Summary

Table of Content

Pet Diabetes Care Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Pet Diabetes Care Devices Market Size

The global pet diabetes care devices market was valued at USD 2.2 billion in 2024. The market size is estimated to grow from USD 2.3 billion in 2025 to USD 4.2 billion in 2034, growing at a CAGR of 6.6% from 2025 to 2034. Factors such as growing pet adoption, technological advancements in veterinary healthcare, and increased animal healthcare expenditures significantly contribute to the robust growth of the market.

To get key market trends

For instance, as per the American Pet Products Association (2023-2024), as of 2024, 66% of U.S. households, accounting to approximately 86.9 million homes own a pet. This remarkable ownership creates an opportunity for pet diabetes care devices and other related healthcare products.

Pet Diabetes Care Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.2 Billion |

| Forecast Period 2025 – 2034 CAGR | 6.6% |

| Market Size in 2034 | USD 4.2 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Advancements in veterinary healthcare have improved the availability and accessibility of glucose monitors as well as insulin pumps that help in managing diabetes in pets. These innovative products help veterinarians and pet owners manage diabetes in pets. Also, the growing rate of diabetes in animals is fueled by rising pet obesity, an aging pet population, and a sedentary lifestyle, therefore creating a greater demand for effective pet diabetes management. Thus, the rising cases of diabetes among pets underscores the need for effective monitoring and treatment methods.

The growing awareness regarding health and wellness among pet owners is allowing them to manage chronic conditions such as diabetes. The socio-economic factors also contribute to market growth because in developed regions where there is higher disposable income, there is greater expenditure towards pet healthcare.

Pet diabetes care devices are designed to aid in the management of diabetes in pets and ensure their health, including glucose monitors, insulin administration pens or syringes, and continuous (real-time) glucose monitors (CGMs). With these devices, proper management, monitoring, and treatment of diabetes is possible for pet owners and veterinarians.

Pet Diabetes Care Devices Market Trends

- The increasing prevalence of diabetes in pets around the globe is a significant factor in the growth of the market. Companion animals like cats and dogs are more likely to get affected with chronic conditions like diabetes, reflected from underlying shifts in pet health due to modern lifestyle, an aging population, and increasing obesity prevalence.

- According to Patterson Veterinary, in 2020, it was estimated approximately 1 in every 300 dogs and 1 in 230 cats are likely to develop diabetes in their lifetime. These numbers demonstrate the growing need for effective monitoring and management tools that can effectively cater to this chronic condition in pets.

- As a greater number of pets are diagnosed with diabetes, eventually the need for advanced treatment options increases. The increased availability and accessibility of at-home devices such as blood glucose monitors, insulin pumps, and even CGM systems further supports the growth of pet diabetes care devices market. These devices enable tracking glucose levels in real time alongside precise dosing of insulin which facilitates improving overall health of the animals.

- Moreover, the advancement of veterinary medicine has made these technologies more precise and reliable, thus gaining traction in the animal healthcare industry.

- Increased humanization of animals and improved pet care awareness among pet owners remain key factors impacting the growth of the market. The availability of user-friendly, innovative devices, managing chronic conditions in pets has significantly boosted the adoption of the market.

- Furthermore, veterinarians are playing a critical role by recommending tailored diabetes care solutions, reinforcing the need for specialized products.

Trump Administration Tariffs

- The market globally will be affected in its pricing, supply chain relationships, and market accessibility because of the tariffs imposed in the Trump Administration. If these tariffs remain in place or are reintroduced under similar trade policies, the cost of importing essential components or finished devices such as glucose monitors, insulin delivery pens, and syringes from countries like China could rise significantly.

- Most companies that rely on international suppliers will be affected and might face high manufacturing costs. This may force them to increase the prices for consumers. Further, veterinary clinics and retailers will likely face severe outages of products and delayed delivery due to broken supply chains without domestic alternatives.

- Resources need to be obtained or dealt with by the companies in new ways which may require spending on domestic production or changing deal conditions. Therefore, if tariff-related uncertainties persist, they could restrain market growth and limit the adoption of pet diabetes care devices, especially in emerging and cost-conscious markets.

Pet Diabetes Care Devices Market Analysis

Learn more about the key segments shaping this market

Based on the device type, the global market is segmented into insulin delivery devices and glucose monitoring devices. The insulin delivery devices segment accounted for the highest market share and was valued at USD 2 billion in 2024. The insulin delivery devices segment is further sub-segmented into insulin syringes and insulin delivery pen.

- Managing diabetes in cats and dogs necessitates the use of insulin, making the insulin delivery devices essential for managing diabetes. In pets, diabetes usually requires lifelong insulin treatment which sustains the demand for effective and effortless delivery systems.

- Insulin delivery devices such as insulin pens and syringes are some of the most widely used devices due to their low cost, wide availability, and ease of use, making them accessible to a broader range of customers.

- Moreover, the growing availability of new devices and supportive veterinary infrastructure has established the insulin delivery devices segment as the dominant segment in the market.

Learn more about the key segments shaping this market

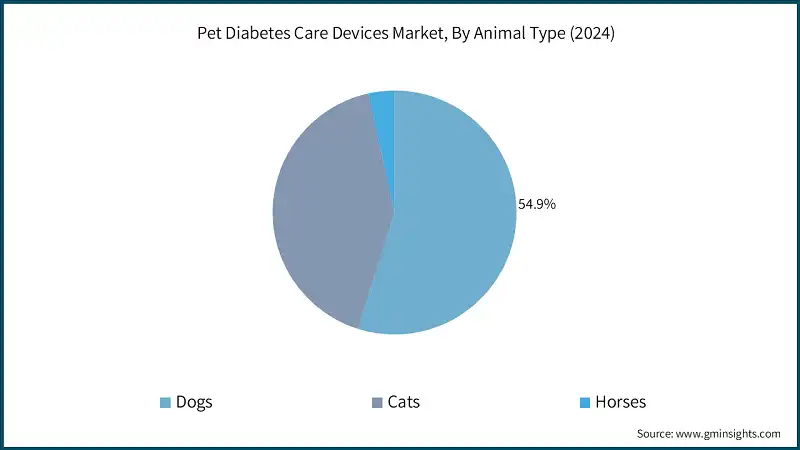

Based on the animal type, the global pet diabetes care devices market is categorized into dogs, cats and horses. The dogs segment dominated the market with 54.9% market share in 2024.

- This dominance is primarily attributed to the higher prevalence of diabetes in dogs compared to other pets driven by factors such as obesity, genetic predisposition, and aging. These conditions are growing common among domestic dogs and significantly increase the risk of developing insulin-dependent diabetes, which requires regular monitoring and insulin administration.

- Pet owners' growing awareness and proactive management of their dogs' health have also contributed to the segment’s leading position. More owners are investing in specialized devices like insulin delivery systems and glucose monitors to ensure timely and accurate care for diabetic dogs.

- According to the U.S. & Worldwide Statistics 2025 provided by Dogster, there are approximately 900 million dogs worldwide, and in the U.S., 65.1 million households own at least one dog.

- This widespread dog ownership, especially in developed markets, combined with rising obesity trends among dogs, has created a substantial market for dog-specific diabetes management solutions.

Based on the end use, the global pet diabetes care devices market is classified into veterinary hospitals and clinics, homecare settings, and other end users. In 2024, the veterinary hospitals and clinics segment held highest market share and is expected to showcase growth at 6.5% CAGR over the analysis period.

- Veterinary hospitals and clinics serve as the first point of contact for the early stages of diabetes detection and management in pets. With the help of modern diagnostic devices such as glucometers and CGM systems, these facilities can effectively cater for the needs of pet care in diabetic pets.

- The need for regular follow-ups and treatment changes fosters dependency on these facilities. Also, these facilities are regarded as trusted centers for insulin therapy, educating pet owners, and providing follow up care.

- Furthermore, the availability of trained veterinary personnel guarantees the correct use of the devices as well as the compliance with treatment protocols, which is essential in management of chronic conditions such as diabetes.

Looking for region specific data?

In 2024, the North America pet diabetes care devices market dominated the global market with 41% market share. The U.S. market was valued at USD 751.6 million and USD 775.9 million in 2021 and 2022, respectively. The market size reached USD 843 million in 2024 from USD 804.9 million in 2023.

- According to Dogster, approximately 65.1 million households in the U.S. own at least one dog, making dogs a significant segment within the market. This widespread ownership, combined with rising awareness of diabetes management in pets, has fueled the demand for advanced care devices such as glucose monitors and insulin delivery systems in the country.

- The widespread availability of cutting-edge medical technologies and pet-specific diabetes devices enhances early diagnosis and improves disease management outcomes.

- Moreover, the U.S. has a strong veterinary infrastructure, with a dense network of veterinary hospitals and clinics offering expert diagnosis, treatment, and follow-up care, thereby supporting the market growth.

Germany pet diabetes care devices market is anticipated to witness considerable growth in the Europe market over the analysis period.

- The market is expanding due to the high prevalence of diabetes among pets, particularly in cats. For instance, according to a recent report from the Central Association of Zoological Specialist Companies (ZZF), 15.7 million cats live in 25% of German households. This significant population of cats reflects the need for specialized diabetes care devices for cats.

- The growing pet ownership trend and the increased awareness of diabetes management among pet owners are fueling the adoption of innovative care devices.

- Furthermore, the growing phenomenon of viewing pets as part of the family has increased the expenditure on advanced medical care solutions tailored for pets, thereby propelling the market expansion.

India pet diabetes care devices market is predicted to grow significantly in the Asia Pacific market over the forecast period.

- In the last few years, veterinary clinics and hospitals that provide urban-level sophisticated services, including the treatment of chronic illnesses such as diabetes, have increased in India.

- With improved infrastructure and increased awareness among pet owners, there has been remarkable growth in India’s pet diabetes care device market. Simultaneously, educational campaigns and instructions from veterinarians are motivating the public to take up quality caring responsibilities for diabetic pets.

- Moreover, rising disposable incomes and an increasing attachment to pets have led to a greater willingness to invest in high-quality healthcare, thus underscoring the market’s strong growth potential in the years ahead.

Brazil is predicted to witness considerable growth over the analysis period in the Latin America pet diabetes care devices market.

- Brazil's market is expected to witness significant growth, driven by the country’s large pet population and rising prevalence of diabetes in pets due to lifestyle changes like obesity and reduced physical activity.

- The rising focus on animal health, economic growth, increased adoption of pet insurance, and introduction of advanced and accessible technologies further fosters the growth of this market.

Saudi Arabia pet diabetes care devices market is poised to grow during the forecast period.

- Saudi Arabia’s market is expected to grow owing to the rising pet ownership in the country, increasing diabetes rates among pets, and developing veterinary services in the country.

- Also, increased awareness of chronic disease management among pet owners as well as the cultural shift that categorizes pets as family members has heightened the need for advanced healthcare solutions.

Pet Diabetes Care Devices Market Share

The market is characterized by the presence of numerous global and regional players vying for market share. Top 5 players in this market include Merck Animal Health, Zoetis, Boehringer Ingelheim, Becton, Dickinson and Company, and Ulticare accounting for approximately 50% - 60% of market share. These key companies focus on product innovation, strategic collaborations, and expanding their distribution networks to strengthen their positions. These companies leverage extensive research and development capabilities, global distribution networks, and strategic partnerships to maintain their market positions.

The competitive landscape is further influenced by ongoing collaborations between device manufacturers and veterinary clinics, enhancing the accessibility and quality of diabetes care for pets.

Pet Diabetes Care Devices Market Companies

Few of the prominent players operating in the pet diabetes care devices industry include:

- Allison Medical

- ALR Technologies

- Becton, Dickinson and Company

- Boehringer Ingelheim

- FitBark

- Henry Schein Animal Health

- i-SENS

- MED TRUST

- Merck Animal Health

- TaiDoc

- Trividia Health

- UltiMed

- Zoetis

Zoetis’s is recognized for its advanced diagnostic capabilities tailored for pet diabetes management, exemplified by its AlphaTrak blood glucose monitoring system. Designed for both home and clinical use, AlphaTrak offers rapid, accurate glucose readings using a minimal blood sample, enhancing convenience and reliability for pet owners and veterinarians. As a leading player in animal health, Zoetis combines innovation with a broad product portfolio to ensure optimal care for diabetic pets.

Merck Animal Health has made significant strides in pet diabetes care with the introduction of VetPen, the first insulin pen approved for use in diabetic dogs and cats. Used with VETSULIN, the only veterinary insulin product approved for both dogs and cats, VetPen simplifies insulin administration, making it more convenient for pet owners and ensuring accurate dosing. This innovation reflects Merck's commitment to improving the management of diabetes in pets.

Pet Diabetes Care Devices Industry News

- In February 2023, Zoetis launched the AlphaTrak 3 blood glucose monitoring system in the U.S., designed specifically for managing diabetes in pets. This next-generation device offers enhanced accuracy and ease of use for both pet owners and veterinarians. The launch strengthened Zoetis’s position in the pet diabetes care market by expanding its diagnostic portfolio and meeting the growing demand for advanced at-home monitoring solutions.

- In December 2022, ALR Technologies partnered with Covetrus to co-brand and distribute ALRT’s GluCurve Pet CGM, the first continuous glucose monitoring system specifically designed for diabetic cats and dogs, exclusively sold to veterinarians. The partnership enhances ALR’s market reach and credibility by leveraging Covetrus’ extensive distribution network and reputation in the animal-health industry.

- In September 2020, Trividia Health introduced the Test Buddy and Healthy Tracks for pet’s product lines, aimed at simplifying diabetes monitoring and management for pets. These innovations provide pet owners with user-friendly tools for tracking glucose levels and supporting overall pet health. This launch strengthened Trividia’s position in the pet health segment by expanding its presence in the growing pet diabetes care market.

The pet diabetes care devices market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 – 2034 for the following segments:

Market, By Device Type

- Insulin delivery devices

- Insulin syringes

- Insulin delivery pen

- Glucose monitoring devices

- Blood glucose monitors (BGMs)

- Continuous glucose monitors (CGMs)

Market, By Animal Type

- Dogs

- Cats

- Horses

Market, By End Use

- Veterinary hospitals and clinics

- Homecare settings

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

How big is the pet diabetes care devices market?

The pet diabetes care devices industry was valued at USD 2.2 billion in 2024 and is projected to grow at a 6.6% CAGR from 2025 to 2034, reaching USD 4.2 billion by 2034.

What is the market share of the dogs segment in the pet diabetes care devices industry?

The dogs segment held a 54.9% share of the pet diabetes care devices market in 2024.

Who are some of the prominent players in the pet diabetes care devices industry?

Key players in the market include Allison Medical, ALR Technologies, Becton, Dickinson and Company, Boehringer Ingelheim, FitBark, Henry Schein Animal Health, i-SENS, MED TRUST, and Merck Animal Health.

How much is the North America pet diabetes care devices market worth?

The North America pet diabetes care devices industry accounted for 41% of the global market share in 2024.

Pet Diabetes Care Devices Market Scope

Related Reports