Summary

Table of Content

Chain Conveyors Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Chain Conveyors Market Size

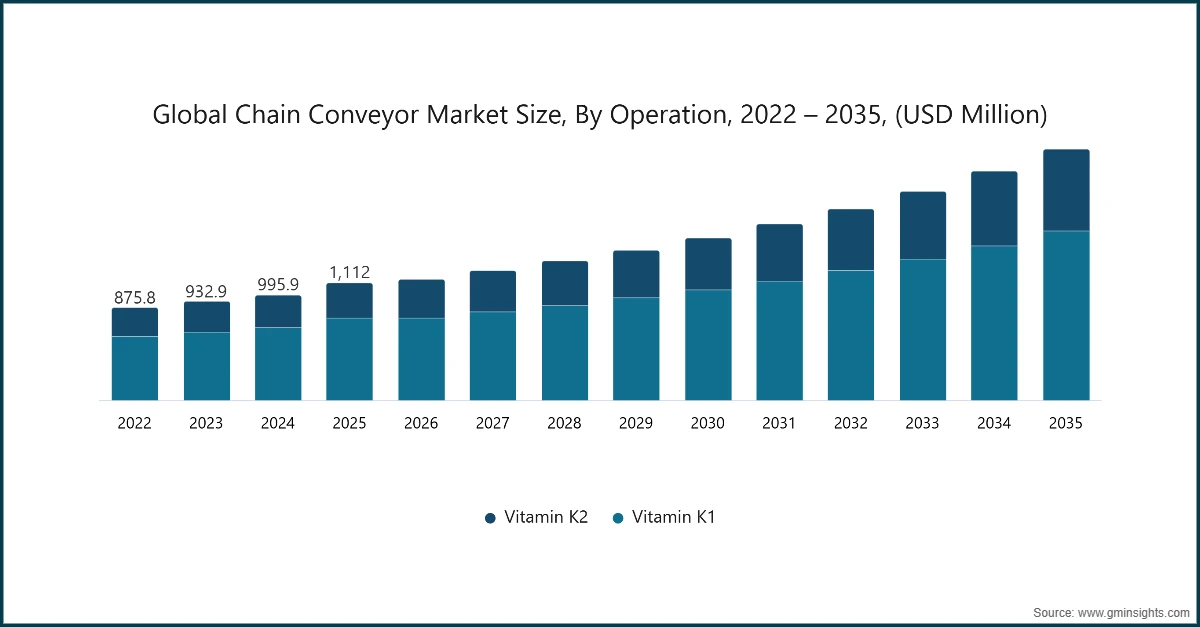

The chain conveyors market was estimated at USD 616.5 million in 2025. The market is expected to grow from USD 648.8 million in 2026 to USD 1.05 billion in 2035, at a CAGR of 5.6% according to latest report published by Global Market Insights Inc.

To get key market trends

The rising awareness of supply chain sustainability and the demand for operational efficiency, which are market trends that have been heavily emphasized, have led to an increase in the demand for conveyor chain systems. The surge mergers and acquisitions of industry leaders is said to be the root of this phenomenon. The union of the forces of key players such as Daifuku Co., Ltd., Interroll Group, and SSI Schaefer has contributed to the increased innovation, broadened product portfolios, and deepened market presence of the heavyweight material handling industry. On the other hand, traditional ways of manual material handling, such as forklift, based transport or manual sorting of pallets, are less environmentally friendly and fail to be economically viable for high, volume production lines. Modern chain conveyors are gradually becoming a more environmentally friendly method as they are equipped with high, torque, energy, efficient motor technology and regenerative braking systems that can save power consumption by up to 30, 39%, thus limiting environmental impact. This environmentally friendly technology is consistent with the trend of heavily manufacturing and food processing industries adopting sustainable practices, thus becoming a primary factor contributing to the market’s growth. The demand for automated warehousing and heavy, duty logistics hubs is rapidly increasing in North America , particularly for unit handling of oversized goods. Besides, there is a rise in the industrial and e, commerce infrastructure expenditure in Europe and the Asia, Pacific region. Both automotive manufacturers and food & beverage professionals are moving towards the use of efficient, mechanized chain solutions for high, throughput distribution. They are thereby abandoning the use of old, time, consuming methods such as manual palletizing or basic gravity, fed systems.

Generally, automated chain sortation, which makes the fulfillment of bulk items a continuous, ultra, fast operation, is considered to be a cleaner, faster, and more environmentally friendly alternative to traditional diesel, powered fleet transport within facilities. Most automotive OEMs and third, party logistics (3PL) providers are demanding faster, less disruptive methods for heavy, load fulfillment. Chain conveyors are therefore becoming a major choice due to their already, known benefits, such as the optimization of floor space and the reduction of the risk of workplace injuries caused by the heavy lifting of engine blocks or industrial crates. This market, in fact, is fundamentally driven by a growing awareness of the long, term benefits of a fully integrated material flow, which is leading to a broader acceptance of these powerful devices. Apart from that, the continued enhancements in modular chain design will certainly contribute to improving the safety and ease of operation for users. The combination of infrastructure support, an industry, wide focus on smart warehouse management, and a demand for high, efficiency convenience is acting as a synergy.

The chain conveyor market is mainly a daily moving machinery market that will be largely influenced by a post, pandemic surge in e, commerce fulfillment and global trade. This has created a demand in the professional and industrial sectors for error, free and high, speed distribution spaces where goods can be moved quickly. One of the main operational differences between traditional transport methods and automated chain conveyors is that the latter do so electrically and automatically, and heavy goods are thus very accurately and effectively handled, resulting in the handling bottlenecks being eliminated. Besides that, the generation of data insights for warehouse optimization is another very felicitous consequence of such effectiveness, and this ensures that the time spent sorting and dispatching is actually going to the floor. Such effectiveness has been embraced by large, scale distribution centers and manufacturing firms that have a need for a steady and timely supply of the production line. The analysis of the market shows that Automatic Chain Conveyors have been continually leading in terms of revenue share, thus being the dominant segment in the total market revenue, due to their performance strength, durability, and suitability for the modern professional’s need for versatility and rapid deployment. As far as technology is concerned, it is gradually becoming a very essential factor, and features such as Programmable Logic Controllers (PLCs) offer a more customized and precise material handling experience.

Stainless steel and specially designed plastic chain systems are quickly becoming the preferred solutions in many industries and professional services where less disruptive and faster methods to maintain operational uptime and component longevity are required. The major recognized benefits of these product types, which have become very popular in the market, are, for instance, the reduction of maintenance hazards and the decrease of contamination risk in sensitive environments. The market for such products is mainly driven by the growing awareness of their long-term benefits in efficient material movement, which has led to the widespread acceptance of these powerful devices. Moreover, the completion of several ongoing projects on improvements in self, lubricating materials and housing design will, in addition, user safety and operating ease. The interplay of better infrastructure, an industry, wide commitment to sustainable resource management, and a demand for high, efficient convenience is thus strengthening the market's bullish financial trend.

Chain Conveyors Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 616.5 Million |

| Market Size in 2026 | USD 648.8 Million |

| Forecast Period 2026-2035 CAGR | 5.6% |

| Market Size in 2035 | USD 1.05 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rapid E-commerce & fulfillment growth | The explosion of online shopping requires high-speed, automated sorting and parcel handling. This drives massive demand for automated belt and roller systems in distribution centers. |

| Industry 4.0 & smart manufacturing | Transitioning to "Dark Warehouses" and smart factories necessitates conveyors that can communicate with robots and AMRs, boosting sales of intelligent, software-driven systems. |

| Sustainability & energy efficiency | Global regulations (like the EU Green Deal) push companies toward regenerative drive systems and VFD-controlled conveyors that reduce power consumption by up to 30-40%. |

| Pitfalls & Challenges | Impact |

| High Initial CAPEX & Long ROI | The significant upfront cost for fully automated, high-precision systems acts as a barrier for SMEs, often delaying facility upgrades or resulting in phased implementations. |

| Complexity of retrofitting legacy sites | Integrating modern smart conveyors into existing older infrastructure often leads to high integration costs, production downtime, and software compatibility issues. |

| Opportunities: | Impact |

| IoT & predictive maintenance integration | Utilizing AI-driven sensors to monitor belt health and motor temperature reduces unplanned downtime by ~30% and opens new revenue streams for "Service-as-a-Product" (SaaS). |

| Modular & flexible conveyor design | The rise of "Micro-fulfillment" centers in urban areas creates a need for modular, easy-to-reconfigure conveyors that can fit into non-traditional, smaller footprints. |

| Market Leaders (2025) | |

| Market Leader |

7% market share |

| Top Players |

Collective market share of 35% in 2025 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Chain Conveyors Market Trends

The Chain conveyor industry is experiencing a tectonic shift in trends due to the plethora of new innovative products launched and technological advancements made by the leaders in the industry. These top, tier companies are delivering to the market cutting, edge automated unit, handling and heavy, duty modular units that boast attractive features such as smart tension sensors, AI, driven wear prediction, integrated pallet sortation, and high, torque energy, efficient gearmotors. These enhancements perfectly align with the evolving expectations of the users who demand efficient and easy, to use solutions for high, throughput heavy logistics and accurate automotive or food, grade manufacturing.

The market's response to these trends is indicative of the industry being committed to perpetual innovation and, therefore, providing the users with advanced tools that elevate the performance level, shorten the installation and chain, linking times, and make the material handling process more productive and streamlined.

- Technology advancement and product innovation: The machinery is evolving to be more advanced and efficient, which is evident in the decision to incorporate IoT, enabled remote monitoring and wireless control systems for enhanced safety and chain, life performance. Companies are pouring resources into the creation of more potent and energy, efficient variable frequency drives (VFDs) as well as the manufacture of long, lasting high, tensile alloy and stainless, steel chains that will increase system uptime and load capacity for oversized items.

- Expansion of e, commerce and automated fulfilment services: Heavy, goods retail and third, party logistics (3PL) industries were in good health, which in turn was a major factor in the market growth. E, commerce and logistics companies together form a crucial segment that accounts for almost 37% of the total conveyor market share. Consequently, the need for efficient chain, driven pallet sortation and distribution systems is continuously rising because of high, speed order fulfilment for bulkier items and last, mile delivery optimization. This growth is fuelling the worldwide supply chain expansion as well as urban micro, fulfilment centres where retailers are heavily investing in automated heavy, load distribution infrastructure.

- Sustainable land and facility management: The proper transport of materials through chain systems is one of the major causes of energy conservation and the elimination of operational bottlenecks resulting mostly from manual forklift handling, thus contributing to the creation of healthier operational ecosystems and facilitating the implementation of green logistics and warehouse efficiency initiatives. These steps, among them the use of self, lubricating chains to do away with chemical runoff, go hand in hand with ESG (Environmental, Social, and Governance) objectives and carbon neutrality programs in various parts of the world.

- Greater incidence of global supply chain disruptions: Global trade volatility impairs global supply chains that have become the primary reason for focusing local logistics on resilience and flexibility. As a result, there is a massive surge in the reconfiguration of modular plastic and steel chain infrastructures. This state of warehouses as being perpetually reconfigured and rescaled leads to an increased demand for chain conveyors among automotive manufacturing hubs, food processing plants, and heavy, duty logistics providers.

- Emphasis on Industry 4.0 and Smart Warehousing: Facility managers and industrial planners focus more on the safety and throughput stability of the automated lines by doing proactive maintenance. For this purpose, they undertake chain health monitoring on a regular basis through predictive diagnostics vibration and motor torque analysis to preclude costly downtime by chain breakage. The constant requirement for integrated material flow leads to an uninterrupted demand for commercial, grade, smart chain conveyors throughout the year.

Chain Conveyors Market Analysis

Learn more about the key segments shaping this market

Based on the operation, chain conveyor market is segmented into manual, automatic, and semi-automatic. In 2025, the automatic segment is projected to hold the largest market share of 65.8%, generating a revenue of USD 405.5 Million.

Automated chain conveyors offer enhanced productivity, reduced labour costs, and improved safety. The integration of technologies like sensors, robotics, and artificial intelligence further bolsters their efficiency and reliability. The automatic segment represents the largest portion of the market, reflecting the industry's shift toward Industry 4.0 and smart technology that maximizes throughput and minimizes human error. Semi-automatic modes maintain a consistent market share of approximately 19.2% in 2025, providing a balance for facilities where some operator interaction is still required for specialized handling. The manual segment shows the lowest growth rate at 4.8%, as industries increasingly move toward automation to meet the growing demand for faster and more accurate material handling operations.

Learn more about the key segments shaping this market

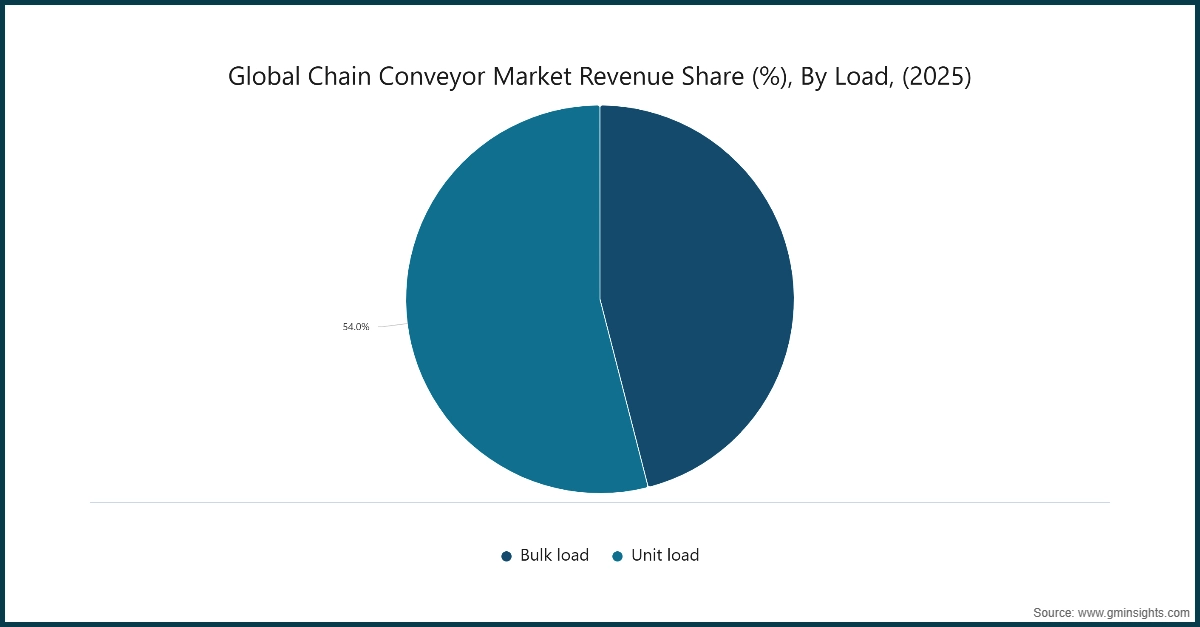

Based on the load, the chain conveyors market is segmented into bulk load and unit load. In 2025, unit load is expected to lead the market with a share of 54%, valued at USD 332.9 Million.

- Unit load segment's dominance is driven by the rise of e-commerce and logistics, where high-speed sortation of individual items, boxes, and pallets is a priority.

- Bulk load conveyors accounted for 46% of the market in 2025, remaining essential for heavy industries such as mining, agriculture, and construction that require the movement of large volumes of raw materials.

Unit load segment is also the fastest growing at a 5.7% CAGR, reflecting a professional global preference for systems that integrate seamlessly with automated warehouse execution software.

Based on the mode of distribution, the chain conveyors market is segmented into direct sales and indirect sales. In 2025, Indirect Sales held the major market share of 51.9%, reflecting the industry’s reliance on specialized distributors and third-party integrators.

- Indirect sales are fueled by the need for localized technical support and aftermarket services. End users often prefer these channels for rapid part replacement and on-site maintenance contracts.

- Direct sales generated USD 296.5 Million in 2025. This channel is typically utilized for large-scale, customized infrastructure projects where the manufacturer manages the installation and long-term service directly.

- The indirect sales segment also shows a slightly higher CAGR of 5.7%, as more businesses seek turnkey solutions from integrators to modernize their existing facilities.

Looking for region specific data?

North America Chain Conveyors Market

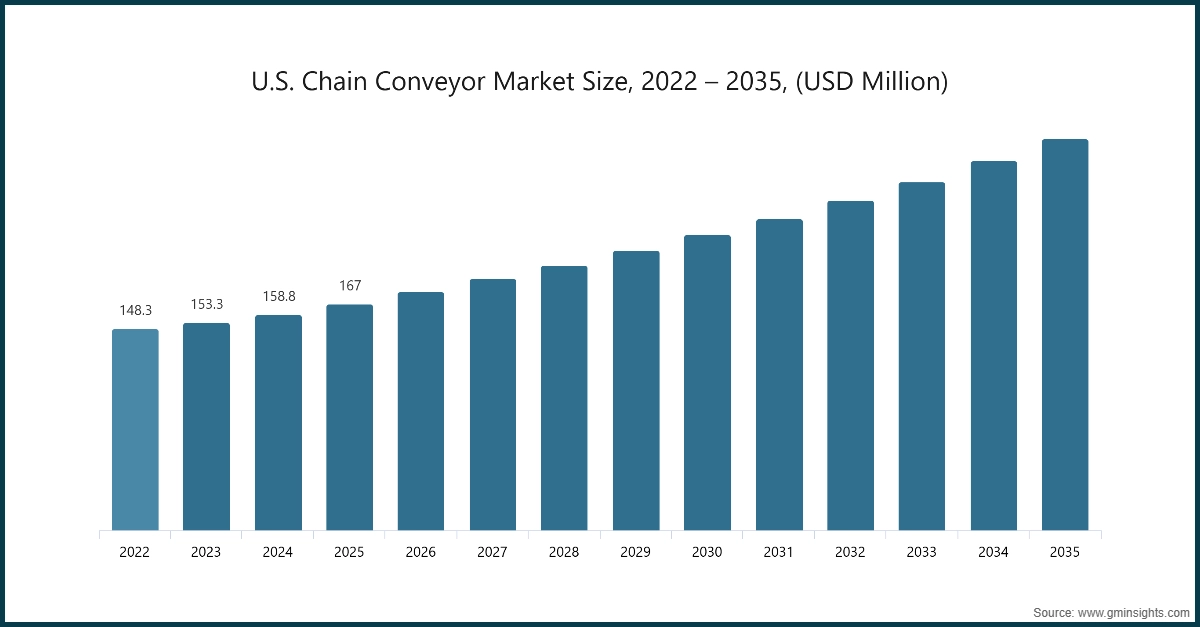

In 2025, North America is a key regional market with an estimated value of USD 197.6 million and a projected growth rate of 5.6% through 2035.

- The U.S. leads the region, holding a staggering 84.5% of the North American market share in 2025. This is driven by massive investments in warehouse automation and the rapid expansion of e-commerce networks.

- The demand in this region is further fueled by a focus on workplace safety and ergonomic handling, as companies look to reduce manual lifting and improve operational efficiency.

- Canada shows steady growth at a 5.3% CAGR, representing a significant market for specialized industrial and agricultural conveyor applications.

Europe Chain Conveyors Market

Europe is a significant market estimated at USD 3.2 million in 2025 with a projected growth rate of 4.7%. Germany leads the region with a high growth rate of 5.6% and a market value of USD 0.6 Million in 2025 due to its advanced automotive and machinery sectors

- Europe is a significant market estimated with a projected growth rate of 5.8%. Germany leads the region with a high growth rate of 6.9% in 2025.

- The German market’s strength is attributed to its advanced automotive and machinery sectors, which heavily utilize heavy-duty chain conveyors for assembly lines.

- The UK follows with a 6% CAGR, driven by the modernization of retail distribution centres and food processing lines.

- European growth is increasingly influenced by sustainability initiatives, encouraging the adoption of energy-efficient conveyor drives that align with regional environmental standards.

Asia Pacific Chain Conveyors Market

Asia Pacific is the largest and fastest-growing regional market with a projected growth rate of 5.6% from 2026 to 2035.

- China holds the largest market share with a high growth rate of 6.3% driven by massive urbanization and infrastructure projects.

- India is a key player with a 5.7% CAGR, as manufacturers in the region rapidly shift from manual labor to automated conveyor platforms to increase production quality.

- Countries like Japan and South Korea are important for high-tech electronics assembly and automotive production, where precision material handling is required.

Latin America Chain Conveyors Market

Latin America represents a developing segment expected to reach USD 69.1 million by 2025, growing at a rate of 5.2% from 2026 to 2035.

- Overall growth is steady as increasing urbanization, and a growing retail sector boosts the demand for professional logistics and warehousing services.

- Mexico shows a steady growth rate of 5.3%, benefiting from its role as a manufacturing hub for the North American automotive and aerospace industries.

- While economic variability exists, the long-term trend points toward increased mechanization in manufacturing to improve regional competitiveness in global trade.

Chain Conveyors Market Share

BEUMER Group is leading with a 7% market share. BEUMER Group, Daifuku Co., Ltd., Dematic, Continental AG, and Flex Link collectively hold around 35%, indicating a moderately fragmented market concentration with a strong tier of dominant global players. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions, and collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Vanderlande completed the acquisition of Siemens Logistics' airport baggage handling and cargo business for approximately USD 325 million. This strategic move significantly expanded Vanderlande’s footprint in the global airport logistics sector, specifically enhancing its portfolio of high-speed baggage chain conveyors and cargo sortation technologies. The acquisition allowed Vanderlande to integrate Siemens' innovative mechanical handling systems, reinforcing its commitment to performance, durability, and high-capacity sorting. Andrew Manship, CEO of Vanderlande, emphasized that the deal provides a broader range of future-oriented, modular chain solutions to help customers tackle evolving supply chain challenges.

- Continental AG unveiled an array of new digital monitoring attachments for its heavy-duty chain conveyors catering to the mining, construction, and bulk logistics applications where chain conveyors are prevalent. The additions included the Conti Load Sense system, a 2D radar-based monitoring tool capable of measuring material flow in real-time. This technology features smart sensors for improved visibility into chain health and robust durability for harsh, abrasive environments. Frank Gangi, a senior product manager, highlighted the company's commitment to enhancing material handling performance by providing operators with a comprehensive set of digital tools for predictive maintenance to prevent chain breakage.

Chain Conveyors Market Companies

Major players operating in the chain conveyors industry are:

- BEUMER Group

- Daifuku Co., Ltd.

- Dematic

- Continental AG

- FlexLink

- Honeywell International Inc

- Hytrol Conveyor Company, Inc.

- Interroll Group

- Kardex

- Regal Rexnord Corporation

- Shuttleworth

- Siemens

- Taikisha Ltd.

- Ultimation Industries, LLC.

- WAMGROUP S.p.A.

Interpol expanded its range of modular conveyor platforms with the introduction of MCP PLAY, a system compatible with high-speed automated warehouses. Engineered for optimal productivity and precise control, this software-driven platform offered faster operation compared to older articulating roller or traditional heavy chain designs. Unveiled at Logi MAT and ProMat 2025, its "Flowing Merge" function improved control for diverse parcel sizes by using decentralized logic rather than complex PLC programming. The design's advantage lies in providing better flow control and eliminating the need for constant manual adjustments during peak fulfilment hours.

Chain Conveyors Market News

- In November 2025, Tsubakimoto Chain announced a significant business integration with Daido Kogyo Co., Ltd. to strengthen their global market share in high-performance industrial chains. Earlier in the year, Tsubaki also expanded its European manufacturing base by acquiring Karl Jungbluth Kettenfabrik, a German specialist in heavy-duty conveyor chains. These moves aim to accelerate the development of lube-free and corrosion-resistant chain systems for the industry 4.0 era.

- In March 2025, Regal Rexnord showcased its latest powertrain systems at ProMat, featuring the RexProX Leaf Chain and Rexnord TableTop chains. These systems are designed to minimize downtime and maximize throughput for distribution centers. Their new ModSort Divert transfer modules allow for high-efficiency sorting on existing lines, addressing the industry's need for rapid reconfiguration without massive overhead.

- In April 2025, Daifuku launched a new manufacturing plant in India (Hyderabad) to meet the rapidly growing demand for automation in the region. This 34,000 m² facility focuses on manufacturing rail-guided pallet sorters and heavy-duty chain conveyors for the food, chemical, and machinery industries. The plant is a key part of Daifuku's strategy to shorten lead times and provide locally engineered solutions for the Asia-Pacific market.

- In September 2024, Daifuku introduced the redesigned AS-35 Sliding Shoe Sorter, tailored for high-volume retail logistics. This new iteration boasted robust performance in package sortation, utilizing a high-efficiency electric drive and a Series III duplex chain system for aggressive infeed of diverse packaging types. Operating at a quiet 65 decibels, the AS-35 addressed the needs of professionals aiming to broaden their fulfillment capacity in "dark warehouses." Christoph Schenk, President of Daifuku Intralogistics America, emphasized its versatility in modern high-speed distribution environments.

- In 2024, FlexLink continued to emphasize its powerful heavy-duty plastic chain models, such as the WLX wide modular series, which uses a high-performance hygienic design to enhance performance in food and beverage production. This focuses on meeting strict international food safety standards (EHEDG) while providing the flexibility required for rapid line changeovers without the need for complex fluid additives or constant lubrication.

The chain conveyors market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Operation

- Manual

- Automatic

- Semi-automatic

Market, By Load

- Bulk load

- Unit load

Market, By Location

- In-floor

- On-floor

- Overhead

Market, By End Use

- Food & beverages

- Pharmaceuticals

- Automotive & transport

- Mining

Market, By Manufacturing

- Airport

- Warehouses & logistic centres

- Others (marine, oil & gas, etc.)

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the chain conveyors industry?

Key players include BEUMER Group, Daifuku Co., Ltd., Dematic, Continental AG, FlexLink, Honeywell International Inc., Hytrol Conveyor Company, Interroll Group, and Siemens.

What are the upcoming trends in the chain conveyors market?

Trends include IoT-enabled remote monitoring, AI-driven wear prediction, energy-efficient variable frequency drives, smart tension sensors, self-lubricating chains, and Industry 4.0 integration for predictive maintenance.

Which region leads the chain conveyors sector?

North America leads with an estimated value of USD 197.6 million in 2025, with the U.S. holding 84.5% of the regional market share, fueled by warehouse automation investments and e-commerce expansion.

What is the expected size of the chain conveyors industry in 2026?

The market size is projected to reach USD 648.8 million in 2026.

How much revenue did the automatic segment generate in 2025?

The automatic segment generated approximately USD 405.5 million, dominating the market with a 65.8% share in 2025.

What is the growth outlook for the unit load segment from 2026 to 2035?

The unit load segment is projected to grow at a CAGR of 5.7% from 2026 to 2035, the fastest growing segment in the market.

What is the projected value of the chain conveyors market by 2035?

The market for chain conveyors is projected to reach USD 1.05 billion by 2035, driven by e-commerce expansion, automated fulfillment services, and Industry 4.0 adoption.

What is the market size of the chain conveyors in 2025?

The market size was USD 616.5 million in 2025, with a CAGR of 5.6% expected through 2035. Rising demand for automation, supply chain sustainability, and operational efficiency in warehousing and logistics is driving the market growth.

Chain Conveyors Market Scope

Related Reports