Summary

Table of Content

Almond Ingredients Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Almond Ingredients Market Size

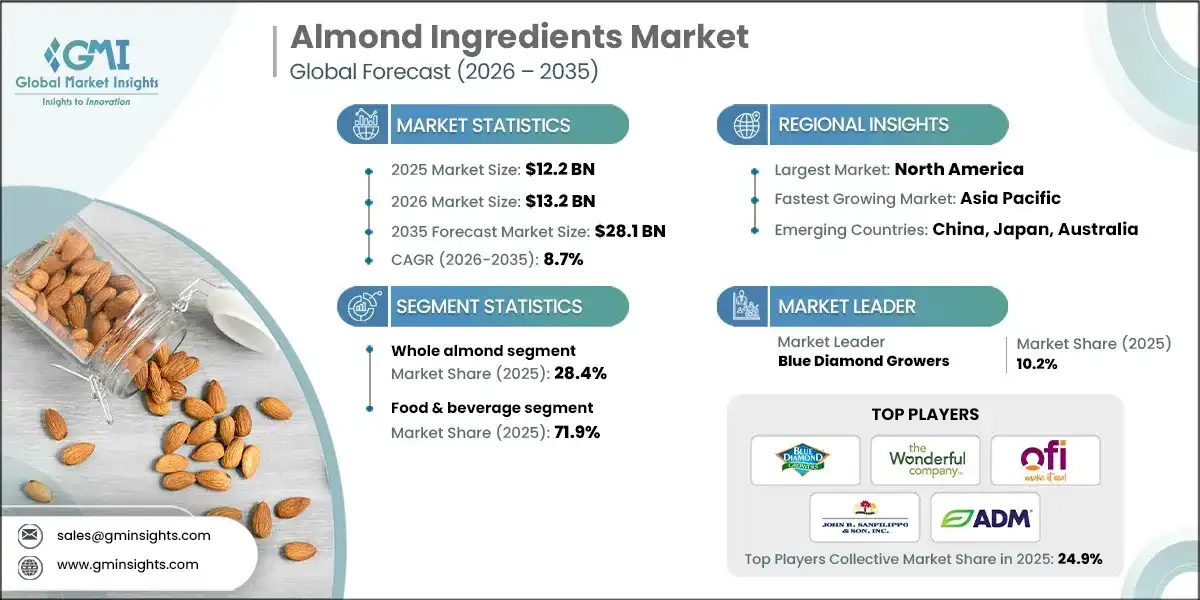

The global almond ingredients market size was valued at USD 12.2 billion in 2025. The market is expected to grow from USD 13.2 billion in 2026 to USD 28.1 billion in 2035, at a CAGR of 8.7% according to latest report published by Global Market Insights Inc.

To get key market trends

- Almond ingredients refer to processed forms such as almond flour, milk, oil, butter, and paste. Specialty bakery, confectionery, beverages, and dairy alternatives are among the common applications. Presently the global almond ingredient market is growing tremendously on account of health consciousness and nutritional awareness being on the rise among consumers.

- Almonds are rich in protein, fiber, and healthy fats, which is why they have become popular among those who thrive on nutrient-dense options in food. Findings from the USDA show that almonds rank high among the plant-based protein and vitamin E sources, both of which are associated with heart health and immunity. Thus, with the trends toward plant-based diets, consumers are increasingly shifting away from animal-derived products in favor of sustainable alternatives.

- Increased consumption of almond milk has been a consequent growth in demand for dairy-free beverages and lactose-free products, aided by dietary guidelines set by the government advocating plant eating patterns for better health outcomes. The preference for clean-label and organic products will drive purchasing decisions as consumers demand transparency and natural ingredients. The USDA and the European Commission have made recommendations to put organic certification standards in place, prompting manufacturers to improve innovation in the organic almond sector.

- North America leads the market with advances in processing industry and supportive food safety regulations, with Asia-Pacific region emerging as the fastest-growing territory due to urbanization, rising disposable income, and awareness about plant-based nutrition. In India and China, the demand for almond-based products is rising due to increased health campaigns conducted by governments and the diversification in diets.

- Health requirements, sustainability-focused initiatives, and regulatory backdrops are steering the favorable moment for almond ingredient manufacturers on the world stage. While the market is increasing considerable and is poised for growth by the health conscious and ethical consumers, almond-based solutions lie right at the front of the clean label and plant-based movement.

Almond Ingredients Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 12.2 Billion |

| Market Size in 2026 | USD 13.2 Billion |

| Forecast Period 2026-2035 CAGR | 8.7% |

| Market Size in 2035 | USD 28.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising health consciousness & nutritional awareness | Increase in demand for almond-based nutraceuticals and functional foods |

| Plant-based diet adoption & dairy alternative demand | Growth in consumption of almond-based dairy substitutes, expanding market share |

| Clean-label & organic product preference | Surge in sales of organic almond ingredients and clean-label almond products |

| Pitfalls & Challenges | Impact |

| Almond price volatility & supply uncertainty | Higher costs for suppliers and manufacturers, potentially leading to price increases for final products |

| Competition from alternative plant-based ingredients | Diversification of options may limit market share growth for almonds |

| Opportunities: | Impact |

| Organic almond market expansion | Increased adoption of organic almonds, boosting premium product segments in the market |

| Almond protein in plant-based meat & dairy | Rising incorporation of almond protein to develop innovative plant-based meat and dairy products |

| Market Leaders (2025) | |

| Market Leaders |

10.2% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, Japan, Australia |

| Future outlook |

|

What are the growth opportunities in this market?

Almond Ingredients Market Trends

- Processing technologies keep advancing with newer almond ingredients. An example is the use of cold-press extraction and other minimally invasive methods that avoid nutrient damage while preserving product quality. Along with more efficient and waste-reducing costs of production, manufacturing brings automated manufacturing lines, enhanced extraction techniques making production more cost-effective. These developments allow manufacturers to deliver more diversified product lines, generally with specialty almond proteins and functional ingredients for health-demanding personalized products. Industry leaders are leaping into R&D for new formulations that align with consumer favorites such as clean-label and minimally-processed products to grow market opportunities.

- Consumers are in search of plant-based functional foods that will provide specific benefits to the body such as improved immunity, digestive, and heart health. Almond ingredients can therefore find their way into almond milk, almond protein isolates, and new fortified almond-based products. Change in consumers' behavior toward functional nourishment creates need for manufacturers to innovate with new formulations like fortified almond powders and functional blends for health-conscious consumers.

- Driving change is consumer demand for products that are environmentally responsible, which has led to sustainability becoming a core concern for industry stakeholders. Such attempts include sustainable water use, eco-friendly packaging, and regenerative farming practices. Innovations in cultivation have seen increased water efficiencies, while the advent of biodegradable packaging has significantly reduced the size of the environmental footprint that almond processing leaves. Such practices are also binding with what society considers as value-laden ideas and go further to meet the face of what regulations require, hence bringing brand loyalty while opening potential new market segments.

Almond Ingredients Market Analysis

Learn more about the key segments shaping this market

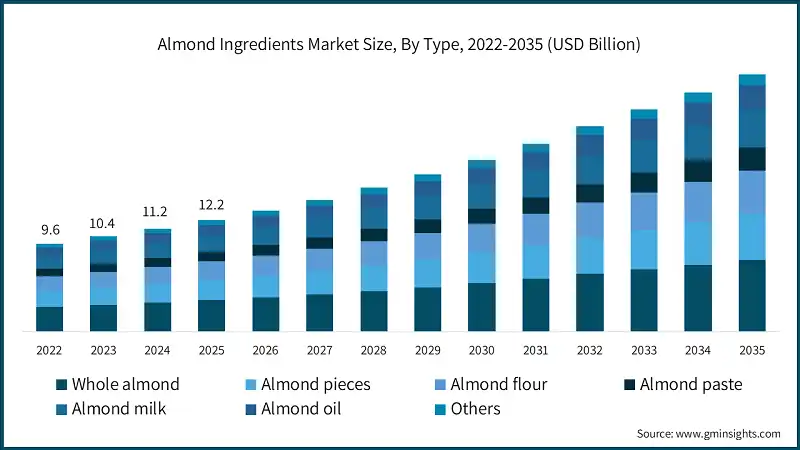

Based on type, the almond ingredients market is segmented into whole almond, almond pieces, almond flour, almond paste, almond milk, almond oil and others. Whole almond dominated the market with an approximate market share of 28.4% in 2025 and is expected to grow with a CAGR of 8.6% till 2035.

- Whole almonds dominates the market due to their versatility and use in snacks, bakery, and confectionery product applications. Their appeal in natural form to a health-conscious consumer looking at minimally processed options is a common marketing angle where these almonds are promoted as premium, healthy snacks, leading to huge demand across markets globally.

- Almond pieces have been used as a topping in bakery products, cereals, and even in chocolate products. Their convenience value, which adds texture and visual appeal, makes them a necessary feature for any manufacturer's confectionery or bakery product.

- Almond flour is rising in vogue as a gluten-free and low-carbohydrate diet. It is a common ingredient in bakery and pastry applications, replacing wheat flour to keep the product healthy but still like wheat flavor and texture. Almond paste is among the ingredients used in confectionery and dessert products, like marzipan, and for fillings.

- The fastest growing area of range expands to the evolving uses of almond milk in beverages and cooking provisions. Stimulated by increased demand for almond oil and its derivatives for cosmetic and personal care uses, the food sector is diversifying from its conventional domains.

Learn more about the key segments shaping this market

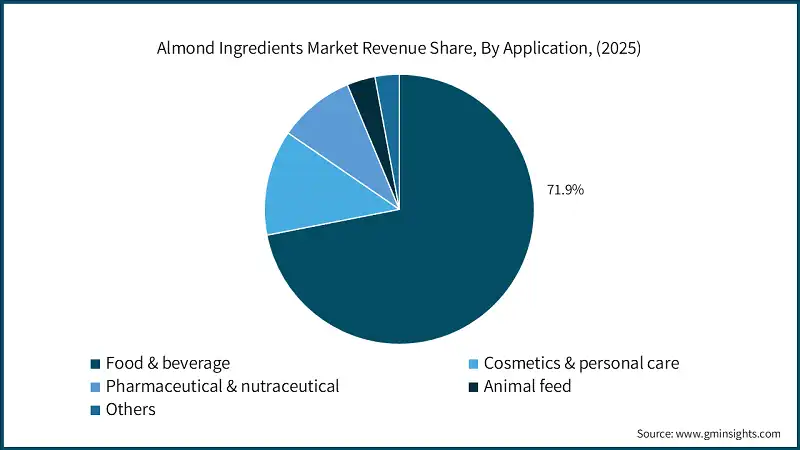

Based on application, the almond ingredients market is segmented into food & beverage, cosmetics & personal care, pharmaceutical & nutraceutical, animal feed and others. Food & beverage held the largest market share of 71.9% in 2025.

- Food and beverage holds the largest market share, with applications of almond ingredients in bakery, confectionery, snacks, and dairy substitutes. Increased acceptance of plant-based and clean label products has led to almonds being widely accepted in gluten free and vegan formulations, giving rise to innovations in the beverage sector, protein bars, and desserts.

- Almond oil finds applications in cosmetics & personal care due to its moisturization and antioxidant properties, making it a vital ingredient in lotions and creams, as well as hair care products. Chemical-free beauty remains a trend and hence the demand is growing.

- Pharmaceutical & nutraceuticals utilize almonds for their nutrient density, whereas supplementation products targeting heart health, immunity, and weight management generally exploit almonds. Almond hulls are utilized for animal feed as they are a cheap and fiber-rich option.. This segment promotes sustainability in almond processing waste to further enhance circular economy measures in agriculture.

Based on distribution channel, the almond ingredients market is segmented into hypermarkets/supermarkets, convenience stores, and online retail.

- Online shopping allows customers access to a wide variety of almond ingredients while offering detailed product information as well as specialties and organic ingredients, encouraging purchases by convenience and giving access to niche markets as well as health-conscious buyers.

- Hypermarkets and supermarkets carry an extensive range of almond products, including bulk formats as well as most trusted brands. The physical presence combined with availability of products and the familiar shopping environment support the continuously anticipated purchase of daily and staple-type ingredients.

- Convenience stores provide quick access to almond snacks, nut butters, and other small-packaged items, appealing to those consumers looking for on-the-go convenience.

Looking for region specific data?

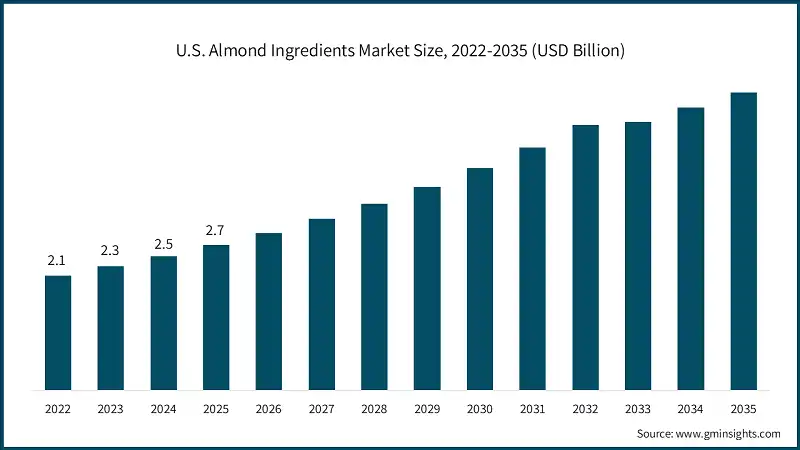

The North America almond ingredients market will grow at a CAGR of 8.7% between 2026 and 2035.

- The increasing demand of consumers towards consumption of plant-based, clean-label, and allergen-free products has contributed to the increased demand for Almond Ingredients in food, beverages, and nutraceuticals. Increasing health and wellness awareness among the consumers constrains companies to invest a lot in research and developmental activities to launch and provide environmental sustainability and functionality to the almond ingredients based on that consumer requirement.

The almond ingredients markets in Europe, especially in a few countries like Germany, are expected to grow with a rapid pace in the coming years.

- Stricter industry and government regulations focused on environmental sustainability consequently raised the adoption of more innovative production methods for Almond Ingredients using greener practices. A surge of interest is directed towards bio-based formulations such as plant proteins and microbial proteins that meet sustainability standards and even some biodegradable formulations.

The almond ingredients market in China and India is expected to have lucrative growth between 2026 and 2035, with CAGR 8.9% in the Asia Pacific region.

- Urbanization, rising health consciousness, and increasing disposable incomes propel demand for functional Almond ingredients in foods, beverages, and dietary supplements. Continues to improvements in innovations on alternative protein and natural ingredient; focus is on plant-based clean label nutrition.

- Awareness about health and sustainability has prompted consumers to adopt new infrastructural changes in retail, thus hastening the adoption of almond ingredients across various food and nutrition sector.

Between 2026 and 2035, the market for almond ingredients in the Middle East is projected to grow significantly during this period.

- The driving forces are increasing demands from hospitality, food processing, and nutritional sectors for clean-label, high-quality almond ingredients. Increasing consumer trends towards health and wellness awareness, along with the emerging government initiatives towards sustainable food systems, are stimulating companies to build environmentally friendly protein solutions based on plant sources.

Between 2025 and 2035, a promising expansion of the almond ingredients sector is foreseen in the Latin America.

- The increased demand for almond ingredients in functional foods, dietary supplements, and applications related to food safety is drawn by a trend for health and well-being and sustainable food choices, thereby fanning innovation and growth within that region.

Almond Ingredients Market Share

Almond ingredients industry is moderately consolidated with players like Blue Diamond Growers, The Wonderful Company, Olam Food Ingredients (OFI), John B. Sanfilippo & Son and ADM accounts for 24.9% market share in 2025.

The almond ingredients market consists of such leading companies operating mostly in their regional areas. Their long years of experience with almond ingredients allow these companies to maintain a strong market position worldwide. Their product offerings are diverse and majorly supported by production capacities and distribution networks, which can serve the increasing demand for almond ingredients in various regions.

Almond Ingredients Market Companies

Major players operating in the almond ingredients industry includes:

- ADM

- Blue Diamond Growers

- Olam Food International

- John B. Sanfilippo & Son, Inc

- Kanegrade

- Borges Agricultural & Industrial Nuts

- Treehouse California Almonds

- Harris Woolf Almonds

- The Wonderful Company

- Royal Nut Company

- Barry Callebaut Group

Blue Diamond Growers is among the largest cooperatives dealing with almonds and their processed products. It is among those who manufacture the ingredients-almond flour, milk, and pieces. They are quite an innovative company with sustainable options that cater to the food, beverage, and snack manufacturers around the globe.

Wonderful Company producing whole high-quality almonds and processed ingredients. The company applies the most modern processing technologies with sustainable farming practices to serve the increasing trend of plant-based and clean-label almond products benefits worldwide.

Olam Food Ingredients has an exhaustive range of almond ingredients such as paste, flour, and oil. Enhanced processing methodologies and global sourcing help the company deliver consistent quality that caters for use in bakery, confectionery, and health products.

John B. Sanfilippo & Son specializes in creating nut-based solutions that encompass good quality premium almond ingredients for use in the snacks, bakery, and confection industries.

ADM’s offerings are extensively inclusive of almond ingredient solutions, from flour and milk to oil, and these solution offerings cater to the food, beverage, and nutraceutical industries.

Almond Ingredients Industry News

- April 2025: The Almond Board of California celebrated research about large increases in almond butter: 7% increases in confectionery, 25% in dairy, and 26% in drinks; all in support of innovation within the industry and in opening market opportunities.

- November 2024: Blue Diamond introduced its new perfect nut line called Almonds and More, with flavored almonds mixed with their protein-packed cashews and pistachios in three flavors: Honey Roasted, Sea Salt, and Smokehouse, creating a whole new innovation in flavored mixed nuts.

- October 2024: Once Again, a better-for-you food provider purchased California-based Big Tree Organic Farms, thereby extending its range of organic nut products and acquiring local almond production capabilities.

This almond ingredients market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Type

- Whole almond

- Almond pieces

- Almond flour

- Almond paste

- Almond milk

- Almond oil

- Others

Market, By Application

- Food & beverage

- Bakery products

- Confectionery

- Dairy alternatives

- Frozen desserts

- Ready-to-eat (RTE) cereals

- Snacks

- Nut & seed butters

- Beverages

- Cooking oils & culinary applications

- Others

- Cosmetics & personal care

- Skin care products

- Hair care products

- Massage & aromatherapy

- Soaps & cleansers

- Cosmetic formulations

- Others

- Pharmaceutical & nutraceutical

- Animal feed

- Livestock feed

- Poultry feed

- Pet food

- Others

- Others

Market, By Distribution Channel

- Hypermarkets/supermarkets

- Convenience stores

- Online retail

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What was the market share of whole almonds in 2025?

Whole almonds held an approximate market share of 28.4% in 2025 and is expected to grow at a CAGR of 8.6% through 2035.

What was the market share of the food & beverage sector in 2025?What was the market share of the food & beverage sector in 2025?

The food & beverage sector accounted for 71.9% of the market share in 2025, with applications in bakery, confectionery, snacks, and dairy substitutes.

What are the key trends in the almond ingredients market?

Advanced processing like cold-press extraction, rising demand for plant-based functional foods, sustainable packaging and farming, and innovation in fortified almond-based products.

What is the growth outlook for the North American almond ingredients sector?

The North American market is set to expand at a CAGR of 8.7% between 2026 and 2035. The market is led by demand for plant-based, clean-label, and allergen-free products.

What is the expected size of the almond ingredients industry in 2026?

The market size is expected to reach USD 13.2 billion in 2026.

Who are the key players in the almond ingredients industry?

Key players include ADM, Blue Diamond Almonds, Olam Food International, John B. Sanfilippo & Son, Inc, Kanegrade, Treehouse California Almonds, Harris Woolf Almonds, The Wonderful Company, Royal Nut Company, and Barry Callebaut Group.

What is the projected value of the almond ingredients market by 2035?

The market is poised to reach USD 28.1 billion by 2035, growing at a CAGR of 8.7% during the forecast period.

What was the market size of the almond ingredients in 2025?

The market size was valued at USD 12.2 billion in 2025, driven by increasing health consciousness and nutritional awareness among consumers.

Almond Ingredients Market Scope

Related Reports