Summary

Table of Content

Pet Insurance Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Pet Insurance Market Size

The global pet insurance market was valued at USD 14.2 billion in 2025. The market is expected to grow from USD 15.9 billion in 2026 to USD 46.8 billion in 2035, at a CAGR of 12.8% during the forecast period, according to the latest report published by Global Market Insights Inc. The market is primarily stimulated due to the rising pet ownership globally, along with the increase in awareness of veterinary care costs, and the growing shift towards pet humanization. These combined factors influence pet owners to seek financial protection against unexpected medical expenses, thereby escalating the adoption of pet insurance policies.

To get key market trends

The rise in pet population has significantly contributed to the market growth. For instance, according to the Health for Animals, the global pet population has surged to over 1 billion pets, with dogs and cats accounting for more than 80% of total pets population. Moreover, the rise in pet ownership further escalates the market growth, with 94% of pet owners globally consider their pet a part of their family, as mentioned by International Survey of Pet Owners & Veterinarians. Additionally, pets are increasingly considered as the part of the family, as International Survey of Pet Owners & Veterinarians also mentions, 89% of pet owners globally mention having a close relationship with their pet, further escalating the pet insurance demand.

Pet Insurance Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 14.2 Billion |

| Market Size in 2026 | USD 15.9 Billion |

| Forecast Period 2026 - 2035 CAGR | 12.8% |

| Market Size in 2035 | USD 46.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising pet ownership globally | Increasing number of households owning pets is driving demand for financial protection against veterinary costs. |

| Rising veterinary care cost | Advanced treatments and surgeries are becoming more expensive, making insurance essential for affordability. |

| Growing trend of pet humanization | Pets are increasingly treated as family members, boosting willingness to invest in comprehensive insurance plans. |

| Increasing awareness of pet insurance | Educational campaigns and digital marketing are improving consumer understanding of coverage benefits, driving adoption. |

| Pitfalls & Challenges | Impact |

| High premiums and limited coverage options | Expensive plans and exclusions for pre-existing conditions can deter price-sensitive pet owners. |

| Lack of standardized pet health codes for reimbursement | Absence of uniform coding systems complicates claims processing and creates inefficiencies for insurers and veterinarians. |

| Opportunities: | Impact |

| Integration of telehealth and wellness add-ons | Offering virtual vet consultations and preventive care packages will differentiate products and attract customers. |

| Expansion into emerging markets | Rising disposable incomes and improving veterinary infrastructure in Asia-Pacific and Latin America present untapped growth potential. |

| Market Leaders (2025) | |

| Market Leaders |

~12% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, Vietnam |

| Future outlook |

|

What are the growth opportunities in this market?

The pet insurance market refers to the global industry focused on providing financial coverage for veterinary care, ensuring affordability and accessibility for pet owners. As pet healthcare costs continue to rise and pet humanization trends strengthen, the demand for comprehensive and customizable insurance plans is expected to surge, positioning the market for sustained long-term growth.

Moreover, veterinary care expenditures have exceeded USD 38 billion, as mentioned by APPA, reflecting substantial growth and underscoring the rising financial burden of pet healthcare. This burden encompasses surgeries, chronic disease management, and preventive care, thereby accelerating the demand for comprehensive pet insurance solutions.

Pet insurance provides coverage for veterinary expenses related to illness, accidents, surgeries, and preventive treatments, offering pet owners peace of mind and cost predictability. The market is dominated by leading insurers such as Trupanion, Nationwide, and Petplan, which are actively expanding their product portfolios to include wellness add-ons, telehealth services, and flexible reimbursement models. These companies play a pivotal role in driving innovation, enhancing customer engagement, and strengthening distribution networks through partnerships with veterinary clinics and digital platforms.

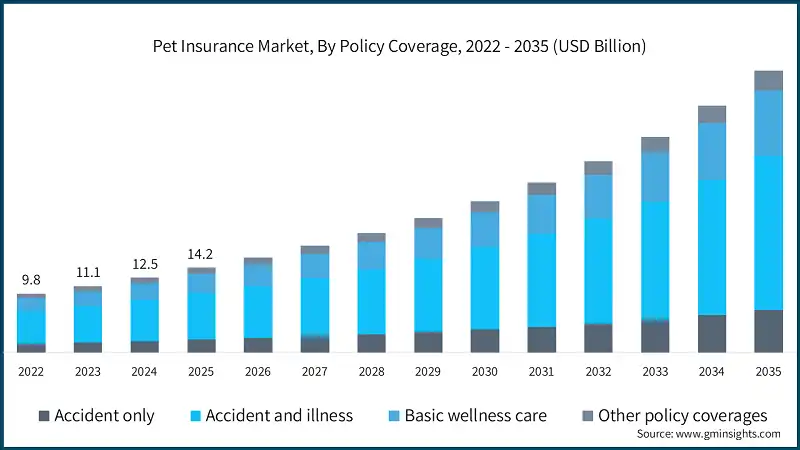

Between 2022 and 2024, the pet insurance market experienced substantial growth, rising from USD 9.8 billion to USD 12.5 billion, at a CAGR of approximately 12.8%. This expansion was driven by the increasing prevalence of chronic conditions in pets, such as diabetes and arthritis, and the rising costs of advanced veterinary procedures, including orthopedic surgeries and cancer treatments. Additionally, the rapid adoption of digital claim processing and AI-driven risk assessment tools has improved customer experience and operational efficiency, further supporting market growth.

Pet Insurance Market Trends

- A major trend in the market is the rising shift from basic accident-only coverage to comprehensive wellness and preventive care plans. These advanced policies include routine check-ups, vaccinations, dental care, and chronic disease management, offering pet owners greater value and peace of mind. The growing emphasis on holistic pet health and preventive care is stimulating demand for more inclusive insurance products.

- Additionally, there is increasing adoption of digital and app-based insurance platforms, driven by convenience and transparency. These platforms enable instant policy issuance, claim submissions, and real-time tracking, reducing administrative burdens and improving customer experience. This aligns with the broader industry trend toward digitalization and self-service models, particularly appealing to tech-savvy pet owners.

- The rising pet ownership rates, coupled with growing humanization of pets, is a major catalyst for market expansion. As pets are increasingly considered family members, owners are more willing to invest in advanced healthcare solutions, including insurance coverage. This cultural shift is particularly strong in urban regions and among millennials, who prioritize structured financial protection for their pets.

- Moreover, technological innovations such as AI-driven risk assessment and telehealth integration are gaining traction in the pet insurance space. These advancements enable personalized policy pricing, predictive health monitoring, and virtual consultations, reducing claim costs and enhancing preventive care. This trend is particularly relevant for chronic conditions and early disease detection.

- Additionally, expanding applications of pet insurance beyond traditional coverage are further boosting market growth. Insurers are increasingly offering add-on benefits such as behavioral therapy, alternative treatments, and genetic testing. These offerings cater to niche segments and reinforce the perception of insurance as a comprehensive pet wellness solution.

- Thus, as veterinary care becomes more specialized and expensive, and as pet owners seek greater financial security, the demand for flexible, tech-enabled, and wellness-focused insurance plans will continue to rise, driving sustained market growth globally.

Pet Insurance Market Analysis

Learn more about the key segments shaping this market

Based on policy coverage, the pet insurance market is segmented into accident only, accident and illness, basic wellness care and other policy coverages. The accident and illness segment has asserted its dominance in the market by securing a significant market share of 54.3% in 2025 and is anticipated to grow at a CAGR of 12.9% over the forecast years.

- Increase in animal abuse and accidental injuries remain primary concerns globally. According to Shelter Animals Count, at least one animal is abused every 60 seconds, and close to 10 million animals die from abuse or cruelty annually in the U.S., that increase the requirement for healthcare and financial protection for pets.

- Moreover, road traffic accidents involving pets is another factor that stimulates the market. For instance, Pet Care mentions, almost 4 in every 1,000 dogs are involved in road traffic accidents, that increase unexpected veterinary expenses that can be covered by insurance plans.

- Also, illness-related risks, including zoonotic diseases, notify the importance of preventive care. WHO reports that, about 1 billion cases of illness and millions of deaths occur every year from zoonoses, further escalating the demand for insurances for better health.

- The second-largest segment, basic wellness care, held a market share of 22.4% in 2025, and are preferred by urban population due to rising popularity of preventive case for pets.

- Lastly, poisoning incidents among pets are common and costly. According to Direct Line Group, over a quarter 28%, 4.6 million of dog owners believe their pet has fallen ill due to eating something poisonous, highlighting the need for insurance coverage that includes emergency care and toxic ingestion treatment.

- On the other hand, the basic wellness care segment is anticipated to be the fastest-growing category, projected to expand to a CAGR of 13.1% over the forecast period, stimulated by increasing demand for preventive healthcare services such as vaccinations, routine check-ups, and dental cleaning, aligning with the broader trend toward proactive pet health management and cost optimization for recurring care.

Based on the animal, the pet insurance market is classified as cats, dogs and other animals. The dogs segment accounted for the highest market revenue of USD 10 billion in 2025 and is projected to grow at a CAGR of 12.7% during the analysis period.

- The dogs hold a dominant market share due to high global population and strong cultural emphasis on canine health. According to the Pet Business World, the global dog population is expected to reach more than 156 million by 2030, escalated by rising adoption rates in urban households.

- Moreover, dogs are more prone to lifestyle-related illnesses and hereditary conditions, increasing long-term care costs. Common issues include hip dysplasia, heart disease, and obesity-related complications. For example, Purina Institute reports that 59.3% of dogs are overweight or obese, which raises the risk of chronic diseases and costly treatments.

- Moreover, high veterinary expenditure for dogs reinforces insurance adoption. Additionally, growing demand for premium care services such as dental cleaning, behavioral therapy, and genetic testing further supports segment growth.

- On the other hand, the other animals segment is anticipated to be the fastest-growing category, projected to expand at a CAGR of 13.4% over the forecast period escalated by rising ownership of horses, rabbits, birds and other exotic pets globally, and growing awareness of exotic animals health needs.

Based on the insurance provider, the pet insurance market is classified into public and private. The private segment accounted for the highest market revenue of USD 11.7 billion in 2025 and is projected to grow at a CAGR of 12.7% during the analysis period.

- The segment is stimulated by strong brand presence, diverse product portfolios, and advanced digital platforms. Companies such as Trupanion, Nationwide, and Fetch by The Dodo offer comprehensive accident and illness coverage, wellness add-ons, and customizable plans, catering to a wide range of pet health needs.

- Moreover, high consumer trust and convenience further escalate adoption of private insurance. These providers leverage mobile apps, real-time claims processing, and telehealth integration, ensuring seamless policy management and faster reimbursements are the key factors influencing customer preference.

- Additionally, private insurers benefit from strategic partnerships with veterinary networks and pet care platforms. Such collaborations enable direct vet payments and bundled services, reducing out-of-pocket expenses for pet owners and enhancing policy attractiveness.

- On the other hand, the public providers segment is anticipated to witness steady growth over the forecast period, escalated by government-backed initiatives and increasing awareness of pet health protection. Public programs are gaining traction in select regions where authorities promote affordable coverage options to encourage responsible pet ownership and reduce the burden of veterinary costs.

Learn more about the key segments shaping this market

Based on sales channel, the global pet insurance market is classified into direct sales, agency sales, broker sales, bancassurance and other sale channels. The direct sales segment held a market share of 44.2% in 2025 and is projected to grow at a CAGR of 12.5% during the analysis period

- Direct sales is the preferred channel due to convenience, transparency, and strong digital adoption. Leading insurers leverage online platforms and mobile apps to enable instant policy issuance, real-time claim processing, and personalized coverage recommendations, appealing to tech-savvy pet owners.

- The dominance of direct sales is reinforced by cost efficiency and better customer engagement. By eliminating intermediaries, insurers can offer competitive pricing and loyalty programs, while maintaining direct communication with policyholders for renewals and upselling.

- Growing penetration of telehealth and digital veterinary services further supports direct channel growth. Integration of insurance platforms with vet networks allows seamless claim approvals and direct payments, enhancing customer experience and trust.

- Likewise, the agency sales segment is anticipated to witness the fastest growth over the forecast period, stimulated by increasing demand for personalized guidance and bundled offerings. Agencies provide tailored advice to pet owners, especially first-time buyers, and often combine pet insurance with other lifestyle or home insurance products, creating cross-selling opportunities and boosting adoption in emerging markets.

Looking for region specific data?

North America Pet Insurance Market The North America market dominated the global pet insurance market with a market share of 39.6% in 2025. The U.S. pet insurance market was valued at USD 3.4 billion and USD 3.9 billion in 2022 and 2023, respectively. The market size reached USD 4.9 billion in 2025, growing from USD 4.4 billion in 2024. Europe market accounted for USD 4.3 billion in 2025 and is anticipated to show lucrative growth over the forecast period. Germany dominates the Europe pet insurance market, showcasing strong growth potential. The Asia Pacific market is anticipated to grow at the highest CAGR of 13.4% during the analysis timeframe. China pet insurance market is estimated to grow with a significant CAGR, in the Asia Pacific market. Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period. Saudi Arabia market is expected to experience substantial growth in the Middle East and Africa pet insurance market in 2025. The market is moderately consolidated, with leading insurance providers dominating space, while innovation continues to thrive among emerging players. Top 5 players Trupanion, Nationwide, Fetch by The Dodo, ASPCA Pet Health Insurance, and Anicom collectively hold a market share of approximately 40% in the global pet insurance market. These companies are continuously investing in digital platforms, AI-driven risk assessment, and telehealth integration to enhance customer experience and expand their product portfolios. Strategic partnerships, mergers, and acquisitions are common, aimed at accelerating market penetration and accessing new geographies. For example, collaborations with veterinary networks and fintech platforms are enabling seamless policy issuance and claim processing. Smaller players and niche startups contribute by focusing on specialized offerings such as wellness add-ons, behavioral therapy coverage, and genetic testing. This dynamic environment fosters rapid technological advancements and competitive differentiation, driving overall market growth and diversification. Prominent players operating in the pet insurance industry are as mentioned below: Trupanion is the leading player in the global pet insurance market, holding an estimated 12% market share. The company offers comprehensive accident and illness coverage with unique features such as direct vet payment systems, eliminating reimbursement delays and improving customer convenience. Trupanion’s competitive advantage lies in its subscription-based model, strong integration with veterinary networks, and advanced data analytics for risk assessment, which enable personalized pricing and high customer retention. Nationwide is a major player in the pet insurance market, leveraging its strong brand reputation and extensive insurance ecosystem. The company offers multi-pet policies, wellness add-ons, and customizable coverage options, appealing to a broad customer base. Its digital platforms for policy management and claims processing, combined with strategic partnerships with veterinary clinics, support widespread adoption and market penetration. Fetch by The Dodo differentiates itself through innovative coverage plans and strong brand engagement, particularly among younger demographics. The company offers comprehensive accident and illness coverage with unique benefits such as dental care and behavioral therapy, catering to evolving pet health needs. Its collaboration with The Dodo, a leading pet-focused media brand, enhances customer trust and brand visibility, driving growth in urban and tech-savvy markets.Europe Pet Insurance Market

Asia Pacific Pet Insurance Market

Latin American Pet Insurance Market

Middle East and Africa Pet Insurance Market

Pet Insurance Market Share

Pet Insurance Market Companies

Pet Insurance Industry News

The pet insurance market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2022 - 2035 for the following segments:

Market, By Policy Coverage

- Accident only

- Accident and illness

- Basic wellness care

- Other policy coverages

Market, By Animal

- Dogs

- Cats

- Other animals

Market, By Insurance Provider

- Public

- Private

Market, By Sales Channel

- Direct sales

- Agency sales

- Broker sales

- Bancassurance

- Other sale channels

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the pet insurance market?

Prominent players include Anicom, ASPCA Pet Health Insurance, Embrace Pet Insurance Agency, Fetch by The Dodo, Figo Pet Insurance, Hartville Group, Health for Pet, Hollard, Lemonade Insurance, Nationwide, Petfirst Healthcare, Petplan, ProtectaPet, and Royal & Sun Alliance.

What was the valuation of the private insurance provider segment?

The private insurance provider segment generated USD 11.7 billion in 2025 and is expected to grow at a CAGR of 12.7% during the forecast period.

What was the market size of the accident and illness segment in 2025?

The accident and illness segment held a significant market share of 54.3% in 2025 and is projected to grow at a CAGR of 12.9% during the forecast period.

How much revenue did the dogs segment generate?

The dogs segment accounted for the highest revenue of USD 10 billion in 2025 and is anticipated to grow at a CAGR of 12.7% during the analysis period.

Which region leads the pet insurance market?

North America led the market with a 39.6% share in 2025, driven by high pet ownership rates and advanced veterinary care infrastructure.

What are the upcoming trends in the pet insurance industry?

Key trends include the shift towards comprehensive wellness and preventive care plans, the adoption of digital and app-based insurance platforms, and the increasing humanization of pets, particularly in urban areas and among millennials.

What was the market size of the pet insurance market in 2025?

The global market was valued at USD 14.2 billion in 2025, driven by rising pet ownership, increased awareness of veterinary care costs, and the growing trend of pet humanization.

What is the projected value of the pet insurance market by 2035?

The market is expected to reach USD 46.8 billion by 2035, growing at a CAGR of 12.8% during the forecast period, fueled by the adoption of comprehensive insurance policies and digital platforms.

Which sales channel led the pet insurance market?

The direct sales channel dominated the market with a 44.2% share in 2025 and is projected to grow at a CAGR of 12.7% during the analysis period.

Pet Insurance Market Scope

Related Reports