Summary

Table of Content

Prebiotic Fibers Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Prebiotic Fibers Market Size

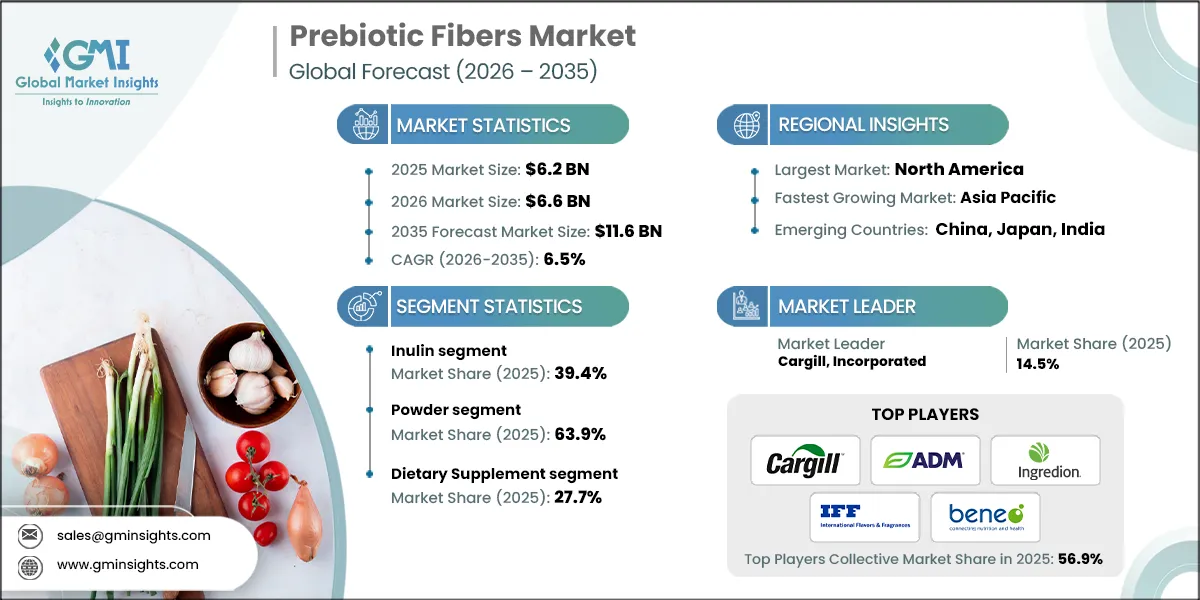

The global prebiotic fibers market was valued at USD 6.2 billion in 2025. The market is expected to grow from USD 6.6 billion in 2026 to USD 11.6 billion in 2035, at a CAGR of 6.5% according to latest report published by Global Market Insights Inc.

To get key market trends

- The prebiotic fibers market is evolving from a supplemental niche to a mainstream ingredient in consumer foods and beverages, driven by rising health consciousness and digestive wellness trends. Manufacturers are focusing on neutral-taste, stable formulations suitable for dairy alternatives, snacks, and beverages, integrating prebiotics into daily routines. Personalized nutrition is emerging as a key trend, with targeted prebiotic blends designed to support the gut microbiome and align with digital health solutions, enhancing perceived consumer value and engagement.

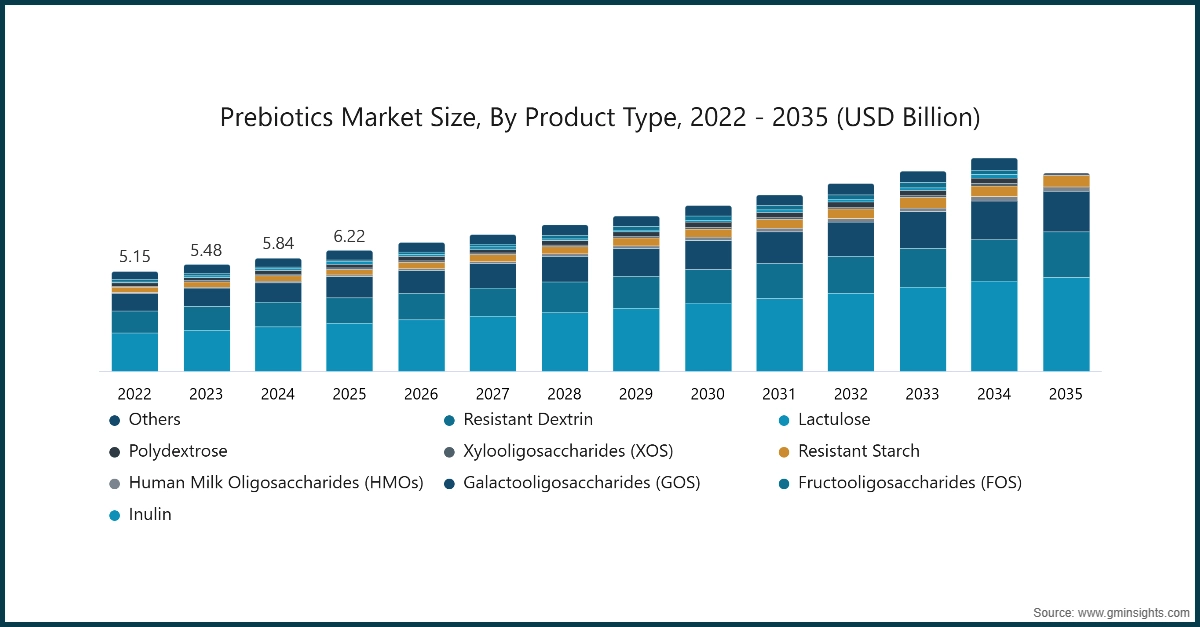

- By product type, Inulin leads with a 39.4% market share in 2025, projected to grow at 7% CAGR to 2035, followed by Fructooligosaccharides (FOS). Galactooligosaccharides (GOS) and Human Milk Oligosaccharides (HMOs) are high-growth premium segments, primarily in infant and clinical nutrition. Resistant starch, resistant dextrin, polydextrose, and lactulose cater to functional health applications like glycemic control and satiety. Emerging fibers such as Xylooligosaccharides (XOS) reflect ongoing innovation.

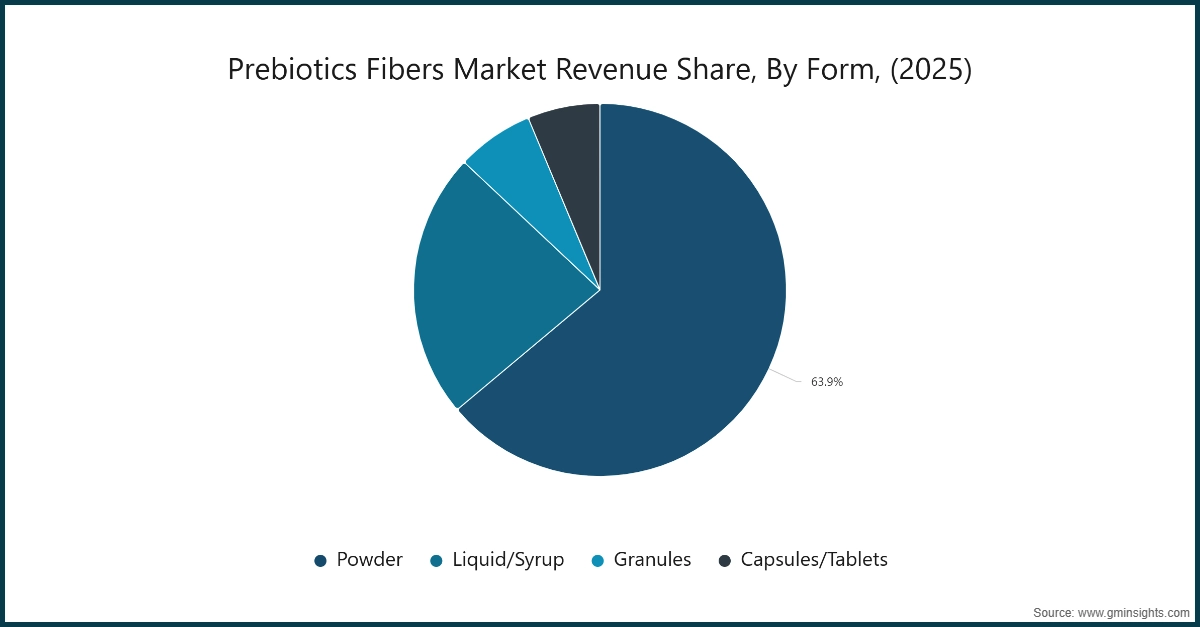

- By form, powdered prebiotics dominate 63.9% in 2025, favored for stability and versatility, while liquid/syrup formats are growing in beverages and infant nutrition. Granules and capsules/tablets serve niche applications in clinical nutrition and dietary supplements.

- By end-use, dietary supplements hold the largest share 27.7% due to precise dosing and preventive health trends, followed by bakery, dairy, beverages, and infant nutrition.

- Regionally, North America leads in revenue, Europe shows strong adoption in functional foods, and Asia-Pacific is the fastest-growing market 9.2% CAGR, supported by rising health awareness and urbanization. Latin America and MEA are emerging markets with increasing dietary supplement and infant nutrition uptake. Overall, the market is poised for steady growth, driven by innovation, functional benefits, and expanding consumer awareness.

Prebiotic Fibers Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 6.2 Billion |

| Market Size in 2026 | USD 6.6 Billion |

| Forecast Period 2026-2035 CAGR | 6.5% |

| Market Size in 2035 | USD 11.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing consumer focus on digestive wellness is driving demand for prebiotic fiber ingredients. | Sustained health awareness accelerates product adoption across food, beverage, and supplement formulations globally. |

| Rising preference for functional and clean-label foods supports wider prebiotic fiber incorporation. | Clean-label positioning improves brand trust and expands usage across everyday nutrition products. |

| Growing emphasis on preventive healthcare encourages routine consumption of gut-health ingredients. | Preventive health trends support long-term demand stability and innovation in fiber-based solutions. |

| Pitfalls & Challenges | Impact |

| Gastrointestinal discomfort at higher doses limits consumer tolerance of certain prebiotic fibers. | Tolerance issues restrict repeat consumption and require formulation improvements to maintain consumer acceptance. |

| Inconsistent regulatory definitions and health claims create uncertainty for manufacturers. | Regulatory ambiguity delays product launches and complicates global commercialization strategies. |

| Opportunities: | Impact |

| Development of low-dose, high-efficiency prebiotics addresses tolerance concerns. | Improved formulations enhance consumer compliance and unlock broader demographic adoption. |

| Personalized nutrition creates demand for targeted prebiotic fiber solutions. | Customization enables premium positioning and strengthens differentiation in competitive markets. |

| Market Leaders (2025) | |

| Market Leader |

Market Share 14.5% |

| Top Players |

Collective Market Share of 56.9% in 2025 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, Japan, India |

| Future outlook |

|

What are the growth opportunities in this market?

Prebiotic Fibers Market Trends

- A prebiotic fibre is no longer just a food additive, but it has now become a common part of everyday consumer food and drink products. Because manufacturers want all of their products to have a neutral flavour, they have created stable formulations and products that are easy to use in making dairy-alternative products, snack foods and beverage products to widen the market for prebiotic fibres and allow them to be incorporated into daily routines by health-conscious consumers.

- The focus on prebiotic fibre innovations will begin to transition from a broad perspective to a focus on personalised nutrition. Manufacturers will create products specific to the needs of the individual emphasising the microbiome. The shift towards creating both personalised blends and specific health benefits increases the perception of value for the consumer and encourages them to participate in the marketplace to a greater degree. The continued development of these personalised options allows for the integration of prebiotics into future digital health technology and personalised wellness solutions, while also establishing the ability to build consumer trust.

Prebiotic Fibers Market Analysis

Learn more about the key segments shaping this market

Based on product type, the prebiotic fibers market is segmented into inulin, fructooligosaccharides (FOS), galactooligosaccharides (GOS), human milk oligosaccharides (HMOS), resistant starch, Xylooligosaccharides (XOS), polydextrose, lactulose, resistant dextrin, and others. Inulin dominated the market with an approximate market share of 39.4% in 2025 and is expected to grow with a CAGR of 7% till 2035.

- Inulin and fructooligosaccharides (FOS) make up the largest prebiotic fiber categories, comprising together greater than 50% of the market for prebiotics by 2025. By 2025, inulin has an estimated market value of about USD 2.6 billion, increasing to USD 4.8 billion by 2035, at a CAGR of about 7.0% due to high utilization rates in the bakery, dairy, beverage and supplement industries.

- Galactooligosaccharides (GOS) and human milk oligosaccharides (HMO) are growing in popularity and value and represent newer higher priced categories within the prebiotic space. The market value of GOS is projected to reach USD 1.1 billion by 2025, growing to over USD 2.1 billion by 2035 due to the rapid growth in pediatric nutrition utilization.

- Resistant starch, resistant dextrin, polydextrose and lactulose are all mid-tier products that offer specific functionality surrounding glycemic control, satiety, and digestive regulation. The values of resistant starch and resistant dextrin in 2025 are projected at USD 316.6 million and USD 145 million respectively and both are expected to grow at a CAGR of approximately 7.0% through 2035. Polydextrose and lactulose are both predicted to have moderate growth trends based on their use in clinical nutrition and processed food applications.

- Xylooligosaccharides (XOS) and other new prebiotics continue to evolve as smaller percentages of the total market but also exhibit steady growth trends. The projected value of XOS in 2025 is USD 90.6 million, while the other category will account for USD 487.4 million, as innovations in prebiotics develop supporting the continued growth of the total prebiotic marketplace.

Learn more about the key segments shaping this market

Based on form, the prebiotic fibers market is segmented into powder, liquid/syrup, granules, and capsules/tablets. Powder held the largest market share of 63.9% in 2025 and is expected to grow at a CAGR of 6% during 2026 to 2035.

- The powdered prebiotic category is estimated to grow at a steady rate of 6% CAGR through 2035 to over USD 7.1 billion, and remain the primary Revenue driver for the industry.

- Liquid and syrup prebiotic forms have quickly gained acceptance and currently represent 23.1% of total market share. Liquid and syrup formulations are typically used in beverage, functional beverage and infant nutrition products, because of their quick dissolution characteristics and their targeted delivery.

- Granular formulations currently represent 6.7% of total market, with an estimated value of USD 414.7 million, with the primary uses being in snack bars, cereals and clinical nutrition applications. Granular formats are ideal for precise dosing, they enable controlled release, and they are compatible with low-moisture formulations.

- Capsule and tablet prebiotic formulations currently represent a small market share, but are considered a high-value segment with an estimated total value of USD 391.9 million in 2025, and represent 6.3% of total market share. The preference for capsules and tablets for dietary supplements and clinical nutrition applications is due to their ability to provide accurate dosing and allow for convenience and compliance.

Based on end user, the prebiotic fibers market is segmented into bakery & confectionery, dairy products, beverages, cereals & snack bars, processed foods, dietary supplements, infant nutrition, clinical nutrition, pharmaceuticals, poultry feed, swine feed, ruminant feed, aquaculture, and pet food. Dietary Supplement segment dominated the market with an approximate market share of 27.7% in 2025 and is expected to grow with the CAGR of 7% till 2035.

- Bakery & Confectionery is a key application segment, valued at USD 663.6 million in 2025, accounting for 10.7% of total market share. The segment benefits from the incorporation of prebiotics in breads, biscuits, and confectionery to enhance fiber content and digestive health claims. Growth is projected at 6.8% CAGR, reaching over USD 1.28 billion by 2035, driven by clean-label trends and increasing consumer awareness of gut health.

- Dairy Products contribute 11.0% market share, with prebiotics widely used in yogurts, fermented drinks, and fortified milk products. Although slightly declining in share percentage, the segment maintains steady revenue growth at 5.6% CAGR, supported by functional dairy innovations and expanding adult nutrition applications.

- Cereals & Snack Bars reach USD 414.7 million in 2025, reflecting high consumer interest in fiber-enriched, on-the-go products. Strong growth of 7.0% CAGR is anticipated, driven by convenient, functional snacks targeting health-conscious adults.

- Processed Foods With 6.9% CAGR, this segment benefits from rising demand for sugar reduction and fiber enrichment in packaged foods. Dietary Supplements are the largest end-user segment, valued at USD 1.72 billion in 2025, holding 27.7% market share. Supplements dominate revenue due to precise dosing, convenience, and growing consumer preference for preventive health solutions. CAGR of 7.0% projects revenues of over USD 3.39 billion by 2035.

- Infant Nutrition driven by formula fortification with GOS, FOS, and HMOs. Growth at 6.0% CAGR reflects rising demand for premium infant formulas and microbiome-focused formulations globally.

- Clinical Nutrition and Pharmaceuticals collectively valued at USD 132.7 million and USD 240.5 million, respectively supported by specialized medical nutrition products and targeted prebiotic therapies.

Looking for region specific data?

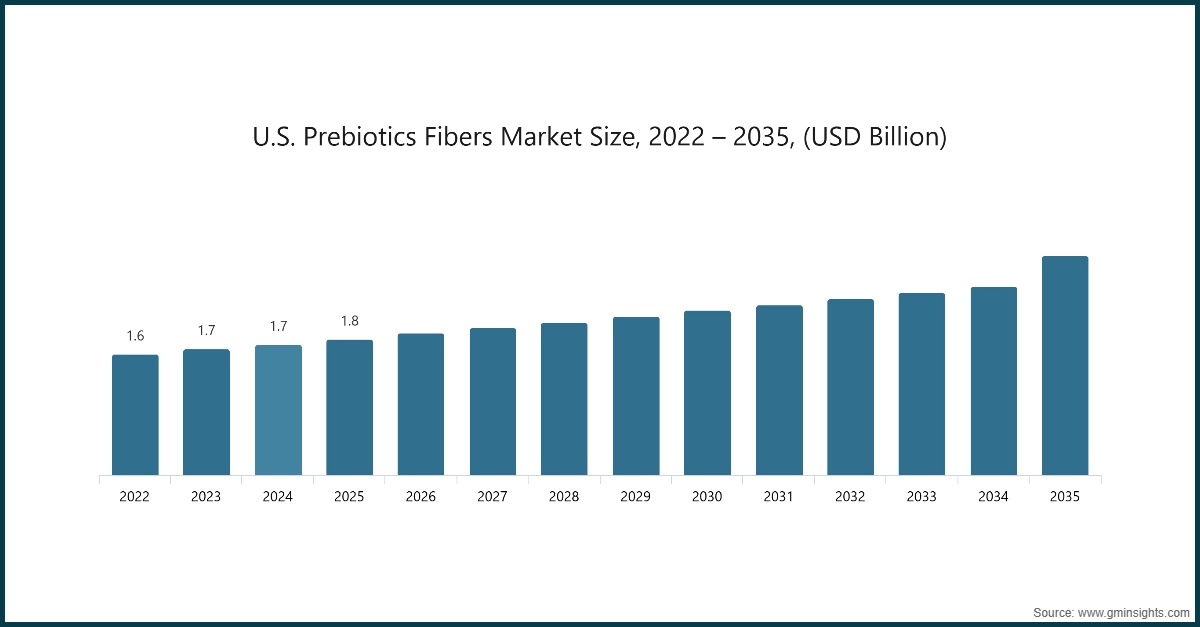

North America prebiotic fibers market leads the industry with revenue of USD 2.3 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- North America is a mature market with the highest level of interest and awareness among consumers regarding the gut microbiome and its link to health and well-being. As such, North America represents the largest share of the prebiotic fibre market. In addition, the market continues to expand due to the high level of innovation in clean-label and plant-based products being supported by various regulatory bodies, as well as ongoing support for dietary supplements and baby foods.

The Europe prebiotic fibers industry is growing rapidly on the global level with a market share of 32.2% in 2025.

- In Europe there is considerable consumer interest, and therefore growth in the use of prebiotic fibres in the bakery sector, dairy sector, and the processed foods sector. As such, there is a strong trend towards the use of prebiotic fibres, especially the enrichment of foods with fibre, development of functional foods, and increasing adoption of prebiotics for infant nutrition. The market size in Europe will continue to grow at a steady pace driven by continued reformulation of existing products, and an increase in the use of prebiotics in dietary supplements.

The Asia Pacific prebiotic fibers market is anticipated to grow at a CAGR of 9.2% during the analysis timeframe.

- Asia Pacific is the fastest-growing region for prebiotic fibre demand through 2035, driven by increasing personal disposable income, an increasing number of people living in cities, and an increase in the awareness of health. The countries in the Asia Pacific region with the highest adoption rates for prebiotic fibre are China, India, and Japan, particularly with regard to the use of dietary supplements, infant nutrition, and functional beverages. There is also a continued and increasing trend of innovation related to the development of plant-based prebiotic fibres and locally formulated products in Asia Pacific, which is accelerating the growth of prebiotic fibre use in the region.

Latin America prebiotic fibers market accounted for 5.5% market share in 2025 and is anticipated to show highest growth over the forecast period.

- Growth in the region of Latin America is supported by the expanding food and beverage sectors that provide functional foods and beverages, along with an increasing awareness of gut health and increased demand for infant and clinical nutrition. Continued expansion of the market will be driven by Brazil and Mexico, due to their continued adoption of dietary supplements along with the growth of their urban populations. Compliance with international regulations for the introduction of prebiotic ingredients will support both safe and high quality products.

Middle East & Africa prebiotic fibers accounted for 3.7% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

- Middle East and Africa(MEA) is classified as a small, but steadily increasing market due to the increasing use of dietary supplements; the increasing use of infant nutrition; functional foods; and the tendency of the people who live in this area who are health conscious and live in urban environments and are also supported by government programs to fortify foods. The total size of this market is significantly less than the other regions, but there continues to be strong CAGRs in response to the increasing emphasis placed on digestive health and wellness awareness.

Prebiotic Fibers Market Share

The top 5 companies in prebiotic fibers industry include Cargill, Incorporated, Archer Daniels Midland (ADM), Ingredion Incorporated, International Flavors & Fragrances (IFF), and BENEO GmbH. These are prominent companies operating in their respective regions covering approximately 56.9% of the market share in 2025. These companies hold strong positions due to their extensive experience in prebiotic fibers market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

Cargill, Incorporated is a global agrifood leader offering a broad range of prebiotic fiber ingredients, including inulin and oligofructose under branded solutions like Oliggo?Fiber. Its extensive supply chain, global manufacturing footprint, and focus on clean-label, digestive health applications support functional food, beverage, and supplement markets worldwide. Cargill collaborates with food manufacturers to integrate prebiotics into innovative product formats.

Archer Daniels Midland (ADM) leverages its agricultural processing strength to produce prebiotic fibers such as Fibersol, a well-tolerated dietary fiber supporting gut health, digestive regularity, and blood sugar control. ADM’s prebiotic offerings are integrated into a broad range of foods,beverages, and supplements, backed by clinical research and industry recognition for functional ingredient innovation.

Ingredion Incorporated is a leading global specialty ingredients provider with a diversified portfolio of functional fibers including prebiotic solutions, uch as resistant starch and soluble corn fiber. It supports food and beverage manufacturers with texture, mouthfeel, and health functionality while addressing clean-label and fiber enrichment trends. Its investments in product development and co-creation labs enhance formulation capabilities.

International Flavors & Fragrances (IFF) develops and supplies prebiotic fiber and specialty carbohydrate solutions within its Health Sciences and functional ingredient portfolio. Through science-driven innovation, IFF supports digestive wellness and metabolic health applications, enabling brands to incorporate prebiotics and fibers into foods, beverages, and supplements with nutritional and consumer appeal.

BENEO GmbH part of the Südzucker Group, is renowned for its plant-based prebiotic fibers such as inulin and oligofructose derived from chicory root. With strong clinical backing and focus on digestive health, BENEO’s Orafti prebiotics are widely used in functional foods, dairy, and nutrition products. The company emphasizes sustainability, scientific validation, and global supply to meet rising gut health demand.Prebiotic Fibers Market Companies

Major players operating in the prebiotic fibers industry include:

- Archer Daniels Midland Company

- BENEO GmbH

- Cargill, Incorporated

- Royal FrieslandCampina N.V.

- Ingredion Incorporated

- International Flavors & Fragrances Inc. (IFF)

- Roquette Frères

- Sensus BV

- Tate & Lyle PLC

- Tereos Group

Prebiotic Fibers Industry News

- In September 2025, BENEO received Thai FDA approval for an exclusive prebiotic claim for its chicory root fiber, Orafti Inulin, marking the first ingredient recognized following rigorous scientific evaluation, enabling food and beverage manufacturers in Thailand to credibly communicate digestive health benefits.

- In April 2023, COMET inaugurated a new production facility in Kalundborg, Denmark, to produce over 4 million kilograms annually of its Arrabina arabinoxylan dietary fiber using patented upcycling technology, enhancing supply for food, beverage, and supplement markets.

This prebiotic fibers market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2026 to 2035, for the following segments:

Market, By Product Type

- Inulin

- Fructooligosaccharides (FOS)

- Galactooligosaccharides (GOS)

- Human Milk Oligosaccharides (HMOs)

- Resistant Starch

- Xylooligosaccharides (XOS)

- Polydextrose

- Lactulose

- Resistant Dextrin

- Others

Market, By Form

- Powder

- Liquid/Syrup

- Granules

- Capsules/Tablets

Market, By End User

- Bakery & Confectionery

- Dairy Products

- Beverages

- Cereals & Snack Bars

- Processed Foods

- Dietary Supplements

- Infant Nutrition

- Clinical Nutrition

- Pharmaceuticals

- Poultry Feed

- Swine Feed

- Ruminant Feed

- Aquaculture

- Pet Food

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the prebiotic fibers industry?

Key players include Archer Daniels Midland Company, BENEO GmbH, Cargill, Incorporated, Royal FrieslandCampina N.V., Roquette Frères, Sensus BV, Tate & Lyle PLC, and Tereos Group.

Which region leads the prebiotic fibers sector?

North America leads the market with revenue of USD 2.3 billion in 2025. The region benefits from high consumer awareness about gut health, innovation in clean-label and plant-based products, and regulatory support for dietary supplements and baby foods.

What are the upcoming trends in the prebiotic fibers market?

Shift toward personalized prebiotic nutrition, targeted gut-health blends, integration with digital health technologies, and expansion into dairy alternatives, snacks, and beverages.

What is the growth outlook for the dietary supplement segment from 2026 to 2035?

The dietary supplement segment, which held a market share of 27.7% in 2025, is anticipated to observe around 7% CAGR through 2035.

What was the valuation of the powdered prebiotic fibers segment in 2025?

The powdered segment held the largest market share of 63.9% in 2025 and is set to expand at a CAGR of 6% till 2035.

What is the expected size of the prebiotic fibers industry in 2026?

The market size is projected to reach USD 6.6 billion in 2026.

What was the market share of inulin in 2025?

Inulin dominated the market with an approximate share of 39.4% in 2025 and is expected to grow at a CAGR of 7% through 2035.

What was the market size of the prebiotic fibers in 2025?

The market size was valued at USD 6.2 billion in 2025, with a CAGR of 6.5% expected through 2035. The growth is driven by increasing health consciousness and the integration of prebiotics into daily diets.

What is the projected value of the prebiotic fibers market by 2035?

The market is poised to reach USD 11.6 billion by 2035, fueled by trends in personalized nutrition, digital health solutions, and rising demand for gut health products.

Prebiotic Fibers Market Scope

Related Reports