Summary

Table of Content

Printed Circuit Board (PCB) Assembly Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Printed Circuit Board Assembly Market Size

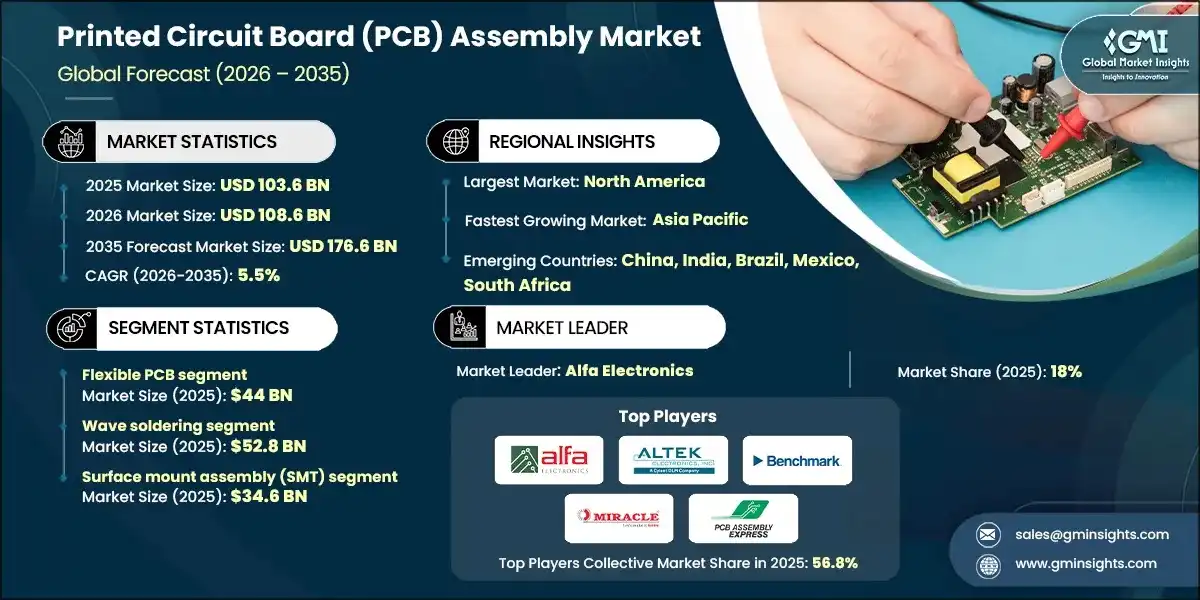

The global printed circuit board assembly market was estimated at USD 103.6 billion in 2025. The market is expected to grow from USD 108.6 billion in 2026 to USD 140.6 billion in 2031 and USD 176.6 billion by 2035, at a CAGR of 5.5% during the forecast period of 2026–2035, according to the latest report published by Global Market Insights Inc.

To get key market trends

The increasing complexity of modern electronic devices and an industrial shift toward larger PCB designs contributes to a growing demand for highly efficient and versatile assembly machines capable of efficiently handling larger boards. Competing with current market demands, Mycronic launched the MYPro A41 series in November 2025, enhancing the efficiency of large board PCB assembly for electronics manufacturers. The MYPro A41 advances from the MYPro A40 Series and maintains interoperability with existing software and feeders. This enables manufacturers to seamlessly incorporate the system into existing production lines and increase efficiency in the high-volume production of complex PCBs.

The rise of advanced computing systems and high-speed communication networks has generated a need for ultra-multilayered PCBs with high thermal stability and ultra-low signal loss. Next-generation 5G, AI servers, and data centers require materials that can maintain signal integrity at high frequencies. The emergence of 5G, data centers, and AI server technologies has led to the development of new materials to sustain signal integrity during the transmission of data at higher frequencies.

The assembly of printed circuit boards (PCBs) is the process of affixing electrical components onto boards to design fully functional circuits. This process employs automated technologies as well as precision soldering and inspection tools to ensure reliability, quality, and scalability across devices such as consumer electronics, industrial machinery, and high-speed communication devices.

Printed Circuit Board (PCB) Assembly Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 103.6 Billion |

| Market Size in 2026 | USD 108.6 Billion |

| Forecast Period 2026–2035 CAGR | 5.5% |

| Market Size in 2035 | USD 176.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing demand for high-precision large board PCB assembly | High-precision large board PCB assembly drives market growth by enabling complex electronic designs with improved reliability. |

| Increasing use of PCBs in vehicle electronics for safety, connectivity, and automation | Automotive electronics adoption boosts PCB assembly demand for advanced safety systems, connectivity modules, and autonomous vehicle components. |

| Rising demand for smartphones, tablets, wearables, and smart home devices | Consumer electronics growth accelerates PCB assembly requirements for compact, high-performance devices and smart home integrations. |

| Expansion of the aerospace & defense industry | Aerospace and defense growth increases demand for durable, high-reliability PCBs in aircraft, satellites, and defense systems. |

| Growing adoption of industrial automation and IoT applications | Industrial automation and IoT drive PCB assembly demand for connected devices, sensors, and smart manufacturing solutions. |

| Pitfalls & Challenges | Impact |

| Increasing complexity of PCBs | Higher PCB complexity increases manufacturing difficulty, costs, and risk of assembly errors, slowing production efficiency. |

| Quality control and testing | Strict quality control and testing requirements add time and expenses, potentially delaying product launch schedules. |

| Opportunities: | Impact |

| Increasing use of flexible and rigid-flex PCBs | Rising demand for flexible and rigid-flex PCBs enables innovative designs in wearables, automotive, and compact electronics. |

| Rising adoption of sustainable and lead-free assembly processes | Sustainable, lead-free PCB assembly adoption drives eco-friendly manufacturing, regulatory compliance, and improved corporate social responsibility. |

| Market Leaders (2025) | |

| Market Leaders |

18% Market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Printed Circuit Board Assembly Market Trends

- PCB Assembly plants use IoT sensors, cloud-based monitoring, and digital twins to combine remote supervision, automated adjustment, and real-time analytics, which provides greater productivity and flexibility. The growing interest in wearables, foldable devices, and advanced communication devices will increase the adoption of assembly techniques that can accurately handle non-traditional board formats.

- The implementation of regulatory compliance and sustainability initiatives are causing manufacturers to use greener materials, more energy-efficient soldering processes, and more recycling-friendly assembly procedures. OEMs are highly dependent upon specialized PCB assembly service providers to decrease their capital investment, gain access to advanced technologies, and quickly scale production in various global markets.

- Cobots are becoming more common in the electronics industry, working alongside human operators to test, inspect, place components, etc. a rise in safety, efficiency, and flexibility in mixed operation environments has increased the need for PCB assembly processes that can provide strong quality control, thermal management, and vibration resistance due to the increasing adoption of electric vehicles, autonomous systems, and avionics.

Printed Circuit Board Assembly Market Analysis

Learn more about the key segments shaping this market

The global PCB assembly market was valued at USD 90.8 Billion and USD 94.7 Billion in 2022 and 2023, respectively. The market size reached USD 103.6 Billion in 2025, growing from USD 98.9 Billion in 2024.

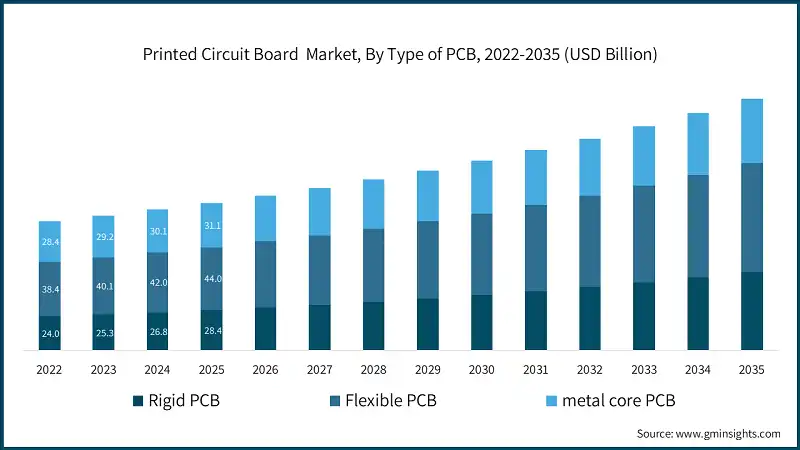

By Type of PCB, the global PCB assembly industry is segmented into rigid PCB, flexible PCB, and metal core PCB. The flexible segment dominated the market in 2025 with a revenue of USD 44 Billion.

- The rigid PCB assembly segment is anticipated to grow at the fastest CAGR of 6.9% due to rising demand in automotive, industrial, and high-performance electronics applications, where durability and multi-layer designs are essential. This segment supports complex circuit integration and high-precision assembly, enabling robust performance in demanding environments.

- Increasing adoption of advanced automated assembly technologies and precision soldering is accelerating production efficiency and reliability for rigid PCBs. The fast growth is further driven by expanding industrial automation, electric vehicle electronics, and aerospace applications requiring high-reliability boards.

- Additionally, enhanced integration with IoT devices, sensors, and advanced electronics is fueling adoption across multiple sectors.

- The flexible PCB assembly segment holds the largest market size due to its widespread use in consumer electronics, wearables, medical devices, and compact communication systems.

- Flexible PCBs enable lightweight, space-saving designs that support multi-directional connectivity and portability, meeting modern device requirements.

- This segment benefits from established manufacturing processes and high-volume production capabilities, ensuring consistent quality and scalability.

- Rising demand for foldable devices, smartwatches, and connected electronics further strengthens the adoption of flexible PCB assemblies.

- Flexible PCBs are increasingly integrated into IoT and automotive applications, enhancing device miniaturization and functionality.

- The segment’s leadership is reinforced by the ability to support complex, high-performance designs while maintaining cost-effective production and broad industry adoption.

By soldering process, the global printed circuit board assembly market is segmented into wave soldering, manual soldering, and reflow soldering. The wave soldering dominated the market in 2025 with a revenue of USD 52.8 billion.

- The wave soldering segment is anticipated to grow due to its efficiency in assembling high-volume PCBs, particularly for through-hole components in consumer electronics and industrial equipment.

- This process enables uniform solder application, reducing defects and improving assembly reliability for complex boards. Growing adoption of automated manufacturing lines and high-speed assembly technologies accelerates wave soldering implementation across multiple industries.

- Demand for automotive, aerospace, and industrial electronics requiring precise and high-speed assembly drives rapid market expansion.

- Wave soldering also supports multi-layer and high-density boards, enhancing productivity and lowering production costs. Continuous process optimization and integration with quality inspection systems further strengthen the segment’s growth trajectory.

- The manual soldering segment is anticipated to have the highest CAGR of 5.4% during the forecast period due to its extensive use in prototyping, low-volume production, and repair operations.

- It is preferred for intricate or custom PCBs where human precision is required for component placement and soldering.

- Manual soldering enables flexibility for varied board types and supports industries like medical devices, aerospace, and specialized electronics.

- High adoption is driven by the need for careful assembly of sensitive components and small-batch production runs.

- The segment benefits from established workforce expertise and minimal equipment requirements, ensuring wide applicability across global markets.

- Its dominance continues as companies balance cost, customization, and precision in PCB assembly operations.

Learn more about the key segments shaping this market

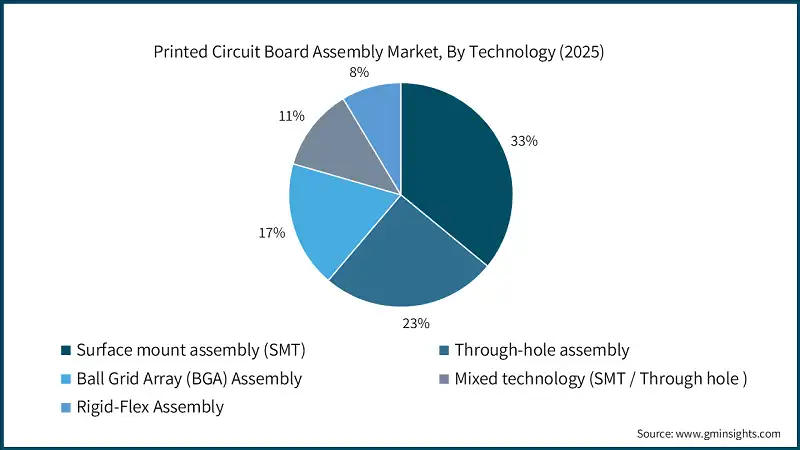

By Technology, the global printed circuit board assembly market is segmented into surface mount assembly (SMT), through-hole assembly, ball grid array (BGA) assembly, mixed technology (SMT/through-hole), and rigid-flex assembly. The surface mount assembly (SMT) segment dominated the market in 2025 with a revenue of USD 34.6 billion.

- The SMT segment is anticipated to grow due to its efficiency in high-speed, high-volume PCB production for consumer electronics, automotive, and industrial applications. SMT enables compact, lightweight, and multi-layer designs, supporting miniaturization and complex circuit integration.

- Rising adoption of automated pick-and-place machines and reflow soldering systems accelerates SMT implementation across industries.

- High demand in wearables, smartphones, and connected devices drives rapid expansion of SMT assembly capabilities.

- SMT also improves production reliability and reduces defect rates, enhancing overall manufacturing efficiency. Technological innovations in precision placement, inspection, and process control further strengthen the segment’s growth trajectory.

- The through-hole assembly segment holds the is anticipated to grow at a CAGR of 5.9% due to its widespread use in industrial, automotive, and high-reliability applications. Through-hole PCBs provide strong mechanical bonds and durability, making them ideal for heavy components and high-stress environments.

- This segment is preferred for aerospace, medical devices, and defense applications requiring robust, long-lasting assemblies. High adoption is supported by established manufacturing processes and workforce expertise in handling complex through-hole designs.

- Through-hole assembly ensures reliable performance in power electronics, connectors, and legacy systems, sustaining broad market demand. The segment’s leadership continues due to its proven performance, versatility, and reliability across diverse industrial applications.

Looking for region specific data?

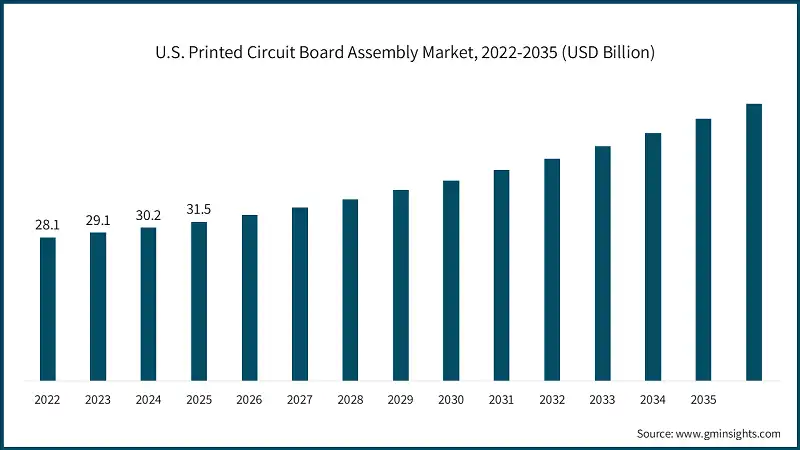

The North America printed circuit board assembly market held a 75.9% share of the global market in 2025.

- The PCB assembly market in North America is expanding steadily, underpinned by strong demand in aerospace, defence, medical electronics and automotive segments. Reshoring and investment incentives such as the U.S. CHIPS Act have bolstered domestic PCB and PCBA capabilities, enhancing supply chain resilience and high-reliability assemblies.

- Demand for HDI and flexible assemblies is rising with 5G and electric vehicle integration, while sustainability initiatives are accelerating adoption of lead-free processes and eco-friendly materials. Growth is supported by advanced manufacturing standards and quality-driven R&D activities.

The U.S. market was valued at USD 28.1 billion and USD 29.1 billion in 2022 and 2023, respectively. The market size reached USD 31.5 billion in 2025, growing from USD 30.2 billion in 2024.

- In the U.S., PCB assembly growth is driven by defence, aerospace and advanced electronics for automotive and telecom sectors. According to the Printed Circuit Board Association of America, advocacy for domestic microelectronics infrastructure aims to strengthen supply chain security and expand PCB production capacity alongside semiconductor investments. Growth in HDI and advanced SMT adoption remains a priority as manufacturers address material cost volatility and onshoring objectives.

Europe printed circuit board assembly market accounted for USD 16.5 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- Europe’s PCB assembly market shows moderate growth supported by automotive electronics, industrial automation and sustainability regulations. Emphasis on eco-compliant manufacturing and digital transformation under EU frameworks accelerates demand for high-density and multi-layer assemblies.

- Automotive electrification and renewable energy electronics drive structural demand, with regional manufacturers integrating automation to mitigate labor cost pressures. While dependent on Asian supply for raw materials, Europe leverages strong OEM presence for customized, high-reliability PCBA solutions.

Germany dominates the Europe market, showcasing strong growth potential.

- Germany represents a key hub for PCB and PCBA activities within Europe, driven by automotive and industrial electronics demand. According to the German Electrical and Electronic Manufacturers’ Association (ZVEI), industry focus includes technological innovation, export-oriented production and environmental compliance, enhancing competitiveness in complex assemblies and automated processes. The country maintains substantial production capacity and integration with Industry 4.0 initiatives.

The Asia Pacific printed circuit board assembly market is anticipated to grow at the highest CAGR of 6.7% during the analysis timeframe.

- Asia Pacific leads the global PCB assembly market with over 60% share, driven by China, Japan, South Korea and Taiwan. The region’s strength lies in large-scale consumer electronics, telecom infrastructure and semiconductor-related assembly, supported by efficient supply chains and competitive cost structures.

- India is emerging as a high-growth market with domestic incentives boosting smartphone and electronics production. Innovation in HDI and multi-layer assemblies caters to AI, 5G and automotive electronics trends.

China market is estimated to grow with a significant CAGR, in the Asia Pacific printed circuit board assembly industry.

- China dominates PCB assembly within the Asia Pacific, benefiting from integrated supply chains and economies of scale. Continued investments in semiconductor and electronics manufacturing infrastructure support high-volume assembly production.

- The focus on advanced interconnect technologies, flexible PCBs and high-density assemblies aligns with robust consumer electronics and automotive electrification demand, despite competitive pressures from regional players.

Brazil leads the Latin American printed circuit board assembly market, exhibiting remarkable growth during the analysis period.

- Brazil’s PCB assembly market is progressing steadily, supported by automotive, industrial and consumer electronics demand. Local production remains limited compared to imports, but strategic positioning as a near-shoring hub for North America enhances competitive prospects.

- Growth opportunities are linked to partnerships with global assemblers and tariffs that encourage regional sourcing, while infrastructure and skills development remain priorities for long-term expansion.

South Africa market to experience substantial growth in the Middle East and Africa printed circuit board assembly industry in 2025.

- In South Africa, PCB assembly growth is emerging within industrial automation, telecom and automotive electronics segments. While local production capabilities are modest, demand is driven by machinery controls and specialized applications. Market expansion is constrained by infrastructure gaps and reliance on imports, but initiatives to improve technical expertise and integrate assembly operations into broader manufacturing networks provide gradual development opportunities.

Printed Circuit Board Assembly Market Share

The competitive landscape of the global PCB assembly market is characterized by moderate fragmentation, strong technological intensity, and a focus on precision manufacturing, reliability, and end-to-end assembly capabilities. Key players such as Alfa Electronics, Altek Electronics, Inc., Benchmark Electronics, Inc., Miracle Electronics Devices Pvt Ltd, and PCB Assembly Express, Inc. collectively account for approximately 56.8% of the global market, indicating a semi-consolidated structure with a mix of global leaders and specialized regional manufacturers.

Market participants primarily compete on assembly quality, production efficiency, process reliability, and the ability to handle complex or high-density boards. Leading companies focus on continuous innovation in automated surface-mount technology (SMT), through-hole assembly, and flexible PCB integration to meet the evolving demands of consumer electronics, automotive, industrial, and aerospace applications. Additionally, major players invest in capacity expansion, advanced inspection systems, and R&D collaborations to enhance supply chain control and accelerate product development. Strategic partnerships with OEMs, electronics integrators, and end-use industries are commonly adopted to expand service offerings and improve time-to-market. Smaller and specialized manufacturers maintain competitiveness by offering customized assembly solutions, rapid prototyping, and niche applications, supporting innovation and sustaining a balanced competitive environment within the PCB Assembly Market.

Printed Circuit Board Assembly Market Companies

Prominent players operating in the printed circuit board assembly industry are as mentioned below:

- Alfa Electronics

- ALLPCB.com

- Altek Electronics, Inc.

- Benchmark Electronics, Inc

- Bittele Electronics Inc.

- Clarydon Electronic Services Limited

- Eurocircuits

- Jayshree Instruments Pvt. Ltd

- Miracle Electronics Devices Pvt Ltd

- PCB Assembly Express, INC

- PCB Power Market

- PCB Unlimited.

- PCBGOGO.

- PCBWay

- Podrain Electronics

- RAYMING TECHNOLOGY

- Seeed Technology Co.,Ltd.

- Tempo

- Vexos

- Visual Communications Company, LLC

- WellPCB Technology Co., Ltd.

- Alfa Electronics

Alfa Electronics is a leading player in the printed circuit board assembly industry with a market share of approximately 18.0%. The company focuses on high-precision PCB assembly, leveraging advanced SMT and through-hole technologies. Alfa Electronics enhances production efficiency and reliability through automated inspection systems, serving diverse sectors including consumer electronics, automotive, and industrial applications. By continuously investing in R&D and process optimization, the company strengthens its competitive position in high-reliability and complex PCB assembly solutions.

Altek Electronics, Inc. holds a significant market share of around 14.3% in the PCB assembly market. The company emphasizes end-to-end assembly solutions, combining design-for-manufacturability expertise with scalable production capabilities. Altek invests in automation, quality control, and advanced soldering technologies to support multi-layer and flexible PCB assemblies. By targeting automotive, industrial, and consumer electronics segments, the company expands its global footprint and meets growing demand for complex, high-performance PCB assemblies.

Benchmark Electronics, Inc. commands a market share of approximately 11.0% in the PCB assembly market. The company is recognized for its robust electronics manufacturing services, integrating SMT, through-hole, and mixed-technology assembly. Benchmark focuses on precision, scalability, and quality assurance to cater to high-reliability applications in aerospace, defense, and medical electronics. Strategic partnerships, capacity expansion, and R&D initiatives allow Benchmark to deliver cost-effective, complex PCB solutions while strengthening its position in global markets.

Printed Circuit Board Assembly Industry News

- In October 2025, Eurocircuits NV expanded its SEMI-FLEX PCB pool by introducing 6-layer flex-to-install PCBs. These boards, made entirely from FR-4, enable compact hardware integration without connectors or cables, offering cost efficiency, higher reliability, and simplified design workflows. The new 6-layer option provides improved routing flexibility, signal integrity, and bendable sections for assembly, supporting compact 3D electronics integration across industrial, consumer, and automotive applications.

- In February 2025, RayMing PCB, a global leader in PCB manufacturing and assembly, launched a new suite of advanced PCB solutions for next-generation electronics. The offerings included high-density interconnect (HDI) PCBs, flexible and rigid-flex PCBs, metal core PCBs, RF and microwave PCBs, and sculptured flex circuits, targeting consumer electronics, automotive, aerospace, and industrial applications. The company emphasized innovation, quality, sustainability, and customer-centric services, strengthening its global presence and commitment to advanced, eco-friendly PCB solutions.

The printed circuit board assembly market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in (USD Billion) & Volume (Units) from 2022 – 2035 for the following segments:

Market, By Type of PCB

- Rigid PCB

- Flexible PCB

- Metal core PCB

Market, By Components

- Active

- Resistors

- capacitors

- Inductors

- Passive

- Integrated circuits (ICs)

- Microprocessors

- Microcontrollers

Market, By Volume

- Low (1-100 units)

- Medium (100-10,000 Units)

- High (More than 10,000 Units)

Market, By Assembly

- In-House

- Outsourced/ Contract

Market, By Soldering Process

- Wave soldering

- Manual soldering

- Reflow soldering

Market, By Technology

- Surface mount assembly (SMT)

- Through-hole assembly

- Ball Grid Array (BGA) Assembly

- Mixed technology (SMT / Through hole)

- Rigid-Flex Assembly

Market, By Vertical

- Consumer electronics

- Automotive

- Healthcare

- IT & Telecom

- Industrial

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the printed circuit board assembly market?

Key players operating in the printed circuit board assembly industry include Alfa Electronics, Altek Electronics, Inc., Benchmark Electronics, Inc., Miracle Electronics Devices Pvt Ltd, PCB Assembly Express, Inc., and other specialized global and regional manufacturers.

Which region leads the printed circuit board assembly market?

The U.S. industry reached USD 31.5 billion in 2025. Growth is driven by strong demand from defense, aerospace, automotive electronics, and investments supporting domestic electronics manufacturing.

What is the growth outlook for rigid PCB assembly technology?

Rigid PCB assembly technology is anticipated to grow at a CAGR of 6.9% through 2035, driven by increasing use in automotive electronics, industrial automation, and aerospace systems requiring high durability.

How much revenue did the surface mount assembly (SMT) segment generate in 2025?

The surface mount assembly (SMT) segment generated USD 34.6 billion in 2025, leading adoption due to high-speed production, miniaturization, and reliability in electronics manufacturing.

What was the valuation of the wave soldering segment in 2025?

Wave soldering dominated the printed circuit board assembly industry with revenue of USD 52.8 billion in 2025, supported by its efficiency in high-volume and through-hole PCB production.

What is the projected value of the printed circuit board assembly market by 2035?

The industry size for printed circuit board assembly is expected to reach USD 176.6 billion by 2035, due to growth in consumer electronics, automotive electronics, and advanced communication infrastructure.

How much revenue did the flexible PCB assembly segment generate in 2025?

The flexible PCB assembly segment generated USD 44 billion in 2025, holding the largest share due to strong demand from wearables, medical devices, and compact consumer electronics.

What is the current printed circuit board assembly market size in 2026?

The printed circuit board assembly industry is projected to reach USD 108.6 billion in 2026, supported by increasing adoption of automated SMT lines and multi-layer PCB integration.

What is the market size of the printed circuit board assembly industry in 2025?

The market size was USD 103.6 billion in 2025 and is projected to grow at a CAGR of 5.5% during 2026–2035, driven by rising demand for high-precision PCB assembly across electronics, automotive, and industrial manufacturing.

Printed Circuit Board (PCB) Assembly Market Scope

Related Reports