Summary

Table of Content

Specialty Oil Crop Seeds Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Specialty Oil Crop Seeds Market Size

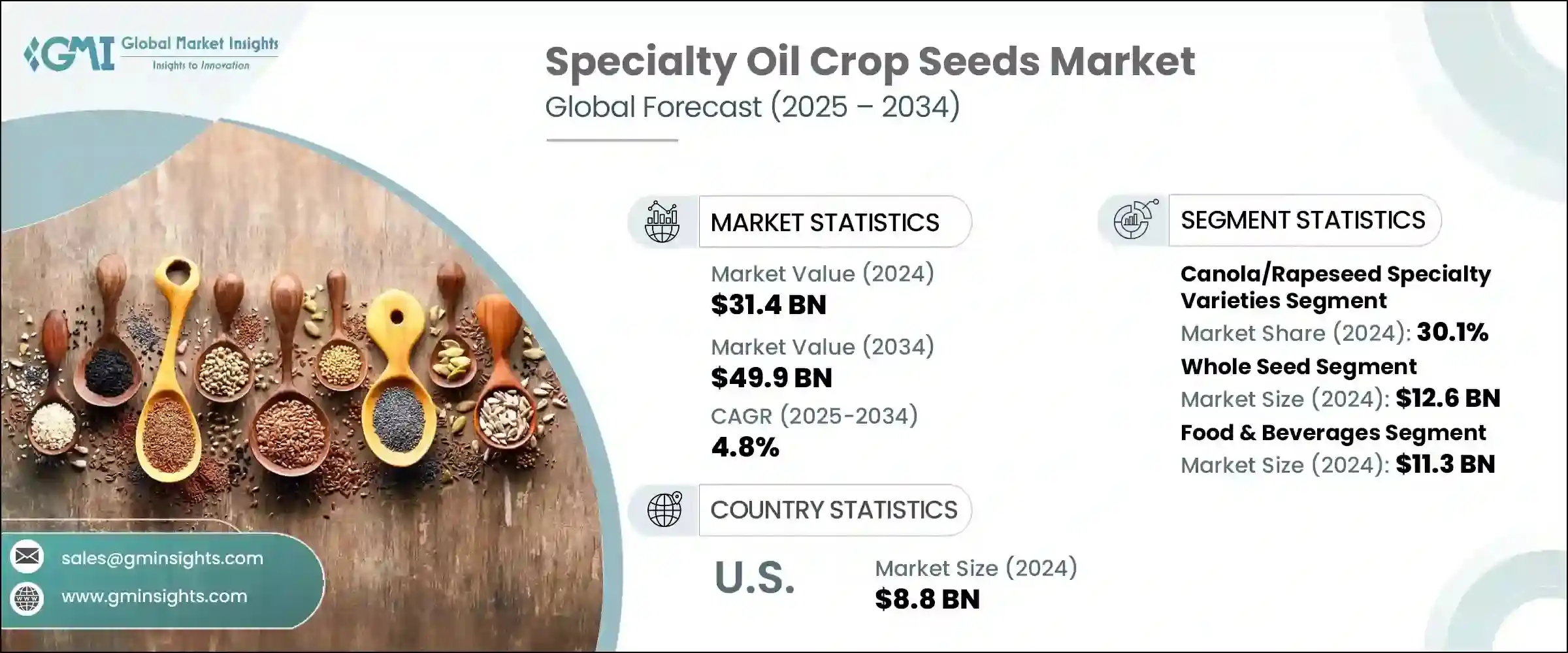

The global specialty oil crop seeds market was estimated at USD 31.4 billion in 2024. The market is expected to grow from USD 32.7 billion in 2025 to USD 49.9 billion in 2034, at a CAGR of 4.8%.

To get key market trends

- The changing demand of consumers for healthy, natural foods and sustainably sourced oils highly contributes to the specialty oil crop seeds market boom. This includes crops such as sunflowers, canola, sesame, hemp, and camelina, all of which are said to have high-quality oil content and are used for diverse applications in various applications. The market trend indicates a growing preference for plant-based oils, brought by the rising popularity of vegan- and vegetarian-style diets along with the corresponding increase in awareness on health benefits brought by omega fatty acids and antioxidants.

- Also, according to the USDA, global oilseed production in 2024/25 is projected at a new record of 687 million tons, up 4% compared to the 2023/24 marketing year.

- Specialty oil crops essentially provide the raw material to produce edible oils, biofuels, cosmetics, pharmaceuticals, and products for industrial applications. Their special nutritional profiles and functional features add an appeal for use in the food industry for cooking oils, dressing, & health supplements.

- Apart from human's consumption, these oils are also applied in cosmetics and personal care products, where they are used for their moisturizing and anti-aging benefits. In the pharmaceutical and nutraceutical sectors, specialty oils find their application because of their therapeutic properties. Besides these classified applications, the increased trend toward chemical-free, natural products has found wide usage of these specialty oils in industrial and animal nutrition.

- North America leads the global specialty oil crop seeds market because of advancements in agricultural infrastructure, availability of vast land areas, and technology.

- Asia Pacific is the fastest growing region in the global specialty oil crop seeds industry because of countries like China, India, South Korea, and others. For instance, China is projected to remain the world’s largest oilseeds crusher, accounting for 26% of global oilseed meal production.

Specialty Oil Crop Seeds Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 31.4 Billion |

| Forecast Period 2025 - 2034 CAGR | 4.8% |

| Market Size in 2034 | USD 49.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising health consciousness and functional food demand | Accelerates market growth for specialty oil crop seeds with health benefits, expanding product offerings and consumer interest |

| Biofuel industry expansion and renewable energy mandates | Boosts demand for specialty oil seeds suitable for biofuel production, encouraging increased cultivation and processing activities. |

| Cosmetics and personal care industry growth | Drives higher demand for high-value specialty oil seeds used in premium cosmetic and skincare products, expanding market opportunities. |

| Pitfalls & Challenges | Impact |

| Climate change and weather variability impact | Disrupts crop yields and supply stability, leading to potential market shortages and increased price volatility. |

| Limited market infrastructure and processing capacity | Restricts the scale of commercialization and hampers the ability to meet rising demand, limiting market growth. |

| Opportunities: | Impact |

| Development of organic and non-GMO oil seeds | Meets rising consumer demand for organic and non-GMO products, opening new premium market segments and increasing market share. |

| Introduction of value-added oilseed varieties | Enables producers to command higher prices and cater to health-conscious consumers, boosting profitability and product differentiation. |

| Expansion into emerging markets with growing middle-class populations | Drives increased cultivation and consumption of specialty oil seeds, expanding the global market footprint and revenue streams. |

| Adoption of sustainable farming practices and certification programs | Enhances market credibility and access to eco-conscious consumers, facilitating premium pricing and brand loyalty. |

| Market Leaders (2024) | |

| Market Leader |

|

| Top Players |

Collective market share in 2024 is 43.1% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, China, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Specialty Oil Crop Seeds Market Trends

- There is tremendous development of the market by the factors of technological innovation, AI integration, developing regulatory frameworks, and increasing product diversification. Advances in biotechnology and genetic engineering now allow the development of crop varieties that can produce more, resisting diseases, and responding better to climate challenges. In turn, these factors contribute to the productivity and sustainability of agriculture.

- For instance, according to Indian Society of Oilseeds Research Secretary the oilseed accounts for 13% of the gross cropped area, 3% of the gross national product and 10% value of all agricultural commodities. So, the advancement in biotechnology and AI integration can help in boosting this ratio securing a good market share in the coming years.

- Enforcement of stricter standards by governments and international agencies on the production of food safety, organic certification, and sustainable practices in farming influence seed development and commercialization. Provisions of the regulatory policies encouraging non-GMO and organic products boost demands for specific varieties of seeds in accordance with market consumer preferences for the products derived from plants as natural and chemical-free.

- For example, regulations like The Seed Act, Federal Seed Act, National Seed Policy, all suggest different guidelines to manufacturer and farmer regarding the responsibility and mandatory norms that they must follow, this market the seed market more transparent to everyone.

- Innovation in the product is a major driver the companies have also developed special seeds for special purposes like biofuels, nutraceuticals, and cosmetics. New opportunities in the specialty oil crop seeds market avail themselves based on newer versions of better seed traits like improved oil composition and extraction efficiency. Hence the market is driven by increasing awareness of various health benefits, sustainable concerns, and consumer tendencies toward plant-based products. With the increase in consumer preferences change, the utmost importance of innovation and compliance with the regulatory standards will be highly critical in keeping the competitive edge in the industry world over in high quality specialty oil crop seeds.

- Technologies such as soil sensors and drones provide real-time data on soil health, moisture levels, and crop growth. By analyzing this data, farmers can make informed decisions about when and how much to irrigate, fertilize, or apply pesticides, reducing waste and costs.

- Variable rate technology (VRT) enables farmers to apply inputs at varying rates across different parts of a field based on specific needs. This approach has been particularly effective in optimizing nutrient application in oil seed cultivation, leading to higher yields and improved soil health.

Specialty Oil Crop Seeds Market Analysis

Learn more about the key segments shaping this market

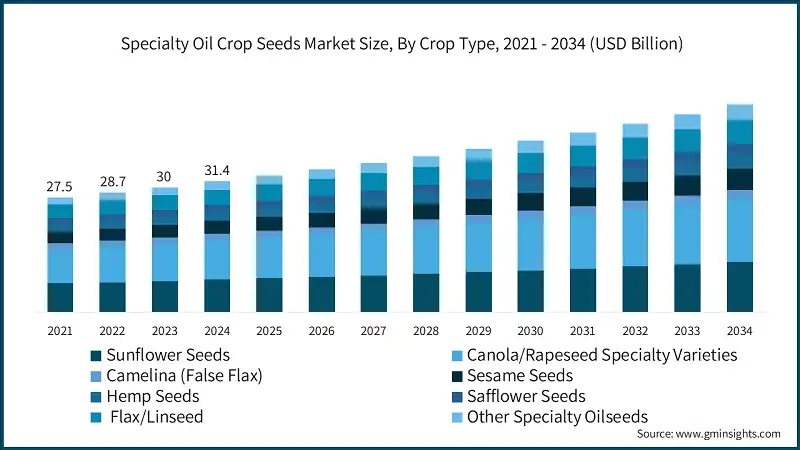

Based on crop type the specialty oil crop seeds market is segmented into sunflower seeds, canola/rapeseed specialty varieties, camelina (false flax), sesame seeds, hemp seeds, safflower seeds, flax/linseed, other specialty oilseeds. The canola/rapeseed specialty varieties accounted for 30.1% of the market share in 2024 and is expected to grow with the CAGR of 4.9% in 2034.

- The high oil content and nutrition along with versatility contribute to attributing canola/rapeseed specialty varieties as a major player in the global market. Generally, canola oil is known to be lower in saturated fats and possesses high omega-3 fatty acids, thus making it popular among health-conscious consumers or food manufacturers. The crop enjoys the benefit of being adaptable to diversified weather conditions, as well as having a relatively short cultivation period which increases farmer attractiveness.

- Continuing consumer interest in healthy oils and organic products has maintained demand for sunflower seeds. Increased climate adaptability and introduction of premium varieties such as non-GMO and organic types have also added to the market's gains.

- For instance, according to USDA global sunflower seed production in 2024/25 is forecast to grow 1% from the previous year to 55.4 million tons.

- Camelina, or false flax, is quickly gaining recognition for its high omega-3 fatty acid content and environmentally friendly production methods. The biofuels and specialty oils markets have potential for growth as health-conscious consumers look for plant-based alternatives.

- Sesame seeds, whose cultural significance and health attributes are the major demand drivers across the world, is the fastest growing crop type in this market with accounting CAGR of 5%. The two segments, organic and specialty sesame oils, are set for growth but quality and traceability are emerging as preconditions for premium market access in this sector.

Learn more about the key segments shaping this market

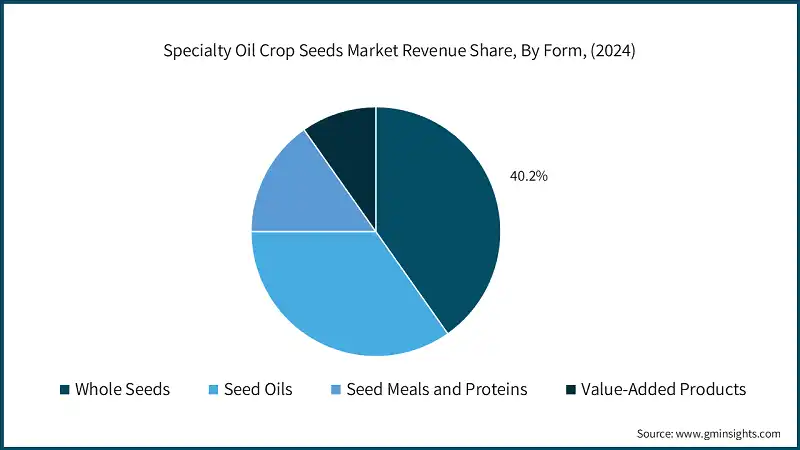

Based on form the specialty oil crop seeds market is segmented into whole seeds, seed oils, seed meals and proteins, value-added products. Whole seed industry holds the market size of USD 12.6 billion in 2024 and expected to grow at a faster rate of 5% CAGR in 2034.

- The dominant presence of whole seeds in the specialty oilseed crop market especially of canola and rapeseed is because of their versatile use and nutritional importance. Whole seeds act as the principal source for producing seed oils, which are appreciated for their health benefits, having, for instance, low saturated fat content with high omega-3 fatty acids.

- Seed oil holds a significant market share of 34.8% in 2024. The trends of the seed oil market indicate that there has been an increased demand for health-promoting, natural products, organic and non-GMO, in consumers' lives. The increasing awareness about clean-label products along with the growing number of vegetarian and vegan diets drives seed oil applications towards innovations.

- For instance, higher consumption of rapeseed oil in the U.S. industrial sector is expected to drive global industrial usage up 2%, also for global food use is expected up 3%.

- Seed meal and protein remaining after oil extraction find numerous applications in animal feed, food products, and nutritional supplements, thus contributing to the economic value of these crops.

- For instance, global oilseed meal production is forecast to grow 4% in 2024/25 led by China, the United States, Brazil, and Argentina.

Based on application the specialty oil crop seeds market is segmented into food and beverages, biofuels and energy, cosmetics and personal care, pharmaceuticals and nutraceuticals, industrial applications, animal feed and nutrition. Food & beverages hold the market size of USD 11.3 billion in 2024 and expected to grow at a faster rate of 4.9% CAGR in 2034.

- The food and beverage industry are the chief propelling force behind the market for specialty oil crop seeds that are utilized in the production of high-quality edible oils, health-oriented products, and functional foods. Such types of oils have gained immense popularity owing to their nutritional benefits, such as essential fatty acids, antioxidants, and vitamins, which make them highly prized in cooking, snacks, and health supplements.

- Oil seeds such as camelina and hemp are converted into biodiesel and bio-jet fuels, thus providing renewable energy sources with lower carbon emissions, sustainable alternatives to fossil fuel sources.

For example, currently, more than 95% of the world biodiesel is produced from edible oils such as rapeseed (84%), sunflower oil (13%), palm oil (1%), soybean oil and others (2%).

- In cosmetic and personal care formulations, oils from hemp, sesame, and flaxseed are used to promote illness prevention and beauty in skin by being moisturized, anti-inflammatory, and antioxidant.

- For instance, sunflower oil is widely used in the different cosmetic product by the Oriflame Sweden company because of its various skin benefits.

- Omega-3-rich seeds such as flax and hemp are converted into supplements, oils, and functional foods to help the cardiovascular system, cognitive functions, and overall well-being with natural bioactive compounds.

- Seed oils such as safflower and sunflower oils are used as drying oils and are stable for industrial manufacture of paints, coatings, lubricants, and bioplastics for an environmentally friendly purpose.

- The seed meals and oils from sunflower, sesame, and hemp are added to livestock and pet feeds for the purpose of supplying essential fatty acids, enhancing nutrition, health, and productivity.

Looking for region specific data?

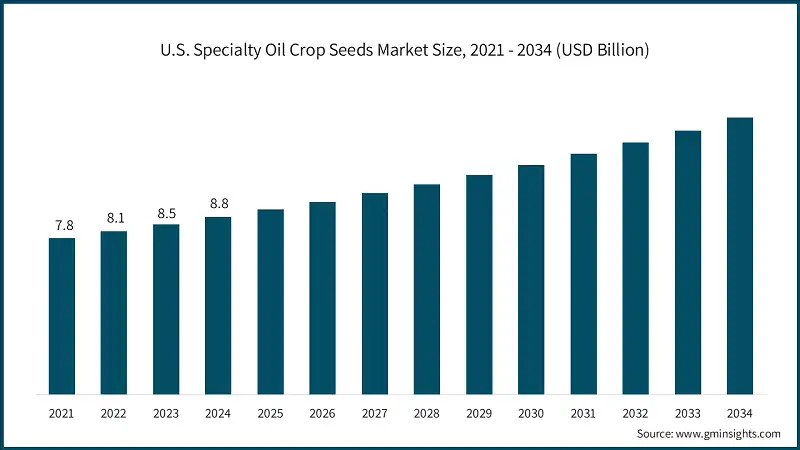

In the specialty oil crop seeds market, U.S. accounts the major share in North America by accounting USD 8.8 billion in 2024 and is expected to grow at a CAGR of 3.7% in 2034.

- The U.S. has become the dominant force in North American specialty oilseed crops because of advancements in agricultural infrastructure, availability of vast land areas, and technology. U.S. farmers focus on the very best seed varieties for commercial production, including oilseed crops such as soybeans, canola, and sunflowers.

- The growing market is also supported by developing startup firms in the agricultural market which are giving new innovations and helping with the frequently changing requirements of consumers across the country.

- Canada is another major actor in specialty oil crops for food, nutraceutical, and industrial applications, with an emphasis on organic and specialty oils. The regional trend towards clean-label and functional foods is expected to keep pushing growth in the market.

The Germany specialty oil crop seeds market is expected to experience significant and promising growth from 2025 to 2034.

- Europe accounts for around 25.1% of the specialty oil crop seed industry in 2024. The market in Europe is characterized by organic, sustainable, and health-oriented products. Countries like Germany, France, and the UK lead the demand for specialty oils due to increasing consumer awareness regarding health benefits and environmental impact.

- For instance, EU produces around 30 million tonnes of oilseeds per year and it is traditionally a net importer. Most of the oilseeds are crushed to produce oils for food or biofuels use and meals for animal feed.

- The European market emphasizes the usage of seeds like sunflower, linseed, and hemp for food, cosmetics, and industrial applications. Stringent regulations thereby favoring organic farming and sustainable sourcing are changing market dynamics. With a growing number of consumers opting for plant-based and natural products, there is expected to be consistent growth in specialty oil seed consumption in the region.

The China specialty oil crop seeds market is expected to experience significant and promising growth from 2025 to 2034.

- Rapid growth in the Asia Pacific market is mainly driven by population growth, rising disposable incomes, and changing dietary patterns. The region is expected to grow with high growth potential at a CAGR of 5.2%. Besides China, countries such as India and Japan play a significant role in sesame, soybean, and mustard seed oil.

- The traditional culinary culture of the region heavily relies on plant oils, while the health and wellness trends further support their demand. The local cultivation and processing capacities provide added efficiency to the supply chain. Meanwhile, the growing applications of specialty oils in cosmetics, nutraceuticals, and functional foods are showing a bright future for the market in this region.

The Brazil specialty oil crop seeds market is expected to experience significant and promising growth from 2025 to 2034.

- With increased knowledge about health benefits and the rising tide of preferences toward plant-based diets, Latin America specialty oil crop seeds industry is growing with a CAGR of 3.5%. The paramount markets are Brazil and Argentina, with emphasis on oils like soybean, sunflower, and sesame.

- For instance, SA domestic use of the 2018-2022 crops was higher by +207% for oilseeds, +127% for feed grains, and +46% for food grains.

- The specialty oil crop seeds market is developing in Brazil by the increasing demand organic oils and their sustainable farming practices, and sesame, sunflower, and soybean oil exports based on health and industrial applications.

- The Mexico market reflects preference toward healthy plant-based oils such as sesame and sunflower, agriculture being local, and with the growing demand from the cosmetic and food industries. This would include thus contributing to the sustainable development of specialty oil seeds.

- Thus, the specialty oil seed market in Argentina is focusing on sunflower and soybean oils for food and industrial applications, giving way to international market expansion with increasing crop diversification and consumer awareness to health benefits.

The UAE specialty oil crop seeds market is expected to experience significant and promising growth from 2025 to 2034.

- Specialty oil crop seeds observe gradual growth in Middle East and Africa markets with CAGR of 4.8% owing to growing health awareness and the shift towards plant-based products. This region focuses on oils such as sesame, sunflower, for food, cosmetics, and industrial applications.

- The specialty oil crop seeds market in Saudi Arabia has witnessed growth due to increased health consciousness, awareness of natural products, and demand for organic sesame, sunflower, and flaxseed oils for food and cosmetics.

- South Africa, where the demand for health benefits, organic agricultural practice, and locally grown seeds of sunflower, sesame, and hemp have stimulated market growth in respect of domestic use and export in food and cosmetics.

- In the UAE, rising disposable income and health-conscious consumers are supporting the growth of premium, organic, and natural oils like sesame and sunflower for cosmetics, wellness, and food applications.

Specialty Oil Crop Seeds Market Share

Top 7 companies include Corteva Agriscience, Bayer Crop Science (Monsanto), Syngenta AG, BASF SE, Limagrain, Sakata Seed Corporation, Nuseed (Nufarm). These are prominent companies within the global market operating in their respective regions covers 48.05% of the market share. These companies hold strong positions globally due to their extensive experience in specialty oil crop seeds market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand for Specialty oil crop seeds across various regions.

- Corteva Agriscience: An innovative seed technology company with a strong focus on R&D, Corteva is devoted to developing oilseed varieties that yield well while fighting off diseases. Its global and North American positions benefit from its wide distribution channels and a clear focus on sustainable farming practices.

- Bayer Crop Science (Monsanto): As a top company in genetically modified seeds and traits, Bayer holds extensive potential from its use of high-grade biotechnologies to develop oilseed crops. Its integration into advanced research with a worldwide presence makes it a leading force in engineered seed varieties, particularly when considering all the aspects of seeds developed.

- Syngenta AG: Innovation and crop protection are the cornerstones of Syngenta, which recently expanded its' offers in oilseed seed for specific climatic conditions under various farming conditions. Syngenta proposes an integrated pest management approach and sustainable solutions for crop protection.

- BASF SE: While predominantly recognized as a company dealing with products for crop protection, BASF carries out some investment in seed technology and traits for oilseed crops. The joint strength is in combining seed innovation with pest and disease management solutions to provide end-to-end crop care.

- Limagrain: Limagrain is a co-operative in which hybrid seeds are mainly concerned, with the specific aim of breeding high-yielding, premium-quality oilseed varieties. The other focus areas include research-driven breeding and regional adaptability, which have proven to strengthen the cooperative's role in niche markets.

- Sakata Seed Corporation: Sakata Seed Corporation becomes an attractive market player who responds appropriately to the competition initiated by other eminent personalities in the field by providing custom-made solutions for farmers and agribusinesses.

- Nuseed (Nufarm): This Nuseed is a division of Nufarm that is a key competitor in the market and is renowned for developing seeds of superior genetic and environmental sustainability.

Specialty Oil Crop Seeds Market Companies

Major players operating in the market are:

- Corteva Agriscience

- Bayer Crop Science (Monsanto)

- Syngenta AG

- BASF SE

- Limagrain

- KWS SAAT SE

- Sakata Seed Corporation

- Nuseed (Nufarm)

- ZeaKal Inc.

- Smart Earth Seeds

- AgReliant Genetics

- Sakata Seed Corporation is a reputed player in specialty oil crops seed market, developing high-yielding and disease-resistant seed varieties through its strong research and development capabilities. The company channels its focus on innovativeness and sustainability to provide farmers with advanced seed options for crops such as sesame, sunflower, and flaxseed. With a global presence and an efficient distribution network, Sakata effectively captures regional markets and fulfills the incrementally growing demand for premium specialty oil crops.

- Nuseed, a subdivision of Nufarm, is renowned for its innovative seed technologies and a strong portfolio of specialty oil crop seeds. The company concentrates on developing drought-tolerant and high oleic varieties matching the consumers' increasing preference toward healthier oils.

- ZeaKal Inc. operates in bioengineering and seed enhancement technologies aimed at improving crop productivity and nutritional content. This innovative approach includes seed coatings and treatments that increase oil yield and quality. ZeaKal's focus on proprietary technology now adds competitive pressure in the specialty oil crop seeds market, which ranges from seeds with high efficiency for better oil profile applicable in food and industrial applications.

Specialty Oil Crop Seeds Industry News

- In July 2023, Pacific Seeds, a subsidiary of Advanta Seeds, introduced two new canola hybrid varieties, Hyola Defender CT and Hayola Continuum CL, to the Australian market. These varieties offer high-yield performance, strong disease resistance, elevated oil content, and enhanced weed control flexibility.

- In June 2023, Syngenta Seeds launched a new conventional soybean brand, "Silverline," into the Canadian market. This brand offers high-protein soybeans and NK-treated soybean varieties.

- In July 2022, Corteva Agriscience, BASF, and MS Technologies signed an agreement to develop next-generation Enlist E3 soybeans with the nematode-resistant soybean trait for farmers in the United States and Canada.

- In May 2022, Corteva, an American agriculture chemical company, expanded its sunflower seed business in Europe with an investment of USD 14.1 million in the Afumati production facility in Romania to meet growing domestic and international demand from farmers for high-quality sunflower seeds.

The specialty oil crop seeds market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion and Tons in volume from 2021 – 2034 for the following segments:

Market, By Crop Type

- Sunflower seeds

- High oleic sunflower varieties

- Mid-oleic sunflower varieties

- Confectionery sunflower seeds

- Oil-type sunflower seeds

- Canola/rapeseed specialty varieties

- High oleic canola

- Omega-3 enhanced canola

- Winter canola varieties

- Spring canola varieties

- Camelina (false flax)

- Industrial camelina varieties

- Food-grade camelina

- Biofuel camelina varieties

- Sesame seeds

- White sesame seeds

- Black sesame seeds

- Brown sesame seeds

- Hemp seeds

- Industrial hemp varieties

- Food-grade hemp seeds

- CBD hemp varieties

- Safflower seeds

- High oleic safflower

- High linoleic safflower

- Birdseed safflower

- Flax/linseed

- Oil flax varieties

- Fiber flax varieties

- Food-grade flaxseed

- Other specialty oilseeds

- Chia seeds

- Pumpkin seeds

- Pennycress

- Brassica carinata

- Crambe

- Jojoba

Market, By Form

- Whole seeds

- Raw unprocessed seeds

- Cleaned and graded seeds

- Roasted and processed seeds

- Seed oils

- Cold-pressed oils

- Expeller-pressed oils

- Solvent-extracted oils

- Refined and processed oils

- Seed meals and proteins

- Defatted seed meals

- Protein concentrates

- Protein isolates

- Value-added products

- Encapsulated oils

- Emulsified products

- Specialty formulations

Market, By Application

- Food and beverages

- Cooking oils and edible applications

- Functional foods and nutraceuticals

- Bakery and confectionery products

- Snack foods and direct consumption

- Food ingredients and additives

- Biofuels and energy

- Biodiesel production

- Aviation biofuels

- Renewable diesel

- Biogas and energy co-products

- Cosmetics and personal care

- Skin care products

- Hair care applications

- Anti-aging and premium cosmetics

- Natural and organic personal care

- Pharmaceuticals and nutraceuticals

- Omega fatty acid supplements

- Pharmaceutical excipients

- Therapeutic applications

- Veterinary medicine

- Industrial applications

- Lubricants and industrial oils

- Paints and coatings

- Adhesives and sealants

- Plastics and polymers

- Animal feed and nutrition

- Livestock feed supplements

- Aquaculture feed

- Pet food applications

- Protein meal co-products

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Who are the key players in the specialty oil crop seeds market?

Key players include Corteva Agriscience, Bayer Crop Science, Syngenta AG, BASF SE, Limagrain, Sakata Seed Corporation, Nuseed (Nufarm), ZeaKal Inc., Smart Earth Seeds, and AgReliant Genetics.

What are the upcoming trends in the specialty oil crop seeds industry?

Key trends include development of non-GMO and value-added seed varieties, AI and biotech integration, and rising demand for sustainable, plant-based oils.

Which region is the fastest growing in the specialty oil crop seeds market?

Asia Pacific is the fastest-growing region with a 5.2% CAGR, driven by rising disposable incomes, dietary shifts, and expanding biofuel demand.

How much revenue did the canola/rapeseed specialty varieties segment generate in 2024?

Canola/rapeseed specialty varieties accounted for 30.1% share with significant contributions from their high oil content and adaptability.

Which region leads the specialty oil crop seeds market?

North America led the market with USD 8.8 billion in 2024. Growth is driven by advanced agricultural infrastructure and technological adoption.

What was the valuation of the whole seeds segment in 2024?

The whole seeds segment generated USD 12.6 billion in 2024, supported by their versatile use and nutritional advantages.

What is the projected value of the specialty oil crop seeds market by 2034?

The market is expected to reach USD 49.9 billion by 2034, fueled by growth in biofuels, cosmetics, and plant-based nutritional products.

What is the market size of the specialty oil crop seeds in 2024?

The market size was USD 31.4 billion in 2024, with a CAGR of 4.8% expected through 2034 driven by health consciousness and demand for functional foods.

Specialty Oil Crop Seeds Market Scope

Related Reports