Automotive Airbag Market worth over $65bn by 2026

Published Date: July 2020

Automotive Airbag Market size is set to exceed USD 65 billion by 2026, according to a new research report by Global Market Insights Inc.

Passenger safety has become the utmost priority for automotive industry players; thus, vehicle manufacturers are incorporating several passive safety systems including airbags in vehicles. Stringent government regulations across the globe have mandated the usage of automotive airbags. In addition, the rising vehicle production will drive the market size.

The automotive industry is constantly evolving with growing safety concerns from consumers and reliability to provide superior protection during collision to minimize fatal accidents. Increasing spending on commercial vehicles safety across the globe will escalate the automotive airbag market growth. Regulatory policies mandating the fitment of such systems in vehicles along with rising preference of automobile OEMs to enhance vehicle safety will support the industry revenue.

Get more details on this report - Request Free Sample PDF

The side airbags segment will showcase considerable growth over the coming years owing to enhanced safety protection capabilities in rollover crashes. The side airbags minimize the impact on chest and abdomen at the crash incidents. In addition, the industry participants are developing systems with lesser deployment time. For instance, in July 2017, Toyoda Gosei along with Toyota Motor Corporation developed side airbags for improving the overall vehicle passenger safety. The conventional side airbags are designed with two separate airbag structure whereas new design implemented three bag structure for instantaneous deployment.

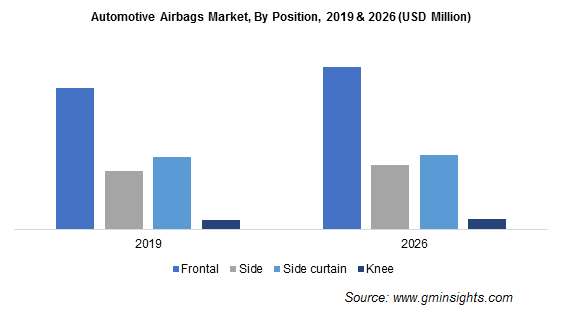

Browse key industry insights spread across 250 pages with 521 market data tables & 10 figures & charts from the report, “Automotive Airbag Market Size By Position (Frontal, Side, Side Curtain, Knee), By Fabric (Coated, Non-coated), By Vehicle (Passenger Vehicles, Commercial Vehicles), By Distribution Channel (OEM, Aftermarket), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/automotive-airbags-market

Uncoated fiber to enhance airbag adoption

The non-coated segment will account for over 20% share in the automotive airbag market by 2026 due to lower cost and ease of recyclability as compared to coated fabric airbags. The non-coated fabric airbags are used in passenger cars owing to issues associated with coated fabrics including formation of bubble and irregularities during coating and difficulty in recyclability. The growing passenger vehicle sales in emerging economies will boost the segment growth.

Aftermarket distribution channel to gain traction in emerging economies

The aftermarket segment will witness around 4% growth during the forecast period on account of replacement of airbags systems from crash vehicles. The airbag control units are sensitive and require calibrating once the airbag deploy in crash incidence. Advanced devices including Tech device are available to recalibrate the control units. However, the costs of replacements and recalibration of airbag systems are high that may hamper the product growth.

Commercial vehicle to showcase promising growth

Commercial vehicle segment in the automotive airbag market will grow substantially through 2026 impelled by rising usage of these vehicles across a wide range of industries. The growing infrastructure projects in emerging economies along with proliferating logistics industry will enhances commercial vehicle penetration. The truck manufacturers are launching side curtain airbags to minimize the injury chances in rollover accidents.

Industry to witness surge in R&D investments

Automotive airbag industry participants are surging their R&D investment to offer enhanced safety operations in vehicles. The key manufacturers include Ashimori Industry, Autoliv, Continental AG, Denso Corporation, Hyundai Mobis, Joyson, Mitsubishi Electric Corporation, Toyota Gosei, Robert Bosch GmbH, Nihon Plast Co., Ltd. and ZF Friedrichshafen AG.