Blood Preparation Market size to exceed $78.5 Bn by 2025

Published Date: February 2019

Blood Preparation Market size is set to exceed USD 78.5 billion by 2025; according to a new research report by Global Market Insights.

Growing geriatric population base prone to suffer from conditions such as liver cirrhosis will act as driving factor for blood preparation market. Explosive outbreaks such as dengue fever result in high demand for blood components majorly platelets and platelet products should drive business growth. Furthermore growing awareness about blood donation and numerous initiatives undertaken by government to escalate number of blood donations should positively impact industry growth.

Surge in number of surgeries will stimulate demand for whole blood thereby fueling industry growth. Strong product pipeline of anti-coagulants along with technological advancements should propel blood preparation market growth over the forecast period. However, risk of infection post blood transfusion will hamper industry growth to certain limit over the coming years.

Get more details on this report - Request Free Sample PDF

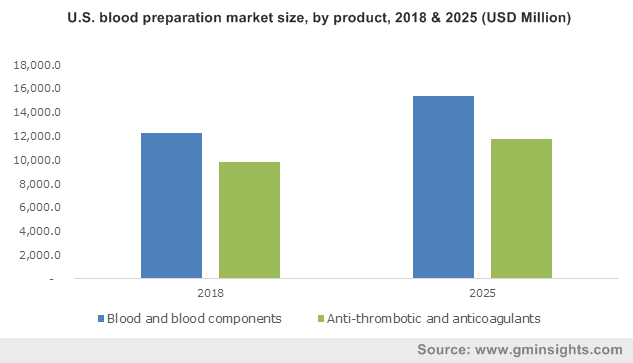

Anti-thrombotic and anticoagulants market is estimated to grow significantly over the analysis period to reach USD 34.0 billion by 2025. High investment made by pharmaceutical companies towards developing highly efficient and cost-effective antithrombotic drugs coupled with high incidence rate of conditions such as venous thrombosis will drive anti-thrombotic drugs market growth over the forecast timeframe. Companies are adopting inorganic growth strategies to strengthen their product portfolio. For instance, Bristol-Myers Squibb entered into strategic collaboration with Pfizer for developing and commercializing anticoagulants. Such initiatives will drive anti-coagulants market in foreseeable future.

Anti-coagulants includes heparins, vitamin K antagonists, direct thrombin inhibitors, and direct factor Xa inhibitors. Heparin dominated anti-coagulants segment by accounting more than 30% market share in 2018. High adoption of heparin injection to reduce clotting ability of blood along with its high application during bypass surgery, kidney dialysis, open-heart surgery and blood transfusions to prevent formation of blood clots should drive heparin anticoagulant market.

Pulmonary embolism application market accounted for USD 12.4 billion in 2018. Pulmonary embolism is frequent complication faced by hospitalized patients, making it one of the primary causes of preventable deaths. Anticoagulation is presently considered to be the central component for treating acute pulmonary embolism should drive pulmonary embolism anticoagulants market growth over the projection period. Unfractionated heparin or low-molecular-weight heparin along with oral vitamin K antagonists have been conventional treatment therapies for pulmonary embolism.

Browse key industry insights spread across 250 pages with 396 market data tables & 7 figures & charts from the report, “Blood Preparation Market Size By Product (Blood and Blood Components {Whole Blood, Blood Components [Red Blood Cells, Platelets, Plasma, White Blood Cells]}, Anti-thrombotic and Anticoagulants {Platelet Aggregation Inhibitors [Glycoprotein Inhibitors, COX Inhibitors, ADP Antagonists, Phosphodiesterase Inhibitors], Fibrinolytics, Anticoagulants [Heparins {Unfractionated Heparin, Low Molecular Weight Heparin (LMWH), Ultra-low Molecular Weight Heparin}, Vitamin K Antagonists, Direct Thrombin Inhibitors, Direct Factor Xa Inhibitors), By Application (Thrombocytosis, Pulmonary Embolism, Renal Impairment, Angina Blood Vessel Complications), Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025 ” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/blood-preparation-market

U.S. blood preparation market accounted for around USD 22.0 billion market size in 2018 and is estimated to witness considerable growth over the forecast timeframe. Growing number of surgeries expanded applications of blood derivatives and high awareness should drive U.S. blood preparation market. The Food & Drug Administration mandates blood centers to keep list of unsuitable donors to reduce risk of infection post blood transfusion.

India blood preparation market will witness 5.4% CAGR over the coming years. Growing geriatric population base coupled with high incidence rate of blood associated diseases should drive Indian blood preparation market. Furthermore, rising awareness regarding blood donation and several initiatives undertaken by Indian government will positively impact Indian blood preparation market growth.

Few notable players operating in blood preparation market are Bayer, Aralez Pharmaceuticals, Pfizer, GlaxoSmithKline, AstraZeneca, Ionis Pharmaceuticals, Leo Pharma, Boehringer Ingelheim, Daiichi Sankyo, Bristol-Myers, Johnson and Johnson among other players. Industry players are adopting various organic and inorganic strategies to consolidate their market position and expand product portfolio. Companies are investing heavily in research and development. Bayer and Ionis have invested into development of IONIS-FXIRX, a second-generation antisense anticoagulant drug that is currently undergoing Phase II clinical trials.

Blood preparation market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD million from 2014 to 2025, for the following segments:

Blood Preparation Market, by Product (USD Million)

- Blood and blood components

- Whole blood

- Blood components

- Red blood cells

- Platelets

- Plasma

- White blood cells

- Anti-thrombotic and anticoagulants

- Platelet aggregation inhibitors

- Glycoprotein inhibitors

- COX inhibitors

- ADP antagonists

- Phosphodiesterase inhibitors

- Others

- Fibrinolytics

- Anticoagulants

- Heparins

- Unfractionated heparin

- Low molecular weight heparin (LMWH)

- Ultra-low molecular weight heparin

- Vitamin K antagonists

- Direct thrombin inhibitors

- Direct factor Xa inhibitors

- Heparins

- Platelet aggregation inhibitors

Blood Preparation Market, by Application (USD Million)

- Thrombocytosis

- Pulmonary embolism

- Renal impairment

- Angina blood vessel complications

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Russia

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia