Summary

Table of Content

Digestive Enzyme Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Digestive Enzyme Market Size

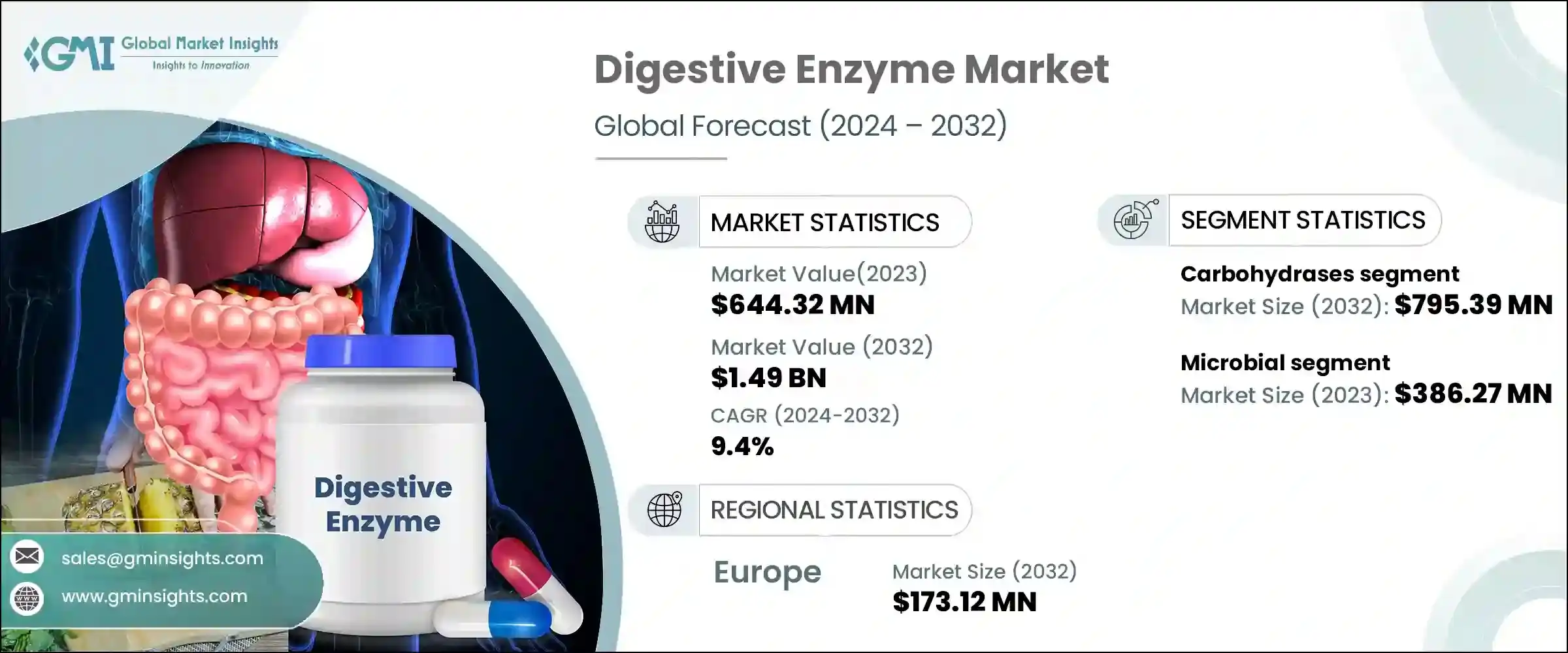

Digestive Enzyme Market size was worth USD 644.32 million in 2023 and is projected to grow at a 9.4% CAGR between 2024 and 2032, driven by advancements in enzyme technology, enhancing stability and effectiveness, and increasing health consciousness among consumers. These innovations cater to the rising demand for natural digestive health solutions. As awareness of gut health benefits spreads, consumers increasingly seek enzyme supplements to support digestion, driving market growth and prompting further development of targeted formulations to meet diverse dietary and health needs.

To get key market trends

For instance, in May 2023, DSM-Firmenich introduced Maxilact®Next, the fastest and purest lactase enzyme in the market, enhancing lactose-free dairy production efficiency. This latest addition to the Maxilact® range sets a new benchmark in enzyme technology.

The growth of the digestive enzyme industry is fueled by increasing digestive disorders such as lactose intolerance and gluten sensitivity. As more individuals seek relief from these conditions, the demand for enzyme supplements that aid digestion rises. Additionally, the expanding functional foods sector integrates digestive enzymes into products like yogurt and granola bars, offering convenient solutions for consumers looking to support their digestive health through everyday dietary choices.

Digestive Enzyme Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2023 |

| Market Size in 2023 | USD 644.32 Million |

| Forecast Period 2024 - 2032 CAGR | 9.4% |

| Market Size in 2032 | USD 1.49 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

For instance, in February 2022, Mimi's Rock Corp. announced that Dr. Tobias, its popular supplements brand, is launching Digestive Enzymes with Prebiotics and Probiotics to meet increasing demand for digestive health products, enhancing their portfolio in this growing market segment.

The digestive enzymes industry faces challenges due to high production costs for top-tier formulations and rigorous regulatory hurdles. However, these obstacles also ensure that products meet stringent quality standards and safety requirements. Overcoming these challenges stimulates innovation and promotes the development of reliable digestive health solutions. This process ultimately benefits consumers by providing effective products they can trust to support and maintain their digestive wellness.

Digestive Enzyme Market Trends

The digestive enzyme industry is propelled by ongoing innovation in delivery formats such as chewable tablets, capsules, and powders, catering to diverse consumer preferences for convenience and efficacy.

Besides, intensive research and development efforts enhance enzyme stability, potency, and application in various formulations. This dual approach meets evolving consumer demands and expands the market by offering effective digestive health solutions that are accessible and appealing to a broad audience. For instance, in September 2022, Creative Enzymes introduced recombinant Kex2 protease from Saccharomyces cerevisiae for cleaving secreted peptides in yeast-based protein expression, enhancing capabilities in exogenous protein production.

Digestive Enzyme Market Analysis

Learn more about the key segments shaping this market

The carbohydrases segment garnered USD 356.05 million in 2023 and will register USD 795.39 million by 2032, attributed to its extensive application in breaking down carbohydrates into simple sugars, essential for energy production. Increased consumption of carbohydrate-rich diets, rising health awareness, and the prevalence of digestive disorders drive demand. Additionally, the expansion of the food and beverage industry, emphasizing functional foods and dietary supplements, further boosts this segment. Carbohydrases' versatility in various industrial applications, including animal feed and biofuel production, also contributes to their significant market share.

Learn more about the key segments shaping this market

The digestive enzyme market from microbial segment exhibited USD 386.27 million in 2023 and will demonstrate a 9.4% CAGR during 2024 to 2032, owing to its superior efficiency and stability under diverse conditions. These enzymes, derived from microorganisms, offer a consistent and scalable production process, meeting the growing demand for dietary supplements and functional foods. Their role in enhancing digestive health, in line with the increasing prevalence of gastrointestinal disorders, boosts their market appeal. Moreover, advancements in biotechnology and fermentation processes enhance the efficacy and application range of microbial enzymes, thus solidifying their market dominance.

Looking for region specific data?

Europe digestive enzymes market achieved USD 173.12 million in 2023 and will expand at a 9.4% CAGR from 2024 to 2032, driven by increasing health consciousness, rising incidences of digestive disorders, and a well-established healthcare infrastructure. The robust food and beverage industry in the region, alongside a growing preference for dietary supplements and functional foods, fuels the demand for digestive enzymes. Furthermore, stringent regulations ensuring high-quality products bolster consumer trust. Innovations in enzyme formulations and extensive research activities also contribute to Europe's leading position as a key market contributor.

Digestive Enzyme Market Share

Companies, including Novozymes, Biotech Research Corporation, Country Life LLC, AST Enzymes, Abbott Corporation, and Amway Corporation, are expanding their footprint by focusing on R&D, enhancing product portfolios, and strategic mergers and acquisitions. By investing in advanced technologies and innovative formulations, they cater to diverse consumer needs for digestive health. Moreover, partnerships with healthcare providers and nutritionists strengthen market penetration and consumer education on enzyme benefits. These initiatives bolster market presence and underscore commitment to delivering effective solutions for digestive disorders and overall well-being.

Furthermore, companies are leveraging digital platforms and e-commerce channels to widen their reach and engage directly with consumers. This approach enables personalized marketing strategies, targeted advertising, and real-time consumer feedback, thus fostering brand loyalty and driving sales growth. Embracing sustainability practices and adhering to regulatory standards further enhance credibility and market competitiveness. As the demand for digestive enzymes continues to rise globally, proactive market strategies ensure these companies remain at the forefront of industry innovation and consumer satisfaction.

Digestive Enzyme Market Companies

Prominent players operating in the digestive enzyme industry include:

- DSM

- Novozymes

- AST Enzymes

- Biotech Research Corporation

- Abbott Corporation

- Country Life, LLC

- Amway Corporation

- Specialty Enzymes and Probiotics

- Lumis Biotech

- Amano Enzyme

- Aumenzymes

Digestive Enzyme Industry News

- In August 2023, Alcresta Therapeutics received FDA clearance to expand RELiZORB® use to children aged 2 to <5 years. This enzyme cartridge mimics pancreatic lipase and was initially cleared in 2015 for adults and in 2017 for children aged five and above.

- In May 2024, Biocatalysts Ltd. introduced a specialized protease platform aimed at producing high-value collagen peptides. The launch includes two unique enzymes optimized for efficiently hydrolyzing extracted collagen, resulting in low-molecular-weight peptides with a neutral taste.

The digestive enzyme market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue and volume (Tons) (USD Million) from 2021 to 2032 for the following segments:

Market, By Product

- Proteases

- Lipases

- Carbohydrases

- Amylases

- Cellulase

- Lactases

- Alpha-Galactosidase

- Maltase

- Others (Sucrases, Protopectinase, etc.)

Market, By Source

- Animal

- Plant

- Microbial

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Malaysia

- Indonesia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

Frequently Asked Question(FAQ) :

What factors are driving digestive enzyme industry growth in Europe?

Europe market size recorded USD 173.12 million in 2023 and is poised to grow at 9.4% CAGR from 2024 to 2032, driven by the increasing health consciousness, rising incidences of digestive disorders, and well-established healthcare infrastructure in the region.

Why is the demand for microbial digestive enzymes rising?

The microbial source segment in the digestive enzyme market held over USD 386.27 million in 2023 and is estimated to depict 9.4% CAGR between 2024 and 2032, owing to its superior efficiency and stability under diverse conditions.

Why is the demand for digestive carbohydrases rising?

The carbohydrases product segment in the digestive enzyme industry accounted for USD 356.05 million in 2023, attributed to its extensive application in breaking down carbohydrates into simple sugars, essential for energy production.

How big is the digestive enzyme market?

The market size of digestive enzyme reached USD 644.32 million in 2023 and is set to witness 9.4% CAGR from 2024 to 2032, led by advancements in enzyme technology for enhancing stability and effectiveness, and increasing health consciousness among consumers.

Digestive Enzyme Market Scope

Related Reports