Summary

Table of Content

U.S. Over the Counter (OTC) Drugs Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. Over the Counter Drugs Market Size

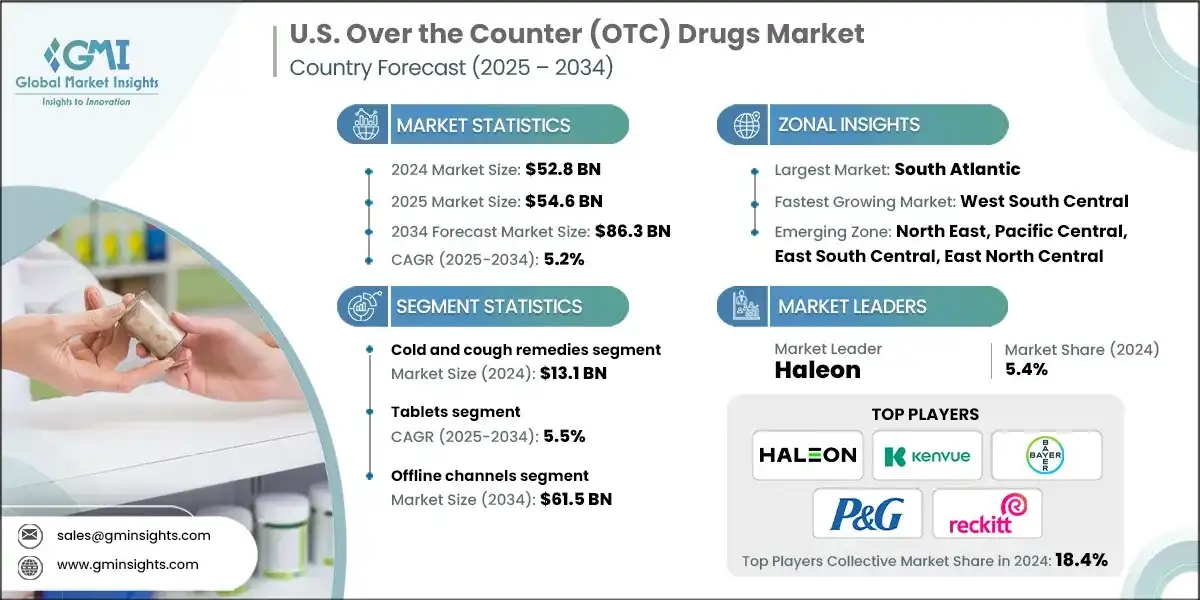

The U.S. over the counter (OTC) drugs market size was estimated at USD 52.8 billion in 2024. The market is expected to grow from USD 54.6 billion in 2025 to USD 86.3 billion in 2034, growing at a CAGR of 5.2% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

This growth is driven by the growing awareness among consumers, convenience, and affordability of OTC drugs over prescription drugs. Another major demographic factor significantly impacting the growth of the U.S. OTC drugs market is the growing geriatric population. For instance, as per the U.S. Census Bureau, in 2023, around 17% of Americans were aged 65 and above, and it is expected to reach 22% by 2050. This substantial growth in aging population underscores a large patient pool with high reliance on OTC drugs for pain, digestive health, and other supplements, thereby driving the market growth.

OTC drugs are medications that can be directly purchased from hospital pharmacies, retail pharmacies, as well as online pharmacies without the need for a doctor’s prescription. These drugs are used for managing various conditions such as pain relief, allergy management, digestive health, dermatological issues, among others. The OTC drugs market is characterized by the presence of several global and domestic pharmaceutical players.

Major players in the market include Haleon, Kenvue, Bayer, Procter & Gamble Company, and Reckitt, accounting for around 15 – 20% of market share. These companies leverage an extensive product portfolio, brand loyalty, strong reputation, and diverse global distribution networks. Continuous research and development activities, consumer-focused formulations, and expanded indications of OTC drug strengthen their dominance in the market.

The U.S. OTC drugs market was valued at USD 49.9 billion in 2021 and witnessed lucrative growth to reach USD 50.3 billion in 2022 and USD 51.4 billion in 2023. During this period, the market growth was driven by the COVID-19 pandemic, which created increased demand for immunity boosters, vitamins, and other supplements. The rising focus on preventive care and the increasing trend to opt for self-medication have further boosted the growth. Moreover, the increased prevalence of seasonal diseases such as cold, cough, and flu increased the acceptance and adoption of cost-effective self-care options, which further propelled the market growth.

Furthermore, a supportive regulatory framework has also played a crucial role in shaping the growth of the U.S. OTC drugs market. The U.S. Food and Drug Administration (FDA) oversees and streamlines regulatory pathways for OTC drug approvals, thereby expanding the availability and accessibility of OTC drugs in the market. Regulations focusing on clear labelling, strong safety standards, and child-resistant packaging further build trust and confidence in consumers. Such favourable regulatory reforms with strict safety monitoring continue to strengthen the growth of the market.

U.S. Over the Counter (OTC) Drugs Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 52.8 Billion |

| Market Size in 2025 | USD 54.6 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.2% |

| Market Size in 2034 | USD 86.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing consumer awareness of self-medication and disease management | Rising health awareness and easy access to information boost OTC drug demand as cost-effective, independent solutions. |

| High cost of prescription drugs leading to a shift towards OTC drugs | Expensive prescriptions push consumers towards affordable OTC alternatives, reducing healthcare costs and driving adoption. |

| Favorable regulatory support for OTC drug approvals | Streamlined FDA pathways and supportive rules speed OTC approvals, expand choices, and foster innovation. |

| Expansion of digital commerce and e-pharmacy platforms | E-commerce enhances OTC accessibility with wider choices, doorstep delivery, and competitive pricing, boosting market growth. |

| Rising prevalence of chronic diseases | Increasing chronic conditions drive steady demand for OTC drugs for long-term symptom relief and management. |

| Pitfalls & Challenges | Impact |

| Concern towards misuse or risk of self-diagnosis | Easy OTC access risks misdiagnosis and misuse, raising safety concerns and stricter regulations. |

| Potential side effects and interactions due to medication | Unsupervised OTC use may cause harmful drug interactions, liability risks, and limit category growth. |

| Opportunities: | Impact |

| Increasing shift towards natural and herbal OTC products | Growing demand for chemical-free remedies enables product innovation, premium pricing, and brand differentiation. |

| Expanding womens health and specialty segments | Rising focus on reproductive and hormonal care drives demand for targeted OTC solutions and niche markets. |

| Market Leaders (2024) | |

| Market Leaders |

5.4% |

| Top Players |

Collective market share in 2024 is 18.4% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | South Atlantic |

| Fastest Growing Market | West South Central |

| Emerging Zones | North East, Pacific Central, East South Central, East North Central |

| Future outlook |

|

What are the growth opportunities in this market?

U.S. Over the Counter Drugs Market Trends

- A major trend shaping the U.S. OTC drugs industry is the growing acceptance of self-care culture and consumer-driven healthcare. As health awareness among the population grows, consumers are proactively investing in managing minor ailments and basic health requirements without relying on healthcare professionals.

- Additionally, increased accessibility and availability of digital health information, wellness blogs, and telehealth consultations facilitate consumers to quickly identify and manage simple conditions and choose appropriate OTC drug options available.

- Urbanization and lifestyle changes have reinforced this trend, where convenience, affordability of OTC drugs, and a growing shift towards making independent healthcare decisions accelerate the OTC uptake.

- Furthermore, another trend influencing the growth of this market is the rising cost of prescription drugs. This trend is promoting consumers to seek cost-effective alternatives, leading to a shift towards OTC drugs. For managing health conditions such as allergies, acute pain, cold and cough, consumers are increasingly opting for OTC drugs, avoiding the expensive prescription medicines.

- For instance, in 2021, the U.S. spending on prescription medicines was approximated at USD 603 billion. This spending was anticipated to grow to 2% in 2023 and 10% to 12% in 2024, as estimated by American Journal of Health-System Pharmacy. Thus, such high spending on prescription drugs has led to an increase in the financial burden on consumers. This has resulted in increased shift of consumers towards OTC drugs, thereby fueling the market growth.

- Furthermore, advances in product development are another trend propelling the growth of this market. Manufacturers are increasingly investing in introducing new formulations, dosage forms, and delivery mechanisms such as sprays, herbal medicinal products, and dissolvable tablets to cater for the growing consumer preferences.

- Moreover, the development of natural and herbal products for specific categories like digestive health, sleep aids, and immune boosters is appealing to consumers seeking chemical-free solutions. This trend is thereby driving the adoption of herbal or natural OTC drugs in the market.

U.S. Over the Counter Drugs Market Analysis

Learn more about the key segments shaping this market

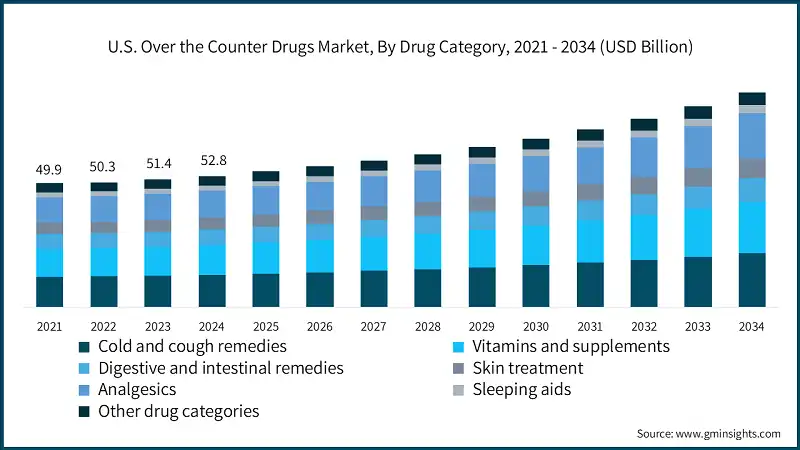

The U.S. over the counter drugs market was valued at USD 49.9 billion and USD 50.3 billion in 2021 and 2022, respectively. The market size reached USD 52.8 billion in 2024, growing from USD 51.4 billion in 2023.

Based on the drug category, the U.S. market is segmented into cold and cough remedies, vitamins and supplements, digestive and intestinal remedies, skin treatment, analgesics, sleeping aids, and other drug categories. The cold and cough remedies segment dominated the market and was valued at USD 13.1 billion in 2024, driven by the high prevalence of respiratory infections. On the other hand, the vitamins and supplements segment accounted for the second-largest market share of 22.7% in 2024.

- Growing consumer emphasis on nutritional intervention and immune modulation has led to a systematic incorporation of vitamins, minerals, and dietary supplements into daily routines.

- Their widespread availability in various formulations such as gummies, soft gels, and plant-based supplements has driven their adoption by diverse age groups.

- The prevalence of cold and cough resulting from seasonal flu outbreaks, changing weather patterns, and viral infections has driven demand for products that provide quick relief from symptoms such as nasal congestion, sore throat, and cough.

- As these conditions are frequent and often self-limiting, consumers prefer OTC drugs instead of visiting hospitals and clinics.

Learn more about the key segments shaping this market

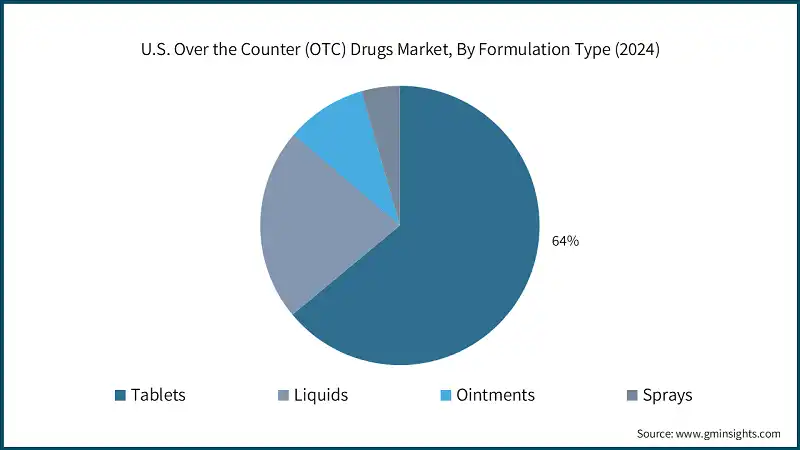

Based on the formulation type, the U.S. over the counter drugs market is bifurcated into tablets, liquids, ointments, and sprays. The tablets segment dominated the market with 64% market share in 2024 and is expected to grow at a 5.5% CAGR.

- High growth of the tablets segment is attributable to the advantages it offers, such as easy storage, precise dosing, and longer shelf life, making them an attractive form for consumers seeking self-administered solutions.

- Furthermore, the broad therapeutic coverage offered by tablets drives their growth in the U.S. OTC drugs market. Most high-demand OTC drug tablets include pain relievers, cold and flu remedies, antacids, and allergy medications. This high versatility, combined with the availability of branded and generic drugs, further solidifies their dominant position in the market.

- On the other hand, the liquid segment held second second-largest market share of 22.3% in 2024. The growth is primarily driven by the ease of administration for a wide range of consumers, including children, elderly patients, and patients with swallowing issues.

- Additionally, continuous efforts of manufacturers in innovating the product and flavor enhancements that improve the palatability of the drugs further support the growth of this segment.

Based on the distribution channel, the U.S. over the counter (OTC) drugs market is segmented into online channels and offline channels. The offline channels segment dominated the market in 2024 and is expected to reach USD 61.5 billion by 2034. The offline channels segment is sub-segmented into hospital pharmacies, retail pharmacies, and other offline channels.

- The high consumer preference for traditional pharmacies and physical stores stems from in-person interactions with pharmacists, who offer guidance and product recommendations. This builds trust and confidence among the consumers, further influencing their purchasing decisions and contributing to the growth of offline channels.

- Additionally, well-established retail pharmacy chains ensure product accessibility across both urban and rural areas, making OTC drugs available for the large and diverse population, further supporting the growth.

- On the other hand, the online channels segment accounted for USD 14.4 billion in 2024, due to the increasing preference of consumers for online channels owing to their convenience, wide product variety, doorstep delivery, and competitive pricing.

Looking for region specific data?

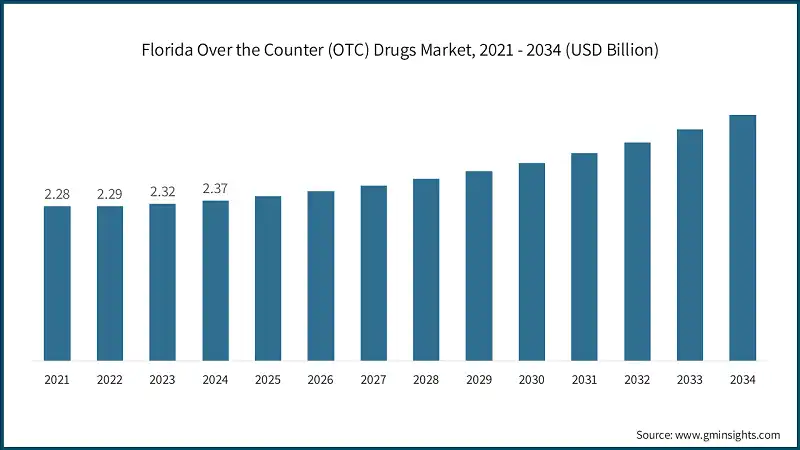

South Atlantic Over the Counter Drugs Market The South Atlantic zone dominated the U.S. market with a market share of 23.5% in 2024. The Florida over the counter drugs market was valued at USD 2.28 billion and USD 2.29 billion in 2021 and 2022, respectively. The market size reached USD 2.37 billion in 2024, growing from USD 2.32 billion in 2023. Georgia over the counter drugs market is anticipated to witness considerable growth over the analysis period. Pacific Central zone of the U.S. was valued at USD 8.9 billion in 2024 and is anticipated to witness significant growth over the analysis period. The U.S. OTC drugs industry is fragmented in nature, with the presence of both leading global players as well as local and regional players. The top 5 players, such as Haleon, Kenvue, Bayer, Procter & Gamble Company, and Reckitt, hold 18.4% of the U.S. market share. The key companies are focused on offering a wide range of OTC drugs across therapeutic categories such as analgesics, cold and cough remedies, digestive health remedies, skin treatment and other categories. Additionally, strategic partnerships with retail chains, e-commerce platforms, and healthcare professionals are improving accessibility and building consumer trust. Many companies are also increasing investments in research and development to create safer, more effective OTC products with fewer side effects. Efforts to expand access in underserved regions and improve affordability further underscore the market’s shift toward global inclusivity, preventive care, and personalized wellness. Few of the prominent players operating in the U.S. over the counter (OTC) drugs industry include: Haleon holds a leading position in the U.S. OTC drugs market with ~5.4% market share in 2024, leveraging its strong portfolio of trusted brands across pain relief, respiratory health, digestive care, and vitamins and minerals, including Panadol, Voltaren, Advil, Centrum, and Tums. In 2024, the company reinforced its leadership by expanding its presence in high-growth regions such as Asia-Pacific and Latin America, while maintaining strong positions in North America and Europe. Its continued investment in research and product development ensures competitive differentiation, while its broad distribution network strengthens its visibility and accessibility in the highly competitive OTC segment. Kenvue holds a growing position in the U.S. OTC drugs market, driven by its portfolio of iconic brands such as Tylenol, Motrin, and Zyrtec. The company also introduced next-generation OTC formulations, such as Tylenol+ with added immune support, and expanded its product line to include natural alternatives. These innovations reflect Kenvue’s commitment to evidence-based product development and responsiveness to evolving consumer preferences. Bayer is one of the leading players in the U.S. OTC drugs market, driven by trusted brands and a commitment to advancing self-care. With a portfolio that includes widely recognized names such as Aspirin, Claritin, and Canesten, Bayer has positioned itself as a key player in therapeutic areas including pain relief, allergy management, dermatology, digestive health, and cardiovascular support.U.S. Over the Counter Drugs Market Share

U.S. Over the Counter Drugs Market Companies

U.S. Over the Counter Drugs Industry News:

The U.S. over the counter (OTC) drugs market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Drug Category

- Cold and cough remedies

- Vitamins and supplements

- Digestive and intestinal remedies

- Skin treatment

- Analgesics

- Sleeping aids

- Other drug categories

Market, By Formulation Type

- Tablets

- Liquids

- Ointments

- Sprays

Market, By Distribution Channel

- Online channels

- Offline channels

- Hospital pharmacies

- Retail pharmacies

- Other offline channels

The above information is provided for the following zones:

- North East

- Connecticut

- Maine

- Massachusetts

- New Hampshire

- Rhode Island

- Vermont

- New Jersey

- New York

- Pennsylvania

- East North Central

- Wisconsin

- Michigan

- Illinois

- Indiana

- Ohio

- West North Central

- North Dakota

- South Dakota

- Nebraska

- Kansas

- Minnesota

- Iowa

- Missouri

- South Atlantic

- Delaware

- Maryland

- District of Columbia

- Virginia

- West Virginia

- North Carolina

- South Carolina

- Georgia

- Florida

- East South Central

- Kentucky

- Tennessee

- Mississippi

- Alabama

- West South Central

- Oklahoma

- Texas

- Arkansas

- Louisiana

- Mountain States

- Idaho

- Montana

- Wyoming

- Nevada

- Utah

- Colorado

- Arizona

- New Mexico

- Pacific Central

- California

- Alaska

- Hawaii

- Oregon

- Washington

Frequently Asked Question(FAQ) :

Who are the key players in the U.S. OTC drugs industry?

Key players include Abbott Laboratories, Alkem Laboratories, Bayer, Cipla, Dr. Reddy’s Laboratories, Kenvue, Perrigo Company, Piramal Pharma, Procter & Gamble Company, Reckitt, and Sanofi.

What are the upcoming trends in the U.S. OTC drugs market?

Trends include the growing adoption of herbal and natural products, advancements in product formulations and delivery mechanisms, and increased consumer reliance on digital health resources for self-care.

Which region leads the U.S. over-the-counter (OTC) drugs sector?

Florida leads with a market size of USD 2.37 billion in 2024. The growth is propelled by the state's aging population and their preference for cost-effective OTC drugs to manage chronic conditions like joint pain and allergies.

What is the growth outlook for the offline channels segment from 2025 to 2034?

The offline channels segment is expected to reach USD 61.5 billion by 2034.

What was the market share of the tablets segment in 2024?

The tablets segment dominated the market with a 64% share in 2024 and is expected to witness over 5.5% CAGR till 2034.

What is the expected size of the U.S. OTC drugs market in 2025?

The market size is projected to reach USD 54.6 billion in 2025.

How much revenue did the cold and cough remedies segment generate in 2024?

The cold and cough remedies segment generated approximately USD 13.1 billion in 2024, led by the high prevalence of respiratory infections.

What is the projected value of the U.S. OTC drugs market by 2034?

The market is poised to reach USD 86.3 billion by 2034, fueled by rising demand for self-care, cost-effective alternatives to prescription drugs, and product innovations.

What is the market size of the U.S. over-the-counter drugs in 2024?

The market size was USD 52.8 billion in 2024, with a CAGR of 5.2% expected through 2034. The market growth is driven by increasing consumer awareness, convenience, and the affordability of OTC drugs compared to prescription medications.

U.S. Over the Counter (OTC) Drugs Market Scope

Related Reports