Non-Alcoholic Wine and Beer Market size worth $30bn by 2025

Published Date: July 2019

Non-Alcoholic Wine and Beer Market size is set to surpass USD 30 billion by 2025; according to a new research report by Global Market Insights Inc.

Improving standard of living along with growing consumer awareness about health benefits will primarily drive the global non-alcoholic wine and beer market growth. Stringent regulations coupled with major health concerns among athletes owing to excessive alcohol intake will stimulate the product penetration. In addition, expansion in digital media including major influence of social media pertaining to health effects associated with excess alcohol consumption has influenced the consumption pattern.

Increasing governments initiative towards promotion of alcohol substitute drinks is among major factors boosting market penetration. For instance, in Europe, industry participants launch products labelled as 0% alcohol free owing to absence of excise duty on non-alcoholic beer thereby driving the business growth. Beer manufacturers such as Kingfisher, Heineken, Carlsberg, and Budweiser have launched non-alcoholic version of their products in order to get accustom to current trend in alcohol industry that will help them to sustain for longer period.

Get more details on this report - Request Free Sample PDF

Stringent regulations on alcohol consumption in Islamic countries such as Iran, Egypt, Libya, etc. will positively influence non-alcoholic wine and beer market growth. Middle east accounts for almost a third of worldwide sales of alcohol-free beer. Demographic trends including potential consumer base from young population will support the industry development. For instance, majority of the population in Iran is aged less than 30 years, displaying high potential for the market growth.

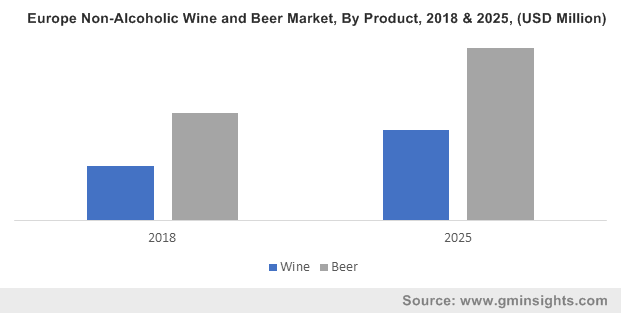

Beer segment accounted for more than 60% market share in 2018. Increasing need for healthier lifestyle coupled with the benefits of non-alcoholic beer are augmenting the product demand in Europe and North America. Increasing product scope and adoption among consumers owing to need for maintaining a social status will supplement the segment demand. High religious considerations among the Muslim community is anticipated to fuel the industry growth over the projected timeframe.

Browse key industry insights spread across 908 pages with 1424 market data tables & 14 charts & figures from the report, “Global Non-Alcoholic Wine and Beer Market Size By Product (Beer {By Material (Grapes, Berries/ Apples, Malted Grains, Hops, Yeast, Enzymes), By Type (Alcohol Free [0.0% ABV], Lower Alcohol [0.0% - 1.5% ABV], Lower Alcohol [1.5% - 3.5% ABV], By Technology (Restricted Fermentation, Dealcoholization [Reverse Osmosis, Heat Treatment, Vacuum Distillation]), By Sales Stores (Liquor Stores, Convenience Stores, Supermarkets, Online Stores, Restaurants & Bar)}, Wine { By Material (Grapes, Berries/ Apples, Malted Grains, Hops, Yeast, Enzymes), By Type (Alcohol Free [0.0% ABV], Lower Alcohol [0.0% - 8.0% ABV], Lower Alcohol [8.0% - 12.0% ABV], By Technology (Restricted Fermentation, Dealcoholization [Reverse Osmosis, Heat Treatment, Vacuum Distillation]), By Sales Stores (Liquor Stores, Convenience Stores, Supermarkets, Online Stores, Restaurants & Bar)}), Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Italy, Spain, Russia, Czech Republic, Sweden, China, India, Japan, South Korea, Indonesia, Thailand, Malaysia, Australia, Brazil, Argentina, Mexico, South Africa, UAE, Saudi Arabia, Iran, Egypt), Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/non-alcoholic-wine-and-beer-market

Wine segment is expected to witness CAGR over 8% up to 2025. Increase in consumption of mocktails during festive period or in non-alcoholic party drinks will boost the product consumption rate. Shifting consumer preference towards exotic flavored wine and rising disposable income are the major factors supporting product sales. Increasing penetration of premium brands by wine manufacturers and robust expansion of distribution network is likely to foster industry expansion.

North America is expected to witness CAGR over 6.5% up to 2025. Wine and beer segment have witnessed tremendous growth in North America owing to the significant investments in R&D for the development of better ales using more efficient and sustainable manufacturing processes such as reverse osmosis and dealcoholization. Growing broad range of preferences and options coupled with the addition of various types of flavors, color, and aroma will further penetrate the product scope over the forecast timeline.

Europe is dominating the non-alcoholic wine and beer market owing to varied products availability, changing consumer preferences, established distribution channels, and large number of manufacturers. Growing tourism industry accompanied by new product developments in the region are among key supporting factors for industry growth. Portfolio expansions among manufacturers & distributors to offer non-alcoholic drinks mostly targeting sportsmen, athletes, and Islamic population will drive the market growth.

Global industry share is moderately fragmented with the presence of medium and large regional players and multinational corporations. Bernard Brewery, Suntory, Heineken N.V, Carlsberg, Anheuser-Busch InBev, Erdinger Weibbrau, Big Drop Brewing and Moscow Brewing Company are among major non-alcoholic wine and beer market participants. The manufacturers are expected to increase their production capacity, invest in product innovations, mergers and acquisitions, for gaining a competitive share. For instance, in January 2018, Molson Coors completed the acquisition of California-based, Clearly Kombucha. This strategy was to expand its foothold in the North American non-alcoholic beverage market.

Non-alcoholic wine and beer market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in Million Liters & revenue in USD Million from 2013 to 2025, for the following segments:

Non-Alcoholic Wine and Beer Market, By Product

- Wine

- Beer

Non-Alcoholic Wine and Beer Market, By Material

- Grapes

- Berries/ Apples

- Malted Grains

- Hops

- Yeast

- Enzymes

Non-Alcoholic Beer Market, By Type

- Alcohol Free [0.0% ABV]

- Lower Alcohol [0.0% - 1.5% ABV]

- Lower Alcohol [1.5% - 3.5% ABV]

Non-Alcoholic Wine Market, By Type

- Alcohol Free [0.0% ABV]

- Lower Alcohol [0.0% - 8.0% ABV]

- Lower Alcohol [8.0% - 12.0% ABV]

Non-Alcoholic Wine and Beer Market, By Technology

- Restricted Fermentation

- Dealcoholization

- Reverse Osmosis

- Heat Treatment

- Vacuum Distillation

Non-Alcoholic Wine and Beer Market, By Sales Stores

- Liquor Stores

- Convenience Stores

- Supermarkets

- Online Stores

- Restaurants & Bar

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Czech Republic

- Sweden

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Australia

- Latin America

- Brazil

- Argentina

- Mexico

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Iran

- Egypt

Kunal Ahuja, Amit Rawat