Flight Inspection Market Size to exceed $1.8 Bn by 2025

Published Date: July 2019

Flight Inspection Market size is estimated to exceed USD 1.8 billion by 2025; according to a new research report by Global Market Insights Inc.

Increasing airport expansion and construction projects will drive the flight inspection market size over the study timeframe. According to Architectural Record, in April 2019, over 50 U.S. airports accounted for around USD 70 billion construction projects in the next three years. Ongoing construction for upgrading taxiways, terminals, and modernization of aging facilities to support increasing flight frequency will further drive the flight inspection market growth.

Growing prominence of drone technology and autonomous aircrafts for inspection will boost the flight inspection market growth over the projected timeframe. Unmanned aerial vehicles (UAV’s) offering accurate results conveniently owing to compact size are providing a positive outlook for the industry expansion. UAV’s equipped with various systems providing real time data of critical parameters allows pilots to operate in extreme conditions.

Get more details on this report - Request Free Sample PDF

Incorporation of redundant flight electronics to meet the required safety standards is escalating the service demand. Reduction in traditional inspection frequencies significantly contributes towards lowering the overall operational cost for airport operations. Rising preference of utilizing advanced flight inspection systems by air navigation service providers is showcasing significant growth prospects for the flight inspection market proliferation.

The flight inspection systems are designed to provide high quality and cost-effective solutions that assures the integrity of guidance system at the airport. The systems are used for authentication of performance-based navigation processes and for the verification and testing of navigational aid. Regulatory organizations including the FAA and ICAO govern the maintenance and inspection activities to ensure safe landing of aircrafts.

Supporting government regulations mandating the regular inspection to ensure passenger safety are positively influencing the flight inspection market growth. For instance, in November 2016, the Federal Aviation Administration (FAA) introduced U.S. Standard Flight Inspection Manual (USSFIM) for flight inspection of air navigation service. Increasing air navigation and instrument flight procedures will further escalate the flight inspection market size over the study timeframe.

Browse key industry insights spread across 210 pages with 275 market data tables & 10 figures & charts from the report, “Flight Inspection Market Size By Solution (Commissioning, Routine), By System (Precision Approach Path Indicator (PAPI), Instrument Landing System (ILS), Very High Frequency (VHF) Omni-Directional Range (VOR), Distance Measuring Equipment (DME)), By End User (Commercial Airports, Defense Airports) Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Italy, Spain, Russia, Poland, Netherlands, Sweden, China, India, Japan, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa), Application Potential, Price Trend, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/flight-inspection-market

Rising number of defense airports due to increasing military expenditure globally is expected to offer large scale opportunities to the market share over the projected timeframe. Further, an upsurge in the implementation of more advanced technologies and increasing air passenger traffic in emerging countries across the globe is anticipated to drive the flight inspection market share over the study timeframe. For instance, China witnessed a large upsurge in passenger traffic of 37 million more passengers in 2016 as compared to the previous year. This factor is expected to propel the market share over the coming years.

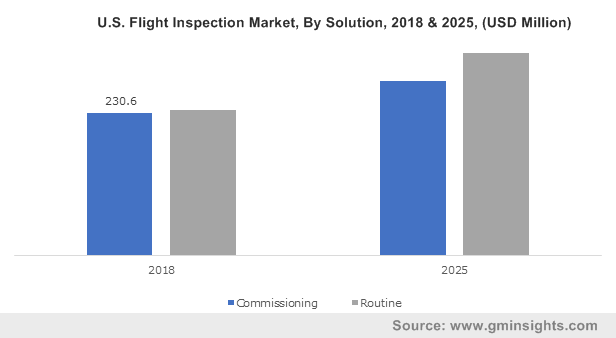

Routine inspection will account for a significant share in the flight inspection market size. This can be attributed to the mandatory requirement for testing and inspection of flight after a certain flight cycle. Stringent government regulations for maintaining airworthiness is playing a major role in boosting the segment size over the projected timeframe. In addition, the continuous enhancement in product quality and calibration processes are expected to positively drive the flight inspection market share.

The Precision Approach Path Indicators (PAPI) will exhibit considerable growth in the flight inspection market size over the projected timeframe. This can be attributed to the requirement to offer visual glide slope guidance for non-precision approach environments such as aerodromes and airstrips. Moreover, advancements in LED technologies with lower power consumption along with reduced maintenance and simpler applications are providing a positive outlook for the flight inspection market expansion.

Rising defense expenditure globally along with increasing political concerns among countries are providing potential growth prospects for the defense airport expansion. Additionally, the integration of radars and nav-aids for felicitating enhanced airfield operations are further accelerating the flight inspection market penetration over the study period. The requirement for periodic airborne inspections along with airfield obstacle evaluations for electronic signal validation are positively influencing the segment growth over the study period.

Europe will exhibit significant growth in the flight inspection market share over the forecast timeframe. This can be attributed to the rapid technological advancements in inspection techniques for improving efficiency and reduce inspection time. Additionally, the increasing usage of drone technology for flight inspection owing to enhanced flexibility along with multiple angular coverage are further boosting the market share. For instance, in April 2019, CANARD drones calibrated all PAPI systems at the Charles de Gaulle Airport, France based on the airport authority requirements.

Major flight inspection market participants include Textron Inc, Safran, Norwegian Special Mission, Bombardier, Airfield Technology, Inc., Aerodata, Saab AB, Cobham plc, and ENAV. Industry players are engaged in securing contracts from airports to enhance their market share. For instance, in May 2014 Enav SpA was awarded a contract from the Uganda Civil Aviation Authority to provide calibration and maintenance services for air navigation assistance systems. This strategy enabled the company to expand their services in Middle East and Africa.

The flight inspection market research report includes in-depth coverage of the industry with estimates & forecast in terms revenue in USD Billion from 2013 to 2025, for the following segments:

Flight Inspection Market, By Solution

- Commissioning

- Routine

Flight Inspection Market, By System

- Precision Approach Path Indicator (PAPI)

- Instrument Landing System (ILS)

- Very High Frequency (VHF) Omni-Directional Range (VOR)

- Distance Measuring Equipment (DME)

Flight Inspection Market, By End User

- Commercial Airports

- Defense Airports t

The above information has been provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Poland

- Netherlands

- Sweden

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Middle East & Africa

- Saudi Arabia

- UAE

- Iran

- South Africa