Summary

Table of Content

Vehicle Rollover Prevention System Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Vehicle Rollover Prevention System Market Size

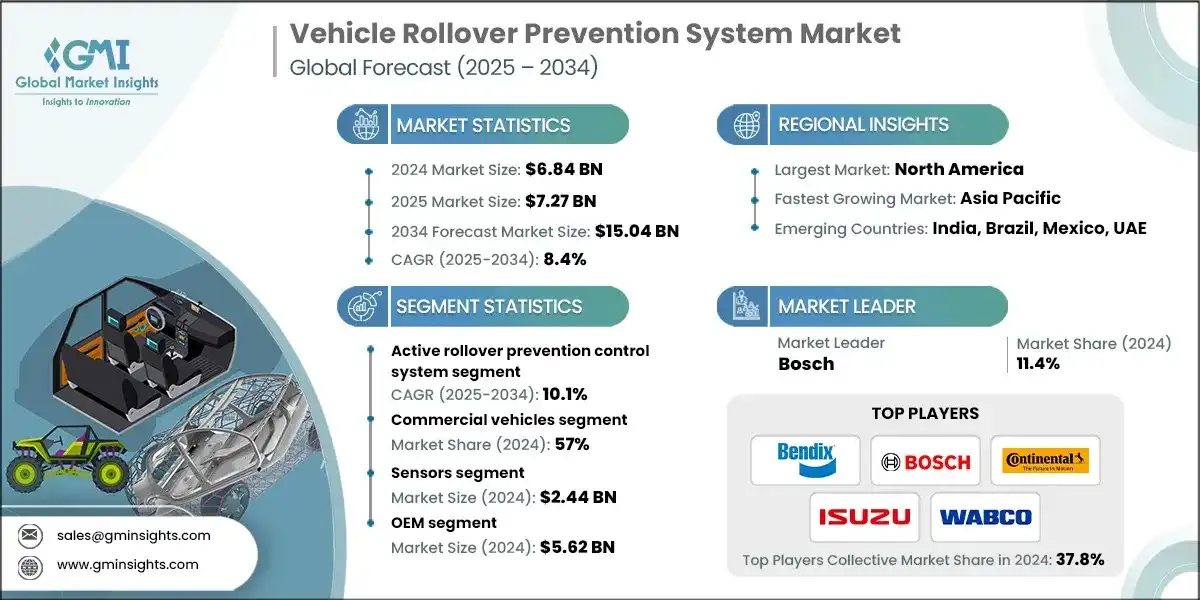

The global vehicle rollover prevention system market size was estimated at USD 6.84 billion in 2024. The market is expected to grow from USD 7.27 billion in 2025 to USD 15.04 billion in 2034, at a CAGR of 8.4% according to latest report published by Global Market Insights.

To get key market trends

The rapid growth in SUVs, pickups, and commercial trucks operating at elevated centers of gravity has increased rollover risk. It is prompting automakers and suppliers to design more advanced rollover countermeasures. Many of these vehicle stability technologies are using electronic motion-sensing, braking control, and predictive algorithms toward the goal of lessening rollover incidents.

Government mandates across the globe are establishing stricter regulatory safety standards including electronic stability control (ESC) and rollover countermeasures installed on new vehicles. These are requirements from several governments, and especially the US, European, Chinese, and Indian governments, are driving manufacturers to design systems that demonstrate integrated highway safety platforms for lessening fatal rollover incidents and assuring road safety.

Advances in MEMS sensors, real-time data processing, and machine learning algorithms are refining the accuracy and responsiveness of rollover countermeasure systems. Reliable rollover countermeasure systems reduce false alerts, improve efficiency with regard to stability control, and reduce the expense with regard to the systems prompting not only more frequent passenger vehicle use, but also vehicle fleet usage globally.

The Asia-Pacific region is experiencing rapid implementation of rollover-prevention systems, spurred by increased commercial vehicle manufacturing, infrastructure improvements and emerging safety regulations. Governments in China, India and Japan are also pushing for vehicle stability standards while OEMs are establishing more local sensor manufacturing capabilities to meet the need and reduce dependence on the West.

In March 2025, Maruti Suzuki launched a refreshed electronic stability program (ESP) with integrated rollover-prevention capabilities in the Super Carry mini-truck. This is India’s first light commercial vehicle with rollover prevention technology. Maruti Suzuki’s initiative furthers a strong emphasis on stability technology and will abide by new Bharat NCAP safety regulations.

Vehicle Rollover Prevention System Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 6.84 Billion |

| Market Size in 2025 | USD 7.27 Billion |

| Forecast Period 2025 – 2034 CAGR | 8.4% |

| Market Size in 2034 | USD 15.04 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising SUV and Truck Demand | The global rise in SUV, pickup, and light commercial vehicle production has increased rollover risks due to higher centers of gravity and load shifts. This trend significantly boosts demand for advanced rollover-prevention systems. OEMs are integrating these features as standard equipment to enhance brand safety reputation and meet evolving consumer expectations for stability and control in utility vehicles. |

| Stricter Global Safety Regulations | Compliance pressure drives automakers to invest in ESC-integrated rollover-prevention technologies. This regulatory momentum ensures consistent global safety standards and expands the adoption rate of active safety technologies across passenger and commercial segments. |

| Advancements in Sensor and AI Technologies | Improved precision and responsiveness reduce rollover accidents by anticipating instability before it occurs. Integration with ADAS and connected-vehicle architectures further enhances predictive capabilities, reducing both human error and vehicle instability during high-speed or uneven-terrain maneuvers. |

| Increased Consumer and Fleet Safety Awareness | Both private consumers and fleet operators are prioritizing vehicles with proven rollover-prevention technology. This behavioral shift pressures OEMs to expand availability across all models, reinforcing the business case for advanced safety integration as a key market differentiator. |

| Growth in Commercial and Off-Road Applications | Fleet safety initiatives and stricter occupational standards are accelerating system adoption. Manufacturers are developing heavy-duty, adaptive rollover-prevention controllers designed for harsh conditions, expanding market potential beyond passenger vehicles and supporting industrial safety compliance globally. |

| Pitfalls & Challenges | Impact |

| High System Cost and Complex Integration | The high integration cost limits adoption among budget and entry-level vehicles, especially in emerging markets. Smaller OEMs face barriers to deploying these technologies due to added weight, system tuning complexity, and software validation requirements. |

| Limited Standardization Across Regions | Lack of harmonized global regulations increases development costs and complicates global platform standardization. Manufacturers must design region-specific configurations, delay product launches and slowing mass deployment, particularly in price-sensitive developing markets. |

| Opportunities: | Impact |

| Integration with Autonomous and ADAS Platforms | Integration with ADAS and self-driving technologies enables predictive stability control using AI and V2X communication. This creates new revenue streams for OEMs and Tier-1 suppliers in software-defined vehicle architectures. |

| Expansion in Electric and Hybrid Vehicles | Adapting rollover-prevention algorithms for EV architectures presents growth potential. OEMs can differentiate electric models through enhanced safety, while Tier-1 suppliers expand offerings into the rapidly growing electrification segment. |

| Growth in Fleet Safety and Telematics Adoption | Telematics-enabled rollover-prevention systems offer real-time monitoring, event analysis, and remote diagnostics. This connectivity enhances fleet efficiency, compliance, and risk management, creating recurring service-based revenue models for suppliers. |

| Emerging Market Adoption through Localization | Localization of sensor and ECU manufacturing reduces cost barriers, making rollover-prevention systems accessible to mass-market vehicles. This expands global penetration, particularly in India, Southeast Asia, and Latin America, fueling sustainable long-term growth. |

| Market Leaders (2024) | |

| Market Leaders |

11.4% |

| Top Players |

Collective market share in 2024 is 37.8% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Brazil, Mexico, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Vehicle Rollover Prevention System Market Trends

Rollover prevention systems are being elegantly combined with electronic stability control (ESC), traction control, and advanced driver-assistance systems (ADAS) features. This comprehensive safety architecture allows for synchronized braking, steering, and torque control from the ESC and traction controllers that increases stability and improves the accuracy of predicting rollover condition for passenger vehicles and commercial vehicles on the market.

The global demand for rollover prevention technology in heavy duty trucks and buses and in off-road vehicles is increasing their significance. Heavy vehicles are at an elevated rollover risk due to the center of gravity location. Original Equipment Manufacturers (OEM) and tier-1 suppliers are rolling out sophisticated roll-stability control systems to comply with increasing fleet safety regulations and minimize downtime due to rollover incidents.

Next-generation systems capitalize on AI, machine learning, and multi-sensor fusion (gyros, accelerometers, wheel-speed sensors, etc.) to identify and prevent rollover events during operation. Predictive control algorithms ultimately improve response time to ensure the vehicle can intervene ahead of instability to minimize roll and improve safety performance in complicated driving and load conditions.

As the popularity of electric vehicles and software-defined architectures is changing the way rollover prevention design is conceived, powertrains allow for faster control response times. Updates give the manufacturer the ability to make real-time improvements to calibration. OEMs leverage over-the-air (OTA) updates to continually improve vehicle stability functions and the accuracy and performance of safety algorithms around the globe.

In July 2025, Mack Trucks rolled out its Pioneer highway model equipped with sophisticated rollover-prevention and stability-assist technology. The new technology, featuring dynamic load sensors and active braking control, will help prevent rollovers and represent a significant leap forward in safety for commercial vehicles operating in the long-haul transport sector of the US.

Vehicle Rollover Prevention System Market Analysis

Learn more about the key segments shaping this market

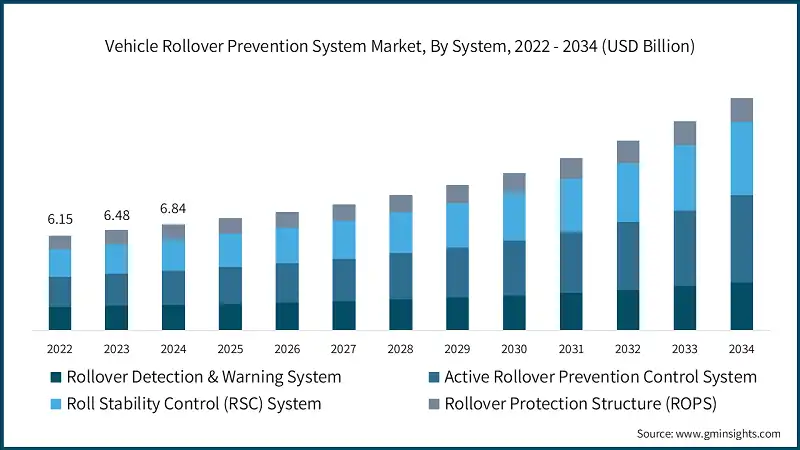

Based on system, the vehicle rollover prevention system market is segmented as rollover detection & warning system, active rollover prevention control system, roll stability control (RSC) system, rollover protection structure (ROPS). Active rollover prevention control system is the fastest growing segment and is expected to grow at a CAGR of 10.1% between 2025 and 2034.

- The active rollover prevention control systems combine electronic stability control (ESC) with advanced sensor networks and actuator systems to provide real-time rollover prevention. They monitor vehicle roll angle, roll rate, lateral acceleration, and yaw rates to determine when the vehicle is potentially entering a rollover condition. Once a rollover condition is detected, the system will control vehicle stability using one or more of the following applications: selective brake application and reduction of engine torque. Research conducted by NHTSA shows that these systems are effective in reducing fatal single vehicle rollovers by 69-88%, thereby affirming rollover prevention systems as a viable safety technology in NHTSA effectiveness studies.

- The Roll Stability Control (RSC) Systems represent 29.4% of the vehicle rollover prevention system market share in 2024 with a 9.2% CAGR till 2034 and focus explicitly on roll angle and roll rate to prevent rollovers. RSC does particularly well in vehicles with higher centers of gravity, such as an SUV, pickup truck, or commercial vehicle. The Insurance Institute for Highway Safety indicates rollover fatalities for pickups and SUVs are 41% and 37%, respectively, compared to 21% for passenger vehicles, showing the importance of rollover prevention systems within these vehicle categories, per IIHS safety statistics.

- The Rollover Protection Structures (ROPS) have a market share of 14.1% and a CAGR of 4.8% and are utilized in commercial vehicles, construction equipment, and agricultural machinery. ROPS are based on passive forms of protection by way of structural design and the active systems ensure that rollovers do not take place. The demand to have full rollover protection with ROPS systems is strengthened by safety statistics released by the Federal Motor Carrier Safety Administration that shows that more than 1,300 cargo tank rollovers occur annually in the US.

Learn more about the key segments shaping this market

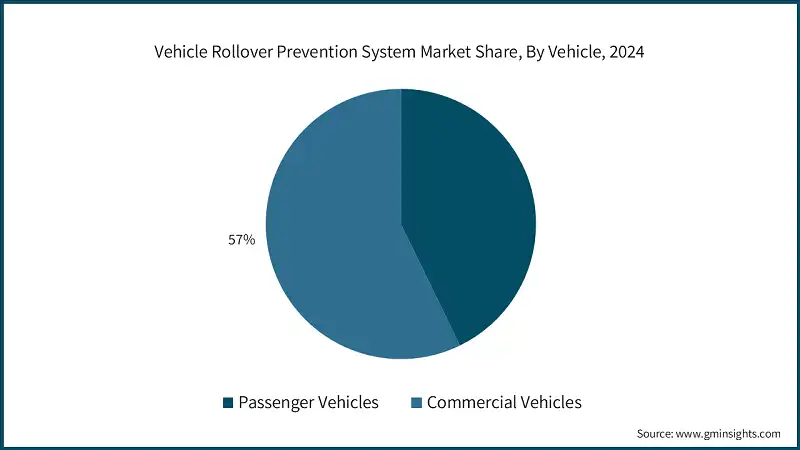

Based on vehicle, the vehicle rollover prevention system market is bifurcated into passenger vehicles, commercial vehicles. Commercial vehicles dominate the vehicle rollover prevention system market with 57% share in 2024, reflecting higher rollover risks and regulatory requirements in this segment.

- Heavy commercial vehicles are more likely to rollover because of having a high center of gravity, differences in cargo loading, and unfavorable operational conditions. The National Highway Traffic Safety Administration (NHTSA) Federal Motor Vehicle Safety Standard (FMVSS) No. 136 requires electronic stability control on vehicles over 26,000 pounds and has pushed broad adoption on commercial vehicles. In the Federal Register, the NHTSA states that the phases of implementing the rule from 2017 until 2019 offered the greatest market coverage for heavy-duty applications.

- Medium and light commercial vehicles are increasing the adoption of rollover prevention due to fleet safety programs and incentive programs from insurers. Fleet operators have a strong economic perspective regarding the present and future of rollover prevention through lower accident costs, premiums, and vehicle downtime. The Federal Motor Carrier Safety Administration estimated that electronic stability control prevents between 67,000 and 91,000 crashes annually. These crashes represent significant economic benefits to operators in the commercial sector, as reported in the FMCSA safety assessment.

- The passenger automobiles have an outstanding market share of 43% in 2024 and a CAGR of 9.3% till 2034 as more and more SUVs and pickups are finding their way into the US fleet. The IIHS record shows that SUV and pickup registration rose 6% and 2% respectively in 2020-2021, respectively, which would mean a bigger group of rollover prevention systems on NHTSA rollover deaths. The IIHS safety data indicate that 28% of pickup deaths are rollover deaths of the vehicle, and in the case of SUVs, it is 24 percent as opposed to 16% of the passenger cars.

Based on component, the vehicle rollover prevention system market is classified into sensors, electronic control unit, actuators & braking module, others. Sensors leads the market with 35.7% share, valued at USD 2.44 billion in 2024.

- Sensors segment is experiencing the continuous gain of technological shift in Micro-Electro-Mechanical Systems (MEMS) technology, which can bring prices down while improving performance levels. STMicroelectronics has developed a new class of sensors with Machine Learning Cores (MLC) built-in allowing for automated pattern detection to take place on the sensor and predict rollover of the vehicle in real time. These technologies will enhance integration into larger ADAS technology and connected vehicle systems while also delivering in synergy safety advantages across multiple vehicle dynamics parameters.

- Electronic control units will grow at the most rapid pace among all the component segments as the amount of software content, as well as processing requirements, rises in modern rollover prevention systems. ECUs will integrate sensor inputs, execute control algorithms, and activate actuators in dimensions of time to achieve real-time rollover prevention. Some ECUs will be considered advanced due to adding artificial intelligence capabilities as well as machine learning capabilities to predict rollover prevention due to knowledge of the connected vehicle data, environmental data, or both.

- Actuators and braking modules provide the physical intervention capabilities necessary for active rollover prevention by applying selective brake pressure on the wheels and managing engine torque to stabilize the vehicle when it is at risk of rollover. These intervention systems must respond rapidly to commands issued by the electronic control unit (ECU) while maintaining control and precision over the amount of braking force applied to each wheel independently. Advanced actuator systems also control regenerative braking in all-electric vehicles, further requiring sophisticated coordination between friction braking and regenerative braking systems.

Based on sales channel, the vehicle rollover prevention system market is segmented into original equipment manufacturer (OEM), aftermarket. OEM dominated the market with 82.1% market share and valued at USD 5.62 billion in 2024.

- The optimal system performance associated with vehicle-specific calibration and integration with larger safety architectures are offered through OEM integration. Modern rollover prevention systems must also integrate with ADAS platforms, autonomous vehicle systems, and connected vehicle technologies, requiring an intimate integration level with the vehicle's electrical architecture and vehicle software architecture. The complexity of integration favors OEM integration over aftermarket retrofit and supports continued dominance in the OEM channel.

- Aftermarket growth is amplified in the demand for retrofit systems in fleet market and new market development. The 2024 Work Truck Safety Study indicates an increase in interest in rollover prevention systems from stakeholders engaged with fleet operations. Choosing to integrate technology within fleet operations must include an organizational culture of safety and prioritization of risk management within fleet operations.

- The aftermarket sector is well positioned with the emergence of companies that specialize in retrofit solutions and the continued availability of off-the-shelf retrofit kits. Additionally, large agricultural and construction equipment markets are exhibiting some demands for retrofitted products because of initiatives such as the National ROPS Rebate Program, which provides cost rebates of up to 70% for installing rollover protection structures.

Looking for region specific data?

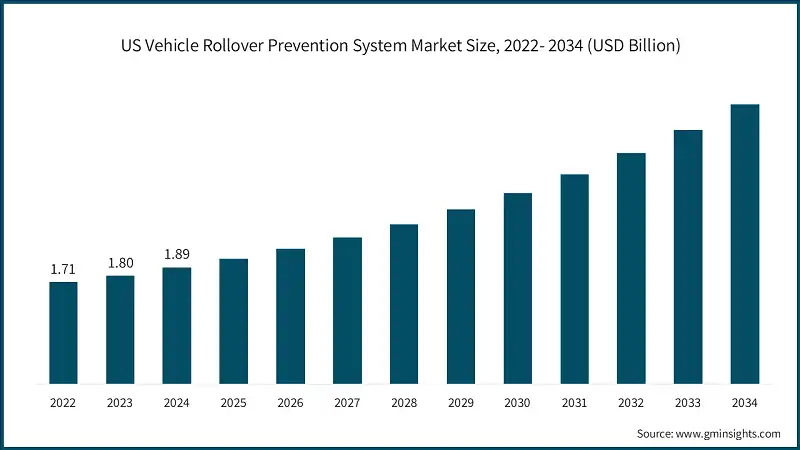

The vehicle rollover prevention system market in US dominates regional revenue with approximately 87.3% share in 2024. The market in US hold a revenue of USD 1.89 billion in 2024 and is expected to experience significant and promising growth from 2025 to 2034.

- The United States is the leading market for the North American rollover prevention system (RPS) with both extensive regulatory requirements and a well-established automotive safety infrastructure. NHTSA Fatality Analysis Reporting System data applied to 2023 indicate that there were 7,816 rollovers for 51,887 vehicles involved in fatal crashes resulting in a 15.1% rollover rate across all vehicle types. Vehicle type rollover rates vary light pickups were 19.0%, SUVs 17.1%, passenger cars 12.3% and large trucks 12.7%.

- The characteristics of the market indicate mature development with growth characteristics based on the mix of vehicles and new technology. According to the Insurance Institute for Highway Safety, 28% of passenger vehicle fatalities involve rollovers and 23% of those fatalities occur without a prior impact indicating the need for additional active stability control systems in vehicles. Rollover events average around $120,000 and most of the commercial vehicles have a significant liability, leading to a proactive adoption process for rollover prevention systems throughout the industry.

- Variations in the occurrence of rollovers, measured at the state level, are attributed to the regional variation in roadway design, weather conditions and enforcement policies. NHTSA analysis indicates that the rate of rollover incidents for a single vehicle crash varies from 0.127 in Missouri to 0.363 in Utah for the same crash type and in the same manner as previously stated, the NHTSA adjusted for road conditions, driver characteristic factors and injury or fatality thresholds for a rollover incident being reported.

North America accounts for 31.6% of the vehicle rollover prevention system market share in 2024 and is expected to grow at 7.6% CAGR during 2025 to 2034, supported by comprehensive regulatory frameworks and mature safety system adoption.

- North America holds a strong market position in rollover prevention with support from fully developed regulations and adoption of mature safety systems. The region benefits from established FMVSS (Federal Motor Vehicle Safety Standards), which include FMVSS No. 126 for light duty vehicles and FMVSS No. 136 for heavy duty vehicles, which create systematic demand in the market for rollover prevention systems. NHTSA (National Highway Traffic Safety Administration) notes there are in excess of 280,000 rollover crashes each year in the US alone, underscoring the critical need for rollover prevention systems.

- The existing suppliers, including Bosch, Continental, and Bendix, have a favorable competitive environment in which they can retention a healthy market presence by a combination of integration capability of systems and regulatory knowledge based on compliance. The emphasis on the evolution of built-in sophisticated driver assistance systems can offer the way to the next generation rollover prevention systems with artificial intelligence capabilities and connected car features.

- The market growth is caused by the increase in the usage of SUVs and pickups. Reported data by the Insurance Institute of Highway Safety found an increment of 6 percent in SUVs and 2 percent in pickup registrations between 2020-2021. These types of vehicles have worse roll over rates and pickups had roll over fatality rate of 41 SUVs coming in, close behind with a roll over fatality rate of 37% versus passenger vehicles of 21%.

The vehicle rollover prevention system market in Europe is expected to reach USD 2.92 million by 2034. The region holds 22.4% market share in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2034, reflecting growing and improving regulatory frameworks.

- Europe shows a mature level of electronic stability control penetration, where focus has now shifted to some next-generation integrated systems and harmonizing regulations. The European Union's General Safety Regulation is responsible for accelerating the adoption of advanced safety systems by mandating the introduction of ESC (electronic stability control) on all new passenger cars starting in November 2014, whilst also enshrining comprehensive safety requirements for commercial vehicles.

- The performance-based standard, while being also neutral on the technology front, is a facet of the European approach to safety that has fostered innovation in the design and implementation of rollover prevention systems. The Euro NCAP safety ratings further incentivize the market for advanced rollover prevention capability by including ESC rule compliance into its safety rating assessment criteria.

- In the commercial vehicle sector, the comprehensive regulatory coverage and safety culture are uniquely advantageous for fleet operators. The focus on the sustainability of the environment has further fueled the development of energy-efficient rollover prevention systems, particularly for enhanced electric commercial vehicles. There are opportunities in eastern European markets from vehicle production capabilities and developing safety regulatory frameworks.

Germany leads European growth, accounting for approximately 33.6% of regional revenue in 2024. German suppliers maintain strong global market positions through comprehensive system integration capabilities and regulatory compliance expertise.

- Germany has a dominant role in the European rollover prevention systems market backed by its status as an automotive powerhouse and a leader in technology development. Germany is home to key suppliers such as Bosch, Continental, and ZF, all contribute to global technology leadership in electronic stability control and advanced rollover prevention systems.

- The German automotive market currently emphasizes premium segments of passenger vehicles with a full array of safety and security equipment built into the vehicles as standard capabilities. German automakers such as BMW, Mercedes-Benz, and Audi deploy advanced rollover prevention systems and display technology viability for the mainstream market.

- The regulatory environment is conducive to the development of advanced safety systems through performance-based requirements and a supportive incentive framework to test technology in the marketplace. Germany also utilizes technical standards and certification processes for high-quality implementation of rollover prevention systems, while providing support for international harmonization. Lastly, Germany has automotive engineering experience and allows for development and deployment of specialized rollover prevention systems across varied vehicle types.

Asia Pacific represents the highest growth opportunity with 35.4% of the vehicle rollover prevention system market share in 2024 and is projected to grow at a CAGR of 10.3% from 2025 to 2034. China leads regional expansion of Asia Pacific revenue, benefiting from rapid urbanization and growing middle-class disposable income.

- The evolution of regulatory frameworks toward regulatory harmonization with global safety standards, such as UN Global Technical Regulation No. 8, has assisted with regional growth, with countries mandating electronic stability control requirements at an increasing pace. Arbitrary access to significant automotive supplier presence and manufacturing capability in the region has facilitated the production and adoption of rollover prevention systems at scale and at lower costs.

- The market conditions differ from country to country. In Japan and South Korea, where markets are more mature, advanced technology uptake is producing significant take-up rates. China and India demonstrate rapid growth potential for take-up in developing markets. The focus of the region on the safety of commercial vehicles, especially in trucking and logistics settings, enhances the demand for heavy-duty rollover prevention systems.

- Competitive factors favor regional suppliers and international supplier relationships with a strong local integration. Japanese suppliers, such as Denso and Panasonic, are contributing leading edge sensor technology; and Chinese suppliers are developing low-cost domestic solutions for export. The regional focus on manufacturing economy and efficiency will support continued growth in the domestic market and technological advancement.

The vehicle rollover prevention system market in China is estimated to hold market revenue of USD 1.02 billion in 2024 and is expected to experience significant and promising growth from 2025 to 2034.

- China is the largest country market in Asia Pacific and has been growing rapidly due to regulatory change, electric vehicle initiatives, and increasing consumer safety awareness. Chinese automotive safety regulations are increasingly coming in line with those seen elsewhere in the world, such as the most recent updates like GB 20072-2024 addressing safety concerns for electric and hybrid vehicles.

- Historically, regulators recognized challenges with electronic stability control adoption across segments and took steps to address those challenges via regulation and consumer education. In 2016, CNBC reported that 43% of SUVs in China did not have ESC, and most consumers, sensitive to price, chose a less expensive model without stability control on these SUVs. Increasing safety awareness and regulatory scrutiny will drive systematic adoption of rollover-prevention systems in the marketplace and across segments of vehicles.

- Rapid urbanization, growth in vehicle ownership, and changing consumer preferences toward safety-equipped vehicles all help to support market growth. The Belt and Road Initiative in that country creates opportunities to export Chinese-manufactured rollover prevention systems in emerging markets. China's leadership in electric vehicles positions it as a technology development hub for the next generation of rollover prevention systems, including regenerative braking integration and battery safety.

The Latin America vehicle rollover prevention system market is estimated to USD 637.9 million by 2034 and is projected to grow at a remarkable CAGR. Market growth is supported by increasing commercial vehicle activity and logistics industry development across the region.

- Despite a relatively small current market share, Latin America offers strong growth prospects due to increasing vehicle production levels, changing safety regulations, and a burgeoning awareness of consumer safety. Latin America benefits from expansion of automotive manufacturing capacity in Brazil, Mexico, and Argentina, in which international manufacturers establish vehicle production capability and safety systems integration.

- Brazil leads the region in developing a market for safety systems due to the presence of regional automotive manufacturing capability and changing safety regulations. The country has mandated safety system testing regulations for heavy commercial vehicles such as a focus on trucking and public transportation which drives demand for rollover prevention systems.

- In the region, a challenge is consumer cost sensitivity and limited infrastructure to support maintenance and calibration of the advanced safety systems. However, an increase in awareness about rollover risk, as well as economic benefits tied to preventative systems, support the development of this market.

- Market opportunities exist for fleet purposes, where the economic benefits of the rollover prevention systems warrant investment costs. International suppliers will maintain local partnerships and technology transfer arrangements, all of which support market development and technology adoption.

The MEA vehicle rollover prevention system market is projected to grow at a CAGR of 5.8% and held a market share of around 6.6% in 2024.

- While economic challenges and infrastructure limits constrain moderate growth in the Middle East, there is an increase in safety awareness and regulatory development. The Gulf Cooperation Council (GCC) countries lead the region in adoption due to favorable economics and a focus on vehicle safety, particularly for high-center-of-gravity SUVs used in desert highway applications.

- Market circumstances vary by country, and these varied economic and regulatory conditions are mirrored in the automotive market. South Africa remains comparatively more advanced in vehicle manufacturer safety and regulations, while other countries vary in regulatory development and enforcement.

- While there are infrastructure challenges such as a limited number of qualified service technicians and calibration equipment to diagnose advanced rollover prevention systems the increase in awareness of safety benefits and economic justification through the decreased of costs of accidents are factors supporting market development. The region does benefit from international programs and technology transfer initiatives supporting the adoption of safety systems.

Vehicle Rollover Prevention System Market Share

- The top 7 companies in the vehicle rollover prevention system industry are Bosch, Continental, WABCO, Bendix, Isuzu Motors, MAN Truck & Bus, Autoliv contributing around 41.1% of the market in 2024.

- Bosch has an 11.4% market share, bolstered by its established electronic stability program (ESP) technology within innovative ADAS platforms. Bosch's global comprehensive solutions sensors, ECUs, and actuators leverage prior market strength to reach both passenger and commercial vehicles. Bosch's global manufacturing ability and their early innovation in the commercial vehicle rollover-prevention segment helps them maintain their leadership position with rollover solutions in varying vehicle segments.

- Continental holds 9.4% market share because of its sensor fusion, control systems, and brake integration for rollover prevention. The company’s focus on ADAS and autonomous applications positions Continental for strong future growth. OEM collaboration strategies will bolster Continental’s position as global leaders in intelligent sensing and stability control solutions in the automotive and commercial segments.

- WABCO has a market share of 8.4%, based on its expertise with air-brake systems and stability systems for commercial-vehicle applications. ZF's acquisition of WABCO significantly enhances its advanced chassis systems and integration of sensors. The company's emphasis on electrified and autonomous vehicle applications will accelerate the development of advanced, adaptive, next-generation rollover-prevention and heavy-vehicle safety technologies.

- Bendix has a market share of 4.6%, specializing in ESC and rollover-prevention systems for heavy-duty vehicles with autonomous driver assistance systems (ADAS). Its new approach to integrating ADAS with torque overlay steering improves stability and control of vehicles. Bendix is mainly focused on Class 8 trucks, where it is expected to leverage its experience to continue its strong position in North America in commercial-vehicle safety and performance systems.

Vehicle Rollover Prevention System Market Companies

Major players operating in the vehicle rollover prevention system industry are:

- Bosch

- Autoliv

- Bendix

- Continental

- Haldex

- Isuzu Motors

- MAN Truck & Bus

- Maruti Suzuki

- WABCO

- Bosch is a market leader with a firm electronic stability program (ESP) and an overall rollover-prevention portfolio consisting of sensors, electronic control units (ECUs), and software algorithms. It became a leader with the introduction of ESP in 2004, and continuous integration of ADAS and autonomous systems drove advancements in its predictive rollover-prevention capabilities, reinforcing Bosch’s dominant market position globally.

- Isuzu Motors prioritization of fuel efficiency and safety combination adds to the proliferation of rollover-prevention technology. Original Equipment Manufacturer partnerships and innovation in stability systems creates a position for Isuzu as a growing player in global commercial vehicle safety technologies.

- MAN Truck & Bus integration of new safety systems supports next generation rollover prevention. Partnerships with technology suppliers add to the performance and reliability, establishing MAN Truck and Bus as a wiser innovator in commercial vehicle stability and control systems.

- Continental leverages advanced sensor fusion, MEMS gyroscopes, and brake system integration for sophisticated rollover prevention systems. Strategic partnerships with partners OEMs (e.g., Toyota) help strengthen its presence with OEMs and global verticals. Continental's strong focus on electric and autonomous architectures of vehicles or purposes means it is uniquely positioned for long-term growth opportunities in next-generation safety and stability technology.

- ZF Friedrichshafen leverages its acquisition of WABCO to provide a strong focus with enhanced heavy-duty rollover prevention integrated with airbrake and chassis control. Utilizing its capabilities in integration with commercial-vehicle dynamics further enhances advanced stability performance. Investments made by ZF Friedrichshafen to develop electrified truck solutions and autonomous truck technology enable ZF Friedrichshafen to innovate truly adaptive, next-generation rollover-prevention systems optimized for current and future commercial vehicle platforms.

Vehicle Rollover Prevention System Industry News

- In March 2024, General Motors announced a strategic partnership with Autoliv to co-develop next-generation rollover protection systems that utilize sensor fusion and artificial intelligence technology. The partnership will initially focus on integrated safety architectures for electric and autonomous vehicle platforms, and the first vehicle platform planned to feature the technology will be GM's premium SUV and full-size pickup truck segments.

- In June 2024, Nissan Motor Company entered into an overarching supply contract with ZF Friedrichshafen for rollover prevention elements and roll rate sensors across its SUV segment. The multi-year agreement includes advanced electronic stability control systems, roll rate sensors, and advanced driver assistance system (ADAS) platforms for the North American and European commercial markets. The partnership's goal is to provide desirable and cost-effective rollover prevention technologies for mass-market vehicle applications.

- In 2024, ZF Friedrichshafen unveiled electric Active Rollover Control (ARC) systems intended for electric vehicle applications. The new systems take battery pack location into consideration, providing improvement to critical vehicle center of gravity and improving rollover characteristics, by providing focused stability control within electric Sport Utility Vehicles (SUVs) and commercial vehicles. Initial offerings will be aimed at electric vehicle markets in Europe and Chinese markets, with plans for North American applications.

- In 2024, KYB Corporation introduced energy efficient Active Rollover Control systems for electric bus applications, specifically addressing the unique stability challenges facing electric commercial vehicles. The systems will integrate with electric vehicle powertrains to provide coordinated stability control in addition to energy consumption impact. Initial offerings will focus on urban transit applications in Japan and Europe.

The vehicle rollover prevention system market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($Mn), volume (Units) from 2021 to 2034, for the following segments:

Market, By System

- Rollover Detection & Warning System

- Active Rollover Prevention Control System

- Roll Stability Control (RSC) System

- Rollover Protection Structure (ROPS)

Market, By Vehicle

- Passenger Vehicles

- Sedan

- Hatchback

- SUV

- Commercial Vehicles

- LCV

- MCV

- HCV

Market, By Component

- Sensors

- Electronic control unit

- Actuators & braking module

- Others

Market, By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Market, By End Use

- Individual Vehicle Owners

- Fleet Operators & Logistics Companies

- Government & Public Transport Agencies

- Industrial & Construction Firms

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Netherlands

- Asia Pacific

- China

- India

- Japan

- ANZ

- Singapore

- Thailand

- Vietnam

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the market size of the vehicle rollover prevention system in 2024?

The market size was USD 6.84 billion in 2024, with a CAGR of 8.4% expected through 2034. The increasing adoption of advanced safety technologies in SUVs, pickups, and commercial trucks is driving market growth.

Who are the key players in the vehicle rollover prevention system industry?

Key players include Bosch, Autoliv, Bendix, Continental, Haldex, Isuzu Motors, MAN Truck & Bus, Maruti Suzuki, and WABCO.

What are the upcoming trends in the vehicle rollover prevention system market?

Trends include AI-driven predictive control, OTA updates, advanced roll-stability systems, and EV-based fast-response architectures.

Which region leads the vehicle rollover prevention system sector?

The United States dominates the market, accounting for 87.3% of regional revenue in 2024, with a valuation of USD 1.89 billion. Growth is propelled by stringent safety regulations and increasing adoption of advanced safety systems.

What is the growth outlook for the passenger automobiles segment from 2025 to 2034?

The passenger automobiles segment is set to expand at a CAGR of 9.3% till 2034, fueled by the rising adoption of SUVs and pickups in the US fleet.

What was the valuation of the sensors segment in 2024?

The sensors segment held a 35.7% market share, valued at USD 2.44 billion in 2024, led by advancements in Micro-Electro-Mechanical Systems (MEMS) technology.

What is the expected size of the vehicle rollover prevention system industry in 2025?

The market size is projected to reach USD 7.27 billion in 2025.

How much revenue did the Roll Stability Control (RSC) Systems segment generate in 2024?

The Roll Stability Control (RSC) Systems segment accounted for 29.4% of the market share in 2024, with a valuation of approximately USD 2.01 billion.

What is the projected value of the vehicle rollover prevention system market by 2034?

The market is poised to reach USD 15.04 billion by 2034, driven by advancements in AI, machine learning, and multi-sensor fusion technologies.

Vehicle Rollover Prevention System Market Scope

Related Reports