Summary

Table of Content

Stretchable Electronics for Wearables Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Stretchable Electronics for Wearables Market Size

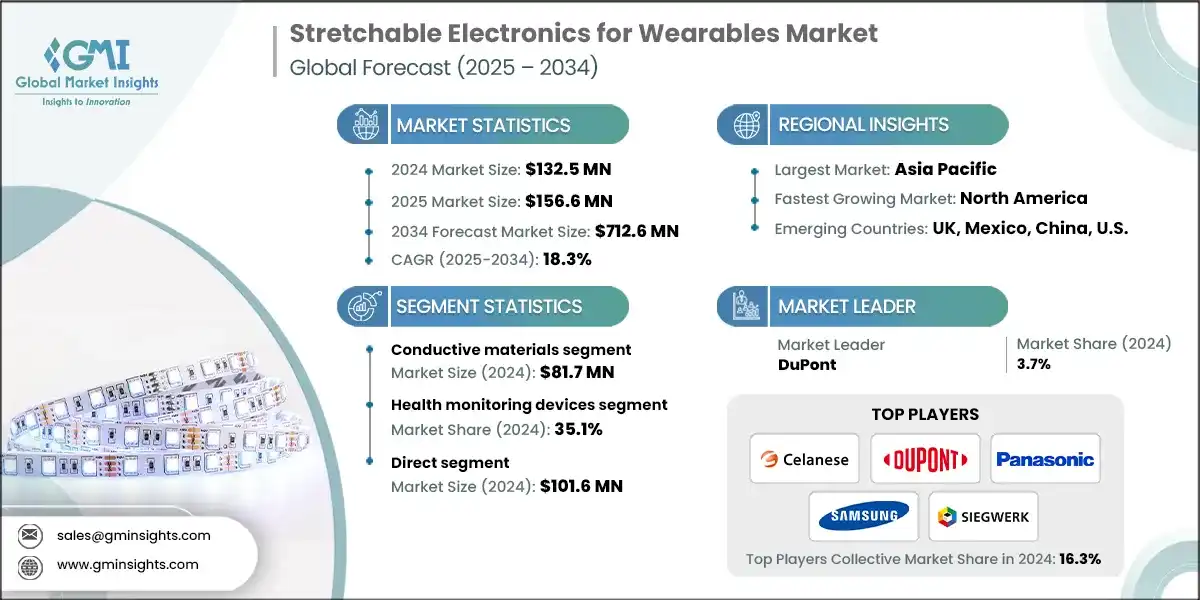

The global stretchable electronics for wearables market size was estimated at USD 132.5 million in 2024. The market is expected to grow from USD 156.6 million in 2025 to USD 712.6 million in 2034, at a CAGR of 18.3% according to latest report published by Global Market Insights Inc.

To get key market trends

The stretchable electronics market for wearables is rapidly emerging as a transformative segment within the broader flexible electronics and smart textiles industry.

One of the primary drivers of this marketplace expansion is the demand among consumers and medical professionals for non-invasive, real-time health information.

Stretchable electronics can measure critical signs of health, such as heart rate, hydration status, muscle activity, and blood oxygenation level. In a report by the World Health Organization, the estimated worldwide population aged over 60 years will reach around 2.1 billion by the year 2050 indicating a need for advanced solutions for better health monitoring. These devices are immensely critical in caring for the elderly, chronic health management, and sports performance. In other words, wearable technologies with stretchable sensors could enable continuous heart activity monitoring, with future potentials of enhancing preventative care in heart disease. These devices will increasingly be wirelessly connected with the internet of things (IoT) to transmit health information for use in both consumer- and provider-based healthcare.

Advances in material science are improving stretchable electronics in terms of performance and durability. Recent innovations in conductive polymers, nanomaterials, and unique substrates are increasing the flexibility and efficiency of these devices. For instance, researchers at Stanford University created an electrically conductive polymer that maintains conductivity when expanded to 200% of its original size. Finding these types of improvements are allowing designers to make devices that function well and are aesthetically pleasing.

Stretchable Electronics for Wearables Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 132.5 Million |

| Market Size in 2025 | USD 156.6 Million |

| Forecast Period 2025 - 2034 CAGR | 18.3% |

| Market Size in 2034 | USD 712.6 Million |

| Key Market Trends | |

| Drivers | Impact |

| Advancements in material science | Innovations in flexible substrates, conductive polymers, and nanomaterials are enabling electronics that can bend, stretch, and conform to the human body—making wearables more comfortable, durable, and functional. |

| Rising demand for health monitoring | The surge in health-conscious consumers and aging populations is driving demand for wearables that offer real-time biometric tracking. Stretchable electronics allow for more accurate and continuous monitoring of vitals like heart rate, hydration, and muscle activity. |

| Integration with IoT ecosystems | Stretchable electronics are increasingly being designed to work seamlessly with IoT platforms, enabling data sharing, remote diagnostics, and personalized feedback—enhancing the value proposition of wearable devices. |

| Pitfalls & Challenges | Impact |

| Manufacturing complexity and cost | Producing stretchable electronics at scale remains technically challenging and expensive, especially when balancing flexibility with performance and durability. |

| Reliability and long-term stability | Ensuring consistent performance under repeated mechanical stress (stretching, bending, twisting) is a major hurdle, particularly for applications requiring long-term wear or exposure to environmental factors. |

| Opportunities: | Impact |

| Expansion into medical and rehabilitation sectors | Stretchable electronics have strong potential in clinical settings, such as smart bandages, prosthetics, and rehabilitation wearables, offering non-invasive, continuous monitoring and feedback. |

| Sustainable and biodegradable electronics | With growing environmental concerns, there is an opportunity to develop stretchable electronics using eco-friendly materials that reduce e-waste and support circular design principles. |

| Market Leaders (2024) | |

| Market Leaders |

3.7% market share |

| Top Players |

The collective market share in 2024 is 16.3% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | UK, Mexico, China, U.S. |

| Future outlook |

|

What are the growth opportunities in this market?

Stretchable Electronics for Wearables Market Trends

There is a growing trend toward using biocompatible and breathable materials that can safely interact with human skin over extended periods.

- These materials help prevent skin irritation and make wearables more comfortable, which is especially helpful for medical and fitness uses. This change is supporting long-term health tracking and making wearables more useful in clinical testing and patient recovery.

- Stretchable electronics are now being made to perform many sensing tasks at the same time, like measuring temperature, body water levels, movement, and heart rate, all in one device. This ability to do multiple things at once makes wearables more valuable, so people can track several health factors without needing different devices

- Wearable electronic devices are being infused with AI to assist with forecasting health issues and monitoring health sensors as the data is recorded.

- AI also allows for early alerts for health issues, meaningful feedback based on users' health data, and ongoing and real-time assistance. The synergy of stretchable electronics and AI is making wearables increasingly dynamic and valuable in meeting health-driven needs.

- Environmental sustainability is also more important now, as makers explore materials that are biodegradable or recyclable. This resolves the increasing problem of e-waste and gives consumers options that reflect an increasing desire for products that are more planet-friendly, especially in lifestyle and health.

- Stretchable electronics are now applied for uses beyond the traditional wearables including soft robotics, and smart clothing. This next generation of stretchable electronics can move freely and respond to stimuli, creating new areas of growth that include assistive technology for people with disabilities, fashion technology, and smart clothing that will respond to the user.

- Much of the motivation is about having wireless, power-efficient stretchable electronics that do not have heavy, bulky batteries. The increased capability to gather energy and utilize flexible energy sources is helping to make wearables less invasive, lighter, and usable for more extended periods without needing to charge.

Stretchable Electronics for Wearables Market Analysis

Learn more about the key segments shaping this market

Based on type, the market is divided into conductive materials and substrate technologies. In 2024, conductive materials held the major market share, generating a revenue of USD 81.7 million.

- To accomplish necessary functionalities like signal transmission, sensing, or power delivery for wearable applications, stretchable electronics depend on conductive materials. Conductive materials, such as silver nanowires, graphene, carbon nanotubes, or conducting polymers specifically provide excellent flexibility, conductivity, and/or biocompatibility for a number of applications.

- This is especially important for wearables intended to remain in contact with the body for an extended period such as fitness bands, medical monitoring devices, and smart textiles. A report from the National Institute of Standards and Technology (NIST) predicts a global market for conductive materials in the wearables electronics market will grow 12.5% compound rate from 2024-2029, based on advances in material science and the adoption of wearable technologies.

- Ongoing research and development efforts are further enhancing the performance of conductive materials. Innovations are focused on improving conductivity while minimizing material fatigue, which significantly extends the lifespan and reliability of wearable devices.

- Another significant aspect driving the interest of conductive materials is how flexible conductive materials can be manufactured and incorporated into diverse form factors for wearables (i.e., skin patches; smart textiles; even eventually onto an implantable biosensor). With the healthcare sector, conductive materials are being created to support new kinds of biosensors to measure and report on vital signs including heart rate; even monitoring your blood glucose level while you eat your lunch. The World Health Organization (2022) supports the global expansion of wearable medical devices and estimates the wearable medical device industry will be worth USD 46 billion in revenues by 2025. As such, conductive materials are becoming ever more important and precious to the healthcare ecosystem, especially in monitoring aspects.

- Substrate technology is also rapidly advancing and keeping pace with the needs and specifications that stretchable electronics have in terms of mechanical and functional requirements. For example, substrates are becoming flexible, especially with respect to elasticity, durability, and skin compatibility. There are flexible polymers that have become popular and useful for stretchable electronics including thermoplastic polyurethanes (TPU), silicone elastomers, and biodegradable polymers that have emerged as the ideal material to support or provide support for conductive materials.

Learn more about the key segments shaping this market

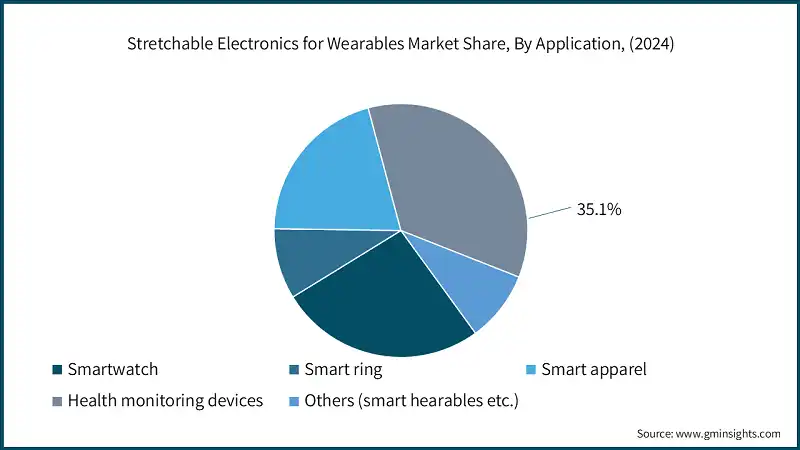

Based on application, the stretchable electronics for wearables market is segmented into smartwatch, smart ring, smart apparel, health monitoring devices and others (smart hearables etc.). The health monitoring devices segment held the largest share, accounting for 35.1% of the global market in 2024.

- Diagnostics or monitoring of health through health monitoring wearables, which may include smart textiles, skin patches and/or biosensors, all incorporate high quality stretchable sensors to accurately measure key health and wellness parameters, such as heart rate, breathing, hydration levels and muscle activity. Their stretchable sensors allow them to conform to the human body and obtain accurate readings in motion, making them highly desirable for longer term monitoring in clinical, fitness or wellness environments. The World Health Organisation (WHO) has estimated that chronic diseases count for 71% of death worldwide. per 100 World Health Organisation (WHO, 2021). This emphasizes the need for innovative approaches, including wearable health monitors, which can promote health and passive monitoring and early disease intervention if required.

- Additionally, the growing aging demographic across the globe, estimated to reach 1.4 billion by 2030 (United Nations), only exacerbates the demand for personalized and preventative health components.

- Health monitoring wearables will be further encouraged by global health systems shifting to value based patient care and the highest standard of care, including early intervention. The growth of telehealth in the U.S., with an increase in usage of more than 50% in 2023 (American Telehealth Association, 2023), will only serve to illustrate the movement toward wearable technologies for holistic and effective care in health care delivery.

- Smartwatches, on the other hand, represent a key growth area within the stretchable electronics ecosystem, evolving from basic fitness trackers to multifunctional health hubs. For example, Apple’s latest smartwatch models incorporate advanced health sensors capable of detecting atrial fibrillation and monitoring blood oxygen levels, showcasing the potential of wearable technology in preventive healthcare.

Based on the distribution channel, the stretchable electronics for wearables market is segmented into direct and indirect. In 2024, direct segment held a major market share, generating a revenue of USD 101.6 million.

- Direct channels brand websites, flagship stores, and brand-exclusive apps—are the predominant distribution channel for wearables in the stretchable electronics space as they allow for branded experiences and have control over brand experience, pricing, and engagement.

- Direct channels also allow manufacturers to showcase innovations, convey the health benefits of stretchy electronics, and gain real-time feedback. As the practice of stretchable electronics migrates into upper mainstream adoption and within clinical practice, indirect channels are gaining traction. Indirect channels provide access to a larger customer footprint nationally and internationally, especially for regions where brands do not have a direct presence.

Looking for region specific data?

North America Stretchable Electronics for Wearables market

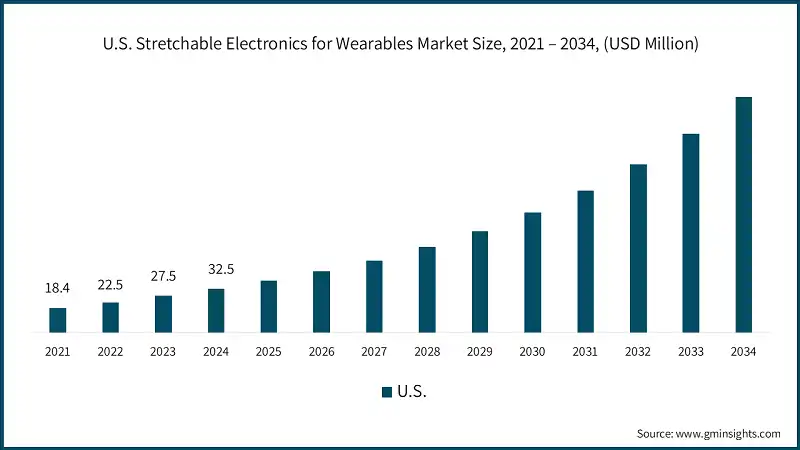

In 2024, the U.S. dominated the North America market, accounting for around 81.6% and generating around USD 32.5 million revenue in the same year.

- North America remains a leading market for stretchable electronics in wearables, driven by strong demand for health monitoring, fitness tracking, and consumer tech innovation. The region benefits from advanced R&D infrastructure, a robust startup ecosystem, and high consumer awareness of wearable technologies.

- Major players in the U.S. are actively integrating stretchable components into smartwatches, skin patches, and medical-grade wearables. The presence of tech giants and healthcare innovators, along with supportive regulatory frameworks, continues to fuel growth and commercialization of next-gen wearable solutions.

Europe Stretchable Electronics for Wearables market

Europe market, Germany leads the market with 19.1% share in 2024 and is expected to grow at 18.9% during the forecast period.

- Europe’s stretchable electronics market is shaped by its emphasis on sustainability, healthcare innovation, and stringent product standards. The region is investing heavily in smart textiles and bio-integrated wearables, particularly for elderly care and rehabilitation. EU-funded research initiatives and collaborations between academia and industry are accelerating the development of eco-friendly, high-performance stretchable devices.

- Countries like Germany, France, and the Nordics are leading in both technological advancement and ethical manufacturing, making Europe a hub for responsible innovation in wearable electronics.

Asia Pacific Stretchable Electronics for Wearables market

The Asia Pacific leads the market; China leads with market share of around 32.1% in 2024 and is anticipated to grow with a CAGR of around 19% from 2025 to 2034.

- Asia-Pacific is the fastest-growing region for stretchable electronics in wearables, fueled by rapid urbanization, rising disposable incomes, and a tech-savvy population. Countries like South Korea, Japan, and China are at the forefront of integrating stretchable sensors into consumer electronics, smart clothing, and healthcare devices.

- The region’s strong manufacturing base and government support for digital health and innovation are driving large-scale adoption. Additionally, cultural interest in wellness and beauty tech is expanding the application of stretchable electronics beyond traditional fitness and medical domains.

Middle East and Africa Stretchable Electronics for Wearables market

Middle East and Africa markets are growing at a CAGR of 17.4% during the forecast period.

- The MEA region is gradually emerging as a promising market for stretchable electronics, particularly in healthcare and wellness applications. While infrastructure and manufacturing capabilities are still developing, rising investments in digital health, smart cities, and wearable tech are creating new opportunities.

- Countries like the UAE and Saudi Arabia are leading regional adoption through innovation hubs and government-backed initiatives. The market is also seeing increased interest in wearable solutions for chronic disease management and remote diagnostics, especially in underserved areas.

Stretchable Electronics for Wearables Market Share

DuPont are leading with 3.7% market share. Celanese, DuPont, Panasonic, Samsung Electronics, Siegwerk collectively hold around 16.3%, indicating fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Celanese has carved a strong position in the wearable electronics space through its Intexar line of stretchable, washable inks and films, which have been widely adopted in smart garments since 2018. Its competitive edge lies in combining material science expertise with market responsiveness, enabling it to develop solutions tailored to evolving fitness and healthcare needs.

- DuPont’s legacy in textile innovation having introduced Nylon, Lycra, and Kevlar gives it a unique advantage in wearable electronics. Its suite of stretchable electronic inks, including conductors and encapsulants, is designed for smart clothing applications that are thin, washable up to 100 cycles, and stable under strain.

Stretchable Electronics for Wearables Market Companies

Major players operating in the stretchable electronics for wearables industry are:

- Bone Health Technologies

- Celanese

- DuPont

- Dycotec

- Electroninks

- Medidata Solutions

- NextFlex

- Panasonic

- Polyera Corporation

- Pragmatic Semiconductor

- Samsung Electronics

- Siegwerk

- StretchSense

- Xsensio

- Yamaichi Electronics

Panasonic’s competitive edge lies in its Copper Clad Stretch (CCS) substrate technology, which addresses the limitations of traditional PCBs in wearable applications. CCS offers exceptional flexibility, heat resistance, and mechanical durability, making it suitable for next-gen wearables and 6G communication systems.

Samsung stands out for its integration of AI and advanced sensor technologies into wearable devices. Its smartwatches now feature world-first LVSD detection capabilities, enabling early diagnosis of heart failure through AI-powered ECG analysis. Samsung also leads in brain-computer interface (BCI) innovation, with wearable EEG prototypes that offer real-time mental state monitoring.

Siegwerk’s strength lies in its expertise in functional inks and coatings, particularly for sustainable and stretchable applications. The company offers customized conductive inks and encapsulants that support flexible electronics and printed sensors in wearables.

Stretchable Electronics for Wearables Industry News

- In September 2025, at the K 2025 trade show, Celanese unveiled its AI-powered Chemille Digital Assistant, designed to accelerate material selection for wearable and stretchable electronics. The company also showcased new washable stretchable inks and films under its Intexar line, and introduced sustainable materials like POM ECO-C and Forton PPS ECO-R, aligning with global sustainability goals in wearable tech.

- In September 2025, DuPont continued to lead in stretchable conductive inks, launching new formulations for automotive and wearable applications. The company’s materials are now used in smart clothing prototypes that are washable up to 100 cycles and stable under strain.

- In May 2024, Stanford’s Bao Group made headlines with a breakthrough in skin-like stretchable integrated circuits. Their modern design enables circuits that are five times smaller and 1,000 times faster than previous versions, capable of driving micro-LEDs and detecting Braille with fingertip sensitivity.

- In January 2024, Bone Health Technologies received FDA clearance for its wearable device Osteoboost, the first non-pharmacological treatment for osteopenia in postmenopausal women. The device delivers targeted vibration therapy to the hips and spine, showing remarkable results in slowing bone density loss. It was also granted Breakthrough Device Designation.

The stretchable electronics for wearables market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, by Type

- Conductive materials

- Conductive polymers

- Stretchable conductive inks

- Liquid metal systems

- Nanomaterial-enhanced conductors

- Substrate technologies

- Elastomeric substrates

- Textile substrates

- Hybrid substrates

- Electronic components

Market, by Application

- Smartwatch

- Smart ring

- Smart apparel

- Health monitoring devices

- Others (smart hearables etc.)

Market, by Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the projected market value of the market by 2034?

The market is expected to reach USD 712.6 million by 2034, growing at a CAGR of 18.3%, fueled by innovations in conductive polymers, integration with IoT ecosystems, and expanding applications in healthcare and sports wearables.

What is the estimated market size of the market in 2025?

The market is projected to reach USD 156.6 million in 2025, supported by the adoption of flexible and biocompatible materials, and rising use in medical and fitness monitoring applications.

Which segment dominated the stretchable electronics for wearables market by type in 2024?

The conductive materials segment dominated the market in 2024, generating USD 81.7 million revenue, due to its essential role in enabling flexibility, conductivity, and biocompatibility in wearable devices.

Which application segment led the stretchable electronics for wearables market in 2024?

The health monitoring devices segment led the market with 35.1% share in 2024, driven by increasing demand for continuous and accurate vital tracking in clinical and fitness environments.

Which distribution channel generated the highest revenue in 2024?

The direct distribution channel dominated the market with USD 101.6 million revenue in 2024, owing to the strong presence of brand websites, flagship stores, and direct-to-consumer sales.

Which region leads the stretchable electronics for wearables industry?

The Asia Pacific region led the global market in 2024, with China holding a 32.1% share, driven by strong manufacturing capabilities, tech innovation, and expanding consumer adoption in healthcare and lifestyle electronics.

Who are the key players in the stretchable electronics for wearables market?

Key players include Celanese, DuPont, Panasonic, Samsung Electronics, Siegwerk, Bone Health Technologies, Dycotec, Electroninks, NextFlex, Medidata Solutions, Polyera Corporation, Pragmatic Semiconductor, StretchSense, Xsensio, and Yamaichi Electronics.

What is the market size of the stretchable electronics for wearables market in 2024?

The market size was USD 132.5 million in 2024, driven by the growing demand for non-invasive, real-time health monitoring and advancements in material science enabling flexible and durable devices.

Stretchable Electronics for Wearables Market Scope

Related Reports