Payment Gateway Market revenue to cross $160 Bn by 2032

Published Date: October 2024

Payment Gateway Market size is anticipated to reach over USD 160 billion by 2032, according to latest research report by Global Market Insights Inc.

The rising acceptance of digital payments is among the key factors driving the development of payment gateway architecture. With rapid digitalization, consumers can access banking services online, for a seamless and convenient experience. Investment in financial technology companies has also escalated. In September 2021, Xendit secured USD 150 million in a funding round, which was intended to be used for the development of advanced, value-added digital payment services. Such factors will boost the requirement for payment gateway services to help online businesses accept payments on their websites.

Get more details on this report - Request Free Sample PDF

Cross-border trading also continues to grow and evolve rapidly. Due to the changing government regulations and the reliance on local laws, most cross-border payment solutions have encountered privacy challenges. This concern regarding data privacy may create roadblocks to payment gateway market growth by 2032. The report reveals that the fundamental changes in consumer behavior and the rise in online banking will, however, create lucrative opportunities for payment gateway providers globally.

High security features to bolster demand for hosted payment gateway services

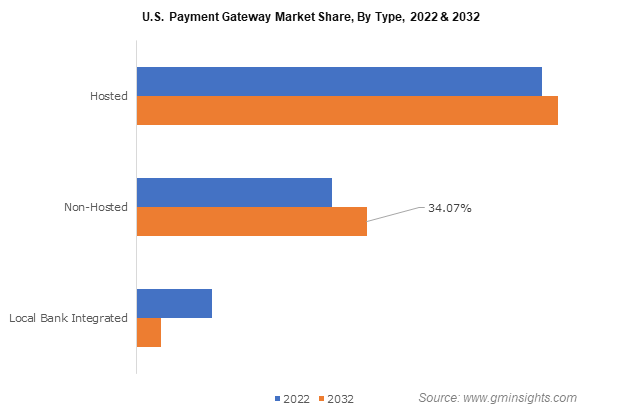

The payment gateway market from the hosted type segment is projected to depict over 22.5% growth through 2032, given the technology’s ability to safeguard sensitive user data through advanced security features. Third-party checkout software can also offer benefits to merchants through the management of their whole transaction process. Furthermore, the strong presence of firms that provide hosted payment gateway solutions including CCAvenue, PayPal, Cyber Source, and GTPay will further contribute to the adoption of the technology.

Increased dependence on digital systems drives payment gateway development for SMEs

Based on the organization size, the SMEs segment held over 65% industry share in 2022. The strong focus of SMEs on developing growth strategies and the subsequent increase in reliance on digital payment systems will fuel the use of payment gateway services. Fintech companies have also been targeting to expand their product offerings to aid SMEs in addressing business complexities, further augmenting the integration of these solutions.

Browse key industry insights spread across 200 pages with 263 market data tables and 40 figures & charts from the report, “Payment Gateway Market Size By Type (Hosted, Non-Hosted, Local Bank Integrated), By Organization Size (SME, Large Enterprises), By Application (Travel and Hospitality, Retail & E-commerce, Media & Entertainment, Healthcare, Energy & Utilities, IT & Telecom, BFSI), COVID-19 Impact Analysis, Growth Potential, Regional Outlook, Competitive Market Share & Forecast, 2023 – 2032” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/payment-gateway-market

Emphasis on convenient service delivery to spur the espousal of payment gateway service in healthcare

The payment gateway market from the healthcare application is poised to attain 25% gains from 2023 to 2032, owing to the rising emphasis on advanced and convenient health service delivery. A notable example is the Bank of America’s acquisition of Axia Technology to serve healthcare customers through a range of payment solutions. The acceptance of digital payments is also on the rise across the medical industry to cope with expected disruptions, thus amplifying payment gateway software demand.

Rise in internet penetration & e-commerce fuels payment gateway integration in APAC

The Asia Pacific payment gateway market is set to witness 27% growth rate through 2032. This is a result of the growing internet and mobile phone penetration in India, China, Japan and other Asian countries. Regional banks have also been adopting omnichannel strategies to cater to changing customer needs. These initiatives, together with the rapid growth of e-commerce, will stimulate the use of online payment processing technologies, especially in Southeast Asia.

Advanced system launch strategies to proliferate industry expansion

Allied Wallet, Inc., Authorize.Net, BluePay (Clover), Bitpay, Inc., BlueSnap Inc., CardStream Limited, Braintree, Payline Data Services LLC, Dwolla, Inc., PayPal Holdings Inc., Payoneer Inc., Amazon.com. Inc., PayU Group, Square, Inc., Skrill Limited, Stripe, Wepay, Inc., Verifone Holdings Inc., and Worldpay, Inc. are some of the key players profiled in the report. These companies are focusing on new software developments and other strategies to reinforce their presence in the competitive landscape.

For instance, in April 2022, UK-based neobank developing wealth management and cross-border banking solutions, Winvesta, launched a foreign payment collection system for exporters in India. This system was aimed at reducing export costs by over 8%, thus enabling the company to increase its footprint in the payment gateway market.