Summary

Table of Content

Sauces and Condiments Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Sauces and Condiments Market Size

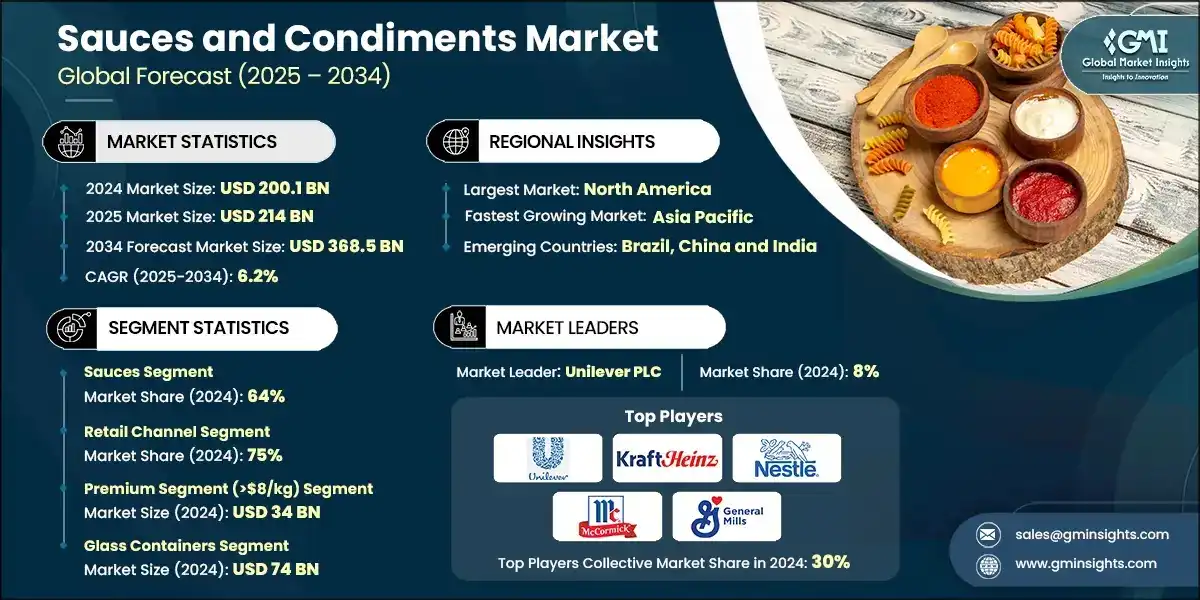

The global sauces and condiments market size was estimated at USD 200.1 billion in 2024. The market is expected to grow from USD 214 billion in 2025 to USD 368.5 billion in 2034, at a CAGR of 6.2% according to latest report published by Global Market Insights Inc.

To get key market trends

- Methods and materials for processing sauces and condiments have continued to vary due to new scientific and technological advances. Manufacturers are embarking on clean-label developments and natural preservation methods and plant-based ingredients, which fit in with different expectations of the consumer. Novel approaches utilize multi-omics analytics and chromatography for various purposes, such as flavor standardization, batch consistency, and regulatory documentation. These developments are geared towards supporting brands in maintaining product quality while fitting health and sustainability trends.

- This category of products is diversifying its formats away from bottles and jars to include fortified sauces, fermented condiments, and functional spreads, especially among the health-conscious consumers. Squeezable pouches, single-serve sachets, and ready-to-use kits are increasingly common, offering convenience and portability. Some products combine gut-friendly ingredients such as miso and apple cider vinegar, which boost digestive health, and natural preservation, promoting the mindful integration of these foods into everyday nutrition.

- Volume growth in Asia Pacific is mainly due to dynamic culinary traditions and increasing disposable incomes coupled with strong urbanization. On the other hand, North America and Europe embrace the booming demand for premium, organic, and ethnic sauces favored by modernized retail and e-commerce development. To this end, promising markets in Latin America and the Middle East are shaped here because of their flourishing foodservice sectors and heightened awareness for global flavor palettes. All these regional background conditions have facilitated the creation of new opportunity avenues for product localization, brand expansion, and strategic distribution.

Sauces and Condiments Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 200.1 Billion |

| Market Size in 2025 | USD 214 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.2% |

| Market Size in 2034 | USD 368.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Health and wellness transformation | This encourages demand for clean-label and low-in-sodium sauces, reformulation with natural ingredients |

| Premiumization and artisanal movement | Encourages the interest in small-batch and heritage style condiments |

| Asia-pacific economic development | Increased consumption through middle-class spending |

| Pitfalls & Challenges | Impact |

| Raw material cost volatility | Challenges pricing stability and long-term contracts |

| Private label competition intensification | Reduces brand loyalty in mainstream segments, forces pricing and promotional adjustments |

| Opportunities: | Impact |

| E-commerce channel development | Expansion of reach for niche and premium products |

| Consolidation and M&A value creation | Streamline operations and expand product portfolios |

| Market Leaders (2024) | |

| Market Leaders |

8% |

| Top Players |

Collective Market Share of 30% in 2024 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | Brazil, China and India |

| Future Outlook |

|

What are the growth opportunities in this market?

Sauces and Condiments Market Trends

- The sauces and condiments industry is reported to be growing rapidly in the coming future, especially for the upcoming decade. The growth of the segment is completely driven by the rising demand of consumers for flavor-enhancing products, increasing acceptance of ready-to-eat meals, and expansion of both the retail and food service sectors. On the other hand, different unique cuisines around the globe these days have increased the consumer preference towards exploring even broader palettes of selected sauces and condiments.

- The consumers largely opt for exotic flavors like harissa, gochujang, and chimichurri, or ethnic flavors. The health-conscious offerings will certainly evolve for the better with respect to organic, low-sodium, gluten-free, and clean-label, all-new demand. Interestingly, the premium or gourmet sauce segment is increasingly becoming popular as the consumers are looking for a more elevated culinary experience.

- Convenience remains a driving force since features like squeezable bottles, single-serve pouches, and resealable packaging formats gain popularity. New flavor profiles inspired from various international cuisines can be key product innovation; functional sauces with health benefits may be another aspect under development. Product reformulation includes changes to meet health regulations and consumer wellness goals, such as sodium reductions.

- Packaging improvement is also a vital element whereby sustainable materials like recyclable plastics, as well as biodegradable films, will be used along with high-end glass packages that are most appealing for premium products. Distribution channels are changing such that some niche products have broader reach and visibility through ecommerce platforms while private-label offerings by retailers assist with affordability and market penetration.

Sauces and Condiments Market Analysis

Learn more about the key segments shaping this market

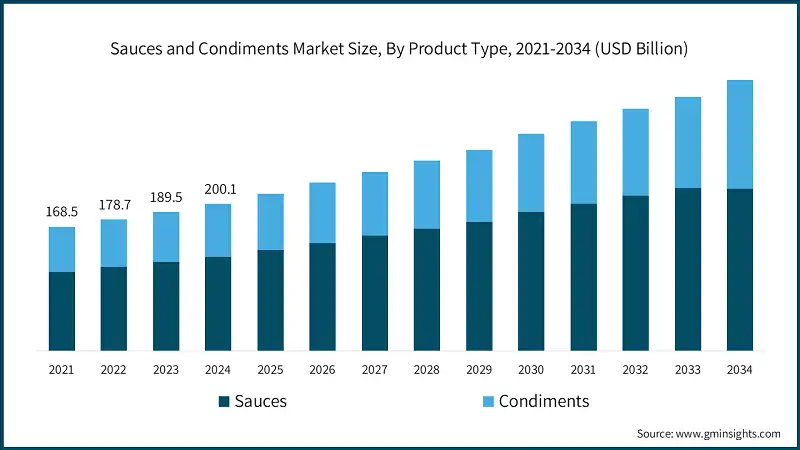

Based on product type, the market is segmented into sauces and condiments. Sauces dominated the market with an approximate market share of 64% in 2024 and is expected to grow with a CAGR of 5.4% by 2034.

- The sauces and condiments market is thriving with opportunity, now essentially divided into two major segments as sauces and condiments. Sauces comprise most of the innovations from consumers' quest for diversified experiences in the form of bold flavors. This segment is also bolstered by a tendency toward convenient meal preparation, with an increasing number of households and foodservice channels embracing ready-to-use globalized sauces. From pasta sauces to stir-fry blends to marinades and gravies, sauces are becoming must-have pantry items for today's modern cooks who want to try international cuisines while enhancing their everyday meals with little hassle.

- Condiments are also on a new trend through premiumization and/or health-based reformulation. Consumers are increasingly looking for more aligned products according to their diets like low-sugar, organic, or functional condiments fortified with probiotics or superfoods; thus, giving rise to a unique differentiating opportunity for the brands by planting themselves on clean label ingredients, green packaging, and novel flavor innovations.

- All of these tend to recreate the notion of condiments from side items to integral components of the culinary experience. Thus, sauces and condiments can be said to be dynamic in their marketplace as culture-relevant nexus shape product versatility and transform consumer expectations into strategic decisions for competitive positioning.

Learn more about the key segments shaping this market

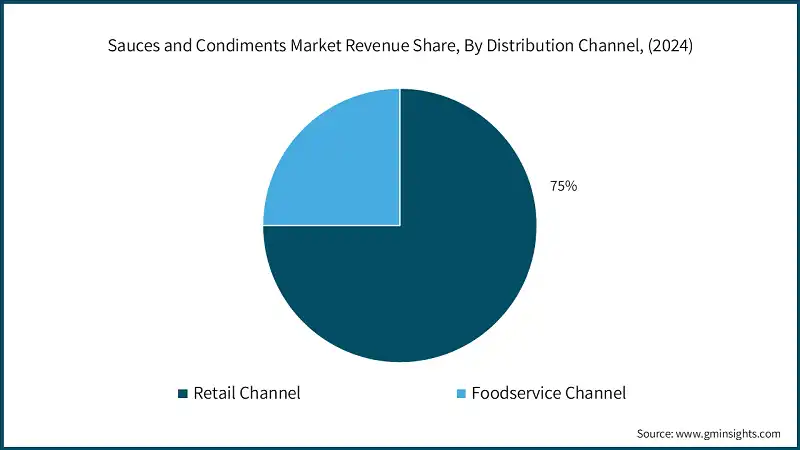

Based on distribution channel, the Sauces and Condiments market is segmented into retail channel and food service channel. Retail Channel holds the largest market share of 75% in 2024 and is expected to grow at a CAGR of 6.9% during 2025-2034.

- On a global scale, the sauces and condiments market is strategically segmented by distribution channels into retail and foodservice, which together with retail channel play important roles in determining the growth path of the industry. While retail remains the channel of choice amongst consumers, the increasing demand for convenience, choice, and premium products has spurred growth in this segment year on year.

- Supermarkets, hypermarkets, and e-commerce are important touchpoints for obtaining a long catalog of sauces and condiments to cater to different culinary tastes and dietary requirements. The growth of online grocery shopping has, in part, boosted retail sales by allowing brands to extend their reach and customize their offering using digital engagement and data-driven marketing.

- On the contrary, there is a developing momentum of foodservice in addressing the changing requirements of restaurants, quick-service restaurants, and institutional customers, all of whom demand tailor-made-to-scale and cost-efficient solutions corresponding to the demand shifts of contemporary consumers. Increasingly, foodservice operators are joining forces with manufacturers to co-create signature sauces and condiments that can be leveraged to differentiate menus and build brand equity.

Based on price positioning, the sauces and condiments market is segmented into premium segment (>$8/kg), mainstream segment ($3-8/kg), value segment (<$3/kg). Premium segment (>$8/kg) is valued at market size of USD 34 billion in 2024 and is expected to grow with the CAGR of 12.5% by 2034.

- Increasing demand for artisan-quality craftsmanship, authentic and in many cases exotic ingredients, and the prestige attached to a brand characterize the premium segment. These are more expensive goods for the cost-conscious buyer and offer good margins to have made them attractive to brands looking for differentiation and loyalty among consumers. Premiums on sauces and condiments also talk of clean labels, sustainability, and gourmet appeal, capturing the attention of health-conscious and discerning consumers ready to pay a bit extra, as those who perceive quality and exclusivity.

- The mainstream segment, on the other hand, strikes a balance between cost and quality, appealing to a broad and diverse consumer base. They also would maintain these high volumes by consistently appealing tastes, easily viewed branding, and broad access to all channels, whether retail or food service.

- On the other hand, the value segment is mainly cost-efficient and access oriented, thus catering price-sensitive consumers and buyers in bulk, referring mainly to emerging markets or institutional settings. Thus, the multi-tiered pricing of these brands enables the strategic brand portfolio diversification and penetration of multiple market segments while optimizing performance across the regions through harmonizing product offerings with local economic conditions and preferences of consumers.

Based on packaging type, the sauces and condiments market is segmented into glass containers, plastic containers, metal/aluminum (cans, tubes), flexible packaging (pouches, sachets), and others. Glass containers comprised of market size of USD 74 billion in 2024 and is expected to grow with the CAGR of 3.6% by 2034.

- Glass containers are very common type of packaging with the touch of a premium or gourmet feeling on it, especially as an item being aesthetically pleasing, recyclable, and preserving the integrity of flavors. It presents itself as a very great quality and tradition, suiting an artisan or heritage brand very well. In contrast, plastic is lightweight, durable, and among the most cost-effective, thus being by far the most widely used packaging for mass-retail. It has flexibility in design and ease of use, and so is the first choice of a household consumer in most cases.

- Metal and aluminum packaging, such as cans and tubes, are predominantly used in the foodservice and industrial domains, wherein the long shelf-life factor and bulk storage become essential. These formats provide excellent protection against light and air and therefore help keep the new products fresh for a long time.

- Meanwhile, flexible packaging, such as pouches and sachets, is capturing the market rapidly as it's easily movable, has portion control, and possesses a smaller footprint. It justifies its on-the-go consumption while capturing the attention of eco-conscious consumers who look for greener alternatives. All types of packaging influence consumer perception and convenience but also play a strategic role in developing pricing, distribution, and even brand positioning along several market segments.

Looking for region specific data?

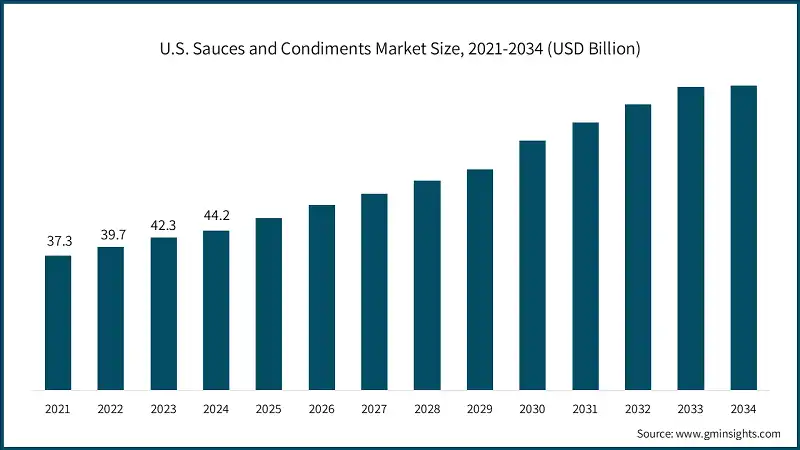

The North America sauces and condiments market dominated 26% of the revenue share in 2024.

- In North America, the market is driven by varying consumer preferences and regional dynamics, with the US by far contributing to the larger market share, innovation, etc. The American consumer has gravely succumbed to the temptation of ready-to-use sauces and condiments that ensure user convenience and flavor diversity. Reflecting a busy lifestyle with less and less time for culinary exploration, they have stressed their craving for convenience.

U.S. dominates the North America sauces and condiments market, showcasing strong growth potential.

- The other growing trends being seen in the U.S. are healthy eating with an increasing demand for premium and gourmet products and clean-label, organic, and plant-based options. The once-niche ethnic flavors are no longer limited to sriracha, teriyaki, and curry. They are fast becoming quite popular elements used in mainstream concoctions. Private label products are also gaining popularity over time due to quality and price. Online retail will alter a new landscape in which these niche or artisanal brands will aim to reach larger audiences.

Europe sauces and condiments market accounted for USD 42 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- The significant interest this market currently demonstrates is for internationally inspired flavors, especially Asian tastes such as soy, chili, and fish sauces. Convenience is another aspect mostly driving ready-to-use and single-serve product configurations. Retailers are currently expanding their assortment toward premium and artisanal products, while consumers can now find more of the international and niche brands through online channels.

Germany dominates the European sauces and condiments market, showcasing strong growth potential.

- Germany is a major player in Europe's market, where consumer focus is primarily around health, sustainability, and culinary diversity. Shoppers in Germany have been more inclined towards organic, sugar-reduced, and no artificial additives, mostly falling in line with the clean label and plant-based diets. This trend has its national supports popularizing healthier eating and environmentally friendly consumption.

The Asia Pacific sauces and condiments market is anticipated to grow at a CAGR of 21.9% during the analysis timeframe.

- The Asia Pacific region sauces and condiments sector is characterized by a diverse culinary world and openness to global flavor. Traditional condiments such as soy sauce, vinegar, and chili pastes are still considered kitchen essentials in Chinese households, but demand for Western-style sauces such as mayonnaise, mustard, and various salad dressings is on the rise. This change in lifestyle and choices, to a great extent fostered by younger consumers, urbanization, and rising acceptance of international cuisines, is most likely responsible for the current trends. E-commerce and modern trade formats thus play a pivotal role in reaching ever more available products, often including gourmet and imported brands.

China sauces and condiments market is estimated to grow with a significant CAGR in the Asia Pacific region.

- The sauces and condiments industry is experiencing growth due to changing lifestyles, increasing disposable income, and growing quick-service restaurants. Increasingly, consumers prefer ready-to-serve sauces that pair well with fast food and fusion dishes like Indo-Chinese and Pan-Asian cuisines.

Latin America sauces and condiments market accounted for 4.9% market share in 2024 and is anticipated to show lucrative growth over the forecast period.

- Health continues to influence product development; manufacturers have focused their attention on low-sodium, organic, and preservative-free products. The new and increasing plant-based and artisanal products caters to this group of consumers who are interested in authenticity and nutrition. Packaging innovation has been increased with pouches and sachets being preferred for convenience while glass jars are retained for premium positioning.

Brazil leads the Latin American sauces and condiments market, exhibiting remarkable growth during the analysis period.

- Brazil ranks first in Latin America as far as sauces and condiments are concerned. This has been complemented by a rich culinary culture as well as an increasing craving for different tastes. Not to say that traditional sauces like chimichurri, molho campanha and hot sauces have lost their popularity, as international tastes, not limited to Asian and Mediterranean sauces, have further found their place in the palate of Brazil.

Middle East & Africa sauces and condiments market accounted for 3.5% market share in 2024 and is anticipated to show lucrative growth over the forecast period.

- Healthier formulations are increasingly demanded since there is increasing health consciousness among consumers who prefer organic, low sodium, and clean-label products. Most of the demand comes from the food service sector, mainly restaurants and hotels. However, this is also covered by supermarkets and hypermarkets. E-commerce goes a step further in enhancing distribution capabilities, granting access to specialty and imported food products.

Saudi Arabia sauces and condiments market to experience substantial growth in the Middle East and Africa market in 2024.

- Saudi Arabia's market is emerging because of urbanization and diet changes along with increasing food conveniences taking part in consumption. It has international barbecue, soy, and mayonnaise flavors extending to international flavors in addition to traditional sauces such as tahini and garlic sauces and tomato-based sauces. This is just indicative of how global cuisines have pervaded an increasing expatriate population.

Sauces and Condiments Market Share

The top 5 companies in sauces and condiments industry include Unilever PLC, Kraft Heinz Company, Nestlé S.A., McCormick & Company, General Mills. These are prominent companies operating in their respective regions covering 30% of the market share in 2024. These companies hold strong positions due to their extensive experience in Sauces and Condiments market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

- Unilever PLC operates in the consumer goods sector with a diverse portfolio that includes food, beverages, personal care, and home care products. In the sauces and condiments category, it offers products under brands such as Hellmann’s and Knorr.

- Kraft Heinz Company is involved in food and beverage manufacturing, offering a wide range of products including sauces and condiments. Its portfolio includes brands like Heinz and Kraft, which feature ketchup, mustard, salad dressings, and cooking sauces.

- Nestlé S.A. operates globally across food, beverage, and nutrition sectors. In the sauces and condiments segment, its MAGGI brand is widely distributed in regions such as Asia, Africa, and Latin America.

- McCormick & Company produces spices, seasonings, and condiments, with brands such as French’s and Frank’s RedHot. Its offerings include mustard, hot sauces, marinades, and spice blends.

- General Mills is active in the food sector with products spanning cereals, snacks, and meal solutions. In the sauces and condiments category, it offers items under brands like Old El Paso and Betty Crocker, which support Mexican-inspired meals and baking.

Sauces and Condiments Market Companies

Major players operating in the sauces and condiments industry include:

- Unilever PLC

- Kraft Heinz Company

- Nestlé S.A.

- McCormick & Company

- General Mills

- Kikkoman Corporation

- Lee Kum Kee

- Conagra Brands

- Campbell Soup Company

- Mizkan Holdings

- Barilla Group

- Orkla ASA

- Develey Senf & Feinkost

- Premier Foods

- Foshan Haitian Flavouring & Food

- Ajinomoto Co., Inc.

- Grupo Herdez

- La Costeña

- Borges International Group

- Yeo Hiap Seng

Sauces and Condiments Industry News

- In September 2025, Kraft Heinz Co. announced to get split into two publicly traded companies, one focused on condiments and sauces, the other on general grocery products. Neither company has been named yet.

- In March 2025, FMCG firm Adani Wilmar Ltd (AWL) announced the acquisition of GD Foods Manufacturing, which sells pickles and sauces under the brand “Tops”.

- In January 2024, Tata Consumer Products announced that it has signed definitive agreements for the phased acquisition of 100% equity shares in Capital Foods, the owner of the brands Ching's Secret and Smith & Jones. 75% of the equity shareholding will be acquired upfront and the remaining 25% shareholding will be acquired within the next three years.

This sauces and condiments market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2025 to 2034, for the following segments:

Market, By Product Type

- Sauces

- Table sauces

- Ketchup & tomato sauces

- Soy sauces & Asian sauces

- Hot sauces & chili sauces

- Specialty table sauces

- Cooking sauces

- Pasta sauces

- Stir-fry & Asian cooking sauces

- Curry & Indian sauces

- Other cooking sauces

- Premium/artisanal sauces

- Table sauces

- Condiments

- Spreads & dressings

- Mayonnaise & mayo-based

- Mustard

- Salad dressings

- Pickled products

- Pickles & relishes

- Olives & capers

- Vinegars & specialty condiments

- Spreads & dressings

Market, By Distribution Channel

- Retail channel

- Modern trade

- Hypermarkets & supermarkets

- Convenience stores

- Warehouse clubs

- Traditional trade

- Independent grocers

- Specialty food stores

- E-Commerce

- Pure-play e-commerce

- Retailer online platforms

- Modern trade

- Foodservice channel

- Quick service restaurants (QSR)

- Full-service restaurants

- Institutional (schools, hospitals, corporate)

- Food processing/manufacturing

Market, By Price Positioning

- Premium segment (>$8/kg)

- Artisanal/craft brands

- Organic/natural

- Gourmet/specialty

- Mainstream segment ($3-8/kg)

- National brands

- Regional brands

- Value segment (<$3/kg)

- Private label

- Economy brands

Market, By Packaging Type

- Glass containers

- Plastic containers

- Metal/Aluminum (cans, tubes)

- Flexible packaging (pouches, sachets)

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the sauces and condiments industry?

Major players include Unilever PLC, Kraft Heinz Company, Nestlé S.A., McCormick & Company, General Mills, Kikkoman Corporation, Lee Kum Kee, Conagra Brands, Campbell Soup Company, and Mizkan Holdings.

Which region leads the sauces and condiments sector?

North America led the market with a 26% share in 2024. The market is driven by consumer preferences for ready-to-use sauces and condiments, reflecting a demand for convenience and flavor diversity.

What are the upcoming trends in the sauces and condiments market?

Trends include exotic flavors, health-focused clean-label products, sustainable packaging, functional sauces, and growth in e-commerce and private labels.

What was the valuation of the premium segment in 2024?

The premium segment, priced above $8/kg, was valued at USD 34 billion in 2024 and is anticipated to observe around 12.5% CAGR up to 2034.

What was the market share of the retail channel segment in 2024?

The retail channel segment held the largest market share of 75% in 2024 and is set to expand at a CAGR of 6.9% during the forecast period.

What is the expected size of the sauces and condiments industry in 2025?

The market size is expected to grow to USD 214 billion in 2025.

What was the market share of sauces segment in 2024?

Sauces segment dominated the market with an approximate share of 64% in 2024 and are expected to witness over 5.4% CAGR through 2034.

What is the market size of the sauces and condiments in 2024?

The market size was estimated at USD 200.1 billion in 2024, growing at a CAGR of 6.2% till 2034, driven by advancements in processing methods, clean-label developments, and increasing consumer demand for flavor-enhancing products.

What is the projected value of the sauces and condiments market by 2034?

The market is poised to reach USD 368.5 billion by 2034, fueled by innovations in product formulations, packaging, and distribution channels.

Sauces and Condiments Market Scope

Related Reports