Automotive Fuel Cell Market Size to hit 14 thousand units by 2023

Published Date: January 2025

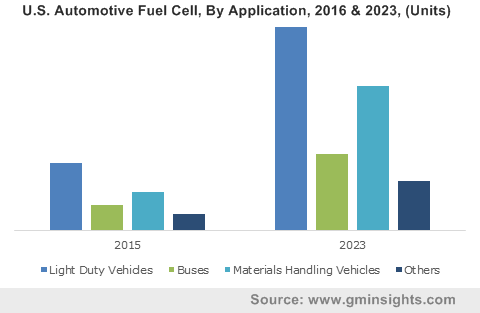

Automotive Fuel Cell Market size is anticipated to reach 14 thousand units by 2023; according to a new research report by Global Market Insights Inc.

Fuel cell technology fetches ingenuity and innovation that can promote a new clean economy and economic growth. Rising prominence of fuel cell technology in automotive industry owing to higher efficiency and environmental benefits will drive the automotive fuel cell market growth. It is more reliable power source, as it can be produced using hydrogen with water being the byproduct. The technology generates clean power and low noise keeping an environmental balance.

Increasing nation’s environmental concern to reduce CO2 emission from vehicles are generating the demand for automotive fuel cells. Multiple economies are taking initiatives to deploy fuel cell vehicles for public and private transportation. For instance, In May 2019, the government of South Korean announced to have 6,400 fuel-cell cars on the country's roads by the end of 2019. The government revealed a roadmap for increasing the adoption of fuel cell vehicles. The country also aims to manufacture around 6.2 million FCEVs and create 1,200 hydrogen refilling pumps by 2040, thereby expanding the market share over the study period.

Get more details on this report - Request Free Sample PDF

Majority leading automotive players are producing fuel cell vehicles as the vehicle refueling time is significantly low, creates zero emission, and can cover distance of 300 to 400 miles on a full tank. For instance, in April 2019, Nikola Corporation launched its hydrogen fuel cell truck for the European market. The truck offers a range of 500 to 1,200 kilometers using a redundant 120 kW hydrogen fuel cell.

Automotive fuel cell industry players are adopting various strategies for business growth such as joint venture, collaboration and new product development. For instance, in April 2019, Hyundai Motor Company established a joint venture with the Swiss company H2 Energy (H2E) specializing in the production and supply of renewable hydrogen. The joint venture is established to provide 1,600 fuel cell trucks.

Browse key industry insights spread across 80 pages with 51 market data tables & 19 figures & charts from the report, “Automotive Fuel Cell Market Size By Application (Light Duty Vehicles, Buses, Materials Handling Vehicles), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2016 – 2023” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/automotive-fuel-cell-market

Fuel cell offering higher power is increasing its demand for heavy material handling vehicles. The material handling vehicles such as forklift and terminal tractors are powered by this technology are recently started its operations at various plants including distribution centers, manufacturing plants, grocery warehouses and ports due to their advantage of longer life, higher power, and faster refueling. For instance, in July 2019, Horizon Fuel Cell Technologies entered into a strategic agreement to supply clean energy trucks for material handling at the Singapore port.

Light duty vehicle will hold substantial share in the market owing to the proliferating logistics and transportation industry globally. Multiple factors fueling this growth include rising consumer preference for online shopping, increasing sole traders, and small businesses with agile logistics operations. The fuel cell powered vehicles are offering high performance and reduced noise compared to diesel or gasoline vehicles, thereby driving the market growth over the forecast period.

Buses will account for a significant revenue share in the market. This can be attributed to the rising focus of governments globally to replace traditional and aging buses with non-polluting and advanced fuel cell buses. For instance, in 2018, ISRO in association with TATA motors developed advanced fuel cell buses, with an aim of replacing the current conventional fleet, thereby expanding the market size over the projected timeframe.

Europe will showcase substantial growth in the automotive fuel cell market owing to the increasing adoption of fuel cell powered vehicles coupled with proliferating infrastructure support. For instance, in October 2018, The Hydrogen Mobility Europe group project announced the establishing of a large network of hydrogen refueling stations with 49 stations to be funded among which 15 are already operating.

Key manufacturers in the market are Ballard Power Systems, Nedstack, Nuvera Fuel Cells LLC, SFC Energy AG, Delphi Automotive Systems, Elcogen AS, and Fuel Cell Energy Inc. Industry players are engaged in strategic partnerships and increasing investments to gain competitive edge in clean energy technology. For instance, in December 2018, Nuvera Fuel Cells LLC and Hangzhou district government of Fuyang, China entered into an agreement with China to provide fuel cell stacks.

The automotive fuel cell market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in units from 2012 to 2023, for the following segments:

By Application

- Light Duty Vehicles

- Buses

- Materials Handling Vehicles

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Asia Pacific

- Japan

- South Korea

- Latin America

- Middle East & Africa