Summary

Table of Content

Nutraceutical Ingredients Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Nutraceutical Ingredients Market Size

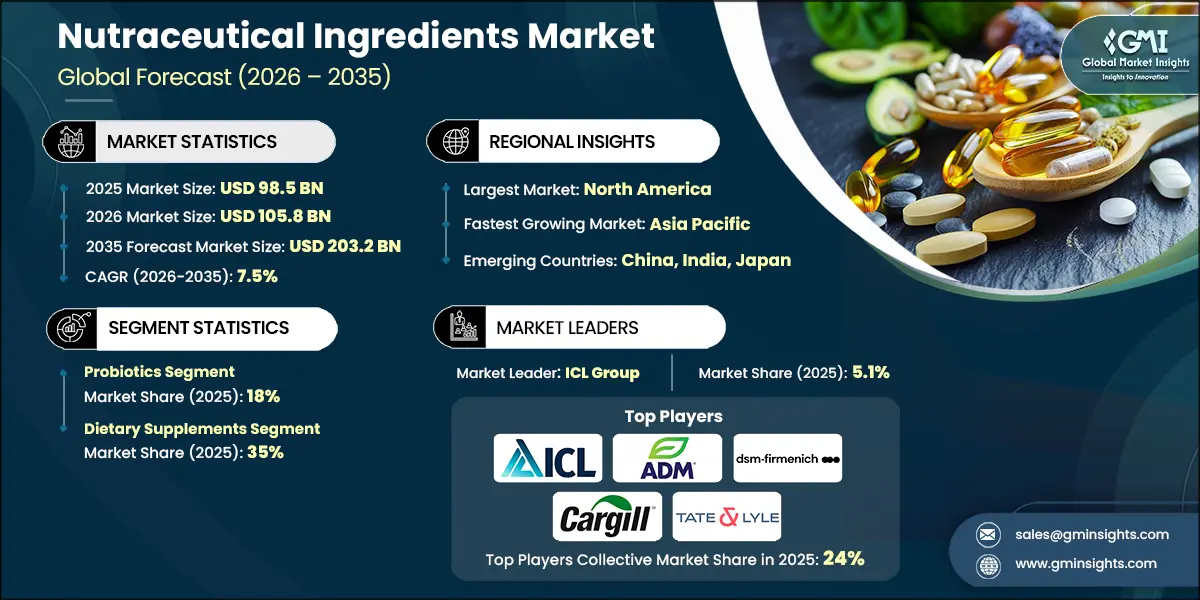

The global nutraceutical ingredients market size was valued at USD 98.5 billion in 2025 and is poised to expand from USD 105.8 billion in 2026 to USD 203.2 billion by 2035, reflecting a 7.5% CAGR from 2026 to 2035, according to the latest report published by Global Market Insights Inc.

To get key market trends

- Near-term growth is set by continued penetration of functional foods and ready-to-drink formats, while medium-term momentum ties to personalization and clinically substantiated claims that consumers can readily understand. Because of this, the nutraceutical ingredients market keeps compounding even when broader food categories slow, its growth engine is diversified across channels and use-cases.

- Vitamins remained the largest product slice, reflecting ubiquity across fortification and supplements. Probiotics represented roughly 18% as microbiome science and digestive wellness moved mainstream in food, beverage, and OTC formats, proteins held around 14% on sports and active nutrition adoption paired with plant-forward diets. Weight of evidence linking diet to chronic disease risk continues to support these categories, and it shows up in purchasing choices consumers make daily.

- North America represented close to 38% of 2025 value, Europe accounted for about 29%, Asia Pacific was near 24%; and Latin America plus Middle East & Africa combined for roughly 9%. Demographics and income growth support Asia Pacific’s higher CAGR, while North America and Europe scale through premiumization, brand trust, and retail and e-commerce depth. Regulatory clarity is a swing factor: predictable rulesets reduce time-to-market and enable sustained innovation velocity.

Nutraceutical Ingredients Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 98.5 Billion |

| Market Size in 2026 | USD 105.8 Billion |

| Forecast Period 2026 - 2035 CAGR | 7.5% |

| Market Size in 2035 | USD 203.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Health & wellness awareness | Expands total addressable market across formats |

| Lifestyle disease burden | Sustains demand for metabolic and cardiovascular support |

| Aging population | Elevates bone, joint, cognitive, and heart categories |

| Pitfalls & Challenges | Impact |

| Regulatory divergence | Slows approvals and inflates compliance costs |

| Opportunities: | Impact |

| Personalized nutrition | Higher ASPs and repeat engagement via tailored solutions |

| Market Leaders (2025) | |

| Market Leaders |

5.1 % market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging country | China, India, Japan |

| Future outlook |

|

What are the growth opportunities in this market?

Nutraceutical Ingredients Market Trends

- Plant-based and organic nutraceutical ingredients consumer surveys show strong associations between plant-forward eating and health, while life-cycle assessments and ethical preferences keep pushing brands to reformulate around botanicals and non-animal sources. Peer reviewed work connects plant-based dietary patterns with lower cardiovascular and metabolic risk, reinforcing demand for plant proteins, algae omega 3s, plant sterols, and standardized botanical extracts. The real driver here is credibility meeting convenience, certified-organic inputs, non GMO verification, and transparent sourcing let consumers trade up confidently and suppliers that can prove origin and quality win share.

- Personalized nutrition and functional foods Nutrigenomics, at-home diagnostics, and AI recommendation engines are enabling targeted ingredient stacks for energy, sleep, mood, immunity, and metabolic goals. Federal and international data confirm the public health burden of chronic disease, which keeps consumers engaged and providers focused on measurable outcomes. Functional foods show how this plays out day-to-day, probiotics in yogurts, sterol-enriched spreads, calcium-fortified beverages, and cognitive blends in snacks bring “better-for-you” into habitual eating. Personalized programs don’t push consumers away from foods; they reframe foods as delivery platforms.

- Gummies turned compliance into a taste win, then migrated well beyond children’s multis into adult formats for probiotics, omega 3s, and specialty actives. Liquids shots, RTDs, fit on-the-go routines and support faster absorption for hard-to-solubilize actives. Microencapsulation protects sensitive compounds, masks off-notes, and enables controlled release, opening food-and-beverage doors for ingredients that once lived only in capsules. Industry and academic literature document the expanding toolkit spray drying, coacervation, liposomal systems each with trade-offs in payload, stability, and cost as brands balance efficacy with experience.

Nutraceutical Ingredients Market Analysis

Learn more about the key segments shaping this market

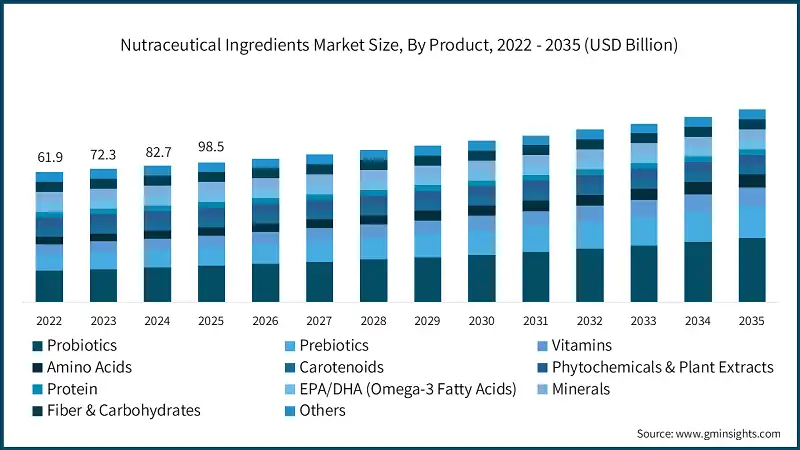

Based on product type the market is segmented as probiotics, prebiotics, vitamins, amino acids, carotenoids, phytochemicals & plant extracts, protein, EPA/DHA (omega-3 fatty acids), minerals, fiber & carbohydrates, and others.

- Probiotics captured roughly 18% of the nutraceutical ingredients market share in 2025, as evidence for gut immune metabolic links grows and formulation science improves stability in shelf stable foods. Vitamins held the largest market share at about 22% in 2025, anchored by widespread fortification and supplement routines.

- Amino acids represented near 11% share on sports and active nutrition growth, while proteins accounted for around 14% driven by plant-forward adoption and performance positioning. Documented strains in probiotics, bioavailable forms in vitamins and minerals, and complete amino-acid profiles in plant proteins raise willingness to pay, especially when paired with delivery formats consumers actually like.

- Carotenoids and phytochemicals/botanicals keep expanding as eye, skin, and cardiovascular benefits meet clean-label demand. Omega 3 EPA/DHA sees rising algae-based adoption addressing sustainability and vegetarian preferences. Minerals remain foundational for bone, immunity, and metabolic support, with chelates and organics improving absorption. Fibers and specialized carbohydrates ride digestive wellness and prebiotic interest.

Learn more about the key segments shaping this market

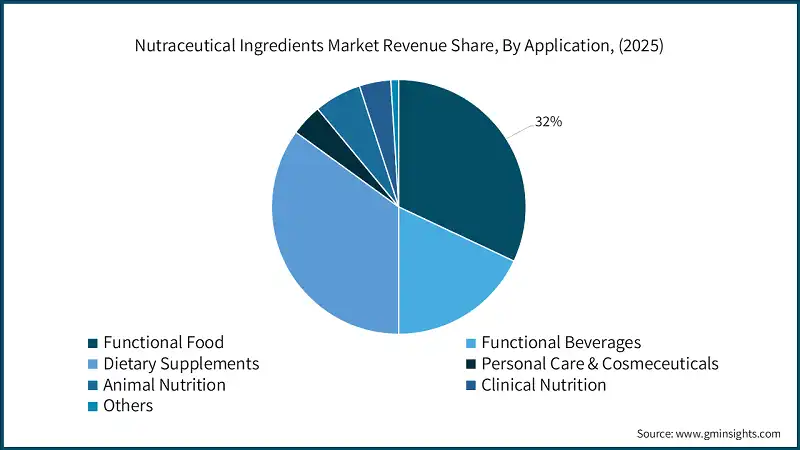

Based on application the market is segmented as functional food, functional beverages, dietary supplements, personal care & cosmeceuticals, animal nutrition, clinical nutrition, and others.

- Dietary supplements represented about 35% of the nutraceutical ingredients market in 2025, reflecting the need for precise dosing, strong claims support, and multi-ingredient stacks for targeted outcomes. Functional foods accounted for roughly 32% as brands fortify cereals, dairy, and snacks to turn routine eating into measurable wellness. Functional beverages held about 18% market share in 2025, aided by improved solubility, taste masking, and stability systems for actives like curcumin and CoQ10. Personal care/cosmeceuticals where ingestible beauty’s collagen, hyaluronic acid, and antioxidant blends continue to preimmunize.

- Animal nutrition benefits from pet humanization and antibiotic reduction in livestock, favoring probiotics, prebiotics, and botanicals. Clinical nutrition leans on medical supervision and stronger evidence thresholds. Dry forms dominate for stability and handling, liquids accelerate for RTDs and shots, and semi solids fill niche performance needs. Applications that make health easy at breakfast, at the gym, or on the go pull the category forward.

Looking for region specific data?

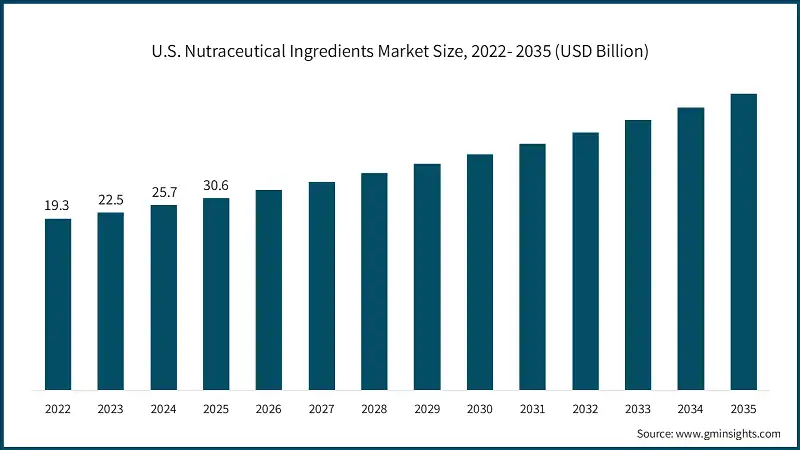

The U.S. Nutraceutical ingredients market valued at USD 30.6 billion in 2025 and estimated to grow to almost USD 63.3 billion by 2035. North America holds around 38% of the market share in 2025.

- The North America market leads on share and depth, supported by a mature supplement culture, strong retail and e-commerce, and clear rules under DSHEA that manufacturers navigate daily. The U.S. market benefits from clinical marketing, HCP recommendations, and premium brand equity, while Canada mirrors trends with rising interest in plant based, probiotics, and beauty from within.

- The Europe nutraceutical ingredients market is shaped by EFSA’s stringent claims regime, which slows launches but boosts consumer trust when approvals land. Germany, UK, France, Italy, and Spain represent the largest demand pools with high awareness of sustainability and organics. Plant based proteins, fibers, and probiotics keep moving into bakery, dairy, and snacks as formulators chase better taste and texture alongside verified benefits.

- The Asia Pacific nutraceutical ingredients market has the fastest growth, combining rising incomes, urban lifestyles, and preventive health adoption. The China market benefits from digital commerce and healthy aging policies, the India market blends Ayurveda heritage with modern formulation; and the Japan market leverages FOSHU and a sophisticated functional food culture to sustain premium pricing. Expect RTDs, probiotics, and beauty nutrition to scale quickly in urban hubs, with local botanicals playing larger roles in region specific SKUs.

Nutraceutical Ingredients Market Share

Market concentration remains moderate. The top five players ICL Group, ADM, DSM Firmenich, Cargill Inc, Tate & Lyle held around 24% share in 2025, with ICL Group leading at roughly 5.1%. That diffusion reflects multiple ingredient classes, regional specializations, and a long tail of botanicals and specialty inputs. Scale matters, but so does speed especially in categories where delivery innovation and clinical evidence move markets quickly.

- BASF SE

- Broad nutrition and health portfolio across vitamins (A, B complex, C, D, E, K), carotenoids, omega 3s, and specialties, global production and pharma grade quality systems; vitamin A/E production restored in Oct 2025 following 2024–2025 constraints.

- Broad nutrition and health portfolio across vitamins (A, B complex, C, D, E, K), carotenoids, omega 3s, and specialties, global production and pharma grade quality systems; vitamin A/E production restored in Oct 2025 following 2024–2025 constraints.

- ADM

- Plant proteins (pea, soy, wheat), probiotics, fibers, botanical extracts, and specialty carbs; vertical integration from crops to ingredients; active nutrition insights guiding capacity additions in proteins and fermentation.

- Plant proteins (pea, soy, wheat), probiotics, fibers, botanical extracts, and specialty carbs; vertical integration from crops to ingredients; active nutrition insights guiding capacity additions in proteins and fermentation.

- DSM Firmenich

- Vitamins, carotenoids, omega 3s, probiotics, enzymes, and specialties plus flavor/fragrance capabilities; science-based innovation and personalization platforms; 2024 communications noted continued growth in nutrition.

- Vitamins, carotenoids, omega 3s, probiotics, enzymes, and specialties plus flavor/fragrance capabilities; science-based innovation and personalization platforms; 2024 communications noted continued growth in nutrition.

- Cargill Inc

- Diversified portfolio including proteins, fibers, starches, and micronutrition; Nov 2025 micronutrition expansion signaled deeper push into fortification categories.

- Diversified portfolio including proteins, fibers, starches, and micronutrition; Nov 2025 micronutrition expansion signaled deeper push into fortification categories.

- Tate & Lyle

- Specialty fibers, low-calorie sweeteners, and fortification ingredients; strategic pivot toward higher value wellness solutions focused on sugar reduction and fiber enrichment.

- Specialty fibers, low-calorie sweeteners, and fortification ingredients; strategic pivot toward higher value wellness solutions focused on sugar reduction and fiber enrichment.

Nutraceutical Ingredients Market Companies

Major players operating in the nutraceutical ingredients industry are:

- BASF SE

- ADM

- Ingredion

- DSM NV

- Cargill Incorporated

- Tate & Lyle

- Ajinomoto

- Prinova Group

- Roquette Freres

- Arla Food Ingredients

- Dupont Nutrition & Biosciences

- Divis Laboratories

- Barentz

- BI Nutraceuticals

Nutraceutical Ingredients Industry News

- In November 2025, Cargill announced micronutrition expansion via acquisitions and capacity adds, strengthening vitamins, minerals, and specialty inputs for fortification. In expansion will increase production capacity by 50%, which will be helpful for the company to meet growing demand.

- In October 2025, BASF resumed full vitamin A and E production after extended disruptions that began in Aug 2024, easing tightness in fat soluble vitamins.

- In October 2025, Bioiberica launched an extended version of its Nucleoforce product line for animal immune and intestinal health. These blocks are building blocks of DNA and RNA. They are critical for cell replication.

The nutraceutical ingredients market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Product

- Probiotics

- Lactobacilli

- Bifidobacterium

- Bacillus

- Streptococcus

- Saccharomyces (yeast)

- Others

- Prebiotics

- FOS (fructooligosaccharides)

- Inulin

- GOS (galactooligosaccharides)

- MOS (mannanoligosaccharides)

- Others

- Vitamins

- Vitamin A

- Vitamin C

- Vitamin D

- Vitamin E

- Vitamin K

- Vitamin B-complex (B1, B2, B6, B12, Biotin, Folic Acid, Niacin)

- Amino acids

- Lysine

- Methionine

- Threonine

- Tryptophan

- Carotenoids

- Beta-carotene

- Lutein

- Astaxanthin

- Canthaxanthin

- Lycopene

- Others

- Phytochemicals & plant extracts

- Phytosterols

- Flavonoids

- Polyphenols

- Others

- Protein

- Plant proteins

- Wheat protein

- Soy protein concentrates (SPC)

- Soy protein isolates (SPI)

- Textured soy protein

- Pea protein

- Canola protein

- Others

- Animal proteins

- Egg protein

- Milk protein concentrates/isolates

- Whey protein concentrates (WPC 80, WPC 35)

- Whey protein hydrolysates (WPH)

- Whey protein isolates (WPI)

- Gelatin

- Casein/caseinates

- Plant proteins

- EPA/DHA (omega-3 fatty acids)

- Anchovy/sardine

- Algae oil

- Tuna oil

- Cod liver oil

- Salmon oil

- Krill oil

- Menhaden oil

- Minerals

- Fiber & carbohydrates

- Cereals & grains

- Fruits & vegetables

- Others

Market, By Application

- Functional food

- Fortified dairy products

- Fortified juices

- Functional bakery

- Fortified cereals

- Functional beverages

- Sports drinks

- Energy drinks

- Fortified water

- Beauty drinks

- Dietary supplements

- Capsules

- Tablets

- Powders

- Gummies

- Softgels

- Liquids

- Personal care & cosmeceuticals

- Nutricosmetics (oral beauty supplements)

- Topical formulations

- Animal nutrition

- Companion animals

- Livestock

- Aquaculture

- Clinical nutrition

- Medical foods

- Therapeutic nutrition

- Infant formula

- Geriatric nutrition

- Others

Market, By Form

- Dry form

- Powders

- Capsules

- Tablets

- Gummies & chewables

- Beadlets & microbeads

- Crystals

- Liquid form

- Solutions & syrups

- Softgels

- Emulsions & suspensions

- Liposomal formulations

- Semi-solid form

- Lozenges

- Oral pouches

Market, By End Use Industry

- Pharmaceutical industry

- Clinical nutrition

- Medical foods

- Therapeutic supplements

- Food & beverage industry

- Functional food manufacturers

- Beverage fortification

- Sports & fitness industry

- Cosmetics & personal care industry

- Animal feed industry

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

What is the growth outlook for the U.S. nutraceutical ingredients sector?

The U.S. market was valued at USD 30.6 billion in 2025 and is set to surpass USD 63.3 billion by 2035. The market is propelled by clinical marketing, healthcare professional endorsements, and premium brand equity.

What was the market share of dietary supplements in 2025?

Dietary supplements represented about 35% of the market in 2025, reflecting the demand for precise dosing and multi-ingredient stacks for targeted health outcomes.

What is the expected size of the nutraceutical ingredients industry in 2026?

The market size is expected to reach USD 105.8 billion in 2026.

What was the market share of probiotics in the market in 2025?

Probiotics accounted for approximately 18% of the nutraceutical ingredients market in 2025, led by advancements in microbiome science and digestive wellness trends.

What are the key trends in the nutraceutical ingredients market?

Key trends include growth in plant-based and organic ingredients, AI-driven personalized nutrition, rising demand for gummies and liquid shots, and improved microencapsulation for stability and controlled release.

Who are the major players in the nutraceutical ingredients industry?

Key players include BASF SE, ADM, Ingredion, DSM NV, Cargill Incorporated, Tate & Lyle, Ajinomoto, Prinova Group, Roquette Freres, and Arla Food Ingredients.

What is the projected value of the nutraceutical ingredients market by 2035?

The market is poised to reach USD 203.2 billion by 2035, supported by personalization trends and clinically substantiated claims.

What was the market size of the nutraceutical ingredients in 2025?

The market was valued at USD 98.5 billion in 2025, growing at a CAGR of 7.5% from 2026 to 2035, driven by the increasing adoption of functional foods and ready-to-drink formats.

Nutraceutical Ingredients Market Scope

Related Reports