Summary

Table of Content

Food Fibers Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Food Fibers Market Size

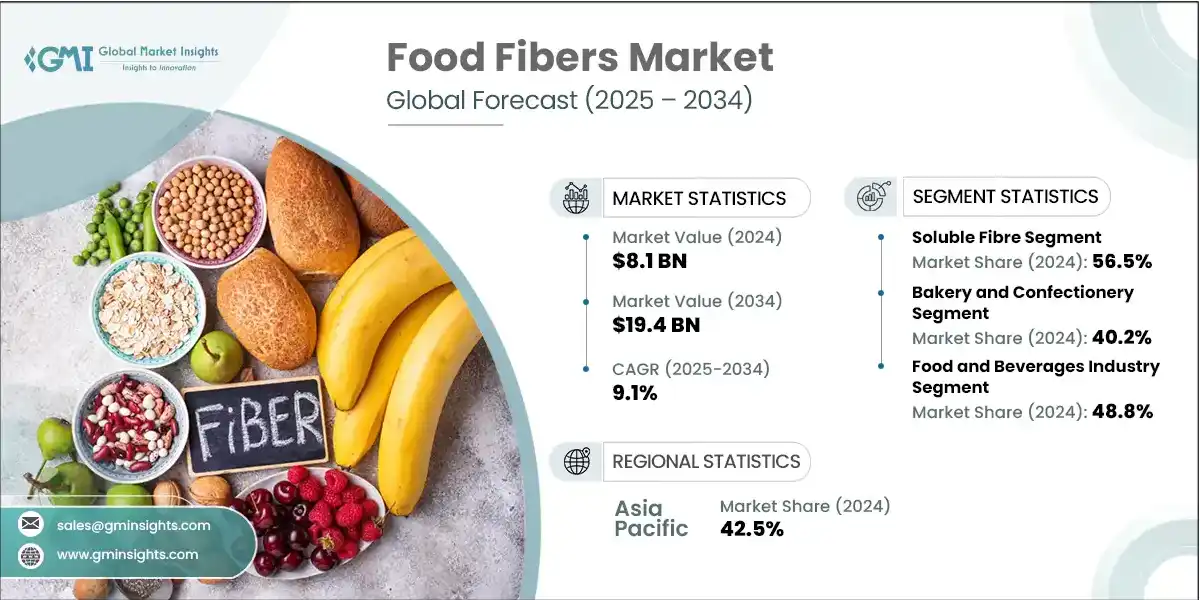

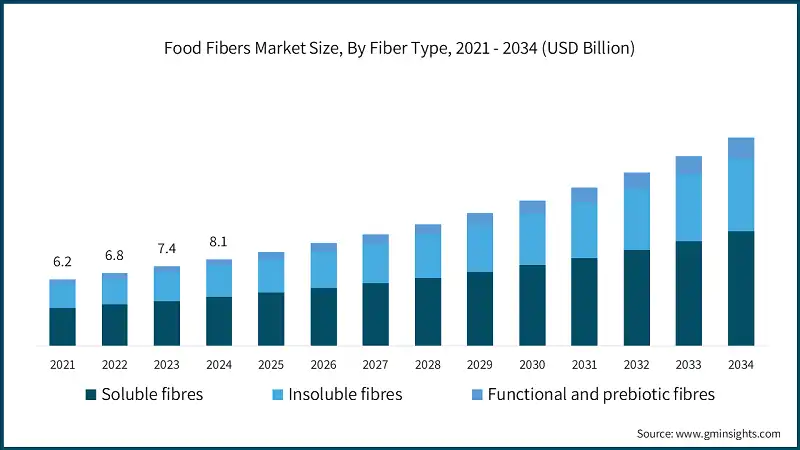

The global food fibers market size was estimated at USD 8.1 billion in 2024. The market is expected to grow from USD 8.8 billion in 2025 to USD 19.4 billion in 2034, at a CAGR of 9.1%.

To get key market trends

Food fibres, also known as dietary fibres, are plant-based carbohydrates that are not digested by the human body but play a crucial role in maintaining digestive health, regulating blood sugar, and supporting weight management. These fibres can occur naturally in fruits and vegetables, grains and legumes and are now widely in food products including bakery, beverages, dairy alternatives, and supplements. The food fibres market is experiencing a strong growth across the globe because of the increased demand of consumers towards the functional and health-conscious food items.

- Manufacturers are now in a position to take full advantage of the growing interest in new food products by developing clean labels, prebiotic-rich, and fiber-fortified products. This growth is mainly fueled by an increasing number of consumers wanting to know how good gut health is for their health; a rising trend of popularity for plant-based diets; and the existence of favorable regulatory frameworks that encourage food producers to incorporate fiber enriched ingredients and clearly label their products.

- New methods of extracting fiber have opened new doors with sophisticated techniques in food formulation such as microencapsulation and extrusion. Therefore, fibers now have a wide application range-from snacks, beverages, baked goods, and even dairy alternatives-all without compromising on taste or texture. Therefore, fiber-enriched foods are coming into their own as mainstream foods that will appeal to health-conscious consumers looking for healthy and functional foods.

- The fiber food market is the birth of a long-term investment and continuous innovation. These emerging markets at fast urbanization rates, increasing disposable incomes, and health awareness among consumers in Asia-Pacific and Latin America are important avenues to harness untapped potential. Overall, investment in extraction technology and advancement in fiber in food technology keeps manufacturers at the forefront of the evolving health-oriented food scene, ensuring sustainable growth and a much wider reach across different countries.

- For instance, according to the World Health Organization (WHO), increasing the intake of dietary fibre to at least 25–30 g per day significantly reduces the risk of noncommunicable diseases such as cardiovascular disorders, type 2 diabetes, and colorectal cancer.

- Similarly, the National Institutes of Health (NIH) highlights that adequate fibre consumption supports gut microbiota health, immune regulation, and metabolic function, driving demand for functional and prebiotic fibres. These global health directives, combined with growing public awareness, are accelerating the adoption of fibre-enriched products in both developed and emerging markets. Alongside this, regulatory alignment, personalized nutrition, and clinical validation of fibre efficacy continue to strengthen the foundation for food fibres market expansion.

Food Fibers Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 8.1 Billion |

| Forecast Period 2025 – 2034 CAGR | 9.1% |

| Market Size in 2034 | USD 19.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Consumer Awareness About Health and Wellness | Increased awareness of the health benefits associated with dietary fibers such as improved digestion, blood sugar regulation, and weight management has led consumers to seek out fiber-rich foods and beverages. This drives demand for a wide range of fiber-enriched products like cereals, snacks, dairy substitutes, and functional foods, fueling market growth globally. |

| Growing Prevalence of Lifestyle Diseases | Increased cases of cardiovascular disease, diabetes, and obesity drive demand for fiber-fortified functional foods, boosting innovation and market growth. |

| Rise of Plant-Based and Clean-Label Products | Preference for natural, minimally processed foods increases demand for natural fibers, encouraging manufacturers to incorporate recognizable ingredients and expand market opportunities. |

| Pitfalls & Challenges | Impact |

| Supply Chain Disruptions and Raw Material Variability | Inconsistent availability and quality of raw materials like grains, fruits, and vegetables can hinder production, lead to price volatility, and impact product consistency, affecting market stability and growth |

| Stringent Regulatory Approvals and Standards | Navigating complex regulations and obtaining approvals for new fibers can delay product launches and increase compliance costs, limiting innovation and market expansion |

| Opportunities: | Impact |

| Growing Demand for Functional and Health-Enhancing Foods | Increased consumer focus on health and wellness creates demand for fiber-rich products, driving innovation and expanding market size. |

| Development of Novel and Sustainable Fiber Sources | Exploring alternative fibers from agricultural by-products and sustainable sources can reduce costs and meet eco-conscious consumer preferences, opening new market segments. |

| Expansion in Emerging Markets | Rising disposable incomes and health awareness in developing countries offer growth opportunities for fiber-based products, broadening global market reach. |

| Product Innovation with Clean-Label and Natural Ingredients | Increasing preference for natural, minimally processed foods encourages formulation of transparent, fiber-enriched products, enhancing brand differentiation and consumer trust. |

| Integration of Food Fibers in Personalized Nutrition | Customizable fiber products tailored to specific health needs (e.g., gut health, weight management) can attract niche markets and foster premium product development. |

| Market Leaders (2024) | |

| Market Leaders |

16.9% Market Share |

| Top Players |

Collective share of 43.1% in 2024 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, China, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Food Fibers Market Trends

The food fibers industry is on a straight and strong growth trend that is influenced principally by rising consumer health consciousness against increasing demand for functional and fortified foods. Today, most consumers know so much about their health and often keep themselves busy by seeking out products that promise to give them digestive benefits and weight management while keeping chronic diseases such as diabetes and heart diseases at bay. For example, Kellogg's and General Mills have since invested a lot into producing fiber-enriched cereals and snack bars to attract into their fold consumers who would be interested in dishes that promise digestive health benefits.

- This tripling of growth in plant-based diets, prebiotic fibers, and awareness regarding gut health has unleashed a flood of innovation across different product categories. Manufacturers have begun to introduce high-fiber bread lines rendering bake products from such companies as Bob's Red Mill into the market for health-conscious consumers. Other examples would include beverages in the fiber-injected waters and smoothies from branded companies such as Naked Juice. Dairy alternatives have also come into the industry by producing plant-based fiber-enriched milks and yogurts, for instance, Oatly and Alpro owned by Danone. The market is now ever-growing and includes dietary supplements and prebiotic fiber powders that are being quickly adopted.

- Technologies like microencapsulation, extrusion techniques, and fiber modification processes have made a great contribution toward introducing fibers into almost all products, and microencapsulation secures sensitive prebiotic fibers through production and storage processes (or between the two), allowing them to be put into beverages and baked goods without changing the taste or texture. Extrusion technology also allows users to manufacture fiber-rich snacks that will maintain desirable mouthfeel and appearance, as demonstrated by high-fiber crackers and snack bars produced by several brands.

- Coverage of positive signals about the above trends, however, also includes challenges that the market will have to contend with. The costs associated with the production of fiber and its further processing especially for specialty prebiotic or functional fibers are quite prohibitive for small and regional manufacturers. In addition to that, disruptions caused in the supply chain for raw fiber sources like grains, legumes, or fruits affect market steadiness.

- Competition with other functional ingredients such as proteins, probiotics, and collagen also fragments consumer attention and ventures into different product development trajectories. Nonetheless, the global change toward clean label products, personalized nutrition, and government initiatives toward healthier eating-behavior practices such as the U.S. Dietary Guidelines regarding fiber intake continue to present stronger justification for including fiber in foods.

- Long-term prospects for the food fibers market are thus very bright because demand is increasing in both developed markets, such as North America and Europe, and emerging markets, such as Asia-Pacific and Latin America. Such market opportunity will be captured by industry players offering innovative alternatives in product formulation, optimizing supply chains, and adopting new technologies.

Food Fibers Market Analysis

Learn more about the key segments shaping this market

The food fibers market by fibre type is segmented into soluble fibres, insoluble fibres and functional and prebiotic fibres. The soluble fibre segment accounted for 56.5% of the market share in 2024 with a market size of USD 4.6 billion.

- For example, inulin and oligofructose are widely favored for their prebiotic properties, promoting beneficial gut bacteria. Companies like Cargill and Tate & Lyle produce inulin and oligofructose that are extensively used in prebiotic-rich beverages, such as fiber-infused smoothies and probiotic drinks. These fibers also feature prominently in dairy substitutes like almond and soy milk, where they enhance texture and nutritional profile.

- Additionally, naturally occurring gels like pectin and gums, extracted from citrus fruits and other plant sources serve as texture enhancers in jams, jellies, and confectionery products. For instance, pectin is a key ingredient in strawberry jams and fruit preserves, providing the desired consistency and mouthfeel. Gums like guar and xanthan are employed in bakery products to improve dough stability and product moisture retention.

- Further, specialty fibers like beta-glucan derived from oats and barley are gaining attention due to their proven cholesterol-lowering effects. These fibers are incorporated into functional breakfast cereals, snack bars, and beverages marketed toward heart health. For example, products such as Kellogg’s Heart to Heart cereal and Oatmega bars feature added beta-glucan to support cardiovascular health, aligning with consumer demand for heart-healthy foods.

- In contrast, the insoluble fiber segment is experiencing steady growth with a CAGR of 9%, driven by its role in supporting digestive health and regularity. This includes fibers like cellulose and modified cellulose, which are commonly used in whole-grain bread, crackers, and snack foods. Wheat bran, known for its high insoluble fiber content, is frequently added to cereals and baking mixes to boost fiber content and improve gut health. For instance, brands like All-Bran incorporate wheat bran to promote digestive regularity.

- Fruits and vegetable-derived fibers also play a significant role, especially in clean-label and minimally processed foods. These fibers are added to cereal mixes, granolas, and snack foods to enhance fiber content naturally.

- Meanwhile, the emerging space of functional and prebiotic fibers is driven by innovations in resistant starch technologies, galacto-oligosaccharides (GOS), and fructooligosaccharides (FOS). Resistant starches, such as those used in products like Hi-Maize, are formulated to modulate gut microbiota and improve metabolic health. GOS and FOS are increasingly incorporated into infant formulas, dietary supplements, and snack foods to promote beneficial gut bacteria and support digestive health.

- For example, companies like Ingredion and Roquette are developing novel fiber ingredients that meet clean-label demands while delivering targeted health benefits, reflecting the growing consumer interest in gut microbiota modulation and natural, minimally processed foods.

Learn more about the key segments shaping this market

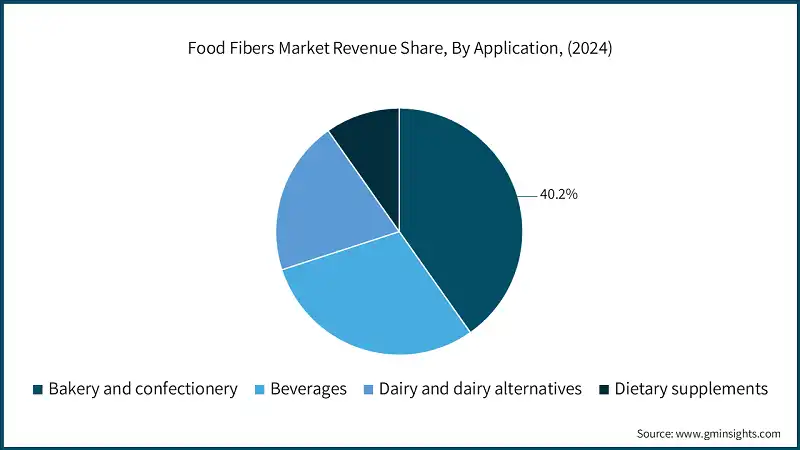

The food fibers market by application is segmented into bakery and confectionery, beverages, dairy and dairy alternative and dietary supplements. The bakery and confectionery accounted for 40.2% of the market share in 2024 with a market size of USD 3.3 billion.

- The bakery and confectionery segment lead the food fibres market by application, driven by the increasing use of dietary fibres in bread and baked goods, breakfast cereals, and snack foods to enhance texture, improve satiety, and meet clean-label demands. Functional fibers are also incorporated into sweet and confectionary products to lower sugar and calorie content without affecting the flavour of mouth feel of the product. The increased consumer demand of high-fiberies snack and whole grain bakery products remains to propel the innovative market in this segment, especially in the North America and Asia-Pacific markets.

- The beverages segment is developing quickly with a market size of USD 2.4 billion, due to the need of functional beverages and sports drinks, non-dairy based milk alternatives, and added-value waters that provide digestive or metabolic advantages. In the same manner, the dairy and dairy alternatives category adds fibre to yogurts, cheese, and plant-based foods to enhance nutritional values. The segment of dietary supplements, which incorporate powder and capsule forms, gut health promoters, and weight management supplements are becoming a crucial segment of application as people become increasingly health conscious and in need of convenient, high-fibre supplement formulations.

The food fibres market by end-use industry is segmented into food and beverages industry, dietary supplement industry, functional foods and nutraceuticals and animal feed and pet food. The food and beverages industry accounted for 48.8% of the market share in 2024 with a market size of USD 4 billion.

- The food and beverage manufacturing segment dominates the food fibres market by end-use industry. This segment benefits from the widespread integration of dietary fibres across multiple food categories including bakery, beverages, dairy, and snacks. The big food producers are spearheading it through new high-fibre formulations as a part of the clean-label and wellness trend. Also, regional and specialty food manufacturers are increasingly utilizing functional fibres to meet the nutrition needs of local health-conscious citizens. Manufacturers of technology and equipment are also very important because they facilitate the advanced technology in fibre blending, extrusion, and encapsulation that enhance the stability, texture, and delivery of nutrients of the products.

- Across other categories, there are also the dietary supplement industry where contract manufacturers, and other private label brands and distribution channels are providing a broad selection of fibre-rich capsules, powders and prebiotic mixes, for gut health and immunity. Functional foods and nutraceuticals industry is taking advantage with respect to fibres in the medical foods, clinical nutrition and in the sports performance products. In the meantime, the animal feed and pet food segment are growing and has applications regarding the premium formulations of pet products, livestock health, and aquaculture, that lead to better digestion, nutrient assimilation, and animal performance.

Looking for region specific data?

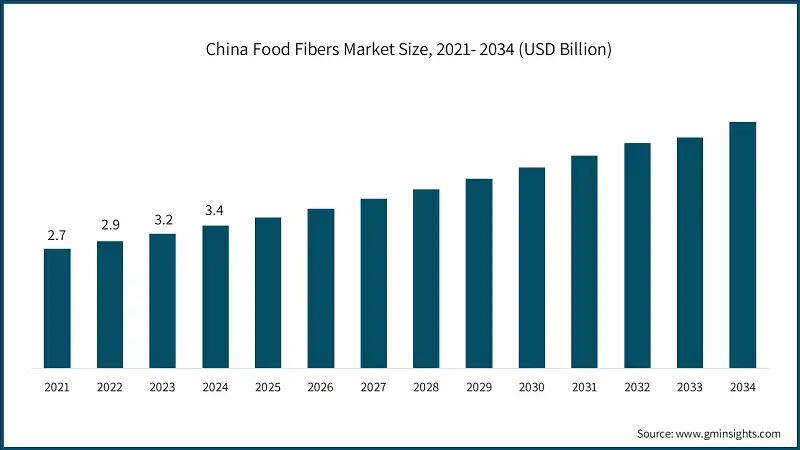

The food fibers market is dominated by Asia Pacific, accounting for 42.5% of total revenue in 2024.

- Asia Pacific leads the food fibres market, driven by rising consumer awareness about digestive health, growing urban middle-class populations, and increasing demand for functional foods and beverages. With helpful government programs, a change in dietary habits, and tradition toward plant-based eating, nations such as China, Japan, India, or South Korea are leading. The market is being driven by the rapid expansion of fibre-rich baked products, dairy substitutes and nutraceutical products. In addition, the presence of big players in the food industry, and the transformation of online commerce pathways further enhances the availability and popularity of fibre products in this area.

- For instance, In Japan, traditional dietary habits already emphasize plant-based foods, but recent trends focus on functional foods containing dietary fibers like inulin and beta-glucan to support aging populations and prevent lifestyle diseases. Companies like House Foods and Otsuka are expanding their portfolios of fiber-rich snack and beverage options tailored for health-conscious consumers.

- India is witnessing a surge in the consumption of fiber-rich foods due to government campaigns like the "Eat Right India" initiative, which encourages increased intake of dietary fiber, fruits, and vegetables. Indian brands such as Patanjali and brands in the organized retail sector are launching fiber-enriched products, including cereals, bakery items, and dairy substitutes, to meet this rising demand.

- South Korea's rapid urbanization and health awareness have led to a boom in fiber-rich baked goods, beverages, and nutraceutical products. Companies like CJ CheilJedang are innovating with functional foods containing prebiotics and fibers, such as fiber-enhanced instant noodles and drinkable yogurts.

- North America and Europe come next as the most important regional contributors, after Asia Pacific. North America has a good market share given a high demand in foods with low calories and fibre, and well-developed health supplementation industries. Innovations of clean-label fibre ingredients and product fortification serve to keep the U.S. and Canadian markets on the front of innovations. Europe, however, is experiencing increased usage of soluble fibres in bakery, cereals, and beverages with Germany, France, and the UK leading the adoptions. In Europe, a progressive fibre market is being influenced by regulatory support of nutritional labelling and green sustainability.

Food Fibers Market Share

The Cargill, Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Tate & Lyle PLC and Roquette Frères SA are significant 5 players in the food fibres industry with respect to innovation and distribution. These are prominent companies within the food fibres market operating in their respective regions. These companies hold strong positions globally due to their extensive experience in food fibres industry. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

- Cargill, Incorporated: Cargill is a leading force in the food fibres market, offering a broad portfolio of soluble and insoluble fibres used in bakery, beverages, dairy, and nutrition products. With its research-driven ingredient innovations like Oliggo-Fiber chicory root fibre and proprietary blends for digestive and glycemic health, Cargill addresses growing consumer demand for functional, clean-label, and sustainable fibre solutions. Its strong global supply chain, strategic acquisitions, and collaboration with food formulators make it a key player in scaling fibre-enriched food production while promoting health-conscious reformulation trends across both developed and emerging markets.

- Archer Daniels Midland Company (ADM): ADM is a global nutrition powerhouse, significantly contributing to the food fibers market with its wide range of dietary fibers sourced from corn, soy, and wheat. The company’s Fibersol brand—recognized for its prebiotic and digestive health benefits—is widely used in functional foods and beverages. ADM’s vertically integrated operations, robust R&D infrastructure, and global reach support consistent fiber supply and innovation. It plays a central role in customizing fiber-based solutions for sugar and calorie reduction, satiety enhancement, and clean-label claims, particularly within health-conscious consumer segments across North America, Europe, and Asia-Pacific.

- Ingredion Incorporated: Ingredion is a major contributor to the food fibers market, renowned for its natural, plant-based fiber solutions under brands like NUTRAFLORA and HI-MAIZE. With a customer-centric focus on clean labels, prebiotics, and digestive health, the company offers versatile fibers for applications in bakery, dairy, beverages, and snacks. Ingredion also leads in nutritional science and formulation support, helping brands optimize texture, taste, and health functionality. Its commitment to sustainable sourcing, combined with global manufacturing and regional innovation centers, positions Ingredion as a preferred partner for health-forward fiber-based product development across multiple industries.

- Tate & Lyle PLC: Tate & Lyle plays a strategic role in the food fibres market through its specialty fibres portfolio that includes PROMITOR Soluble Fiber and STA-LITE Polydextrose. These ingredients are formulated to improve digestive health, reduce sugar and calorie content, and maintain taste and texture in processed foods. With a strong emphasis on gut health and consumer well-being, Tate & Lyle focuses on innovation, regulatory compliance, and scientific backing to drive fibre adoption in global markets. Its extensive global presence, technical service teams, and partnership-driven business model make it a key enabler of fibre innovation in food and beverage sectors.

- Roquette Frères SA: Roquette Frères SA is a key global supplier of high-performance plant-based ingredients, including dietary fibres extracted from wheat, corn, and peas. Its fibre portfolio supports gut health, blood glucose management, and texture modification in bakery, dairy, beverages, and nutraceuticals. Roquette’s emphasis on pea fibre, soluble fibres, and clean-label solutions aligns with the increasing demand for non-GMO, gluten-free, and sustainable products. Through continuous investment in R&D and innovation centres worldwide, Roquette contributes significantly to the expansion of fibre-enhanced food applications and remains a critical partner for functional product formulation across both food and health industries.

Food Fibers Market Companies

Major players operating in the food fibers industry are:

- Cargill, Incorporated

- Tate & Lyle PLC

- Archer Daniels Midland Company

- Ingredion Incorporated

- Roquette Freres SA

- Kerry Group PLC

- International Flavors & Fragrances Inc

- J Rettenmaier & Söhne GmbH + Co KG

- Nexira Inc

Food Fibers Industry News:

- In April 2024, Cargill invested in and expanded its partnership with Enough, to scale mycoprotein-based fibres (Abunda), accelerating sustainable fibre-rich meat and dairy alternatives.

- In February 2025, Cargill partnered with BinSentry to deploy AI-powered feed inventory solutions in Brazil, optimizing fibre-inclusive animal feed supply chains.

- In February 2025, Roquette launched a new plant-based film-coatings platform (Tabshield and Readilycoat) for the nutraceutical and pharma sectors, enhancing fibre-based product delivery systems.

- In June 2025, Nexira showcased new prebiotic acacia fibre and botanical extracts for functional beverages at IFT FIRST 2025, expanding its portfolio for gut-health and clean-label drink formulations.

- In June 2025, Roquette completed its acquisition of IFF Pharma Solutions, strengthening its presence in pharmaceutical and nutraceutical excipients alongside plant-based dietary fibres.

- In June 2025, Roquette unveiled a savoury tomato-feta snack featuring its NUTRIOSE soluble fibre and NUTRALYS pea protein, emphasizing integrated nutrition in on-the-go formats.

The food fibers market research report includes an in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) and volume (Kilo Tons) from 2025 to 2034 for the following segments:

Market, By Fiber Type

- Soluble fibres

- Inulin and oligofructose segment

- Pectin and gums segment

- Beta-glucan and specialty fibres

- Insoluble fibres

- Cellulose and modified cellulose

- Wheat bran and cereal fibres

- Fruit and vegetable fibres

- Functional and prebiotic fibres

- Resistant starch technologies

- Galacto-oligosaccharides (GOS) and fructo-oligosaccharides (FOS)

- Novel and emerging fibres

Market, By Application

- Bakery and confectionery

- Bread and baked goods

- Breakfast cereals and snack foods

- Confectionery and sweet goods

- Beverages

- Functional and sports beverages

- Dairy and plant-based alternatives

- Juice and enhanced water

- Dairy and dairy alternatives

- Yogurt and fermented products

- Cheese and processed dairy

- Plant-based dairy alternatives

- Dietary supplements

- Powder and capsule formats

- Prebiotic and gut health supplements

- Weight management and metabolic health

Market, By End-Use Industry

- Food and beverage manufacturing

- Large-scale food manufacturers

- Regional and specialty food companies

- Technology and equipment suppliers

- Dietary supplement industry

- Supplement manufacturers and brands

- Contract manufacturers and private label

- Distribution and retail channels

- Functional foods and nutraceuticals

- Functional food development

- Medical foods and clinical nutrition

- Sports and performance nutrition

- Animal feed and pet food

- Premium pet food applications

- Livestock and aquaculture

- Market development and innovation

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What is the market size of the food fibers in 2024?

The market size was USD 8.1 billion in 2024, with a CAGR of 9.1% expected through 2034. The growth is driven by increasing consumer demand for functional and health-conscious food products.

What is the projected value of the food fibers market by 2034?

The market for food fibers is set to reach USD 19.4 billion by 2034, fueled by innovations in product formulations, rising health awareness, and advancements in fiber integration technologies.

How much revenue did the soluble fiber segment generate in 2024?

The soluble fiber segment generated approximately USD 4.6 billion in 2024, accounting for 56.5% of the market share.

What was the valuation of the bakery and alternatives segment in 2024?

The bakery and alternatives segment representing 40.2% of the market share and accounted for USD 3.3 billion in 2024.

What is the growth outlook for the food and beverages segment from 2025 to 2034?

The food and beverages industry held over 48.8% of the revenue share in 2024 with a market size of USD 4 billion.

Which region leads the food fibers sector?

Asia Pacific leads the market, contributing 42.5% of total revenue in 2024. Growth is driven by rising awareness of digestive health, urbanization, and demand for functional foods.

What are the upcoming trends in the food fibers market?

Trends include tech adoption (microencapsulation, extrusion), rise of plant-based/prebiotic fibers, and demand for clean label and personalized nutrition.

Who are the key players in the food fibers industry?

Key players include Cargill, Incorporated, Tate & Lyle PLC, Archer Daniels Midland Company, Ingredion Incorporated, Roquette Freres SA, Kerry Group PLC, International Flavors & Fragrances Inc, J Rettenmaier & Söhne GmbH + Co KG, and Nexira Inc.

Food Fibers Market Scope

Related Reports