Aircraft Refueling Hose Market Size worth $2.5bn by 2025

Published Date: May 2019

Aircraft Refueling Hose Market size is estimated to reach USD 2.5 billion by 2025; according to a new research report by Global Market Insights Inc.

The proliferating demand for military jets for special purpose missions coupled with the increasing tanker size for supporting aerial refueling operations will drive the aircraft refueling hose market growth. The significant product demand is further propelled by the rising defense budget, including the U.S., China and India, along with the increasing commercial airplane deliveries. For instance, in March 2019, China government announced its defense budget that will account for USD 177.61 billion with an increase of around 7.5% compared to the previous year.

Increasing commercial airplane delivery with a high demand for lighter airplanes with improved fuel efficiency will boost the aircraft refueling hose market share. The rising air passenger traffic along with the increasing demand for low-cost carriers is fostering the usage of refuellers in commercial air carriers. According to the Centre for Aviation (CAPA), in 2017, 1,740 commercial air carriers were delivered with an increase of around 1.5% compared to the previous year.

Rising low cost carriers demand will positively enhance aircraft refueling hose market size. Increasing adoption of low-cost carriers can be attributed to the availability of a vast network of routes at lower fares. Additionally, airliners are focusing on reducing extra services given to customers for free and offering packages at standardized rates, supporting the lowering of air fares.

Get more details on this report - Request Free Sample PDF

Growing demand for advanced refuellers and sales is driving the aircraft refueling hose market size over the study timeframe. Availability of wide range of built-in hose assembly with different diameter will further support the business growth. For instance, in 2018 FTI started manufacturing aircraft fuel hose assembly along with test and management services.

Industry participants are continuously investing in R&D to retrofit new technologies for enhancing the system performance. For instance, in 2017, Australian air force signed a research agreement with Airbus to develop automatic fueling capability. The products can be retrofitted to existing jets including certain hardware changes and software upgrades providing a positive outlook for aircraft refueling hose market share.

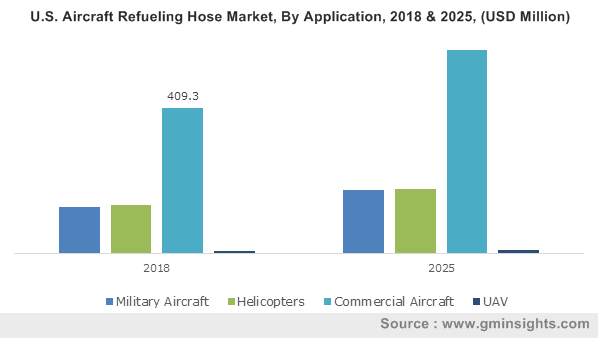

Browse key industry insights spread across 300 pages with 438 market data tables & 14 figures & charts from the report, “Aircraft Refueling Hose Market, By Application (Military Aircraft, Helicopters, Commercial Aircraft, UAV), By Distribution Channel (OEM, Aftermarket), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/aircraft-refueling-hose-market

Stringent government regulations across the globe mandating periodic maintenance of products and replacements of old products not meeting the standards are supporting the revenue generation. For instance, according to the regulation of FAA shelf storage life for such product is maximum 2 years and maximum life is 10 years from the date of manufacturing.

Helicopters will showcase a considerable growth in the aircraft refueling hose market size on account of the rising prevalence for Helicopter In-Flight Refueling (HIFR) systems. Upsurge in the tourism industry is significantly contributing to the growing demand for helicopters. Moreover, increased applications of helicopters in several industries, including oil & gas and mining, along with the installation of refueling hoses for increased reliability and higher fuel flow assurance will further propel the market size till 2025.

OEMs accounted for a substantial revenue share in the aircraft refueling hose market size on account of the increased installation of refuelers in airplane and ongoing technological advancements. Industry participants are developing lightweight fueling hoses to provide easier handling for reel services and meet the all-stringent requirements. Furthermore, airplane manufacturers are establishing strategic agreements to address air carriers fueling services for the U.S. defense requirements. For instance, in December 2018, Lockheed Martin signed Memorandum of Agreement (MoA) with Airbus to offer reliable & advanced refueling services for the U.S. defense customers.

North America will witness around 3% CAGR in the aircraft refueling hose market share owing to the increasing investments by industry participants to advance technologies. For instance, in February 2016, Boeing tanker KC-46 carried out the successful fueling of F/A-18 during its flight. Additionally, the deployment of multiple tankers with probe & drogue systems including the KC-130, C-160 NG, and KC-135 will further support the aircraft refueling hose market expansion over the projected timeframe.

The key aircraft refueling hose industry players include Perkar Hannifin, Eaton, Elaflex, Husky Corporation, Cobham Plc and Apache. Industry participants are engaged in long-term partnerships and strategic expansion of existing facilities. For instance, in 2015, Apache Inc opened new production and distribution facility in Dallas, Texas offering hose products and belting for heavy and light duty. This expanded company’s distribution network, thereby providing a positive outlook for the industry growth.

Aircraft refueling hose market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in thousand units and revenue in USD million from 2013 to 2025, for the following segments:

By Application

- Military Aircraft

- Helicopters

- Commercial Aircraft

- UAV

By Distribution Channel

- OEM

- Aftermarket

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Poland

- Netherlands

- Sweden

- Norway

- Asia Pacific

- China

- Japan

- India

- Thailand

- Australia

- Vietnam

- Malaysia

- Indonesia

- Singapore

- South Korea

- Pakistan

- Latin America

- Brazil

- Chile

- Colombia

- Middle East & Africa

- Saudi Arabia

- Turkey

- UAE

- Israel

- Iran

- Algeria

Kiran Pulidindi, Soumalya Chakraborty