Summary

Table of Content

Road Safety Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Road Safety Market Size

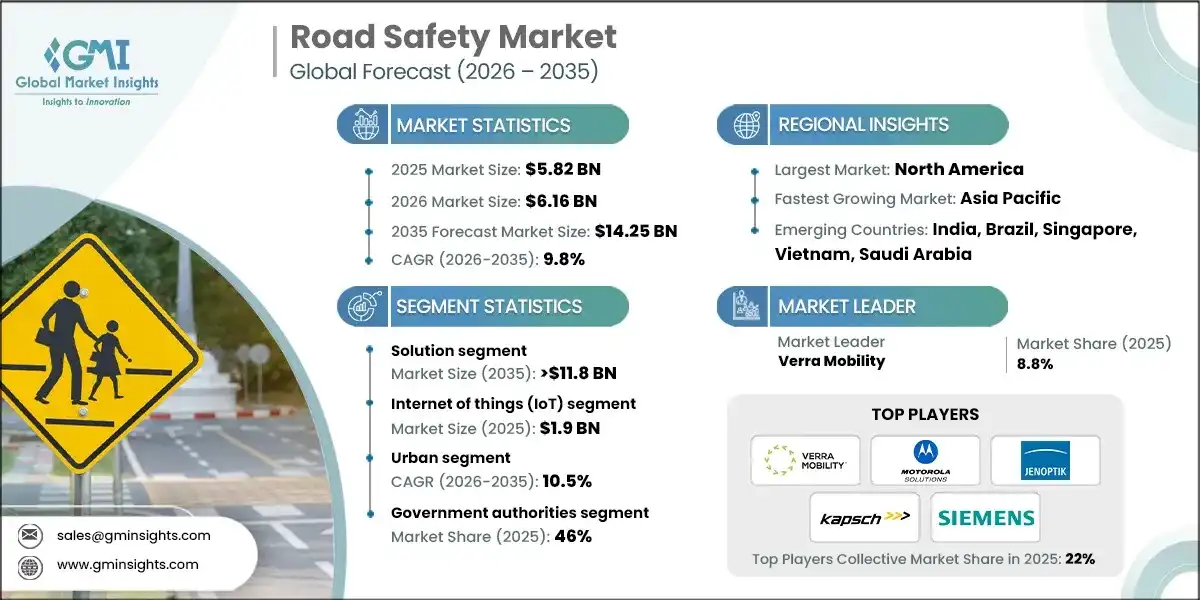

The global road safety market size was estimated at USD 5.82 billion in 2025. The market is expected to grow from USD 6.16 billion in 2026 to USD 14.25 billion in 2035, at a CAGR of 9.8% according to latest report published by Global Market Insights Inc.

To get key market trends

Governments worldwide are enforcing stricter road safety regulations, speed limits, and zero-fatality targets. Mandatory deployment of enforcement systems and intelligent traffic management solutions is driving sustained public investment in advanced road safety technologies across urban and highway infrastructure.

Rapid urbanization, vehicle population growth, and congested road networks have increased accident frequency and severity. This has intensified demand for real-time monitoring, automated incident detection, and predictive safety solutions that reduce collisions and improve overall traffic flow efficiency.

Continuous innovation in artificial intelligence, computer vision, IoT sensors, and cloud computing has enhanced the accuracy, scalability, and cost-effectiveness of road safety systems, encouraging faster adoption by public authorities and private operators seeking data-driven safety outcomes.

For instance, in February 2024, Iteris expands partnership with Arity to deliver enhanced traffic data solutions. With Arity, Iteris will expand its offerings to manage increased traffic volume by improving intersection signal timing, solving urban bottlenecks, making transportation smarter, safer, and more efficient.

The growth of the market is driven by factors such as increasing number of vehicles, increased focused on public safety, urbanization, and infrastructure development. The rising number of vehicles on the road increases the need for effective road safety measures to manage traffic and reduce accidents. Also, there is rapid urbanization and infrastructure development in various regions leading to development of road safety solutions to manage increased traffic volumes, urban bottlenecks, and ensure safety.

Road Safety Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 5.82 Billion |

| Market Size in 2026 | USD 6.16 Billion |

| Forecast Period 2026-2035 CAGR | 9.8% |

| Market Size in 2035 | USD 14.25 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Regulatory Enforcement Expansion | Mandatory safety laws and Vision Zero initiatives compel large-scale deployment of automated enforcement and intelligent road safety systems globally. |

| Increasing Road Traffic Fatalities | Rising accident rates intensify demand for preventive technologies, real-time monitoring, and analytics-driven interventions across urban and highway networks. |

| Urbanization and Vehicle Population Growth | Urbanization and Vehicle Population Growth |

| Technological Advancements in AI and IoT | Improved accuracy, scalability, and automation capabilities lower operational barriers and encourage broader implementation of advanced safety solutions. |

| Smart City Development Initiatives | Integration of road safety systems within smart city frameworks drives sustained public investment and long-term infrastructure modernization. |

| Pitfalls & Challenges | Impact |

| High Initial Investment Requirements | Significant capital expenditure limits adoption in budget-constrained regions, slowing deployment of advanced road safety technologies. |

| Data Privacy and Surveillance Concerns | Regulatory and public resistance to data collection restricts large-scale implementation of monitoring and enforcement systems. |

| Opportunities: | Impact |

| Emerging Market Infrastructure Development | Developing economies present untapped demand for cost-effective road safety solutions supporting rapid urban and transportation expansion. |

| Public–Private Partnership Models | Collaboration between governments and private operators enables shared investment, faster deployment, and expanded market penetration. |

| Integration with Autonomous and Connected Vehicles | Growing connected vehicle ecosystems create opportunities for infrastructure-based safety platforms and predictive traffic management. |

| Advanced Analytics and Big Data Utilization | Monetization of traffic and safety data enables new service models, value-added insights, and performance-based contracts. |

| Market Leaders (2025) | |

| Market Leaders |

held 8.8% Market Share in 2025 |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Brazil, Singapore, Vietnam, Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

Road Safety Market Trends

Road safety solutions are increasingly leveraging artificial intelligence and advanced analytics to predict high-risk locations, identify unsafe driving behaviors, and enable proactive interventions, shifting road safety management from reactive incident response to preventive, data-driven decision-making.

Deployment of IoT sensors, connected cameras, and vehicle-to-infrastructure communication is expanding rapidly, enabling real-time traffic monitoring, continuous data collection, and dynamic control of signals and enforcement systems to improve situational awareness and reduce accident risks.

Automated speed, red-light, and average-speed enforcement systems are gaining traction as authorities seek consistent, unbiased, and scalable enforcement methods that reduce dependence on manual policing while improving compliance and overall road safety outcomes.

Road safety platforms are increasingly deployed on cloud and edge architectures to support real-time data processing, scalable analytics, remote system management, and integration with smart city ecosystems, improving operational efficiency and lowering long-term infrastructure costs.

Private operators, including toll road companies and fleet managers, are investing in road safety technologies to reduce operational risks, enhance compliance, and meet sustainability goals, driving public-private partnerships and expanding the commercial adoption of advanced safety solutions.

For instance, in April 2024, FLIR introduces TrafiBot AI camera to enhance interurban traffic flow and road safety. This closed-circuit traffic camera offers the most robust artificial intelligence (AI) for the highest detection performance and most reliable traffic data collection.

Road Safety Market Analysis

Learn more about the key segments shaping this market

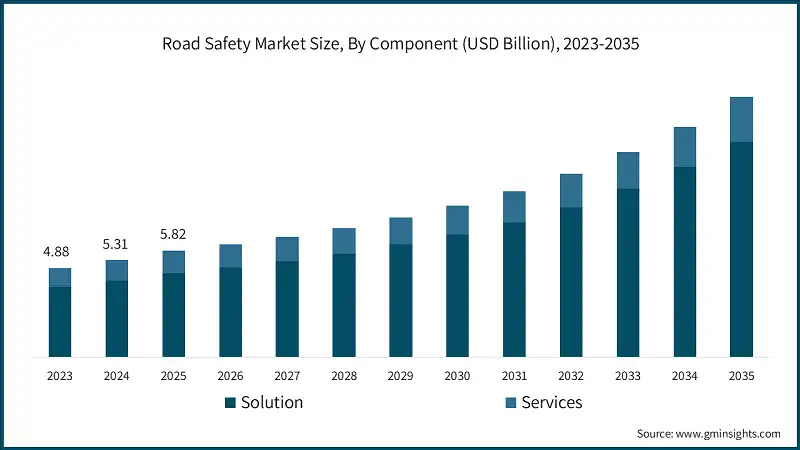

Based on component, the road safety market is divided into solutions, services. In 2025, the solution segment accounted for over 79% of the market share and is expected to exceed USD 11.8 billion by 2035.

- Road safety solutions are increasingly integrated into unified platforms combining enforcement, traffic management, and analytics, enabling authorities to deploy scalable, interoperable systems that support real-time monitoring, predictive risk assessment, and smart city alignment.

- Demand for managed services, system integration, and long-term maintenance contracts is rising as governments and operators seek outsourced expertise to reduce operational complexity and ensure continuous performance optimization of advanced road safety deployments.

- Companies are developing sophisticated surveillance systems to monitor and enforce traffic laws. With introductions of new technologies in the road safety market the solutions are becoming more efficient to manage and monitor the traffic.

- In March 2024, Miovision announces innovative integration with samsara to enhance emergency vehicle response times. By integrating Opticom EVP solutions with Samsara’s comprehensive IoT offerings including vehicle telematics, driver safety, and vehicle health.

Learn more about the key segments shaping this market

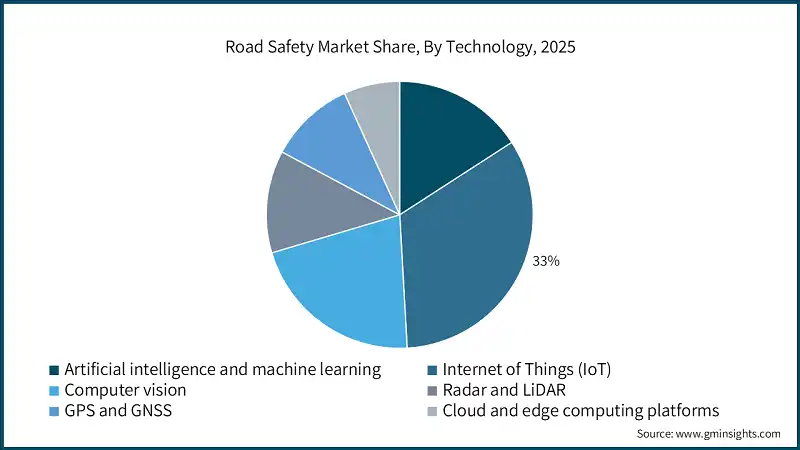

Based on technology, the road safety market is categorized into artificial intelligence and machine learning, internet of things (IoT), computer vision, radar and lidar, GPS and GNSS, cloud and edge computing platforms. In 2025, the internet of things (IoT) segment held a market share of over 33% and was valued at around USD 1.9 billion.

- AI and machine learning adoption is accelerating to enable predictive accident modeling, automated violation detection, and adaptive traffic control, shifting road safety strategies from reactive enforcement toward proactive, data-driven prevention frameworks.

- IoT-enabled sensors, cameras, and connected devices are expanding across road networks, supporting continuous data collection, vehicle-to-infrastructure communication, and real-time situational awareness to enhance traffic safety and operational efficiency.

- Computer vision technologies are evolving toward higher accuracy and multi-object detection, enabling reliable identification of violations, pedestrian behavior, and traffic incidents under diverse environmental and lighting conditions.

- Radar and LiDAR technologies are increasingly deployed for precise speed measurement, vehicle classification, and incident detection, particularly in complex traffic environments where weather resilience and high accuracy are critical.

- GPS and GNSS technologies are being integrated with enforcement and fleet systems to enable location-based monitoring, average speed enforcement, and enhanced traffic data accuracy across expansive road networks.

Based on application, the road safety market is categorized into urban, highway, rural, work zone safety and others. The urban segment led the market in 2025 and is expected to grow at a CAGR of 10.5% during the forecast period from 2026 to 2035.

- Government authorities are increasingly implementing integrated, long-term road safety programs aligned with national mobility and Vision Zero strategies, focusing on standardized platforms, centralized data analytics, performance measurement, and demonstrable reductions in traffic accidents, injuries, and fatalities across public road networks.

- Law enforcement agencies are adopting automated and AI-enabled enforcement technologies to improve compliance consistency, reduce dependence on manual policing, enhance transparency, and optimize limited human resources while strengthening violation detection, evidence accuracy, and enforcement efficiency across jurisdictions.

- Private operators, including toll road operators and fleet managers, are expanding investments in road safety technologies to minimize liability exposure, enhance operational efficiency, comply with regulations, support sustainability objectives, and improve safety performance across commercial transportation infrastructure.

Based on end use, the road safety market is divided into government authorities, law enforcement agencies and private operators. The government authorities segment held a major market share of 46% in 2025.

- Urban road safety applications increasingly prioritize vulnerable road user protection through smart intersections, adaptive traffic signaling, pedestrian detection systems, and AI-based monitoring to manage congestion, enhance situational awareness, and significantly reduce pedestrian and cyclist-related accidents.

- Highway road safety solutions emphasize average-speed enforcement, real-time incident detection, lane monitoring, and traffic analytics to improve safety on high-speed corridors, reduce severe collision risks, and enable rapid response to accidents and traffic disruptions.

- Rural road safety initiatives focus on deploying cost-effective speed enforcement, warning systems, and monitoring solutions to address higher fatality rates, compensate for limited infrastructure, and improve response times in remote locations with lower traffic density.

- Work zone safety solutions increasingly utilize temporary automated enforcement, connected variable message signage, and real-time alert systems to protect construction workers and motorists, manage changing traffic conditions, and reduce accidents in dynamic and high-risk environments.

Looking for region specific data?

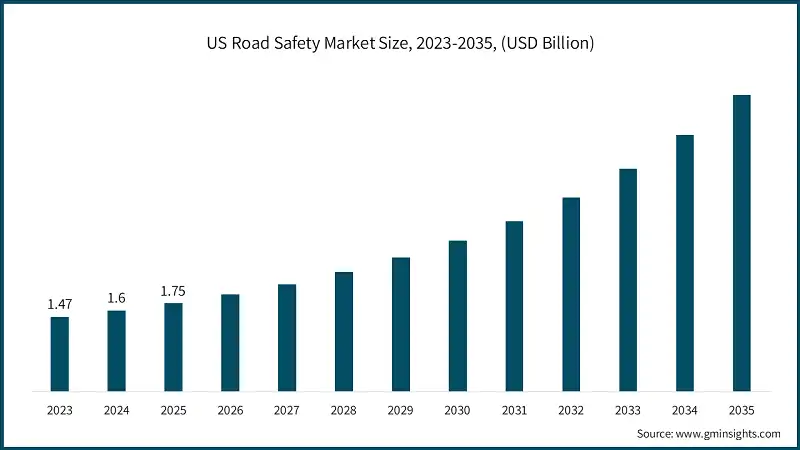

The road safety market in US is valued at USD 1.75 billion in 2025 and is expected to experience significant and promising growth from 2026 to 2035.

- Expansion of automated speed and red-light enforcement programs is accelerating across states and cities, supported by federal road safety funding and Vision Zero initiatives, driving sustained demand for camera-based systems, processing violation platforms, and data-driven traffic safety solutions.

- Federal infrastructure and transportation safety investments are enabling modernization of aging road networks, encouraging adoption of intelligent traffic systems, integrated analytics platforms, and smart intersection technologies to improve traffic flow, enforcement efficiency, and accident reduction outcomes.

- Road safety strategies increasingly prioritize protection of vulnerable road users, including pedestrians and cyclists, through deployment of smart crosswalks, AI-based monitoring, adaptive signal control, and enhanced urban safety design standards.

- Public agencies are increasingly adopting cloud-based traffic management and enforcement platforms to improve scalability, data sharing, system interoperability, and long-term operational efficiency across multi-jurisdictional road safety programs.

North America region in the road safety market held a market revenue USD 2.1 billion in 2025 and is anticipated to grow at a CAGR of 9.2% between 2026 and 2035.

- Regional collaboration on transportation safety standards is increasing, enabling cross-border adoption of standardized enforcement technologies, data-sharing frameworks, and integrated traffic management systems across the United States and Canada.

- Rising adoption of AI-driven analytics is improving incident detection, predictive safety modeling, and performance measurement, supporting evidence-based policy decisions and more efficient allocation of road safety investments.

- Public-private partnerships are expanding across North America, allowing governments to accelerate deployment of advanced road safety infrastructure while sharing financial risk and leveraging private sector technology expertise.

- Increasing focus on climate resilience and sustainability is influencing road safety investments, with emphasis on energy-efficient systems, smart traffic control, and technologies supporting reduced congestion and emissions.

Europe road safety market accounted for USD 1.4 billion in 2025 and is anticipated to show growth of 8.8% CAGR over the forecast period from 2026 to 2035.

- European Union road safety initiatives and harmonized regulations are driving adoption of standardized enforcement systems, cross-border data interoperability, and consistent compliance monitoring across member states.

- Strong emphasis on Vision Zero and sustainable mobility is accelerating investments in pedestrian safety, cycling infrastructure, and smart urban traffic management solutions integrated with environmental objectives.

- Advanced adoption of AI, computer vision, and automation technologies is enhancing traffic monitoring, violation detection, and predictive risk analysis across urban and interurban road networks.

- Data protection and privacy regulations are shaping system design, encouraging secure, compliant road safety platforms with robust governance, transparency, and citizen trust mechanisms.

Germany dominates the Europe road safety market, showcasing strong growth potential, and held a market share of 25% in 2025.

- Germany’s strong automotive and engineering ecosystem is supporting integration of advanced road safety infrastructure with connected and automated vehicle technologies, reinforcing its leadership in intelligent transportation systems.

- High standards for precision, reliability, and regulatory compliance are driving demand for advanced sensor technologies, including radar, LiDAR, and high-accuracy enforcement solutions.

- Investments in digital highways and smart mobility corridors enabling deployment of real-time traffic monitoring, adaptive speed management, and incident detection systems.

- Strict data protection and procurement requirements are encouraging development of secure, interoperable, and highly reliable road safety platforms tailored to national regulatory frameworks.

Asia Pacific region leads the road safety market, exhibiting remarkable growth with a CAGR of 11% during the forecast period of 2026 to 2035.

- Rapid urbanization and growing vehicle populations are driving large-scale investments in smart traffic management, automated enforcement, and scalable road safety infrastructure across major metropolitan regions.

- Governments across APAC are increasingly leveraging smart city programs to deploy AI-enabled traffic monitoring, IoT-based sensors, and integrated control centers to reduce congestion and accident rates.

- Public spending on transportation infrastructure is accelerating adoption of cost-effective, high-volume enforcement and monitoring solutions suitable for dense traffic environments.

- Technology adoption is characterized by strong demand for scalable, cloud-based platforms capable of supporting large data volumes and multi-city deployments.

China to experience substantial growth in the Asia Pacific road safety market in 2025. The market in China is expected to reach USD 1.8 billion by 2035.

- China continues large-scale deployment of AI-powered traffic surveillance, computer vision systems, and integrated command centers to manage complex urban traffic and improve road safety outcomes.

- Strong government-led smart city initiatives are accelerating adoption of IoT-enabled road infrastructure and real-time data platforms across urban and intercity transport networks.

- Domestic technology providers are increasingly developing proprietary road safety solutions, enhancing localization, cost efficiency, and rapid deployment capabilities.

- Integration of road safety systems with broader public security and urban management platforms is strengthening centralized monitoring, enforcement, and emergency response efficiency.

Latin America is valued at USD 537 million in 2025 and is expected to experience substantial growth during the forecast period from 2026 to 2035.

- Rising traffic fatalities and congestion levels are prompting governments to strengthen road safety regulations and invest in automated enforcement and monitoring technologies.

- Budget constraints are driving demand for cost-effective, modular, and phased deployment models, including managed services and public-private partnerships.

- Urban safety initiatives focus on speed management, pedestrian protection, and traffic calming measures, particularly in high-density city centers.

- International development funding and multilateral support are enabling pilot projects and modernization of road safety infrastructure across key metropolitan areas.

MEA is valued at USD 410.6 million in 2025 and is expected to experience substantial growth during the forecast period from 2026 to 2035.

- Large-scale infrastructure development and urban expansion are driving investments in intelligent traffic management and enforcement systems across major cities and highways.

- Smart city initiatives in the Gulf region are accelerating adoption of AI, IoT, and integrated command-and-control platforms for road safety and traffic optimization.

- Governments are increasingly emphasizing highway safety and speed enforcement to reduce accident rates on long-distance transport corridors.

- In parts of Africa, road safety investments are focused on scalable, cost-efficient technologies supported by international funding and capacity-building programs.

Road Safety Market Share

- The top 7 companies in the road safety industry are Verra Mobility, Motorola Solutions, Jenoptik, Kapsch TrafficCom, Siemens, Conduent, Sensys Gatso contributed around 25% of the market in 2025.

- Verra Mobility has built market leadership through aggressive organic growth and targeted acquisitions, creating a broad portfolio across speed, red-light, tolling, and parking solutions. Its integrated platform, turnkey service model, and revenue-sharing approach enable municipalities to deploy advanced enforcement infrastructure without upfront capital investment.

- Motorola Solutions leverages deep public safety technology expertise and longstanding law enforcement relationships to deliver integrated traffic enforcement within broader public safety ecosystems. Its cloud-native CommandCentral platform, advanced analytics, and acquisitions such as Vigilant Solutions enable unified situational awareness, AI-driven investigations, and seamless integration across communications, video, and data systems.

- Jenoptik is a European leader in road safety technology, offering unified enforcement platforms for speed, red-light, and traffic management. Its privacy-by-design solutions, GDPR-compliant edge processing, and advanced AI capabilities support reliable enforcement across conditions, while its average speed systems demonstrate proven effectiveness in reducing accidents on European roadways.

- Kapsch TrafficCom provides end-to-end intelligent transportation systems integrating tolling, traffic management, and safety enforcement on shared platforms. Its multi-application approach lowers lifecycle costs and complexity, while strong C-ITS expertise positions the company for connected vehicle, vehicle-to-infrastructure communication, and future automated mobility deployments across Europe.

- Siemens applies extensive transportation infrastructure experience to deliver large-scale, integrated urban mobility solutions. Its open, standards-based traffic management platforms enable multi-vendor integration, while global scale, financial strength, and long-term relationships with authorities support complex, multi-year infrastructure and public-private partnership projects worldwide.

- Conduent delivers road safety solutions primarily through its intelligent transportation and automated traffic enforcement services, including red-light, speed, and tolling-related enforcement. Its strength lies in large-scale program management, data processing, and analytics capabilities that support end-to-end operations for governments seeking compliance-driven safety improvements.

- Sensys Gatso is a global road safety specialist focused on speed and red-light enforcement technologies with a strong safety-outcomes orientation. Its systems emphasize accuracy, legal robustness, and data integrity, supporting Vision Zero initiatives by demonstrably reducing speed, improving driver behavior, and lowering accident and fatality rates across deployments.

Road Safety Market Companies

Major players operating in the road safety industry are:

- Conduent

- Cubic

- IDEMIA

- Jenoptik

- Kapsch TrafficCom

- Motorola Solutions

- Sensys Gatso

- Siemens

- Verra Mobility

- Verra Mobility delivers end-to-end road safety solutions through automated enforcement, tolling, and analytics platforms across North America. Its AI-driven, cloud-based technology and managed services model enables municipalities to improve safety and traffic flow without upfront capital, supported by large-scale deployments and revenue-sharing program structures.

- Motorola Solutions applies decades of public safety leadership to road safety by integrating traffic enforcement with communications, video, and command center platforms. Its command central ecosystem, strengthened by license plate recognition capabilities, enables data-driven enforcement, predictive analytics, and seamless coordination between traffic safety and broader law enforcement operations.

- Jenoptik is a leading European road safety provider offering speed, red-light, and average speed enforcement on unified platforms. Its GDPR-compliant, privacy-by-design technologies and advanced AI ensure reliable enforcement across conditions, with proven reductions in speeding and serious accidents on highways and urban corridors.

- Kapsch TrafficCom provides integrated road safety and intelligent transportation solutions combining enforcement, tolling, traffic management, and connected vehicle infrastructure. Its multi-application platforms reduce lifecycle costs while supporting emerging vehicle-to-infrastructure use cases, positioning the company for future-ready, data-driven road safety ecosystems.

- Siemens delivers holistic road safety solutions as part of large-scale urban mobility systems integrating traffic management, enforcement, and infrastructure control. Its open, standards-based platforms, global delivery capability, and experience with complex public projects enable long-term, citywide safety and congestion reduction initiatives.

- Conduent supports road safety programs through automated enforcement operations, violation processing, and payment services. Its cloud-based, AI-enabled back-office platforms allow governments to implement enforcement initiatives efficiently, improving compliance and safety outcomes without building internal operational or technology capabilities.

- Sensys Gatso specializes in high-accuracy speed and red-light enforcement systems designed to measurably reduce accidents and fatalities. Its radar-based technologies, flexible deployment models, and analytics-driven platforms support Vision Zero objectives across diverse geographies and operating environments.

- Cubic contributes to road safety through intelligent transportation and traffic management systems integrated with broader mobility platforms. Its strength in system integration, real-time data processing, and long-standing transit authority relationships enables safer traffic operations and informed transportation planning at metropolitan scale.

Road Safety Industry News

- In December 2024, Verra Mobility expanded its AI-powered traffic safety platform to 50 additional U.S. municipalities, deploying over 500 new automated enforcement devices. The upgraded system delivers 99% violation detection accuracy, significantly reduces false positives, and demonstrates measurable speed and violation reductions, particularly in school zones.

- In November 2024, Motorola Solutions secured an USD 85 million contract to deploy integrated traffic management, enforcement, and connected vehicle infrastructure across a major metropolitan area. The project integrates cameras, license plate recognition, and C-ITS with the CommandCentral platform, creating one of North America’s largest connected vehicle deployments.

- In October 2024, Jenoptik launched its VECTOR Prime enforcement platform featuring edge-based AI for real-time violation detection without cloud dependency. The system achieves high accuracy across adverse weather conditions, supports multiple enforcement modalities on shared infrastructure, and delivers ultra-low latency with high operational resilience.

- In September 2024, Kapsch TrafficCom completed Austria’s first nationwide 5G-enabled intelligent transportation corridor on the A1 autobahn. The deployment supports vehicle-to-infrastructure communication, advanced safety monitoring, and real-time traffic optimization, delivering significant improvements in traffic flow and collision reduction.

- In August 2024, Siemens Mobility announced a USD 150 million intelligent transportation project with a major Chinese metropolis, deploying AI-enabled cameras, adaptive signals, and integrated mobility systems. The platform will manage millions of daily vehicle movements, supporting large-scale traffic optimization and enforcement.

- In July 2024, Conduent expanded its managed transportation services through USD 120 million in new contracts for automated enforcement and tolling operations. Its AI-enabled cloud platform supports high-volume transaction processing and end-to-end program management for state transportation agencies.

- In June 2024, Sensys Gatso secured EUR 45 million in contracts for average speed enforcement across multiple European countries. The deployments target high-risk highway corridors and leverage proven technologies that significantly reduce speeds and serious accidents compared to point-based enforcement.

The road safety market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Mn) from 2022 to 2035, for the following segments:

Market, By Component

- Solutions

- Enforcement

- Red light enforcement

- Speed enforcement

- Bus lane enforcement

- Section enforcement

- Automatic license plate recognition (ALPR/ANPR)

- Incident detection

- Backoffice

- Intelligent transport system

- Traffic management system

- Others

- Enforcement

- Services

- Consulting

- Support & maintenance

- Integration

- Deployment

Market, By Technology

- Artificial intelligence and machine learning

- Internet of Things (IoT)

- Computer vision

- Radar and LiDAR

- GPS and GNSS

- Cloud and edge computing platforms

Market, By Application

- Urban

- Highway

- Rural

- Work zone safety

- Others

Market, By End Use

- Government authorities

- Law enforcement agencies

- Private operators

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Portugal

- Croatia

- Benelux

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Singapore

- Thailand

- Indonesia

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

- Turkey

Frequently Asked Question(FAQ) :

What was the valuation of the IoT segment in 2025?

The IoT segment held a market share of over 33% in 2025, valued at approximately USD 1.9 billion.

What is the growth outlook for the urban segment from 2026 to 2035?

The urban segment is set to expand at a CAGR of 10.5% during the forecast period.

Which region leads the road safety sector?

The United States leads the market, valued at USD 1.75 billion in 2025. Growth is led by federal funding, Vision Zero initiatives, and the expansion of automated enforcement programs.

What are the upcoming trends in the road safety market?

AI-driven safety analytics, IoT-based real-time traffic monitoring, automated enforcement, cloud/edge platforms, and stronger public–private partnerships.

What is the expected size of the road safety industry in 2026?

The market size is projected to reach USD 6.16 billion in 2026.

How much revenue did the solutions segment generate in 2025?

The solutions segment accounted for over 79% of the market share in 2025 and is expected to exceed USD 11.8 billion by 2035.

Who are the key players in the road safety industry?

Key players include Conduent, Cubic, IDEMIA, Jenoptik, Kapsch TrafficCom, Motorola Solutions, Sensys Gatso, Siemens, and Verra Mobility.

What is the projected value of the road safety market by 2035?

The market is poised to reach USD 14.25 billion by 2035, driven by advancements in AI, IoT, and smart traffic management solutions.

What was the market size of the road safety in 2025?

The market size was USD 5.82 billion in 2025, with a CAGR of 9.8% expected through 2035. Increasing government regulations, mandatory enforcement systems, and investments in advanced technologies are driving market growth.

Road Safety Market Scope

Related Reports