Aerospace & Defense Chemical Distribution Market Size worth $5bn by 2025

Published Date: September 2019

Aerospace & Defense Chemical Distribution Market size is likely to surpass USD 5 billion by 2025; according to the latest research report published by Global Market Insights Inc.

Rising aircraft maintenance, repair, and overhaul (MRO) activities would boost the growth in aerospace & defense chemical distribution market. The global air transport MRO demand has been estimated to be around USD 64.3 billion in 2015 and would generate around USD 96 billion by the end of the forecast time period. The key reasons that are driving the global MRO demand are the rising need for the replacement of aging aircraft and increasing air travel demand across the globe.

Air travel demand have been growing exponentially over the past decade, especially in the emerging economies, owing to growing population and rise in middle-class income in India and China. This trend will enhance the aircraft demand in the near future. Such rise in the passenger aircraft demand will further boost the aerospace & defense chemical distribution market in the coming years. Although, stringent government regulations for aerospace chemicals could hamper the growth in the market over the study period. Various authorities like Federal Aviation Authorities, Joint Aviation Authority, etc. have provided various standards and limits to maintain the cabin air quality. This restrains the market for non-compliant products but provides incentive to products meeting regulation criteria.

Get more details on this report - Request Free Sample PDF

Based on products, the aerospace & defense chemical distribution market is segmented into adhesives & sealants, paints & coatings, oils & hydraulic fluids, lubricants & greases and cleaners & solvents. The demand for cleaners & solvents in the aerospace industry is likely to be very high due to its frequent usage. Adhesives & sealants would attain a market share of about 15% owing to its major usage in aircraft manufacturing process. Adhesives used in the aviation industry includes epoxy based, structural acrylics, water based, and solvent based. Epoxy based adhesives are majorly used to impart weight reduction and strength to the aircraft, whereas acrylic based are used for bonding electric motors to magnets.

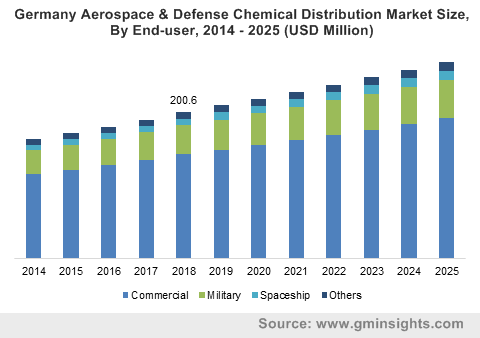

Browse key industry insights spread across 230 pages with 255 market data tables & 34 figures & charts from the report, “Aerospace & Defense Chemical Distribution Market Size By Product (Adhesives & Sealants, paints & Coatings, Lubricants & Greases, Oils & Hydraulic Fluids, Cleaners & Solvents), By Application (Airframe, System, Engine, Interiors), By Distribution Channel (OEM, Aftermarket), By End-user (Commercial, Military, Spaceships), Industry Analysis Report, Regional Outlook, Application Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/aerospace-defense-chemical-distribution-market

Various application segments in the A&D chemical distribution market are airframe, system, engine and interiors. System segment attained a considerable share due to rising demand for lubricants and hydraulic fluids. System includes bleed system, flight controls, landing gear, hydraulics, cooling system, etc.

Aerospace chemicals distribution takes place through different channels. They are distributed either directly by manufacturers, independent distributors, or through brokers. The demand for the product depends both on the demand for new aircraft and on the demand for maintenance & repair during the life cycle of an aircraft. This encompasses original equipment manufacturers (OEMs) and aftermarket.

Defense segment generated a market revenue of about USD 800 million in 2016. This segment includes combat and non-combat aircrafts. This segment will have considerable product demand in the upcoming years due to growing investment in the defense sector by the major economies.

After Asia Pacific, Europe is another important regional market owing to the size of its aerospace industry. Extensive use of the product in manufacturing & maintenance of aircrafts is projected to drive aerospace & defense chemical distribution market in the coming years. France attained a significant share in Europe region due to its flourishing aircraft production. Rising demand for air travel in EU countries will further boost the demand for the market over the study period.

Major product distributors in the aerospace & defense chemical distribution market are Wesco Aircraft, Spectrum Aerospace GmbH, Univar Inc, E.V. Roberts, AirChem Consumables BV, etc.

The A&D chemical distribution market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in Kilo Tons & revenue in USD Million from 2014 to 2025, for the following segments:

By Product

- Adhesives & Sealants

- Paints & Coatings

- Lubricants & Greases

- Oils & Hydraulic Fluids

- Cleaners & Solvents

By Application

- Airframe

- System

- Engine

- Interiors

By Distribution Channel

- OEM

- Aftermarket

By End-user

- Commercial

- Military

- Spaceship

- Other end-users

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Poland

- Russia

- Asia Pacific

- China

- India

- Japan

- Singapore

- Latin America

- Brazil

- MEA

- South Africa

- Saudi Arabia

- UAE

Kiran Pulidindi, Soumalya Chakraborty