Aerospace & Defense C-class Parts Market worth over $15.8bn by 2027

Published Date: June 2021

Aerospace & Defense C-class Parts Market size is set to surpass USD 15.8 billion by 2027, according to a new research report by Global Market Insights Inc.

Aerospace & defense C-Class parts are widely used as joining & sealing materials to reduce friction between basic electronic components & fittings in commercial, business & military aircraft, commercial & military helicopters, defense missiles, aviation electronics, defense systems & satellites, and rockets & spaceships. The market growth is mainly attributed to the replacement of old aging aircraft in the commercial & defense aviation sector. The demand for new-generation fuel-efficient aircraft by major airliners across the world will drive the C-class parts market demand in the aerospace & defense sector.

Favorable trends in the defense sector, mainly in North America and Europe, are led by the rise in defense expenditure and development of advanced systems & aircraft, which will augment the aerospace & defense C-class parts market expansion during the forecast period. The industry growth will be triggered by the expanding commercial aerospace segment, which is witnessing a strong growth, mainly in Asia Pacific. This is majorly credited to the rising socio-economic factors in the region, propelling the air travel demand owing to the increased affordability. These trends will boost the commercial aircraft demand to accommodate the rising air passengers in the region.Nevertheless, usage of adhesives in place of fasteners in the aerospace & defense industry may become a barrier to the market progression during the forecast timeframe. Adhesives are rapidly substituting mechanical fasteners, such as rivets, bolts, and nuts, due to significant benefits of adhesives over mechanical fasteners including reduction in the materials, labor & processing costs, reduced assembly time, and ease of application.

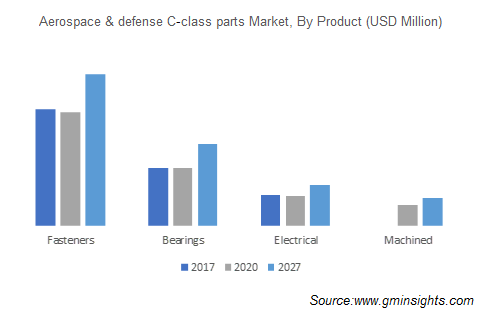

Bearings will be the swiftest growing part family/components

Get more details on this report - Request Free Sample PDF

Aerospace bearings in the aerospace & defense C-class parts market is estimated to register growth of 5% through 2027 impelled by their growing utilities across a broad range of aerospace applications. These are used in flight controls, landing gear, passenger seating, engines, and a wide variety of applications for the aerospace industry. These bearings offer various advantages, such as space & weight reduction, improved strength & safety, energy efficiency, reducing the noise and increasing operating temperatures.

Browse key industry insights spread across 250 pages with 245 market data tables & 33 figures & charts from the report, “Aerospace & Defense C-class Parts Market Size By Component (Fasteners, Bearings, Electrical, Machined Parts), By Application/Work Package (Airframe, System, Engine, Interiors), By Distribution Channel (OEM, Aftermarkets), By End User (Commercial, Military & Defense, Spacecraft), COVID-19 Impact Analysis, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2021-2027” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/aerospace-defense-c-class-parts-market

Interiors are projected to hold a considerable revenue share

Interior applications will account for 15% of the aerospace & defense C-class parts market share by 2027. An aircraft interior, the cabin section of an aircraft, in which passengers travel, includes the design and sizing of interiors such as monuments, stowage, seats, overhead bins, passenger service unit panels, ceilings, and partitions. The increasing utility of C-class parts in the assembly of aircraft interiors will stimulate the industry expansion. The modernization and refurbishment strategies for old airline fleets are also anticipated to generate a higher demand for cabin interiors, influencing the C-class parts industry progression.

OEM is slated to become the fastest distribution channel

OEM distribution in the aerospace & defense C-class parts market is expected to expand at a CAGR of 4.5% by 2027 on account of the increasing orders for new-generation aircraft coupled with the focus on improving fuel efficiency. However, OEM C-class parts are low-value parts and these manufacturers are more focused on A-class components. The prevalence of demand & supply gap for aircraft components since 2016 will also push OEMs to maintain inventory during the forecast timeline.

The military & defense industry is poised to foster a significant revenue share

The military & defense end-use segment will capture 20% of the market share by 2027. China and India play major roles in generating a huge demand for military aircraft globally. Currently, both these nations are one of the top five defense spenders across the world. China has successfully developed & designed its own defense aircraft and transport systems over the years.

Europe to observe strong advancements during the forecast timeframe

The Europe aerospace & defense C-class parts market will attain a CAGR of more than 4% during 2021 to 2027. Aeronautics is one of the EU's key high-tech sectors in the global market. Foreign investors have exciting investment opportunities in the aerospace sector, specifically in the R&D sector as the EU aerospace industry needs efforts in R&D to maintain global competitiveness. The European region is projecting growth in the commercial aircraft aftermarket parts owing to the increased fleet of commercial aircraft as a result of the globalization and expansion of Maintenance Repair and Overhaul (MRO) services in the region’s aviation industry.

The key companies operating in the market are Precision Castparts Corporation, Amphenol Corporation, Arconic Inc., RCB Bearings Incorporated, Eaton Corporation, Stanley Black & Decker Inc., LiSi Aerospace, Trimas Corporation, Satcom Direct, Triumph Group, NTN Corporation, Safran SA, LMI Aerospace, National Aerospace Fasteners Corporation, and SKF.