Global Blockchain Market Size to hit $25 Bn by 2025

Published Date: November 2019

Blockchain Market size is slated to exceed USD 25 billion by 2025; according to a new research report by Global Market Insights Inc.

Blockchain technology is a digitally recorded distributed ledger where each transaction is validated by an agreement between most of the stakeholders in an organization. It permits the transfer of digital files without depending on a central monitoring entity. This allows members to prove the content of the database at a precise moment. This guarantees that all the members have a constant view of the collective database.

The blockchain market growth is attributed to the growing trend of Initial Coin Offering (ICOs), which intended to raise funds from investors. For instance, in 2017, the initial coin offerings have raised more than USD 2 billion with over 250 ICOs across the globe. This token can be subsequently traded on cryptocurrency exchanges. It provides early access to potential blockchain protocols and applications, encouraging investments in ICOs.

Rising need to automate compliance & risk management business processes

Get more details on this report - Request Free Sample PDF

Blockchain automates various compliance & risk management business processes across multiple parties, which are slow, manual, and error-prone in the existing system. It facilitates real-time desktop monitoring across external regulators & internal professionals. It is an emerging solution across the lending and risk management space. The technology provides organizations with an opportunity to document & track how assets are being transferred in more intuitive ways than they were in the past. Various financial services firms, which get ahead of this trend have an opportunity to implement blockchain along with other emerging technologies to develop alternative lending strategies in their operations.

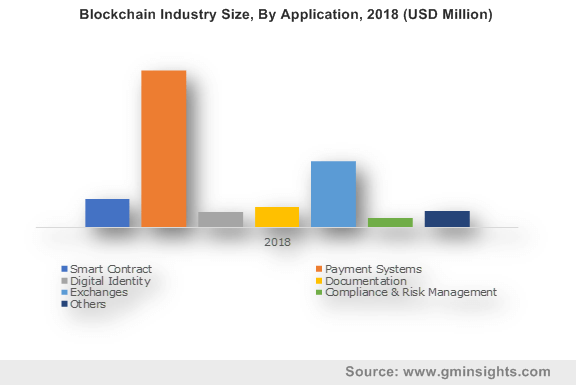

Browse key industry insights spread across 259 pages with 226 market data tables and 33 figures & charts from the report, “Blockchain Market Size By Providers (Infrastructure Provider, Application Provider, Operators), By Application (Smart Contract, Payment & Wallet, Digital Identity, Exchange, Compliance & Risk Management), By End-use (BFSI, Government, Healthcare, IT Service, Media & Entertainment, Transportation & Logistics), Industry Analysis Report, Regional Outlook), Growth Potential, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/blockchain-technology-market

Rapid adoption of distributed ledger among firms in the BFSI industry

The BFSI sector held a dominant market share and is anticipated to maintain it over the forecast period due to the rapid adoption of distributed ledger among BFSI firms. Central banks, commercial banks, and stock exchanges across the globe are keenly exploring the technology’s potential by partnering with various blockchain startups to implement the technology in the system. For instance, in 2017, R3CEV, a blockchain startup, collaborated with 40 banking institutions globally including UBS, JPMorgan, Barclays, and Royal Bank of Scotland.

Increasing demand for the media & entertainment industry to strengthen IP rights

The media & entertainment sector in the blockchain market is projected to grow at 71% CAGR over the forecast timeline due to the growing need to strengthen IP rights on its content. The advent of blockchain technology facilitates the bypassing of platform providers, content aggregators, and other royalty collection associations significantly, shifting the market toward copyright owners. It enables content owners to generate additional revenue streams by leveraging on Consumer to Consumer (C2C) sales. This will allow the copyright owners to fully monetize on all copyright assets that are recorded using the technology. Additionally, illegal file sharing & other copyright infringements will be eliminated due to the transparency offered by the technology. However, illegal content sharing remains a major challenge in the adoption of peer-to-peer content sharing by content creators.

Supportive government initiatives are propelling the MEA blockchain technology market

The Middle East blockchain industry is projected to grow at 72% CAGR over the forecast timeline due to supportive government policies, which support startup growth and secure investor funds. For instance, in 2018, Tel Aviv Stock Exchange (TASE), Israeli’s security regulator has barred the entry of public companies, which primarily hold, mine, and invest in cryptocurrencies due to their highly volatile stock price. The new policy is intended to protect passive investors who might be exposed to such companies. The restriction will prevail for a year at first and will be subjected to further examination.

The industry players are focusing on strategic alliances with key market players of various verticals to increase their market share. For instance, in April 2018, Peer Ledger signed an agreement with SAFE-BioPharma Association, LLC to become its vendor partner. This partnership was intended to offer blockchain solutions for increasing health transaction security and protecting the patient’s identity using the identity bridge product.

Some of the market players are Alphapoint; Amazon Web Services, Inc.; Asta Solutions Pty Ltd.; Bacoor, Inc.; Blocko, Inc.; Chain, Inc.; Coinbase, Inc.; Digiledge; Digital Asset Holdings, LLC; Earthport; Exioms Technology Pvt. Ltd.; Hewlett Packard Enterprises (HPE); Huobi; IBM Corporation; Microsoft Corporation; Paystand; Peer Ledger; R3; SAP SE; SimplyFi SofTech India Pvt. Ltd.; and SmartMesh Foundation Pte. Ltd.