Summary

Table of Content

Spinal Fusion Device Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Spinal Fusion Device Market Size

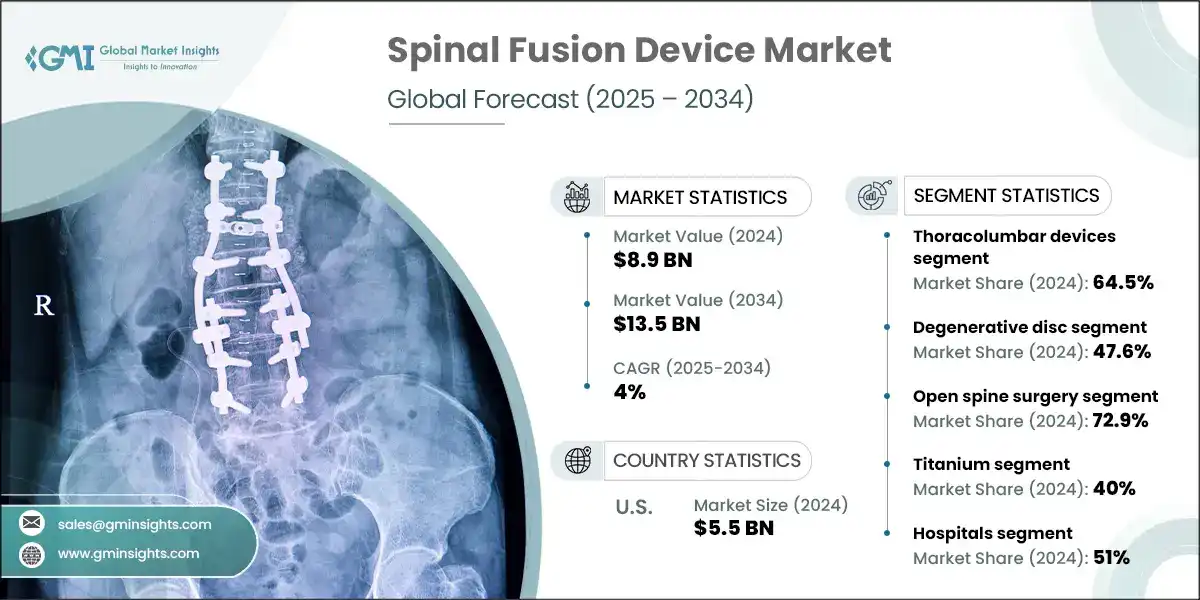

The global spinal fusion device market was estimated at USD 8.9 billion in 2024. The market is expected to grow from USD 9.5 billion in 2025 to USD 13.5 billion in 2034, growing at a CAGR of 4%. The spinal fusion devices market is growing due to the increasing incidence of spinal disorders, growing target patients, and sustained research and development funds by public and private divisions to innovate fusion techniques. However, limited reimbursement policies in emerging markets remain a substantial barrier to full market potential over the next decade.

To get key market trends

The market reached from USD 6.8 billion in 2021 to USD 8.4 billion in 2023, registering a negative CAGR of 10.7% during this period. This development was primarily driven by the growing prevalence of chronic diseases such as cancer, diabetes and autoimmune disorders, which require long-term and large-volume drug delivery. Additionally, growing patient preference for home-based treatment, developments in biologic drugs, and the shift toward self-administration solutions contributed significantly to the acceptance of wearable injectors across healthcare systems worldwide.

The spinal fusion device market is pushed by several key drivers that underscore its strong growth trajectory. First, the cumulative prevalence of spinal disorders such as spinal stenosis, degenerative disc disease, and traumatic injuries, driven by aging populations, inactive lifestyles, and growing obesity rates, has strengthened demand for fusion procedures. Second, rapid technological developments are transforming the field: integration of robotic-assisted surgery (e.g., Medtronic’s Mazor X Stealth Edition), real-time navigation systems, computer-assisted navigation, and intraoperative imaging enhance surgical precision, cut complication rates, and improve patient outcomes.

Third, the rising shift toward minimally invasive spinal fusion, supported by dedicated instrumentation and enhanced pain management protocols, enables procedures in ambulatory surgery and outpatient settings, dropping hospital stays and healthcare expenses. Additionally, the growth of personalized medicine through patient-specific implants is restructuring care: 3D printed custom cages demonstrate significant reductions in subsidence risk up to 91% in osteopenic patients while additive manufacturing of flexible pedicle screws and topology-optimized implants are nearing clinical feasibility.

Lastly, promising reimbursement policies, strategic partnerships, and improved hospital investments in spine centers further foster market expansion. For example, GE Healthcare and DePuy Synthes (part of Johnson & Johnson) are cooperating to bring GE Healthcare's OEC 3D imaging system to more spine practices. This partnership aims to enhance surgical precision and efficiency in spine procedures by providing surgeons with high-quality intraoperative 3D imaging and 2D high-definition images. Collectively, these factors epidemiological trends, innovation, care delivery shifts, personalization, and financial support are accelerating adoption and driving sustainable growth in the spinal fusion device market.

A spinal fusion device is a medical implant used to permanently join two or more vertebrae in the spine, eliminating motion between them. These devices, such as rods, screws, cages, and plates, stabilize the spine and support bone growth, often used in treating conditions like degenerative disc disease, spinal deformities, or traumatic spinal injuries.

Spinal Fusion Device Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 8.9 Billion |

| Forecast Period 2025 – 2034 CAGR | 4% |

| Market Size in 2034 | USD 13.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing prevalence of spinal diseases | Rising cases of degenerative disc disease and deformities are driving consistent demand for spinal fusion devices. |

| Technological advancements | Innovations like 3D-printed implants and robotics are improving outcomes, boosting adoption among surgeons and hospitals. |

| Rise in number of trauma and injury cases | Growing spinal injuries from accidents and falls are increasing the volume of spinal fusion procedures globally. |

| Rising geriatric population coupled with high demand for minimally invasive procedures | Aging demographics prefer low-risk, minimally invasive solutions, accelerating the shift toward advanced spinal fusion technologies. |

| Pitfalls & Challenges | Impact |

| Stringent regulatory scenario | Complex approval processes delay product launches and limit entry of innovative devices into several regional markets. |

| High cost of spinal procedures | Expensive implants and surgical technologies restrict access in low-income settings, reducing overall market reach. |

| Opportunities: | Impact |

| Growth of ambulatory surgical centers (ASCs) | Rising ASC adoption will expand outpatient spinal procedures, lower costs and increasing procedural volumes. |

| Increasing adoption of robotic and navigation-assisted surgery | Advanced systems will enhance surgical accuracy, reduce revision rates, and drive higher market value long term. |

| Market Leaders (2024) | |

| Market Leaders |

27.1% market share |

| Top Players |

Collective Market Share in 2024 is 71.3% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, Indonesia, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Spinal Fusion Device Market Trends

The market is observing a dynamic shift influenced by amalgamation of macro and micro trends that are redesigning the landscape. At the macro level, the global rise in spinal conditions due to aging populations, rising road traffic accidents, and inactive lifestyles is creating constant demand for spinal fusion surgeries.

- Furthermore, the healthcare sector’s pivot toward value-based care and minimally invasive procedures is fostering the acceptance of innovative spinal implants and surgical systems that reduce recovery times and improve patient outcomes. On the micro level, patient-specific methods and surgeon preferences are driving demand for customizable and anatomically adaptive fusion systems.

- Technological innovations are central to current market trends robotic-assisted surgery, real-time navigation, and AI-driven surgical planning are gaining prominence. For example, Medtronic’s Mazor X Stealth Edition and Globus Medical’s ExcelsiusGPS are revolutionizing precision and workflow efficiency.

- Next-gen spinal fusion devices are increasingly 3D-printed, lightweight, and designed with porous structures to encourage osseointegration and faster bone healing. Regulatory bodies like the FDA are actively streamlining approvals for innovative devices, including fast-track pathways for devices with breakthrough designation, which is encouraging research and development investments.

- Manufacturing trends include the growing use of additive manufacturing, biocompatible polymer-metal hybrids, and smart implants embedded with sensors for post-operative monitoring. Companies are also focusing on modular systems that simplify inventory management and surgical adaptability. Moreover, sustainability initiatives are beginning to influence packaging and device sterilization methods.

- Product evolution is marked by a shift from rigid, bulky hardware to more refined, minimally invasive, motion-preserving devices with enhanced biomechanical compatibility.

- Overall, the market is trending toward personalized, data-integrated, and technologically advanced solutions, driven by a convergence of clinical needs, technological advancements, and regulatory support. These trends collectively aim to improve surgical precision, reduce complications, and enhance long-term patient outcomes.

Spinal Fusion Device Market Analysis

Learn more about the key segments shaping this market

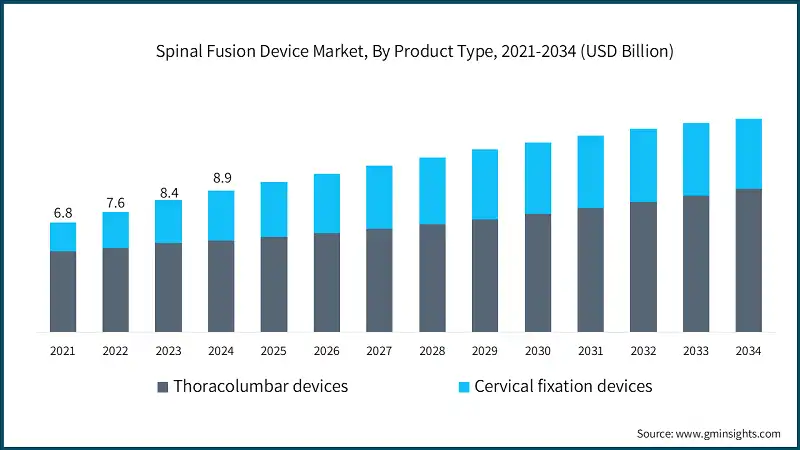

The global market was valued at USD 6.8 billion in 2021. The market size reached USD 8.4 billion in 2023, from USD 7.6 billion in 2022.

Based on the product type, the market is bifurcated into thoracolumbar devices, and cervical fixation devices. The thoracolumbar devices segment accounted for 64.5% of the market in 2024 due to the high prevalence of lumbar degenerative disorders and spinal trauma, which commonly require surgical stabilization in the thoracic and lumbar regions. The segment is expected to exceed USD 9.1 billion by 2034, growing at a CAGR of 4.7% during the forecast period. On the other hand, cervical fixation devices segment is expected to grow with a CAGR of 2.6%. The rising incidence of cervical spine disorders and increasing adoption of anterior cervical discectomy and fusion (ACDF) procedures.

- The thoracolumbar devices segment in the spinal fusion devices market is driven by the rising incidence of lumbar degenerative conditions, spinal trauma, and thoracolumbar fractures. These conditions often necessitate surgical stabilization, especially in the thoracic and lumbar spine regions, making thoracolumbar devices vital in treatment protocols.

- The growing ageing population, who are more prone to degenerative spine conditions, and the growth in high-impact injuries from road accidents and falls further fuel demand for these devices. Additionally, developments in minimally invasive thoracolumbar fixation techniques and the development of biomechanically superior implants are improving surgical outcomes and reducing recovery time.

- The increasing adoption of these technologies by spine surgeons and their integration into hospital systems contribute to the continued expansion of the thoracolumbar segment.

- The cervical fixation devices segment is driven by the growing prevalence of cervical spine disorders and the increasing preference for surgical interventions that ensure spinal stability. Advancements in surgical techniques and the widespread adoption of procedures like anterior cervical discectomy and fusion are further accelerating the demand for these fixation systems.

Based on the disease type, the spinal fusion device market is segmented into degenerative disc, trauma and fractures, spinal deformity, spinal tumors, and other disease types. The degenerative disc segment accounted for the highest market share of 47.6% in 2024 due to the rising prevalence of age-related spinal disorders and increasing demand for minimally invasive spinal fusion procedures.

- The segment is fueled by the growing burden of age-related spinal conditions such as disc herniation and spondylosis. Advancements in minimally invasive surgical techniques have made spinal fusion a more attractive option for elderly patients, offering reduced recovery times and lower surgical risks. Additionally, increased awareness and early diagnosis of spinal degeneration have further supported demand for these procedures.

- The second-largest segment, trauma and fractures, held a market share of 23.8% in 2024. The segment is driven by the increasing incidence of spinal injuries due to road accidents, falls, and sports-related trauma, necessitating surgical intervention for stabilization and pain relief.

- The spinal deformity segment, though smaller with a market share of 14.2%, is expected to grow at a CAGR of 3.9%, is driven by the rising prevalence of scoliosis and kyphosis, increasing early diagnosis, and advancements in corrective surgical techniques that offer improved spinal alignment and long-term outcomes.

- The spinal tumors segment accounted for 5.4% of the market in 2024 and is driven by the rising incidence of metastatic spinal tumors and advancements in surgical techniques that allow for safer tumor resection and stabilization. Fusion devices play a critical role in restoring spinal integrity following tumor removal.

Based on technology, the spinal fusion device market is bifurcated into open spine surgery, and minimally invasive spine surgery. The open spine surgery segment accounted for the highest market share of 72.9% in 2024 is driven by its widespread adoption for complex spinal disorders requiring direct visualization and access for effective stabilization.

- The open spine surgery segment is driven by its widespread adoption in complex spinal conditions requiring direct visualization and extensive anatomical correction. Surgeons often prefer this approach for severe deformities, multilevel fusions, or trauma cases where comprehensive access to the spinal column is essential. Moreover, the availability of advanced surgical tools and standardized techniques makes open spine surgery a trusted and reliable option, particularly in cases where minimally invasive methods may not provide sufficient access or control.

- The minimally invasive spine surgery segment, though smaller with a market share of 27.1%, is expected to grow at a CAGR of 4.8% is driven by growing demand for procedures that offer reduced surgical trauma, shorter hospital stays, and faster recovery times. Advancements in surgical tools, imaging technologies, and navigation systems have significantly enhanced the safety and precision of MISS.

- Additionally, increasing patient preference for less invasive options is pushing hospitals and surgeons to adopt these techniques more widely.

Based on the material type, the spinal fusion device market is segmented into titanium, polyether ether ketone (PEEK), cobalt chrome, stainless steel, and other materials. The titanium segment accounted for the highest market share of 40% in 2024 due to its excellent biocompatibility, corrosion resistance, and superior strength-to-weight ratio, making it ideal for spinal fusion procedures.

- The segment is driven by its exceptional performance characteristics, including high biocompatibility, lightweight nature, and excellent resistance to corrosion. These properties enhance implant integration with bone and reduce the risk of post-surgical complications. Titanium’s ability to support long-term spinal stability while minimizing immune response makes it a preferred choice among surgeons, thereby fueling its continued dominance in spinal fusion procedures.

- The second-largest segment, polyether ether ketone (PEEK), held a market share of 25% in 2024. The PEEK segment is driven by its superior biomechanical and biocompatible properties. PEEK closely mimics the elasticity of natural bone, reducing stress shielding and improving fusion outcomes. Its radiolucency allows for better post-operative imaging and assessment. Additionally, increasing preference for non-metallic implants and advancements in surface modification technologies are boosting the adoption of PEEK-based spinal fusion devices.

- The cobalt chrome segment, though smaller with a market share of 15.5%, is expected to grow at a CAGR of 3.7%. The segment is driven by the material's superior strength, biocompatibility, and resistance to wear and corrosion. These properties make it ideal for load-bearing applications in spinal procedures, particularly in patients requiring enhanced durability and long-term support. Its radiopacity also aids in precise post-operative imaging, supporting surgeon confidence and clinical outcomes, thereby fueling steady demand in complex fusion surgeries.

Learn more about the key segments shaping this market

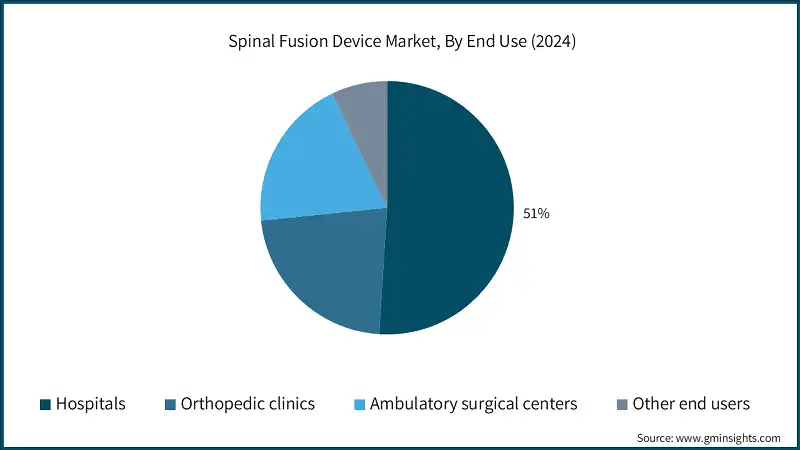

Based on the end use, the spinal fusion device market is segmented into hospitals, orthopedic clinics, ambulatory surgical centers, and other end users. The hospitals segment accounted for the highest market share of 51% in 2024 is driven by the increasing volume of complex spinal surgeries and the availability of advanced surgical infrastructure.

- The top two application segments represent 73.4% of total market value. The hospital segment in the market is primarily driven by the growing demand for complex spinal procedures that require specialized care and advanced surgical setups. Hospitals are equipped with cutting-edge technologies, skilled surgical teams, and comprehensive post-operative care facilities, making them the preferred choice for both patients and surgeons.

- This has led to a consistent rise in spinal fusion procedures being performed in hospital settings, further fueling segment growth.

Looking for region specific data?

North America dominated the global spinal fusion device market with the highest market share of 66.3% in 2024.

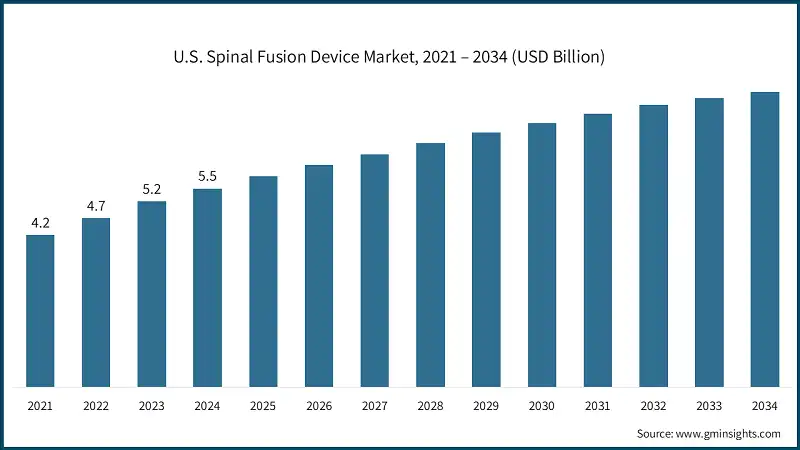

- The U.S. market was valued at USD 4.2 billion and USD 4.7 billion in 2021 and 2022, respectively. In 2024 the market size reached USD 5.5 billion from USD 5.2 billion in 2023. This growth is primarily driven by the rising prevalence of degenerative spinal disorders, increasing geriatric population, and growing adoption of minimally invasive spine surgeries. Technological advancements in spinal implants and navigation systems also contributed to this market expansion.

- The region is driven by several key factors, making it the most dominant regional contributor globally. One of the primary drivers is the high prevalence of spinal disorders, including degenerative disc disease, spinal stenosis, and traumas-related injuries, particularly among the aging population.

- The region benefits from advanced healthcare infrastructure and a strong presence of leading medical device companies, which facilitates rapid adoption of innovative spinal fusion technologies such as minimally invasive techniques, robotic-assisted surgeries, and 3D-printed implants. Favorable reimbursement policies and widespread health insurance coverage in countries like the U.S. and Canada further encourage both patients and providers to opt for surgical interventions.

- Additionally, growing awareness about the benefits of early surgical management, along with increasing access to specialized spine care centers, supports continued market expansion. Ongoing research and development investments and FDA approvals for next-generation fusion systems also enhance market growth in this region.

Europe spinal fusion device market accounted for USD 1.6 billion in 2024.

- The spinal fusion devices market in Europe is experiencing steady growth, driven by an aging population and a rising incidence of spinal disorders such as degenerative disc disease, spinal stenosis, and trauma-related injuries. Countries like Germany and the UK are at the forefront due to their advanced healthcare infrastructure, growing number of spinal procedures, and increasing adoption of minimally invasive surgeries.

- Germany, in particular, benefits from a high volume of spine surgeries and strong integration of surgical navigation systems and robotic-assisted technologies in orthopedic care.

- Meanwhile, the UK is seeing expanding use of image-guided fusion techniques and increasing investments in spinal care units across both public and private sectors. Additionally, favorable reimbursement policies and a well-established network of orthopedic specialists further support market adoption.

- The demand for faster recovery and reduced postoperative complications has also fueled the use of innovative fusion implants and biologics, contributing to the region’s overall market expansion.

The Asia Pacific spinal fusion device market is anticipated to witness high growth over the analysis timeframe.

- The Asia Pacific spinal fusion devices market is experiencing rapid growth due to several key factors, with China and India playing a pivotal role in driving demand. Rising incidences of spinal disorders such as spondylolisthesis and degenerative disc disease, combined with growing awareness about advanced spinal treatment options, are fueling the adoption of spinal fusion procedures.

- In China, expanding healthcare infrastructure and favorable government policies to improve access to surgical care are supporting market growth. Similarly, in India, the increasing geriatric population, higher rates of traffic-related spinal injuries, and the growing presence of spine care centers are contributing to increased demand. Additionally, the rise in medical tourism across Asia Pacific, particularly for orthopedic and spinal surgeries, is boosting the region's prominence.

- Technological advancements, such as the introduction of minimally invasive techniques and navigation-assisted surgeries, are also gaining traction, making spinal fusion procedures more accessible and effective across the region.

Spinal Fusion Device Market Share

Leading companies like Medtronic, DePuy Synthes, Stryker, NuVasive, and Globus Medical together hold between 70-75% of the market share in the moderately consolidated global market. These companies dominate due to their extensive product portfolios, strong clinical outcomes, strategic mergers, and innovation pipelines.

Medtronic remains the market leader, driven by its expansive suite of minimally invasive fusion systems and robotic-assisted platforms. DePuy Synthes, a Johnson & Johnson company, leverages its wide orthopedic distribution network and product innovations like the CONCORDE Clear MIS system to retain a competitive edge.

Stryker, following its acquisition of K2M, expanded its spinal product line and integrated advanced navigation and imaging technologies, which have bolstered its market share.

NuVasive has strengthened its position with its X360 system and less invasive lateral fusion techniques, while Globus Medical continues to gain momentum through its ExcelsiusGPS robotic system and expandable implant technologies.

These top-tier players have also capitalized on recent procedural trends such as outpatient spinal fusion and value-based care models, enabling wider adoption across ambulatory surgery centers. Meanwhile, mid-tier and emerging companies like Alphatec Spine, Zimmer Biomet, and Aesculap are focusing on differentiated technologies such as 3D-printed interbody cages and patient-specific implants to carve out niche segments.

Strategic partnerships, including Globus Medical’s merger with NuVasive in 2023, are reshaping the competitive landscape, signaling consolidation and cross-platform synergies. As innovation, surgical efficiency, and patient-centric design continue to drive demand, market share competition is expected to intensify across both established and disruptive players.

Spinal Fusion Device Market Companies

Few of the prominent players operating in the spinal fusion device industry include:

- ATEC

- B. Braun

- Captiva Spine

- ChoiceSpine

- DePuy Synthes

- Globus Medical

- K2M

- Life Spine

- Medtronic

- NuVasive

- Orthofix

- Premia Spine

- Stryker

- Xtant Medical

- Zimmer Biomet

DePuy Synthes

DePuy Synthes offers a comprehensive portfolio of spinal fusion devices, including advanced MIS systems and interbody cages. Its proprietary technologies, like the VIPER and CONCORDE platforms, enable precise fixation and disc height restoration. Backed by Johnson & Johnson’s global reach, it emphasizes clinical outcomes, surgeon training, and integrated orthopedics solutions.

Globus Medical

Globus Medical stands out for its innovation-driven approach, particularly through its ExcelsiusGPS robotic navigation system, which enhances spinal fusion precision. It offers a wide range of expandable interbody implants and titanium-coated cages. Its vertically integrated model allows for rapid product development and cost control, making it a highly agile market competitor.

Medtronic

Medtronic leads the spinal fusion market with its extensive product range, including the CD Horizon Legacy system and Infuse Bone Graft technology. Its StealthStation navigation and Mazor X robotic systems offer advanced intraoperative guidance. Medtronic emphasizes outcomes-based innovation, global distribution strength, and integrated digital solutions for spinal surgery optimization.

NuVasive

NuVasive specializes in minimally invasive spinal fusion, led by its proprietary XLIF (eXtreme Lateral Interbody Fusion) platform. The X360 procedural solution integrates access, interbody fusion, and fixation in a single workflow. Its innovation in lateral access surgery and real-time neuromonitoring technology positions it as a leader in surgical efficiency and safety.

Spinal Fusion Device Industry News:

- In August 2024, NanoHive secured a USD 7 million funding round to support the development and commercialization of its 3D-printed titanium spinal interbody fusion implants. This investment aims to accelerate NanoHive's U.S. market entry and drive its expansion into international markets.

- In January 2024: Asian Spine Hospital in Hyderabad, India, achieved a milestone by successfully performing 200 spinal fusion procedures (EndoFusion) utilizing advanced Keyhole Endoscopic Spine Technology.

- In October 2023, Alphatec Holdings, Inc. introduced the Calibrate LTX lateral expandable implant system, a cutting-edge solution designed to enhance alignment accuracy and disc height restoration in lateral spinal surgeries, further reinforcing its technological leadership in the market.

- In October 2023, Silony Medical International completed the acquisition of Centinel Spine’s global fusion business, a strategic move to strengthen its footprint in the U.S. market.

- In August 2023, Kauvery Hospital, located on Radial Road in Chennai, launched the Institute of Brain & Spine, a specialized center performing complex neurosurgical and spine procedures, including spinal fusion surgeries.

The spinal fusion device market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product Type

- Thoracolumbar devices

- Pedicle screws

- Intervertebral body fusion device (IBFD)

- Rods

- Plates

- Other thoracolumbar devices

- Cervical fixation devices

- Intervertebral body fusion device (IBFD)

- Plates

- Rods

- Hooks

- Other cervical devices

Market, By Disease Type

- Degenerative disc

- Spinal deformity

- Trauma and fractures

- Spinal tumors

- Other disease types

Market, By Surgery

- Open spine surgery

- Minimally invasive spine surgery

Market, By Material Type

- Titanium

- Polyether ether ketone (PEEK)

- Cobalt chrome

- Stainless steel

- Other materials

Market, By End Use

- Hospitals

- Ambulatory surgical centers

- Orthopedic clinics

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which segment accounted for the highest market share in 2024?

The degenerative disc segment held the largest market share of 47.6% in 2024.

What was the market share of the open spine surgery segment in 2024?

The open spine surgery segment accounted for 72.9% of the market share in 2024, attributed to its widespread adoption for complex spinal disorders requiring direct visualization and effective stabilization.

What was the revenue growth of the U.S. spinal fusion device market in 2024?

The U.S. market reached USD 5.5 billion in 2024, driven by the increasing prevalence of degenerative spinal disorders, a growing geriatric population, and the adoption of minimally invasive spine surgeries.

What are the key trends in the spinal fusion device industry?

Key trends include the shift towards value-based care, the adoption of minimally invasive procedures, and the growing demand for customizable and anatomically adaptive fusion systems.

Who are the key players in the spinal fusion device market?

Prominent players include ATEC, B. Braun, Captiva Spine, ChoiceSpine, DePuy Synthes, Globus Medical, K2M, Life Spine, Medtronic, and NuVasive.

What is the market size of the spinal fusion device in 2024?

The market size was USD 8.9 billion in 2024, with a CAGR of 4% expected through 2034, driven by the increasing prevalence of spinal disorders, an expanding patient base, and ongoing R&D investments in fusion techniques.

What is the projected size of the spinal fusion device market in 2025?

The market is expected to reach USD 9.5 billion in 2025.

What is the projected value of the spinal fusion device market by 2034?

The market is expected to reach USD 13.5 billion by 2034, fueled by advancements in minimally invasive procedures and the adoption of innovative spinal implants and surgical systems.

Spinal Fusion Device Market Scope

Related Reports