Summary

Table of Content

Latin America Veterinary Orthopedic Implants Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Latin America Veterinary Orthopedic Implants Market Size

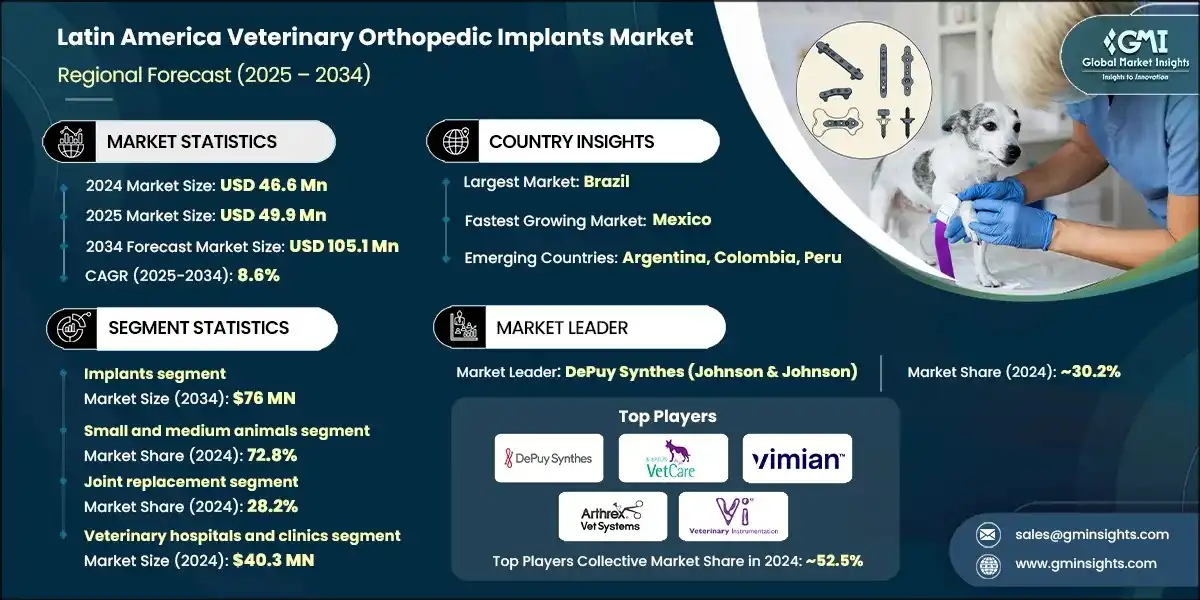

The Latin America veterinary orthopedic implants market size was estimated at USD 46.6 million in 2024. The market is expected to grow from USD 49.9 million in 2025 to USD 105.1 million in 2034, growing at a CAGR of 8.6% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

As the pet owners increasingly consider pets as family members, there is a growing willingness to invest in advanced veterinary care, including surgical procedures. For instance, as per Statista, in 2022, it was estimated that there were 187 million pets in Latin America. This represents a growth of 17% in the pet population compared to the number in 2017, which stood at 160 million pets throughout the region. In 2019, Brazil was Latin America's biggest pet market and among the largest in the world. These increasing animal healthcare expenditures highlight a growing demand for veterinary care products and services. Thus, a high pet population in the region, coupled with high veterinary expenses, increases the demand for various pet care services, including surgeries, thereby driving the market growth.

Veterinary orthopedic implants are medical devices used for correcting fractures, stabilizing joints, and assisting bone healing in animals. Such implants consist of bone plates, screws, pins, wires, and prosthetic joints customized to resist the biomechanical stresses of various species. Key market players such as DePuy Synthes (Johnson & Johnson), B. Braun, Movora (Vimian Group AB), Arthrex Vet Systems, and Veterinary Instrumentation support the overall market growth. They shape the market through innovation in implant materials and design, research and development innovation, and new product launches. Furthermore, their strong distribution network enhances the availability and accessibility of high-quality products across the region.

In 2021, the Latin America veterinary orthopedic implants market was valued at USD 38.6 million and witnessed growth to reach USD 40.9 million and USD 43.6 million in 2022 and 2023, respectively. A key trend that fueled market growth during this period was the increasing adoption of pets in the region, fueled by COVID pandemic, which led to a higher demand for advanced veterinary care, including orthopedic treatments. For example, as per “The Radar Pet 2020” survey, that was carried out by the H2R Institute and SIDAN, the National Union of the Animal Health Products Industry in Brazil, contacted 750 families, revealed that 23% of families acquired the first pet during the pandemic: 55% acquired a cat, 38% a dog and 7% dogs and cats. This surge in pet ownership contributed to the market's expansion during this period.

Veterinary orthopedic implants are artificial components used in veterinary medicine to restore function to fractured bones or replace damaged joints, bones or cartilage. These implants are made of metals such as titanium or stainless steel. The implants serve to manage fractures, joint disorders, and other musculoskeletal afflictions in animals.

Latin America Veterinary Orthopedic Implants Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 46.6 Million |

| Market Size in 2025 | USD 49.9 Million |

| Forecast Period 2025 – 2034 CAGR | 8.6% |

| Market Size in 2034 | USD 105.1 Million |

| Key Market Trends | |

| Drivers | Impact |

| Rising penetration of pet insurance | It improves the affordability of orthopedic procedures, encouraging more pet owners to opt for advanced surgical treatments. |

| Growing incidence of musculoskeletal disorders in animals | High incidence of musculoskeletal disorders has increased the demand for implants to treat fractures, arthritis, and ligament injuries in both pets and livestock. |

| Rising pet ownership and humanization | Rising pet ownership drives spending on veterinary care, especially orthopedic procedures, as pets are increasingly seen as family members. |

| Pitfalls & Challenges | Impact |

| High cost of orthopedic procedures and implants | Limits access for many pet owners, particularly those without insurance or in low-income regions. |

| Post-surgical complications and recovery time | Discourages some pet owners from opting for surgery, impacting overall adoption rates of implants. |

| Opportunities: | Impact |

| Emergence of biodegradable and resorbable implants | Emergence of biodegradable and resorbable implants will reduce the need for secondary surgeries, improving patient recovery and increasing acceptance among veterinarians and pet owners. |

| Expansion of veterinary specialty hospitals and referral centers | Improving access to advanced orthopedic care will boost surgical procedure volume and implant demand. |

| Market Leaders (2024) | |

| Market Leaders |

30.2% market share |

| Top Players |

Collective market share in 2024 is ~52.5% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Brazil |

| Fastest growing market | Mexico |

| Emerging countries | Argentina, Colombia, Peru |

| Future outlook |

|

What are the growth opportunities in this market?

Latin America Veterinary Orthopedic Implants Market Trends

- A notable trend in the Latin America market is increasing demand for sophisticated fixation systems, including locking plates and intramedullary nails. These products provide increased stability, minimize risks for complications, and facilitate quicker recovery than conventional implants.

- As veterinary practitioners deal with more complex fractures and joint injuries, hospitals and clinics are switching to these superior solutions, thereby supporting higher product adoption in the region.

- Additionally, the market is witnessing rapid growth due to the increasing incidence of bone fractures, ligament injuries, and joint diseases in pets.

- For example, osteoarthritis (OA) is the most common joint disorder in animals, affecting about 20% of pet dogs and 60% of cats, with the prevalence increasing with age in both species. Veterinary implants are used to treat or manage osteoarthritis (OA) in animals, with total joint replacement (TJR) for hips and elbows being a common option to alleviate pain and improve function. Thus, with the rise in the prevalence of such disorders, the demand for veterinary implants is anticipated to rise over the analysis period.

- The rise of minimally invasive surgical techniques is also reshaping the market. Veterinarians are adopting implants compatible with smaller incisions, arthroscopic procedures, and faster post-operative recovery. This approach reduces animal discomfort and speeds up rehabilitation, making it more attractive to pet owners.

- The availability of implants specifically designed for minimally invasive use is therefore driving higher acceptance and supporting market expansion.

- Further, growing adoption of pet insurance is another major factor driving adoption of veterinary implants in the region.

- Moreover, the expanding applications of veterinary orthopedic implants are not only limited to small animals but also for large animals is another key trend in reshaping the growth of this market.

Latin America Veterinary Orthopedic Implants Market Analysis

Learn more about the key segments shaping this market

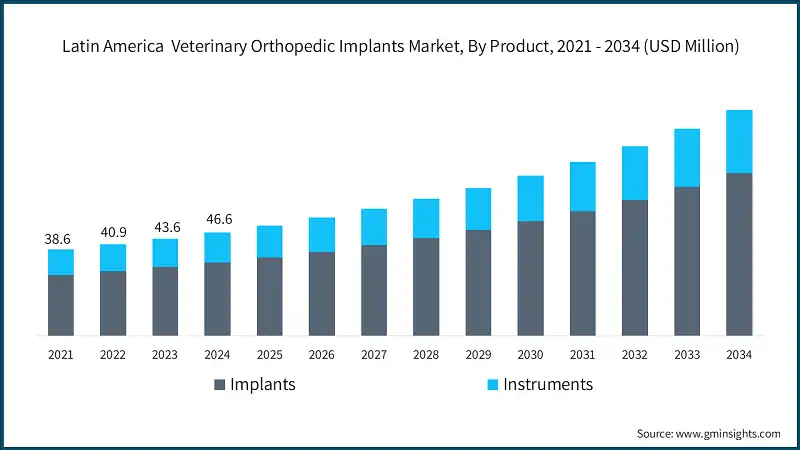

The Latin America market was valued at USD 38.6 million and USD 40.9 million in 2021 and 2022, respectively. The market size reached USD 46.6 million in 2024, growing from USD 43.6 million in 2023.

Based on the product, the Latin America market is divided into implants and instruments. The implants segment is further sub-segmented into plates, joint implants, bone screws and anchors, pins and wires, and other implants. The implants segment dominated the market in 2024 with USD 33.2 million and is expected to reach USD 76 million by 2034.

- High demand for veterinary implants is attributed to the increasing population of pets and rising awareness of sophisticated orthopedic implants. The surge in pet ownership, especially the growing population of pet dogs, is anticipated to propel the growth of the veterinary orthopedic implants market in the projected years.

- In addition, the growing incidence of orthopedic disorders in animals, such as fractures, hip dysplasia, CCL injuries, and osteoarthritis is further accelerating growth in the market.

- For example, osteoarthritis (OA) is the most common degenerative joint disease in dogs affecting up to 20% of the adult canine population.

- Lastly, the growing demand for total joint replacement (TJR) implants, with a specific focus on hip and knee replacements for older pets, further contributes to segmental growth.

- On the other hand, the instruments segment accounted for 28.8% of market share in 2024.

- Innovations in surgical instruments, such as electronic bone drills, power saws, and minimally invasive surgical tools, have significantly improved the efficiency and precision of orthopedic procedures, thereby driving their demand.

- Additionally, increased reliance of veterinarians on a wide range of specialized instruments further propels the growth of this segment.

Learn more about the key segments shaping this market

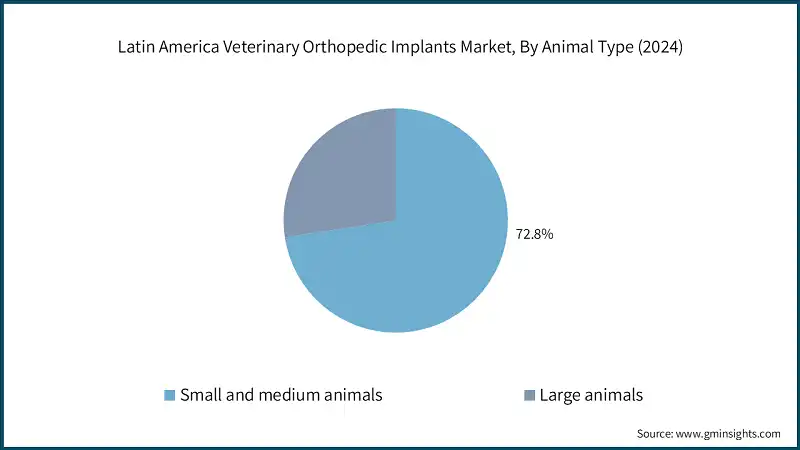

Based on animal type, the Latin America veterinary orthopedic implants market is categorized into small and medium animals and large animals. The small and medium animal’s segment is further categorized into dogs, cats, and other small and medium animals. The small and medium animals segment dominated the market in 2024 with a market share of 72.8%. On the other hand, the large animal’s segment is poised to grow at a 7.9% CAGR over the analysis period. This growth is driven by the economic importance of large animals like swine and cattle in the region, encouraging the producers or breeders to invest in advanced orthopedic care to maintain animal health and productivity.

- The dominance small and medium animal’s segment is primarily due to the high pet population, particularly cats and dogs in the region.

- For instance, as per the Pet Food Industry report, the estimated pet population in Latin America is 120 million dogs and 45 million cats.

- This high pet population demonstrates the regular need for veterinary care products and services, including orthopedic interventions for conditions such as fractures, joint diseases, and degenerative disorders.

- Veterinary practices and referral hospitals are also more focused on canine and feline orthopedics, where procedures like fracture fixation and cruciate ligament repair are common.

- As a result, implant manufacturers design and market most of their product ranges around small-animal needs, which further strengthens this segment’s leading position in the market.

Based on the application, the Latin America veterinary orthopedic implants market is categorized into Tibial Plateau Leveling Osteotomy (TPLO), Tibial Tuberosity Advancement (TTA), joint replacement, trauma, and other applications. The joint replacement segment is further sub-categorized into hip replacement, knee replacement, elbow replacement, and ankle replacement. The joint replacement segment held the highest market share of 28.2% in 2024.

- The large market share of joint replacement segment is primarily driven by a rising incidence of joint disorders such as hip dysplasia and ligament injuries among companion animals, especially dogs.

- Technological advancements in implant materials and minimally invasive surgical techniques further boost the adoption of these treatments in the region.

- On the other hand, the trauma segment is anticipated to witness high growth at a CAGR of 8.9% over the forecast period, driven by the increasing prevalence of fractures, dislocations, and musculoskeletal injuries in companion and livestock animals.

- Veterinary trauma cases often result from accidents, falls, or sports-related injuries, necessitating surgical interventions using specialized implants. These implants, including plates, screws, pins, and external fixators, play a critical role in stabilizing fractured bones, promoting healing, and restoring mobility.

Based on the end use, the Latin America veterinary orthopedic implants market is classified into veterinary hospitals and clinics and other end users. The veterinary hospitals and clinics segment accounted for revenue of USD 40.3 million in 2024 and is anticipated to grow at a CAGR of 8.8% over the analysis period.

- Veterinary clinics and hospitals are the primary point of contact for diagnosing and treating musculoskeletal conditions such as fractures, joint disorders, and ligament injuries, thus contributing to the growth of this segment.

- The presence of specialized veterinary surgeons and access to advanced implant technologies improve surgical success rates and post-operative recovery, further contributing to the segment’s growth.

- Furthermore, the continuous increase in the number of veterinary clinics, hospitals, and professionals is significantly driving the expansion of the veterinary hospitals and clinics segment within the veterinary orthopedic implants market.

Looking for region specific data?

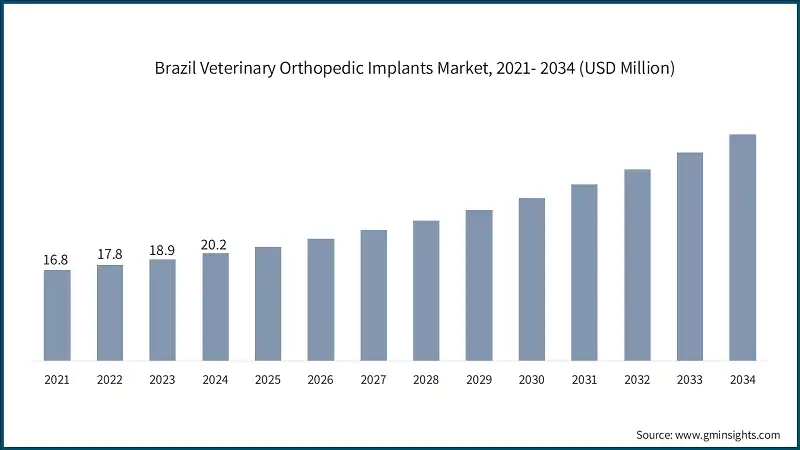

Brazil dominated the Latin America veterinary orthopedic implants market with a revenue of USD 16.8 million and USD 17.8 million in 2021 and 2022, respectively. The market size reached USD 20.2 million in 2024, growing from USD 18.9 million in 2023.

- Brazil holds a dominant market share in the Latin American veterinary orthopedic implants sector, largely due to its well-developed veterinary infrastructure and high pet ownership rates.

- The country benefits from a strong network of specialized veterinary clinics and research institutions that drive innovation and adoption of advanced implant technologies.

- Furthermore, as per data published by GlobalPets, Brazil has the third-largest pet population in the world, following China and the U.S. In Brazil, there are four pets for every five people.

- This high pet population further drives the adoption of veterinary implants.

Mexico Veterinary Orthopedic Implants Market Mexico veterinary orthopedic implants market is predicted to witness considerable growth over the analysis period. The Latin America market is witnessing substantial growth, fueled by the increasing prevalence of orthopedic conditions in companion and farm animals, a surge in pet ownership, and the rising demand for advanced surgical procedures. This market encompasses leading global healthcare companies, medical device manufacturers, and veterinary-focused firms delivering innovative orthopedic solutions. The top 5 market players in the Latin America market, including DePuy Synthes (Johnson & Johnson), B. Braun VetCare, Movora (Vimian Group AB), Arthrex Vet Systems, and Veterinary Instrumentation, account for 52.5% of the market. These industry players undertake strategic initiatives, such as product launches and approvals, assisting them in sustaining market competition. Further, technological advancements such as 3D printing, customized implant design, and minimally invasive surgical techniques are revolutionizing veterinary orthopedics. Additionally, growing veterinary infrastructure, strategic collaborations with veterinary hospitals, and investments in research and development are driving market expansion. The focus on sustainability, affordability, and enhanced implant biocompatibility ensures continued innovation to meet the evolving needs of veterinary surgeons and animal healthcare providers. Few of the prominent players operating in the Latin America veterinary orthopedic implants industry include: DePuy Synthes (Johnson & Johnson) DePuy Synthes, a subsidiary of Johnson & Johnson, is a key player in the Latin American veterinary orthopedic implants market, accounting for ~30.2% of the market share. The company offers a wide range of implants and instruments designed to address fractures, joint issues, and musculoskeletal conditions in companion animals. It integrates cutting-edge technologies such as 3D printing, bioabsorbable materials, and minimally invasive surgical systems to enhance implant performance and surgical outcomes. Movora, a subsidiary of Vimian Group AB, operates exclusively within the veterinary orthopedic implants market, offering a dedicated range of implants and surgical instruments. The company focuses on developing innovative orthopedic solutions, including advanced joint replacement systems, plates, and fixation devices tailored specifically for companion animals. Through strategic collaborations with veterinary clinics, educational initiatives, and partnerships with veterinary surgeons, Movora strengthens its position in the market.Latin America Veterinary Orthopedic Implants Market Share

Latin America Veterinary Orthopedic Implants Market Companies

Latin America Veterinary Orthopedic Implants Industry News:

The Latin America veterinary orthopedic implants market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product

- Implants

- Plates

- TPLO plates

- TTA plates

- Trauma plates

- Specialty plates

- Other plates

- Joint implants

- Bone screws and anchors

- Pins and wires

- Other implants

- Instruments

Market, By Animal Type

- Small and medium animals

- Dogs

- Cats

- Other small and medium animals

- Large animals

Market, By Application

- Tibial plateau leveling osteotomy (TPLO)

- Tibial tuberosity advancement (TTA)

- Joint replacement

- Hip replacement

- Knee replacement

- Elbow replacement

- Ankle replacement

- Trauma

- Other applications

Market, By End Use

- Veterinary hospitals and clinics

- Other end users

The above information is provided for the following countries:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

Frequently Asked Question(FAQ) :

Which end-use segment held the largest market share in 2024?

The veterinary hospitals and clinics segment generated USD 40.3 million in 2024, benefiting from access to skilled surgeons and adoption of minimally invasive surgical techniques.

Who are the leading companies in the Latin America market?

Leading companies include DePuy Synthes (Johnson & Johnson), B. Braun VetCare, Movora (Vimian Group AB), Arthrex Vet Systems, and Veterinary Instrumentation, collectively holding over 52% market share in 2024.

Which country leads the Latin America veterinary orthopedic implants market?

Brazil dominated the regional market with USD 20.2 million in 2024, owing to its high pet ownership rate, advanced veterinary infrastructure, and presence of leading global suppliers.

Which application segment dominated the market in 2024?

The joint replacement segment led with a 28.2% share in 2024, due to the growing incidence of hip dysplasia and ligament injuries in dogs, coupled with adoption of advanced implant materials.

Which animal type segment held the largest share in 2024?

The small and medium animals segment accounted for 72.8% of the market in 2024, driven by the large population of companion animals, particularly dogs and cats, requiring orthopedic care.

Which product segment led the Latin America veterinary orthopedic implants market in 2024?

The implants segment dominated with USD 33.2 million in 2024, supported by high demand for plates, screws, and joint implants designed for fracture management and joint replacement procedures.

What is the market valuation for 2025?

The market is projected to reach USD 49.9 million in 2025, reflecting continued growth from rising musculoskeletal disorders in pets and increasing availability of specialized surgical facilities.

What is the market size of the Latin America veterinary orthopedic implants market in 2024?

The Latin America market was valued at USD 46.6 million in 2024, driven by rising pet ownership, growing animal healthcare spending, and increased demand for advanced orthopedic care.

What is the projected value of the Latin America veterinary orthopedic implants market by 2034?

The market is expected to reach USD 105.1 million by 2034, growing at a CAGR of 8.6% from 2025 to 2034, supported by higher adoption of implants, advancements in biomaterials, and expansion of veterinary specialty centers.

Latin America Veterinary Orthopedic Implants Market Scope

Related Reports