Military Vetronics Market Size worth over $5 bn by 2026

Published Date: September 2023

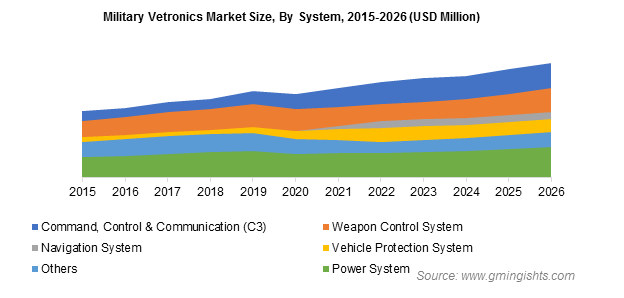

Military Vetronics Market size is set to surpass USD 5 billion by 2026, according to a new research report by Global Market Insights Inc.

Growth in the market is owing to increasing demand for automated systems in the defense sector. Integrating vetronics with military vehicles improves situational awareness, operational capabilities, and decision-making abilities during critical situations. Regional enterprises backed up by government support are engaged in the development of advanced military vetronics.

The rising requirement for cybersecurity in military vehicles will drive the growth of C3 systems in the market. Industries are providing solutions that operate on secured networks, eliminating chances of cyber-attacks.

Rising arms acquisition and modernization budgets to keep military forces in ready for combat condition is supporting market growth. Various countries are initiating acquisition programs to strengthen their forces.

Get more details on this report - Request Free Sample PDF

Rising defense budget allocation for research and modernization programs

Rising defense budget allocation for research, development, and modernization of military vetronics will positively impact the market revenue. For instance, in April 2020, the U.S. Department of Defense provided a contract worth USD 70 million to Carnegie Mellon University for the research & development of AI framework in the defense industry. It is a cost-no-free contract where the university will dedicate complete funds toward R&D and system integration.

Browse key industry insights spread across 300 pages with 282 market data tables & 23 figures & charts from the report, “Military Vetronics Market Size By System (Command, Control & Communications (C3) System, Navigation System, Weapon Control System, Power System, Vehicle Protection System), By Platform (Light Armored Vehicle, Main Battle Tank, Mine-resistant Ambush Protection (MRAP) Vehicle, Infantry Fighting Vehicle (IFV), Unmanned Armored Ground Vehicles, Amphibious Vehicles), By Fit (Line Fit, Retro Fit), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/ military-vetronics-market

Establishment of various regional players to promote market competitiveness

Increasing participation of regional players in the development of military vehicles and other vetronics systems will support the regional penetration of the market. These companies collaborate with major industry participants or are backed up by government funding for the research & development of vetronics systems.

For instance, in March 2020, Zhong Tian Zhi Kong Technology Holdings Company, a technology firm headquartered in China, displayed Mule-200, an advanced Unmanned Ground Vehicle (UGV), at the Unmanned System Exhibition and Conference 2020, Abu Dhabi.

Rising focus to develop nationwide integrated systems in Europe

The Europe military vetronics market will demonstrate growth of more than 4% between 2020 to 2026 due to efforts taken by various governments to integrate advanced communication systems into the existing armored vehicle fleet. This will positively impact the Command, Control & Communications (C3) systems segment within the region, allowing them to capture a 25% market share by 2025.

For instance, in February 2020, the German Defense Ministry assigned a radio specialist to lead the development of a tactical radio for the European land forces. The project is termed, European Secure Software Defined Radio (ESSOR) and aims to unify radio equipment used by the land forces across the continent, replacing national variants with a common system.

Increasing adoption of indigenous systems in Asia Pacific

The Asia Pacific market is set to witness over 5% CAGR during the forecast timeframe, The growth can be credited to efforts taken by governments and regional enterprises to develop & integrate regionally developed systems in their country’s framework.

Technology acquisition by companies to improve geographical reach

Major strategies practiced by companies operating in the market include technology acquisition, such as SATCOM, advanced batteries, and radars, to improve their product/service offerings. Companies are trying to improve their market share by providing custom solutions as per client requirements.

For instance, in March 2020, Peraton received USD 219 million under a five-year contract to provide satellite communication for the U.S. Afro command. Under this tenure, the company will initiate the acquisition of SATCOM services through a vendor-agnostic approach.

Prominent industry vendors are Thales Group, Saab Group, Lockheed Martin Corporation, General Dynamics Corporation, Raytheon Company, Curtiss-Wright Corporation, Leonardo-Finmeccanica S.P.A, Rheinmetall AG, BAE Systems PLC., and L3Harris.