Summary

Table of Content

Oxygen-free Copper Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Oxygen-free Copper Market Size

Oxygen-free Copper Market size was valued at around USD 29.66 billion in 2019 and will exhibit a growth rate of over 5.5% between 2020 to 2026. The rising penetration of electric vehicles is further accelerating demand for oxygen-free copper in the automotive industry.

Oxygen-free copper is a group of highly conductive copper alloys that have been processed electrolytically to minimize oxygen levels to 0.001% or below. It provides superior thermal and electrical conductivity. Furthermore, the product also offers consistency in brazed and welded joints.

To get key market trends

High oxygen content in copper wires generates a potential threat of wire breaks during a wire drawing process. Oxygen-free copper provides higher processing properties during manufacturing processes. Therefore, due to these versatile properties, it is widely used in electronic products.

The consumer electronics industry was valued at around USD 1 trillion in 2019 and is expected to showcase a growth rate of over 7% from 2020 to 2026. Rising purchasing power and changing lifestyles are further expected to drive the consumer electronics industry. Oxygen-free copper materials are widely used in high-end audio-visual systems. Rapidly growing internet connectivity services in emerging economies along with the adoption of high-end audio devices are supporting the oxygen-free copper market expansion.

Oxygen-free Copper Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | USD 29.66 Billion |

| Forecast Period 2020 to 2026 CAGR | 5.5% |

| Market Size in 2026 | USD 37.96 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Growing R&D investments and usage of oxygen-free copper in electric vehicles are expected to drive the market. Several industry participants are engaged in integrating oxygen-free copper in electric and hybrid electric vehicles. Furthermore, advanced certification passed by these materials will also help to expand product demand.

For instance, in March 2017, Furukawa Electric Co., Ltd. achieved JIS standard certification for oxygen-free copper used in EVs, PHVs, and submarine optical cables. However, volatility in the prices of copper may hamper the overall oxygen free copper market growth between 2020 to 2026.

Oxygen-free Copper Market Analysis

Learn more about the key segments shaping this market

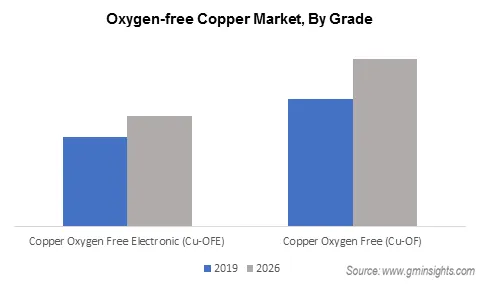

The Copper Oxygen-free (Cu-OF) segment held the largest market share of around 59% in 2019 and is anticipated to grow at a CAGR of over 5.8%. Copper oxygen-free grade materials are widely used in the electrical and automotive industries owing to good conductivity and excellent formability of the material.

The development of several new wire and rod products that are used in automotive and electronic applications coupled with distribution expansion of several industry participants across the globe will drive the Cu-OF grade demand. Additionally, the use of Cu-OF in aerospace applications is expected to offer lucrative opportunities for the oxygen free copper market growth.

Wires segment dominated the oxygen free copper market and accounted for 40% demand share in 2019 owing to the rising applications in consumer electronics, electrical sector, along with industrial applications. Wire manufacturers are using oxygen-free copper to minimize number of voids present within the wire that hinders electric signal transmission.

Acoustic cables require excellent electric signal transmission characteristics; thereby several acoustic cables are made by using oxygen free copper materials. Furthermore, the material also offers excellent formability without requirement of intermediate process anneals during wire manufacturing process.

Learn more about the key segments shaping this market

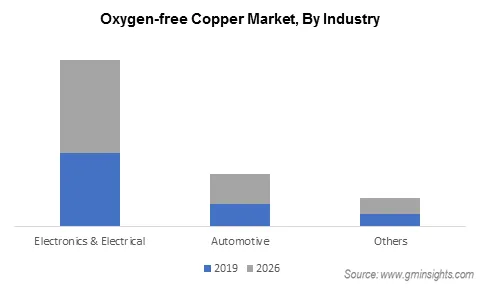

The electronics & electrical segment will account for over 65% in 2026. The electronics & electrical segment is projected to observe a rapid growth rate owing to a wide range of applications in consumer electronics and high-end vacuum applications in industrial processes. The proliferating consumer electronics sector coupled with the development of new highly efficient electronic devices will drive material usage.

Furthermore, growing FDIs in several industries across Asia Pacific and rising power demand will emerge as key growth factors for oxygen free copper market analysis.

The automotive segment is projected to grow at the highest CAGR due to growing demand for Electric Vehicles (EVs) and requirements for high conductivity copper in battery & other components of EVs. Several governments across the globe including the U.S., India, and European countries are offering subsidies on sales of electric vehicles coupled with aggressive economic plans to adopt electric transportation options.

Looking for region specific data?

Asia Pacific region will account close to 70% demand share in 2026. Asia Pacific dominated the global market and will showcase significant growth owing to the higher product demand from countries including China, Japan, South Korea, and India. The presence of large electronic companies in China, Japan, and South Korea coupled with ongoing several electric projects in China are driving the oxygen-free copper market demand.

Furthermore, the proliferating automotive industry and rising disposable income in emerging economies are expected to offer new growth opportunities to the industry.

Oxygen-free Copper Market Share

The global oxygen-free copper market players majorly focus on offering advanced products and enhancing their production capabilities. The major players are expanding their product portfolio and presence in emerging countries to cater to the increasing need for products. For instance, Fukurawa Electric announced an increase in the production of GOFC oxygen-free copper strips from 2018, having enhanced thermal resistance.

Some of the key manufacturers in the oxygen-free copper industry include:

- Aviva Metals

- Citizen Metalloys Limited

- Sam Dong America

- SH Copper Products Company (Hitachi Metals Neomaterial)

- KGHM Polska MiedY S.A

- Mitsubishi Materials Corporation

- KME Germany GmbH

- Freeport-McMoRan Inc

- Aurubis AG

- Metrod Holdings Berhad

- Cupori Oy

- Wieland-Werke AG

- thyssenkrupp Materials NA

- Zhejiang Libo Holding Group Company

- Pan Pacific Copper Company

- Furukawa Electric Co., Ltd

- Watteredge LLC. (SOUTHWIRE COMPANY LLC.)

- RK Copper & Alloy LLP

Oxygen-free Copper Market report includes in-depth coverage of the industry with estimates & forecast in terms of volume in kilo tons & revenue in USD million from 2016 to 2026 for the following segments:

By Grade

- Copper oxygen-free electronic (Cu-OFE)

- Copper oxygen-free (Cu-OF)

By Product

- Wire

- Strips

- Rods

- Busbars

- Others

By Industry

- Electronics & Electrical

- Automotive

- Others

By Region:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Turkey

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- Malaysia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Where will the global oxygen-free copper industry share depict increase?

Asia Pacific may hold around 70% of the global oxygen-free copper market share by 2026 owing to expanding electronics sector in countries like India, China, Japan, etc.

How will electronics & electrical industry segment fare through 2026?

The electronics & electrical segment may hold 65% of oxygen-free copper market share by 2026 due to widespread high-end vacuum applications in industrial processes.

What factor will drive wires segment outlook?

Wires segment held 40% of the overall oxygen-free copper market share in 2019 owing to rising deployment in the electrical and consumer electronics sectors.

Which grade segment may push industry growth?

Oxygen-free (Cu-OF) segment accounted for 59% of the global oxygen-free copper industry share in 2019 and may depict 5.8% CAGR through 2026, as this grade is majorly used in electronics & automotive sectors.

How will oxygen-free copper market fare through 2026?

Global oxygen-free copper industry size in 2019 was worth USD 29.66 billion. Increasing EV penetration may impel market share that is slated to depict 5.5% CAGR through 2026.

Why will consumer electronics demand drive oxygen-free copper requirement?

Oxygen-free copper materials are massively deployed in high-end audio-visual systems, owing to which expansion of consumer electronics industry, which in 2019 was worth USD 1 trillion and may exhibit 7% CAGR through 2026, will augment product demand.

Oxygen-free Copper Market Scope

Related Reports