Summary

Table of Content

Orthopedic Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Orthopedic Devices Market Size

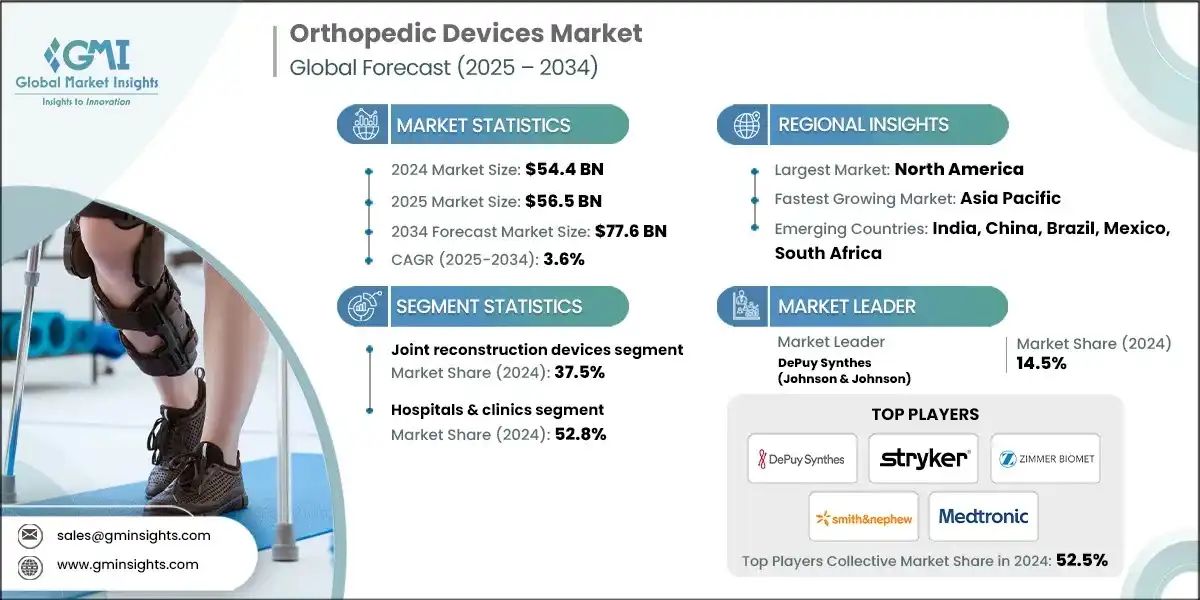

The global orthopedic devices market size was valued at USD 54.4 billion in 2024. The market is expected to grow from USD 56.5 billion in 2025 to USD 77.6 billion in 2034, propelling at a CAGR of 3.6% during the forecast period, according to the latest report published by Global Market Insights Inc. Increasing incidence of musculoskeletal disorders, aging population, and advancements in implants and surgical devices fuel the growth of the market.

To get key market trends

The orthopedic devices industry offers cutting-edge healthcare solutions to payers, providers, life sciences organizations, and healthcare technology firms to enhance regulatory compliance, patient outcomes, and operating efficiency. Solutions range from joint reconstruction devices, trauma fixation systems, spinal implants, sports medicine solutions, and digital health technologies that facilitate surgical accuracy, rehabilitation, and quality of care. Some of the most prominent players in the market are DePuy Synthes (Johnson & Johnson), Stryker, Zimmer Biomet, Smith & Nephew, and Medtronic. These players continue to maintain their competitive edge by continuously developing new product offerings, taking advantage of robust global distribution channels, establishing strategic alliances, and spending heavily in research and development to cater to changing clinical demands and increase their market share.

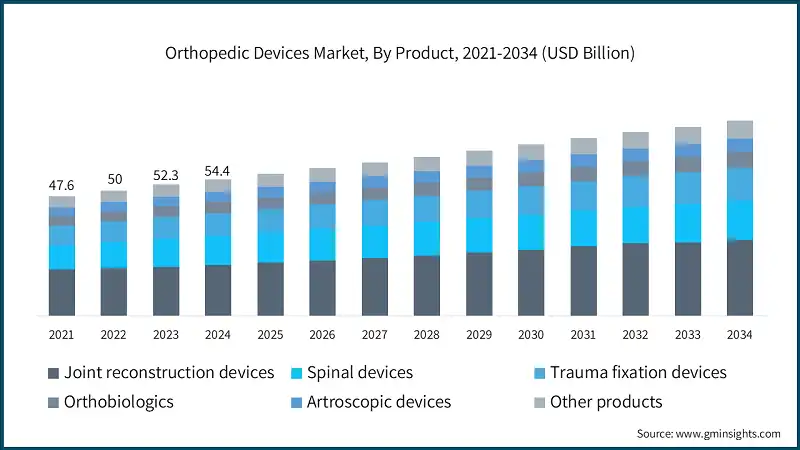

The market has increased from USD 47.6 billion in 2021 and reached USD 52.3 billion in 2023. The global orthopedic devices market is experiencing steady growth, driven by a combination of demographic, clinical, and technological factors. A primary driver is the rising prevalence of musculoskeletal disorders such as osteoarthritis, osteoporosis, and traumatic injuries, which continue to increase the demand for advanced orthopedic interventions. The rapid expansion of the global geriatric population further supports market growth, as elderly individuals are more susceptible to degenerative bone diseases, fractures, and joint-related complications requiring implants or surgical procedures.

The rise in sports injuries and road accidents has increased demand for trauma fixation devices and sports medicine solutions. Technological advancements such as minimally invasive surgery, robotics-assisted procedures, 3D-printed implants, and smart orthopedic devices are enhancing surgical precision and recovery. Growing patient awareness and early treatment preference, especially in emerging markets, are accelerating adoption, collectively driving market growth and transforming orthopedic care globally.

Orthopedic devices are specialized medical tools, implants, and instruments designed to diagnose, prevent, and treat musculoskeletal disorders, injuries, and deformities. They include joint reconstruction implants, trauma fixation systems, spinal devices, and sports medicine solutions, aiming to restore mobility, reduce pain, improve functionality, and enhance patients’ overall quality of life.

Orthopedic Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 54.4 Billion |

| Market Size in 2025 | USD 56.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 3.6% |

| Market Size in 2034 | USD 77.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing base of geriatric population | Rising elderly population increases demand for joint replacements, implants, and advanced orthopedic interventions globally. |

| Augmented incidence of orthopedic diseases | Increasing musculoskeletal disorders significantly boost the need for orthopedic devices, enhancing surgical volumes and market expansion worldwide. |

| Technological advancements | Innovations like robotics, 3D printing, and smart implants improve surgical outcomes, reduce recovery time, and drive adoption. |

| Escalating rate of orthopedic surgeries in developed nations | Higher surgical volumes in advanced healthcare systems strengthen device demand, accelerating revenue growth and market penetration. |

| Pitfalls & Challenges | Impact |

| Excessive cost of orthopedic devices | High device costs restrict affordability, particularly in developing regions, limiting widespread adoption and market expansion. |

| Stringent FDA regulations and biocompatibility issues | Regulatory hurdles delay product approvals, while biocompatibility challenges increase R&D costs, restraining faster market commercialization. |

| Opportunities: | Impact |

| Rising adoption of minimally invasive orthopedic procedures | Minimally invasive techniques reduce patient trauma, speed recovery, and increase acceptance, offering long-term growth potential for device manufacturers. |

| Expanding healthcare infrastructure in emerging economies | Improved healthcare facilities, insurance coverage, and investments broaden patient access, creating significant new opportunities for orthopedic device companies. |

| Market Leaders (2024) | |

| Market Leaders |

14.5% Market Share |

| Top Players |

Collective market share in 2024 is 52.5% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, China, Brazil, Mexico, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Orthopedic Devices Market Trends

The growing geriatric population is a key driver of the global market, as aging is strongly associated with a higher prevalence of musculoskeletal disorders such as osteoarthritis, osteoporosis, degenerative spinal conditions, and fracture risk.

- Populations in developed markets such as North America, Europe, and segments of Asia-Pacific are experiencing accelerated aging, leading to steady demand for joint reconstruction implants, spinal devices, and trauma fixation systems. This trend is expected to substantially increase the pool of patients requiring orthopedic procedures, driving market growth during the forecast period.

- Rising healthcare spending in both developed and developing economies is expanding access to advanced surgical care and orthopedic technologies. Government initiatives and favorable reimbursement policies in mature healthcare systems further support treatment affordability for elderly populations.

- Greater patient awareness, increased willingness to undergo elective procedures, and a focus on quality of life among older adults are boosting procedure volumes, particularly in joint replacements and spinal surgeries.

- Technological innovations such as robotics-assisted surgery, minimally invasive techniques, 3D-printed implants, and biologics-based regenerative solutions are enhancing surgical precision, reducing recovery times, and improving outcomes for elderly patients. These advancements align with the growing demand for safer, more effective, and personalized treatments among aging populations.

Orthopedic Devices Market Analysis

Learn more about the key segments shaping this market

The global market was valued at USD 47.6 billion in 2021. The market size reached USD 52.3 billion in 2023, from USD 50 billion in 2022.

Based on the product, the market is segmented into joint reconstruction devices, spinal devices, trauma fixation devices, orthobiologics, arthroscopic devices, and other products. The joint reconstruction devices segment has asserted its dominance in the market by securing a significant market share of 37.5% in 2024, driven by the rising prevalence of osteoarthritis, hip & knee replacements, and an aging population. The segment is expected to exceed USD 30.3 billion by 2034, growing at a CAGR of 4.1% during the forecast period. The joint reconstruction devices segment is further segmented into knee replacement, hip replacement, shoulder replacement, ankle replacement, and other joint reconstruction devices. The knee replacement segment held a revenue of USD 9.8 billion in 2024, with projections indicating a steady expansion at 4.6% CAGR from 2025 to 2034

On the other hand, the spinal devices segment is expected to grow with a CAGR of 2.8%. The segment is driven by increasing cases of spinal disorders, minimally invasive spine surgeries, and technological advancements in implants.

- The joint reconstruction devices segment is the largest and most dominant in the orthopedic devices market, driven primarily by the rising incidence of osteoarthritis and other degenerative joint conditions that significantly impact mobility and quality of life. Growing demand for hip and knee replacement surgeries, particularly among the elderly, is a major growth driver, as these procedures are often necessary to restore function and alleviate chronic pain.

- Improvements in biomaterials, prosthetic design, and 3D printing technology have enhanced implant durability, patient comfort, and surgical accuracy, further facilitating adoption. Moreover, increasing awareness of early surgical interventions, combined with improved reimbursement policies in developed markets, has encouraged greater patient willingness to undergo joint reconstruction.

- The spinal devices segment generated revenue of USD 11.7 billion in 2024 and is projected to expand steadily at a 2.8% CAGR from 2025 to 2034. Growth in this segment is fueled by the rising prevalence of spinal disorders such as degenerative disc disease, scoliosis, and spinal stenosis, which are increasingly common due to aging populations and lifestyle factors.

- The adoption of minimally invasive spine surgeries has surged, as patients and healthcare providers prefer procedures that reduce recovery time, minimize complications, and shorten hospital stays. Technological advancements in spinal implants, including motion-preserving devices, bioresorbable materials, and image-guided surgical systems, have improved surgical outcomes and broadened treatment options.

- The trauma fixation devices segment recorded revenue of USD 9 billion in 2024, with projections indicating steady growth at a 3.7% CAGR from 2025 to 2034. This segment is primarily driven by the rising global incidence of fractures and traumatic injuries resulting from road accidents, sports activities, falls, and occupational hazards. Additionally, the growing elderly population, with age-related osteoporosis and fragility fractures, has further accelerated demand for internal and external fixation devices. Advances in biomaterials, such as titanium and bioresorbable polymers, have enhanced device durability, biocompatibility, and patient outcomes, making these devices increasingly preferred by surgeons.

Learn more about the key segments shaping this market

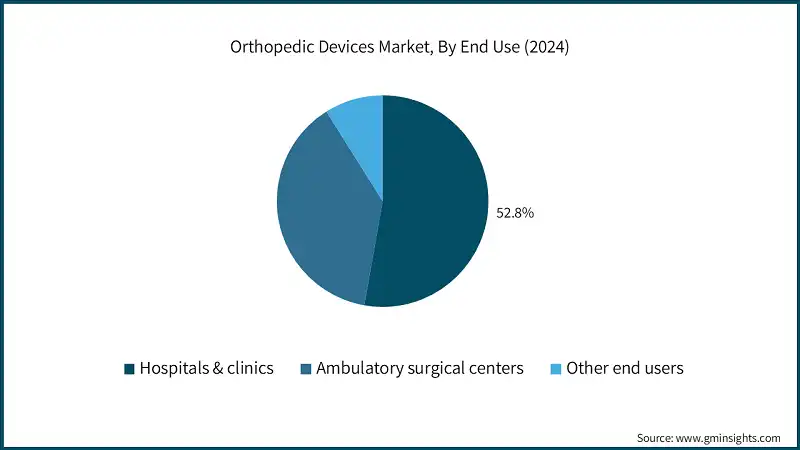

Based on end use, the orthopedic devices market is classified into hospitals & clinics, ambulatory surgical centers, and other end users. The hospitals & clinics segment dominated the market with a revenue share of 52.8% in 2024 and is expected to reach USD 43 billion within the forecast period.

- The two largest segments account for over 91.1% of the total market value. Hospitals & clinics segment retains the largest market share of the market owing to their established infrastructure, wide range of care abilities, and availability of advanced surgical technologies.

- These centers are the central hubs of sophisticated orthopedic procedures like joint replacements, spinal interventions, and trauma fixation that need advanced equipment and expertise. The increasing burden of musculoskeletal disorders, road injuries, and sports injuries is further propelling patient traffic into hospitals and clinics.

- Also, the increasing use of robot-assisted surgeries, enhanced reimbursement schemes, and access to multidisciplinary units further enhance their stronghold.

- The ambulatory surgical centers segment held a revenue of USD 20.8 billion in 2024, with projections indicating a steady expansion at 2.6% CAGR from 2025 to 2034. ASCs are witnessing significant growth in the market due to their cost-effectiveness, shorter patient stay, and convenience for less complex orthopedic procedures. These centers are increasingly equipped with advanced minimally invasive technologies that enable outpatient joint arthroscopy, spinal interventions, and fracture management.

- Rising demand for same-day surgeries, coupled with patient preference for quicker recovery and reduced hospital-associated risks, is fueling the expansion of ASCs. Furthermore, supportive government initiatives to reduce healthcare costs and advancements in anesthesia and pain management have accelerated the adoption of orthopedic devices in these centers.

- With the growing shift toward value-based healthcare and emphasis on efficiency, ASCs are emerging as an important setting for orthopedic procedures, particularly in developed markets.

Looking for region specific data?

North America Orthopedic Devices Market

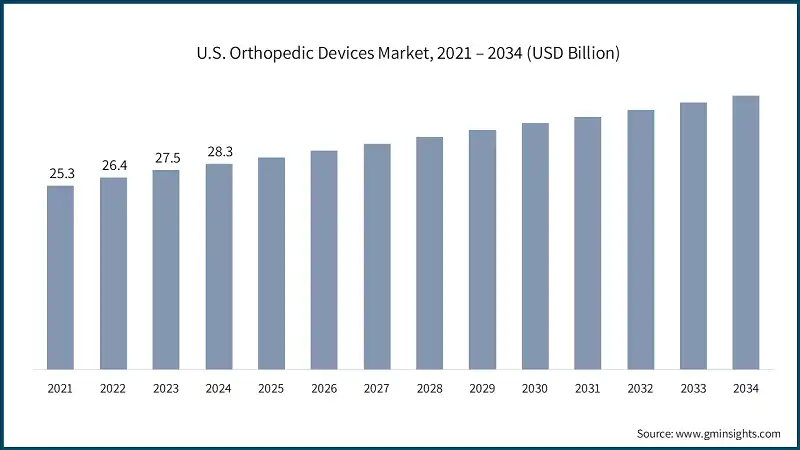

North America dominated the global market with the highest market share of 55.6% in 2024.

- North America leads the global market due to its advanced healthcare infrastructure, high healthcare spending, and strong adoption of new medical technologies. The region also has a large elderly population with a high prevalence of arthritis, osteoporosis, and degenerative joint diseases, which drives significant demand for orthopedic interventions.

- High rates of obesity and sports-related injuries further increase the need for joint reconstruction, spinal fixation, and trauma fixation devices. Growing awareness of minimally invasive procedures, coupled with the rising use of robotics-assisted surgeries and orthobiologics, continues to strengthen market growth.

- Additionally, ongoing research collaborations, regulatory approvals, and clinical trials in orthopedic care create a robust growth ecosystem, ensuring that North America maintains its leading position in the global market.

The U.S. orthopedic devices market was valued at USD 25.3 billion and USD 26.4 billion in 2021 and 2022, respectively. In 2024, the market size grew to USD 28.3 billion from USD 27.5 billion in 2023.

- A rapidly aging population, with millions requiring hip, knee, and spine procedures, is significantly driving demand for advanced orthopedic devices. The country’s strong healthcare infrastructure, combined with high patient access to specialists, facilitates timely adoption of innovative solutions.

- Favorable reimbursement structures from Medicare and private insurers enhance affordability and uptake of joint reconstruction and spinal implants. The U.S. also leads in technological innovation, with substantial investments in robotics-assisted orthopedic surgeries, AI-based surgical planning, and customized 3D-printed implants.

- The presence of major orthopedic device manufacturers, academic institutions, and clinical research organizations fosters continuous product development. Additionally, rising patient preference for minimally invasive and outpatient orthopedic procedures has strengthened the role of ambulatory surgical centers, contributing to the U.S. dominant market share in the region.

Europe Orthopedic Devices Market

Europe market accounted for USD 11 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- The European market is largely influenced by the aging population in the region, which greatly elevates the incidence of musculoskeletal diseases like osteoarthritis, osteoporosis, and spinal disorders. Increasing cases of sports injuries and road accidents also fuel the demand for orthopedic treatments.

- Technological innovations, such as minimally invasive procedures, robotic surgeries, and 3D-printed implants, are improving surgical success and patient recovery, eventually driving the market even higher. Sophisticated healthcare infrastructure and favorable reimbursement policies in nations like the UK, France, and Italy are supporting wider use of advanced orthopedic devices.

- Additionally, increasing awareness of early diagnosis and treatment, coupled with government initiatives to improve orthopedic care accessibility, supports market expansion. The trend toward outpatient and ambulatory surgical centers in Europe is also encouraging the use of portable and cost-efficient orthopedic devices, making the region a lucrative market for both established and emerging players.

Germany dominates the European orthopedic devices market, showcasing strong growth potential.

- Germany, as one of the largest healthcare markets in Europe, plays a significant role in driving the market due to its aging population and high prevalence of musculoskeletal diseases. Rising demand for joint replacement procedures, particularly hip and knee arthroplasty, is a key growth driver.

- Technological advancements in implants, navigation systems, and minimally invasive orthopedic surgeries are improving surgical accuracy and patient outcomes, boosting adoption rates. Germany’s sophisticated healthcare infrastructure, high-quality medical treatment, and robust reimbursement systems further enable the use of advanced orthopedic devices.

- The nation’s strong emphasis on research and development, along with partnerships between healthcare organizations and medical device manufacturers, supports ongoing product innovation. Additionally, increasing patient awareness of early intervention and a preference for outpatient orthopedic procedures are further accelerating market growth, positioning Germany as a high-potential market within the European orthopedic devices landscape.

Asia Pacific Orthopedic Devices Market

The Asia Pacific market is anticipated to grow at the highest CAGR of 5.6% during the analysis timeframe.

- The Asia Pacific market is expanding rapidly, driven by a rising incidence of musculoskeletal disorders, a growing population, and increased cases of trauma from road accidents and sports injuries. Developing healthcare infrastructure, expanding hospital networks, and greater availability of orthopedic surgical procedures are supporting market adoption in the region.

- Growing awareness of orthopedic treatment options, enhanced diagnostic capabilities, and supportive government policies to improve healthcare accessibility are further fueling market growth. The increasing demand for joint replacement surgeries, spinal implants, and minimally invasive procedures is attracting investments from global orthopedic device manufacturers.

- Additionally, the rise of medical tourism in countries such as India, Thailand, and Malaysia, combined with cost-effective treatment options compared to Western markets, is boosting the adoption of orthopedic devices. Favorable reimbursement policies and rising healthcare expenditure further contribute to the robust growth trajectory of the Asia Pacific market.

China orthopedic devices market is estimated to grow with a significant CAGR in the Asia Pacific market.

- China’s market is growing rapidly, driven by the country’s aging population, which increases the prevalence of osteoarthritis, osteoporosis, and other musculoskeletal conditions. Rising urbanization, lifestyle changes, and a higher incidence of sports and traffic-related injuries are further contributing to the demand for orthopedic interventions.

- Government initiatives to modernize healthcare infrastructure, expand access to advanced surgical procedures, and promote medical device innovation are accelerating adoption. The increasing availability of hospital-based and outpatient orthopedic services, along with improved reimbursement policies, is making orthopedic surgeries more accessible.

- Growing awareness of joint replacement, spinal surgeries, and trauma management, combined with the rise of medical tourism, is further boosting demand. Foreign investment and partnerships with global orthopedic device manufacturers are facilitating the introduction of technologically advanced implants and instruments, positioning China as a high-growth market within the Asia Pacific region.

Latin American Orthopedic Devices Market

Brazil leads the Latin America market, exhibiting remarkable growth during the analysis period.

- Brazil dominates the Latin America market due to a combination of rising musculoskeletal disorders, an aging population, and increasing incidences of road traffic accidents and sports-related injuries.

- The country has witnessed substantial investment in healthcare infrastructure, including modern hospitals and specialty orthopedic centers, which boosts the adoption of advanced orthopedic devices such as joint reconstruction implants, spinal devices, and trauma fixation systems.

- Government initiatives to improve healthcare accessibility, along with private sector expansion and public-private partnerships, have increased procedure volumes, particularly for joint arthroplasty and minimally invasive surgeries.

- Moreover, growing awareness about orthopedic care, coupled with rising healthcare insurance coverage, is driving patient preference for timely interventions. Technological advancements, including robotic-assisted surgeries and advanced biomaterials, further enhance surgical outcomes, supporting market growth.

- The combination of high procedure rates, infrastructure development, and increasing disposable income contributes significantly to Brazil’s leadership in the regional market.

Middle East and Africa Orthopedic Devices Market

Saudi Arabia market is expected to experience substantial growth in the Middle East and Africa market in 2024.

- The market in Saudi Arabia is driven by rising orthopedic disorders, including arthritis, spinal conditions, and traumatic injuries, compounded by road accidents and an expanding elderly population. The government’s Vision 2030 initiative emphasizes healthcare modernization and investment in specialized hospitals and surgical centers, supporting the adoption of advanced orthopedic devices.

- Increasing public and private healthcare expenditure, along with greater medical insurance penetration, is improving access to joint replacement, spinal surgery, and trauma care procedures. Technological advancements such as minimally invasive surgeries, navigation systems, and 3D-printed implants are widely adopted in tertiary care hospitals, enhancing surgical precision and patient outcomes.

- Additionally, the growing medical tourism sector attracts patients from neighboring countries for orthopedic interventions, further expanding device demand. Awareness programs, rising disposable income, and urbanization are also driving patient preference for high-quality orthopedic care, positioning Saudi Arabia as a rapidly growing market in the Middle East.

Orthopedic Devices Market Share

The global market is highly competitive, with leading medical device companies emphasizing product innovation, technological advancements, and strategic collaborations to consolidate their market positions. Rising prevalence of musculoskeletal disorders, increasing orthopedic surgeries, and growing awareness of minimally invasive procedures are driving companies to invest in R&D, smart implants, and digital surgical planning tools to improve patient outcomes and surgical efficiency. The global shift toward value-based and patient-centric healthcare is also encouraging players to develop cost-effective solutions and expand their footprint in emerging markets.

Key players include DePuy Synthes (Johnson & Johnson), Stryker, Zimmer Biomet, Smith & Nephew, and Medtronic, collectively accounting for 52.5% of the global market. These companies maintain leadership through diverse product portfolios, robust global distribution networks, and continuous innovation in joint reconstruction, spinal, trauma, and orthobiologic devices. Their dominance is reinforced by strategic partnerships with hospitals, ambulatory centers, and orthopedic specialists to enhance accessibility and adoption.

Smaller and niche players are gaining traction by offering portable, patient-friendly, and procedure-specific devices. Competitive differentiation is increasingly defined by the ability to deliver technologically advanced, minimally invasive, and cost-efficient orthopedic solutions tailored to diverse healthcare settings. As the market evolves, competition is expected to intensify, with both established leaders and emerging firms focusing on innovation, digital integration, and strategic alliances to capture greater market share.

Orthopedic Devices Market Companies

Few of the prominent players operating in the orthopedic devices industry include:

- aap Implantate

- Arthrex

- ATEC

- B. Braun

- ConforMIS

- CONMED

- DePuy Synthes (J&J)

- Enovis

- Globus Medical

- Integra

- Medacta

- Medtronic

- MicroPort Scientific

- Smith & Nephew

- Stryker

- TriMed

- Waldemar

- Zimmer Biomet

DePuy Synthes dominates the market with a share of 14.5%. It stands out for its comprehensive orthopedic portfolio, including joint reconstruction, trauma, spinal, and sports medicine solutions. Its USPs include cutting-edge implant technologies, minimally invasive surgical systems, advanced digital planning tools, and strong global distribution, enabling improved patient outcomes and streamlined surgical efficiency.

Stryker’s USPs lie in its innovative orthopedic devices, particularly in joint reconstruction, trauma, and spinal care. The company excels with technologically advanced implants, robotic-assisted surgery systems, and digital surgical planning platforms, combined with strong clinician support and global reach, ensuring precision, efficiency, and enhanced recovery in orthopedic procedures.

Orthopedic Devices Industry News:

- In January 2025, Stryker (US) finalized an agreement to sell its spinal implant business segment to Viscogliosi Brothers, LLC (US), leading to the creation of a new entity, VB Spine, LLC, which will oversee the acquired spinal implant operations.

- In December 2024, Zimmer Biomet (US) received FDA clearance for the Persona Solution PPS Femur, a total knee implant designed specifically for patients sensitive to bone cement or metal, expanding treatment options in orthopedic knee replacement procedures.

- In December 2024, Zimmer Biomet (US) received FDA 510(k) clearance for its OsseoFit Stemless Shoulder System, a total shoulder replacement solution designed to provide patients with improved joint function and surgeons with a versatile, stemless implant option.

- In July 2024, Smith+Nephew (UK) partnered with Healthcare Outcomes Performance Company (US) to provide healthcare professionals, patients, and ASCs with enhanced solutions by leveraging the company’s digital analytics platform for improved outcomes and operational efficiency.

The orthopedic devices market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Product

- Joint reconstruction devices

- Knee replacement

- Hip replacement

- Shoulder replacement

- Ankle replacement

- Other joint reconstruction devices

- Spinal devices

- Trauma fixation devices

- Orthobiologics

- Arthroscopic devices

- Other products

Market, By End Use

- Hospitals & clinics

- Ambulatory surgical centers

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which end-use segment held the largest share in 2024?

Hospitals and clinics dominated the market with a 52.8% share, accounting for USD 28.8 billion in 2024, owing to advanced infrastructure, skilled professionals, and high procedure volumes.

Which region is expected to witness the fastest growth?

The Asia Pacific region is projected to grow at the highest CAGR of 5.6%, supported by improving healthcare infrastructure, growing medical tourism, and increasing adoption of orthopedic implants in emerging economies such as India and China.

Which region leads the orthopedic devices industry?

North America led the global market with a 55.6% share and revenue of USD 30.3 billion in 2024, driven by strong healthcare infrastructure, advanced surgical technologies, and a large aging population.

What is the growth outlook for ambulatory surgical centers (ASCs) from 2025 to 2034?

The ASC segment is projected to grow at a 2.6% CAGR through 2034, fueled by cost efficiency, shorter hospital stays, and rising demand for same-day minimally invasive orthopedic surgeries.

Who are the key players in the orthopedic devices market?

Key players include DePuy Synthes (Johnson & Johnson), Stryker, Zimmer Biomet, Smith & Nephew, Medtronic, Arthrex, B. Braun, CONMED, Globus Medical, and MicroPort Scientific.

How much revenue did the trauma fixation devices segment generate in 2024?

The trauma fixation devices segment recorded USD 9 billion in 2024, with an expected 3.7% CAGR through 2034, driven by the rising number of fractures and trauma cases globally.

What was the valuation of the spinal devices segment in 2024?

The spinal devices segment generated USD 11.7 billion in 2024 and is projected to grow at a CAGR of 2.8% from 2025 to 2034, supported by rising spinal disorders and minimally invasive surgery adoption.

Which product segment dominated the orthopedic devices industry in 2024?

The joint reconstruction devices segment led the market with a 37.5% share, generating USD 20.4 billion in 2024. The segments dominance is attributed to the rising number of knee and hip replacement surgeries and the growing elderly population.

What is the market forecast for 2025?

The global market is projected to reach USD 56.5 billion in 2025, reflecting a steady rise in surgical procedures and expanding access to advanced orthopedic care.

What is the projected value of the orthopedic devices market by 2034?

The market is expected to reach USD 77.6 billion by 2034, growing at a CAGR of 3.6% from 2025 to 2034, supported by innovations in robotics, 3D printing, and minimally invasive surgical techniques.

What is the market size of the orthopedic devices market in 2024?

The market size for orthopedic devices was valued at USD 54.4 billion in 2024, driven by the increasing incidence of musculoskeletal disorders, an aging population, and advancements in orthopedic implants and surgical technologies.

Orthopedic Devices Market Scope

Related Reports