethora of food and supplement products for a more powerful nutritional profile. The functional properties of this offers distinct health outcomes, thus appealing to health-conscious consumers who look for functional foods to ensure that the products consumed will provide them with specific health benefits.

- Basic and hypoallergenic formulations are being emphasized due to the increased incidence of food allergies. Manufacturers are working to develop non-GMO protein hydrolysates that are hypoallergenic and reduce all allergic potential, maintaining their nutritional quality. Such formulations enable these consumers to be able to have safer products, extending the sales access of food products to a greater market.

- Consumers who are more active and want to either improve their performance or recover from exercise now look for functional protein ingredients that could supplement and contribute to muscle growth and help with endurance as well as general wellness. This reflects the trend that health and fitness are part of daily life; thus, sports nutrition is popularly normalized beyond the conventional athlete.

Non-GMO Protein Hydrolysates Market Analysis

Learn more about the key segments shaping this market

Based on source, market is segmented into plant-based, animal-based, marine-based and others. The plant-based segment generated USD 179.2 million revenue in 2024.

- The market is currently trending in favor of plant-derived GMO-free protein hydrolysates primarily due to the rising consumer preference for sustainability and ethically produced goods. Consumers are actively searching for plant-based ingredients as the trend toward clean-label formulations further encourages plant-based sources that align with consumers' desires for transparency and naturalness.

- Animal-based non-GMO protein hydrolysates have applications in sports nutrition, infant formulas, and specialized medical foods; they are accepted largely for their high bioavailability and complete amino acid profiles. However, animal welfare and environmental concerns, strongly voiced by an increasing number of consumers, put a brake on its growth to a large extent as compared to its plant-based counterparts.

- Marine-based, non-GMO protein hydrolysates are specialized ingredients containing unique bioactive properties including anti-inflammatory and antioxidant, thus making them popular in functional foods and dietary supplements. Such products are targeted at the high-end niche markets that cater to specific health benefits.

Learn more about the key segments shaping this market

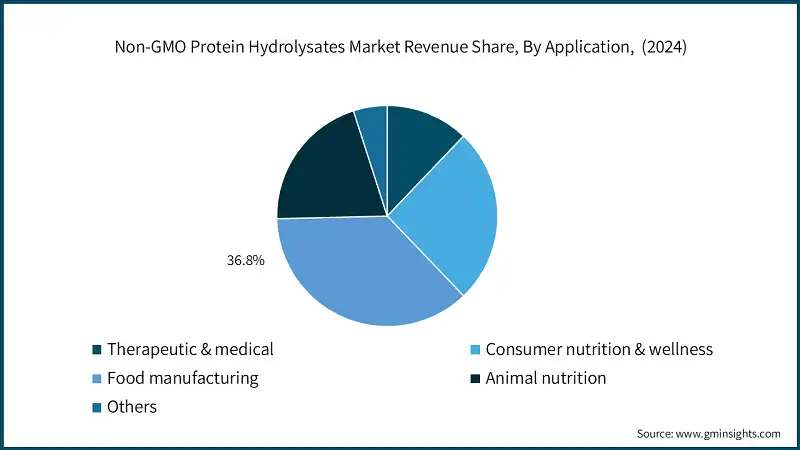

Based on application, the non-GMO protein hydrolysates market is segmented into therapeutic & medical, consumer nutrition & wellness, food manufacturing, animal nutrition and others. The food manufacturing segment accounted for 36.8% of market share in 2024.

- Food manufacturing leads the market, with consumers increasingly demanding clean-label, natural ingredients incorporated into packaged foods, manufacturers have incorporated hydrolysates to improve texture, flavor, and nutritional content. Moreover, the benefits of allergen-friendly and hypoallergenic formulations adds to their values.

- Therapeutic and medical applications are booming due to increased consumption of functional ingredients promising health benefits such as improving digestion and enhancing immunity. Hydrolysates are easily digestible, and their bioavailability makes them suitable for specialized medical nutrition. Increased prevalence of chronic health conditions requiring dietary targeted solutions has proved to be the driving force behind the segment's expansion.

- Hydrolysates are easily digestible and functional, provides muscle recovery and immune support. Hence, the consumer nutrition and wellness benefits from increased consumer preference for natural, non-GMO ingredients in dietary supplements and functional foods.

- Hydrolysates are used to improve feed palatability, digestibility, and amino acid profiles in pet and livestock nutrition. Increased awareness about animal health and performance coupled with growing sustainability demand for natural and environmentally friendly ingredients continues to drive growth in this area.

Looking for region specific data?

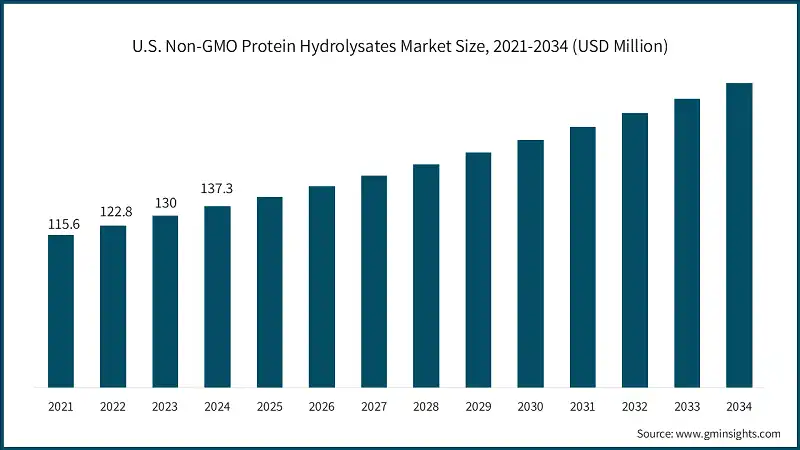

The non-GMO protein hydrolysates market in North America will grow at a CAGR from approximately 5.3% between 2025 and 2034.

- There is increasing consumer awareness along with a preference for clean-label, natural, and allergen-free products that compel food manufacturers to employ non-GMO protein hydrolysates in a wide range of functional foods, dietary supplements, and medical nutrition products.

- Innovations in processing technology, such as enzymatic hydrolysis and sustainable extraction methods, are leading to the generation of high-quality bioactive hydrolysates for health-conscious consumers and wellness trends.

- The rising interest in sustainable sourcing and green production modalities for safe environmental ingredients is further boosting North America market growth.

The non-GMO protein hydrolysates market in Europe, especially in a few countries like Germany, are expected to grow with a rapid pace in the coming years, especially from 2025 to 2034, with CAGR of 5.1%.

- Research and development are being focused on optimizing extraction and hydrolysis techniques, thereby enlarging application in pharmaceuticals, natural extracts, and organic farming.

- Non-GMO protein hydrolysates have investment opportunities to cater to a growing market of clean-label, vegan, and allergen-free offerings.

The non-GMO protein hydrolysates market in China and India is expected to have lucrative growth between 2025 and 2034, with CAGR 5.4% in the Asia Pacific region.

- Urbanization and increasing disposable income are the demand sources for organic fertilizers, natural extracts, and plant-based ingredients derived via sustainable processes.

- Government regulations on waste-to-resource programs and green energy solutions are proving critical in attracting investments in food waste valorization and bioproduct manufacturing.

- Increased use of bio-based ingredients in pharmaceuticals, dietary supplements and functional foods has been complemented, thus supporting market growth, by the expansion in the healthcare and wellness industries.

Between 2025 and 2034, the market for non-GMO protein hydrolysates in the Middle East is projected to grow significantly during this period.

- Eco-sustainable food waste management solutions now represent one of the trends most defined by wellness trends and have, therefore, burgeoned alongside the lively developments within the hospitality and tourism industry.

- Incorporation of non-GMO protein hydrolysates will further be accelerated in the industries manufacturing foods, supplements, and cosmetics by government measures regarding sustainability and healthier lifestyles.

Between 2025 and 2034, a promising expansion of the non-GMO protein hydrolysates sector is foreseen in the Latin America.

- Rising awareness toward environmental sustainability and organic sourcing encourages industries like cosmetics, functional foods, and dietary supplements to adopt more eco-friendly ingredients.

- Increasing disposable income is also supporting the uptake of natural, sustainably grown ingredients, thus further bolstering the advances of this market from the region.

Non-GMO Protein Hydrolysates Market Share

- Non-GMO protein hydrolysates industry is moderately consolidated with players like Arla Foods Ingredients, Cargill Inc., FrieslandCampina, Glanbia Nutritionals and Roquette Frères accounts for 48.5% market share in 2024.

- The non-GMO protein hydrolysates market consists of such leading companies operating mostly in their regional areas. Their long years of experience with protein hydrolysates allow these companies to maintain a strong market position worldwide. Their product offerings are diverse and majorly supported by production capacities and distribution networks, which can serve the increasing demand for non-GMO protein hydrolysates in various regions.

Non-GMO Protein Hydrolysates Market Companies

Major players operating in the non-GMO protein hydrolysates industry includes:

- Arla Foods Ingredients Group

- Carbery

- Cargill Inc.

- Chaitanya Agro Biotech Pvt. Ltd.

- FrieslandCampina

- Glanbia Nutritionals

- International Flavors & Fragrances Inc

- Roquette Frères

- Tatua Co-operative Dairy Company Limited

- Titan Biotech

Glanbia Nutritionals leads in whey protein ingredients and sports nutrition formulations. Competitive advantages and differentiators stem from the broadest whey protein hydrolysate portfolio covering applications in sports nutrition, infant nutrition, and medical foods.

Cargill Inc, offers a widely diversified protein ingredient ranging from plant proteins (soy, pea, and canola) to animal-based proteins (collagen and gelatin) and specialty protein hydrolysates. Competitive advantages include global sourcing and supply chain infrastructures to support the procurements and preservation of non-GMO raw materials. This allows the company to provide technical application that support not only to food manufacturers but also to clients in animal nutrition.

Roquette Frères holds strong position in plant-based protein hydrolysates, especially pea protein. Their advantages stem from the leadership in pea protein production and processing as well as proprietary extraction and hydrolysis technologies. The company can hold non-GMO and organic certifications for its facilities in Europe, Asia, and North America. The introduction of 4 multifunctional pea proteins in February 2024 proves tendentious innovations within plant-based protein functionality.

Arla Foods Ingredients specializes in dairy protein hydrolysates with competitive advantages in uniting access to premium European dairy supply sources with a non-GMO status. The company has technical expertise in whey protein hydrolysis and bioactive peptide development.

FrieslandCampina has a distinguished position in dairy protein hydrolysates backward integrated into dairy raw materials through cooperatively organized farmer members. The technical capabilities of FrieslandCampina include applications to infant and medical nutrition. This increasing incidence of food allergies has created a demand for low-allergen formulations that meet the stringent regulatory requirements for allergens, fulfilling the other major objective for which the company is focusing its expertise on extensively hydrolysed formulations.

Non-GMO Protein Hydrolysates Market News

- In November 2024, Arla Foods Ingredients launched the Lacprodan DI-3092, a whey hydrolysate with a high protein content that tastes better. It offered 10g of high-quality protein per 100ml and, thus, remedied taste challenges to improve patient compliance with peptide-based nutritional products.

- In February 2024, Roquette has launched four new multi-functional pea proteins with increased taste, texture, and application versatility in plant-based foods.

- In August 2023, first-ever certification as a non-GMO project was granted to Arla Foods Ingredients for its MicelPure, a native milk protein. This demonstrates company's commitment to good quality as well as acknowledging the consumer demand for GMO-free products.

The non-GMO protein hydrolysates market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and volume in terms of Kilo Tons from 2021-2034 for the following segments:

Market, By Source

- Plant-based

- Pea protein hydrolysates

- Soy protein hydrolysates

- Rice protein hydrolysates

- Wheat/gluten hydrolysates

- Animal-based

- Milk protein hydrolysates (whey, casein)

- Meat protein hydrolysates

- Egg protein hydrolysates

- Marine-based

- Fish protein hydrolysates

- Collagen hydrolysates

- Others

Market, By Application

- Therapeutic & medical applications

- Infant & pediatric nutrition

- Adult clinical nutrition

- Foods for special medical purposes

- Consumer nutrition & wellness applications

- Sports & performance nutrition

- General health & wellness

- Food manufacturing applications

- Processed food ingredients

- Beverage ingredients

- Flavor & texture enhancement

- Animal nutrition applications

- Companion animal feed

- Livestock feed

- Aquaculture feed

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the non-GMO protein hydrolysates market?

Key players include Arla Foods Ingredients Group, Carbery, Cargill Inc., Chaitanya Agro Biotech Pvt. Ltd., FrieslandCampina, Glanbia Nutritionals, International Flavors & Fragrances Inc., Roquette Frères, Tatua Co-operative Dairy Company Limited, and Titan Biotech.

What are the upcoming trends in the non-GMO protein hydrolysates market?

Key trends include the rise of bioactive peptides, hypoallergenic formulations, and the growing integration of functional protein ingredients in sports nutrition and dietary supplements.

Which region leads the non-GMO protein hydrolysates market?

The North American market is projected to grow at a CAGR of approximately 5.3% during the forecast period, driven by increasing consumer awareness and demand for clean-label products.

What was the market share of the food manufacturing segment in 2024?

The food manufacturing segment accounted for 36.8% of the market share in 2024, supported by the demand for allergen-friendly and natural ingredients in packaged foods.

What is the current non-GMO protein hydrolysates market size in 2025?

The market size is projected to reach USD 474.6 million in 2025.

How much revenue did the plant-based segment generate in 2024?

The plant-based segment generated USD 179.2 million in 2024, fueled by consumer preference for sustainability and clean-label formulations.

What is the market size of the non-GMO protein hydrolysates in 2024?

The market size was USD 451.2 million in 2024, with a CAGR of 5.2% expected through 2034, driven by rising demand for clean-label and easily digestible protein ingredients.

What is the projected value of the non-GMO protein hydrolysates market by 2034?

The non-GMO protein hydrolysates market is expected to reach USD 750.1 million by 2034, propelled by expanding applications in personalized nutrition, functional foods, and animal feed.

Non-GMO Protein Hydrolysates Market Scope

Related Reports