Global Assembly Machines Market Size worth $9bn by 2025

Published Date: August 2019

Assembly Machines Market size is set to exceed USD 9 billion by 2025; according to a new research report by Global Market Insights Inc.

The rise in the demand for automated manufacturing processes to improve quality by eliminating errors and reducing variability is a major factor driving the assembly machines market growth. These machines substitute human labors for carrying out hazardous and repetitive tasks performed in the manufacturing process. The rising trend of smart factory and Industry 4.0 is encouraging manufacturers to invest in new production tools & technologies. Manufacturers across industries such as automotive, pharmaceutical, electronics, and cosmetics are implementing automated machinery to increase their sales and production of goods. Automated assembly enhances optimization and reliability, providing flexibility and rapid process monitoring. Machines simplify the task of sorting, filling, sealing, and labeling, allowing the company to increase its productivity.

Automated assembly equipment is being manufactured with different capabilities and functions. In the healthcare industry, medicine, tools, and equipment must be specifically designed to function appropriately. These machines help to enhance processes in health facilities. They can bend, drill, polish needles, barb & form structures, and assemble syringes & catheters. Designing these tools by hand involves labor and is time-consuming, slowing down overall work cycle. With the use of machines, manpower can be significantly reduced, and the production of utensils, tools, and equipment can be increased. The increasing usage of small plastic components by healthcare professionals is encouraging manufacturers to adopt new plastic molding technology to enhance output, improve quality, and reduce production costs. They are implementing new technologies for the assembly of small plastic parts such as filters, inhalers, pumps, syringes, tubes, valves, and other medical products. For instance, in September 2017, SINTECO, a provider of special machines and robotic lines for assembly and testing for medical applications, announced the launch of Medtech machine. The machinery is managed by PLC and SCADA systems. Such factors are driving the assembly machines market demand.

Get more details on this report - Request Free Sample PDF

Manufacturers across the globe are focusing on reducing their operating costs and increasing the profitability. The use of fully automatic assembly equipment helps to streamline the production process and allows mass production for manufacturers, reducing manufacturing errors. These machines reduce energy costs due to low heating requirements and provide maximum efficiency in assembly processes. Fully automated processes increase accuracy and productivity in manufacturing operations. These machines are being increasingly adopted for pharmaceuticals or medical device assembly. Manufacturers in the healthcare industry need to follow the federal regulations for producing medical devices. The FDA regulatory in the U.S. directs the industry to ensure the adoption of high-quality standard products for the safety of patients. Companies are offering ISO 9001-2008 certified machines, which help ensure the quality of manufactured products, positively impacting the market growth.

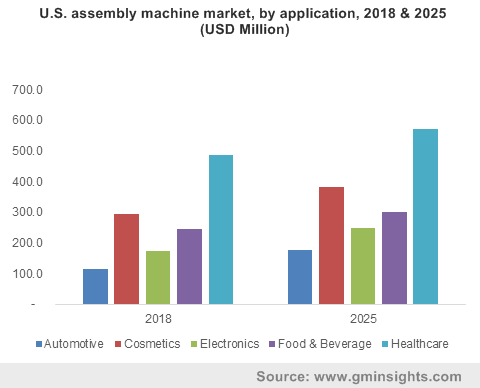

Browse key industry insights spread across 150 pages with 103 market data tables & 27 figures & charts from the report, “Assembly Machines Market Size By Type (Manual, Semi-Automatic, Fully Automatic), By Application (Automotive, Cosmetics, Electronics, Food & Beverage, Healthcare), Industry Analysis Report, Regional Outlook (U.S., Canada, UK, Germany, France, Italy, Spain, Russia, China, India, Japan, South Korea, Brazil, Mexico), Growth Potential, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/assembly-machine-market

Increasing focus on product quality and patient safety from the healthcare sector will drive the market share. Manufacturers are implementing these technologies to comply with international hygiene standards and improve the production processes. In the industry, disposable devices are the essential components of all medical, dental, and veterinary practices. The use of disposables increases efficiency, lowers costs, and reduces the spread of infections. In 2018, the U.S. witnessed sales of medical disposables worth USD 50 billion. Moreover, medical devices such as catheters, syringes, inhalers, disposables, and other medical devices, require precise and accurate assembly to operate effectively. The machines help in processing, assembling, testing, inspecting, and packaging these devices without errors. The presence of stringent standards in pharmaceutical and healthcare sectors requires manufacturers to ensure the safety & efficiency of regulated medical devices.

In 2018, Asia Pacific assembly machines market accounted for 40% of the global industry share. The manufacturing sector in countries including China and India is driven by low labor & manufacturing costs, technically skilled workforce, and good infrastructure, encouraging investments from manufacturers. The growth in digitization across the region enables manufacturers to expand and scale their businesses while reducing costs. For instance, in November 2017, the Singapore Government launched the Smart Industry Readiness Index (SIRI), to guide companies in the Industry 4.0 transformation. Similarly, countries such as Thailand and Indonesia have launched their own Industry 4.0 initiatives to improve the quality of manufacturing industries, driving the demand for machines.

Major companies participating in the market include RNA Automation Limited, Norwalt Design Inc., Mondragon Assembly, Kawasaki Heavy Industries, Ltd., Isthmus Engineering, Intec Automation, Inc., Humard Automation SA, Hindustan Automation, Haumiller, Gefit Group, FANUC Corporation, Extol, Inc., EMAG GmbH & Co. KG, Bystronic Maschinen AG, and A UNO TEC S.R.L.. Several major equipment manufacturers are engaged in developing partnerships and acquiring small companies for expanding their business operations and product offerings in market. Similarly, companies are also involved in partnering with other players of the ecosystem such as raw material & component suppliers, manufacturers, system integrators, and distribution channels.

The assembly machines market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2015 to 2025, for the following segments:

By Type

- Manual

- Semi-automatic

- Fully automatic

By Application

- Automotive

- Cosmetics

- Electronics

- Food & Beverage

- Healthcare

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Mexico

- MEA