Aircraft Health Monitoring Market size worth over $6 Bn by 2026

Published Date: June 2020

Aircraft Health Monitoring Market size is set to surpass USD 6 billion by 2026, according to a new research report by Global Market Insights Inc.

The rise in defense budget allocation toward acquisition of new aircraft will drive the aircraft health monitoring system industry growth. Increasing aircraft deliveries within commercial and military sectors will generate major market opportunities. For instance, in 2019, Airbus delivered 863 commercial aircraft, 63 more than previous year with total growth of 37% in deliveries in last five years. In the defense segment, HAL announced to double the production of LCA Mark 1 A jets from 8 aircraft to 16 aircraft in 2020.

The sudden outbreak of COVID-19 pandemic will moderately slow down the aircraft health monitoring market growth in 2020. Restriction in air travel and international trade to limit the spread of coronavirus has paused the demand for aircraft health monitoring systems. Significant reduction in profit margins of major market players will negatively impact the budget allocation toward research & development, hampering technological competitiveness.

Get more details on this report - Request Free Sample PDF

Technological development and integration of sensors in aircraft health monitoring systems

Technological developments in optical and laser sensors allowing them to detect minute changes will improve opportunities for integration of hardware in aircraft health monitoring systems.

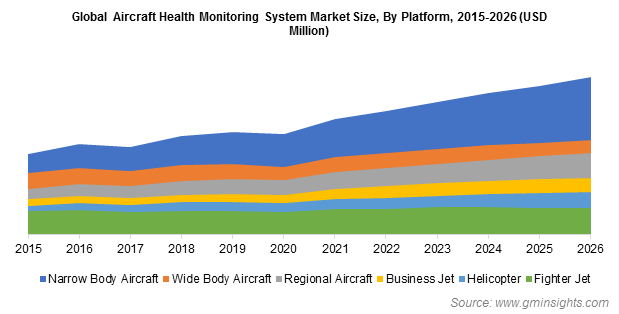

Browse key industry insights spread across 250 pages with 280 market data tables & 23 figures & charts from the report, Aircraft Health Monitoring System Market Size, By Platform (Narrow Body Aircraft, Wide Body Aircraft, Regional Aircraft, Business Jet, Helicopter, Fighter Jet), By Fit (Line Fit, Retro Fit), By System (Hardware, Software, Services), By Operation (Real Time Operation, No Real Time Operation), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/aircraft-health-monitoring-system-market

Establishment of new regulations to improve airworthiness

Government bodies are establishing various regulations for increasing airworthiness of aircraft to minimize aerial accidents. Requirement to integrate certain hardware including ADS-B transmitters and receivers to improve aerial communication and increase frequency of A, B, C, and D checks to minimize problems during aircraft operations is imposed by various countries. On an average, the line maintenance happens with every landing and takeoff, the C checks are done every 18 months and D checks are done according to the model of an aircraft.

Component support agreements to augment growth of the hardware segment

The aircraft health monitoring hardware market to capture more than 65% share in 2026. Major industry players outsource inventory management to MRO vendors, reducing their operational cost for re-orders. The contracts are long-term fixed price contracts. For instance, in July 2019, Northrop Grumman received a contract from government of Bahrain worth USD 104 million to upgrade UH-1Y, AH-1Z, and UH-60V Aircraft Mission Computers. The contract encloses indefinite delivery, indefinite quantity (IDIQ) delivery of production units, retrofit units, and spare units for the following aircraft.

Increasing efforts to increase commercial aircraft MRO facilities in Asia Pacific

The Asia Pacific aircraft health monitoring market held over 30% share in 2019. Increasing efforts of Asia Pacific to enter in the aircraft MRO market at global level will fuel regional growth.

Long-term agreements to secure market share

One of the major strategies practiced by companies operating in the aircraft health monitoring market is entering long-term agreements to secure their market shares over coming years.