Summary

Table of Content

North America Dental Implants and Abutment Systems Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

North America Dental Implants and Abutment Systems Market Size

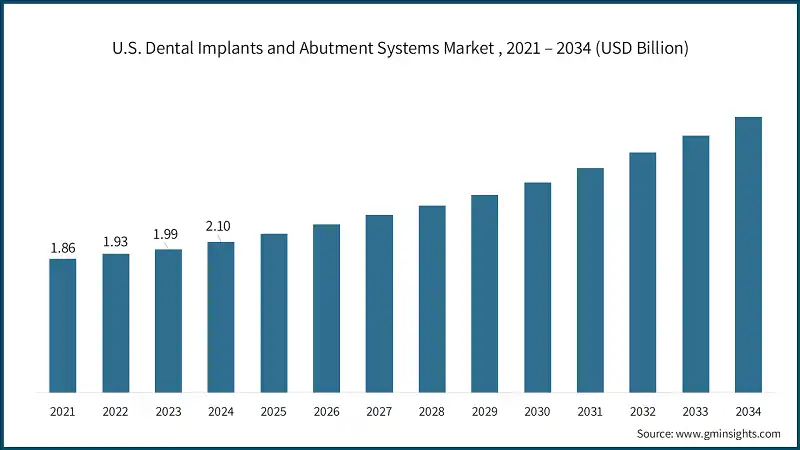

The North America dental implants and abutment systems market was valued at USD 2.3 billion in 2024 and is projected to grow from USD 2.4 billion in 2025 to USD 4.2 billion by 2034, expanding at a CAGR of 6.3%, according to the latest report published by Global Market Insights Inc.

To get key market trends

The market growth is significantly driven by the robust dental insurance adoption rates, growing prevalence of dental disorders, rising demand for cosmetic dentistry, and advancements in implant technologies.

Some of the industry's key players are Institut Straumann, Envista Holdings Corporation, Dentsply Sirona, Henry Schein, and ZimVie. A number of leading players in the North America dental implants and abutment systems markets are focusing on innovation and investment in developing solutions that are precise, durable, and relevant for the patients. These companies are redefining the treatment planning process and clinical applicability through digital technologies such as advanced dental imaging, CAD/CAM systems, and 3D modeling. In addition, many are utilizing minimally invasive surgical techniques and regenerative biomaterials to enhance clinical outcomes and increase efficiency in practice across the region.

The market increased from USD 2 billion in 2021 to USD 2.2 billion in 2023. The rising demand for cosmetic dentistry is significantly propelling the growth of the North America dental implants and abutment systems market. Cosmetic procedures such as tooth reshaping, gum contouring, and orthodontics are becoming increasingly popular as individuals seek to enhance their smiles and overall facial aesthetics. American Association of Orthodontists (AAO) recorded 6.66 million individuals undergoing active orthodontic care across the U.S. and Canada in 2024, including 1.91 million adult patients in the U.S., a significant increase from 1.64 million in 2022. This upward trend in aesthetic-focused dental care is fueling the need for advanced support technologies such as dental implants and abutment systems.

The increasing prevalence of dental disorders across North America is a key factor driving growth in the dental implants and abutment systems market. In 2019, the prevalence of oral diseases in the U.S., as reported by the World Health Organization (WHO), highlighted significant public health concerns. Among children aged 1 to 9, 42.6% had untreated caries in their deciduous teeth, while 24.3% of individuals aged 5 and older experienced untreated caries in their permanent teeth. Severe periodontal disease affected 15.7% of people aged 15 and above, and 10.2% of adults aged 20 and older suffered from edentulism, or complete tooth loss. These figures highlight a substantial and growing need for durable, effective, and accessible restorative solutions positioning dental implants and abutment systems as essential components of modern oral healthcare delivery in the region.

Additionally, robust adoption of dental insurance across North America is a significant factor fueling growth in the dental implants and abutment systems market. According to data from the American Dental Association (ADA), 61% of U.S. adults are covered by private dental insurance, while 38% of children benefit from public dental programs such as Medicaid and CHIP. Notably, only 9% of children were uninsured for dental care as of 2021, reflecting strong coverage across key age groups.

Dental implants and abutment systems are parts that are used in restorative dentistry to replace missing teeth and restore oral function and aesthetic appearance. A dental implant is an artificial tooth root, usually made from either titanium or zirconia, that is surgically placed in the jawbone to hold a dental prosthesis, such as a crown, bridge, or denture. The abutment is a connector placed on top of the implant that connects the tooth to the implant. Implants and abutment systems provide a long-term, stable, and natural-looking solution to tooth loss that is commonly used in both functional and esthetic dental treatment.

North America Dental Implants and Abutment Systems Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.3 Billion |

| Market Size in 2025 | USD 2.4 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.3% |

| Market Size in 2034 | USD 4.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Robust dental insurance adoption rates | Supports wider access to implant procedures, increasing patient volume and reducing out-of-pocket barriers. |

| Growing prevalence of dental disorders | Fuels demand for dental implants due to rising cases of tooth loss, periodontal disease, and oral trauma. |

| Rising demand for cosmetic dentistry | Boosts interest in esthetic implant solutions and custom abutments for natural-looking restorations. |

| Advancements in implant technologies | Improves treatment outcomes and expands clinical indications, encouraging adoption among general practitioners. |

| Pitfalls & Challenges | Impact |

| Regulatory compliance challenges | Slows product approvals and market entry for new technologies, especially for smaller or international manufacturers. |

| High cost of dental implant treatment | Limits accessibility for uninsured or underinsured populations, particularly in rural and low-income areas. |

| Opportunities: | Impact |

| Shift towards minimally invasive procedures | Drives demand for narrow-diameter implants, flapless surgery kits, and digital planning tools that reduce recovery time. |

| Expansion of dental tourism | Encourages competitive pricing and innovation among North American providers to retain domestic patients. |

| Market Leaders (2024) | |

| Market Leaders |

35% market share |

| Top Players |

Collective market share in 2024 is 85% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | U.S. |

| Fastest Growing Market | Canada |

| Future outlook |

|

What are the growth opportunities in this market?

North America Dental Implants and Abutment Systems Market Trends

- The North America dental implants and abutment systems industry is changing rapidly due to advancements in implant technologies.

- Robot-assisted implant placement is revolutionizing dental surgery in North America by enhancing precision, safety, and clinical outcomes. This technology utilizes robotic systems to assist clinicians during implant procedures, offering real-time feedback and guidance. One of the most notable advancements in this space is Yomi by Neocis, the first and only FDA-cleared robotic system for dental implant surgery. Yomi provides haptic feedback, real-time navigation, and digital planning tools, allowing for minimally invasive procedures with improved accuracy and reduced risk of complications.

- Similarly, the Straumann BLX and TLX implant systems are designed for full digital integration, having real-time planning, guided surgery, and immediate loading protocols. These technologies not only provide increased clinical accuracy and efficiency, but also improve patient outcomes overall, and are important growth pulls within the North American dental implants and abutment systems market.

- Enhanced surface technologies have changed the way implants integrate with bone. Processes such as nano-texturing, plasma spraying, and hydrophilic coatings speed osseointegration, heal time, and implant stability. These surfaces optimize the biological response and long-term success of implants.

- Overall, these technologies hasten to implant recovery, establish more predictable outcomes and customize treatment, thereby expanding the adoption of dental implants and abutment systems across North America.

North America Dental Implants and Abutment Systems Market Analysis

Learn more about the key segments shaping this market

The North America dental implants and abutment systems industry was valued at USD 2 billion in 2021. The market size reached USD 2.2 billion in 2023, from USD 2.1 billion in 2022.

Based on products, the market is segmented into dental implants and abutment systems. The abutment systems segment was valued at USD 338 million in 2024, accounting for the market share of 14.7%.

- Abutment systems are important parts of dental implantology. They serve as the connection between the fixture of the implant and prosthetic restoration. The systems maintain proper alignment, stability, and aesthetics of the dental restorative prosthesis. They are available in various materials such as titanium, zirconia, and hybrid combinations to suit clinical and cosmetic needs.

- The demand for abutment systems is rising in North America due to the increasing adoption of dental implants, growing awareness of oral health, and the shift toward customized and patient-specific solutions. Innovations in CAD/CAM technology and digital workflows have enabled precise fabrication of abutments, improving fit, function, and long-term outcomes.

- For example, the Straumann Variobase Abutments allow for versatile and flexible prosthetic options for both titanium and ceramic restorations. The Dentsply Sirona Atlantis Abutments use patient-specific digital impressions during design to allow a proper emergence profile and soft tissue management. They allow for screw or cement retention of the restoration providing for more clinical versatility of the system.

- The integration of digital dentistry, along with advancements in surface treatments has significantly improved the biomechanical performance and esthetic outcomes of abutment systems, further fueling the market growth.

Based on the material, the North America dental implants and abutment systems market is segmented into titanium, zirconium, and other materials. The zirconium segment accounted for the market share of 24.3% in 2024.

- Zirconium, primarily used in the form of zirconia (zirconium dioxide), is a high-strength ceramic material valued for its biocompatibility and natural tooth-like appearance. In dental implants and abutment systems, zirconia offers a metal-free alternative that supports both functional and aesthetic outcomes, especially in anterior restorations.

- Zirconia is highly resistant to corrosion, has low thermal conductivity, and maintains its strength even under high loads. This makes it well-suited for patients with metal allergies, those with a thin gingival biotype, and those who might otherwise be concerned about metal components. The ongoing conversion to digital workflows with CAD/CAM technology opens the door to potentially precise custom-designed zirconia implant abutments that promote new approaches to soft tissue integration and improved fit for the final prosthesis.

- BioHorizons Hybrid Zirconia Abutments, offered through Vulcan Custom Dental, combine zirconia’s esthetics with a titanium base for secure implant connections. These hybrid abutments are designed for screw-retained restorations and provide natural translucency and strength, making them ideal for anterior zones.

- As patient preferences shift toward metal-free and highly aesthetic solutions, zirconia continues to gain traction in the market. Its integration with digital design platforms and compatibility with advanced prosthetic systems is further increasing demand in North America dental implants and abutment systems market.

Learn more about the key segments shaping this market

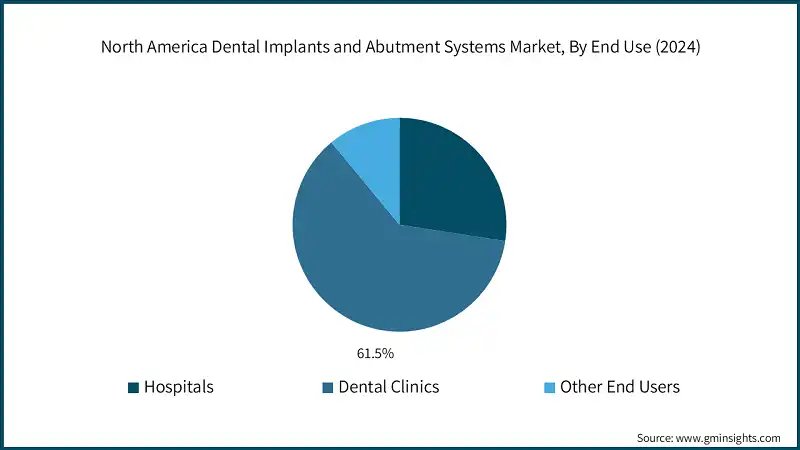

Based on the end use, the market is segmented into hospitals, dental clinics, and other end users. The hospitals segment accounted for the market share of 27.4% in 2024.

- Hospitals are increasingly managing a higher volume of patients requiring complex dental implant procedures, such as bone grafting, full-mouth reconstructions, and treatment for chronic dental conditions.

- Their ability to handle both scheduled and emergency implant cases positions them as a significant contributor to the overall number of procedures performed, thereby driving market growth.

- In addition, hospitals in North America have high patient turnover owing to referrals from family doctors and dental practitioners, which in turn boosts the demand for the implants in these settings, propelling the growth of the segment.

Looking for region specific data?

U.S. dominated the North America dental implants and abutment systems market with USD 2.1 billion in 2024 and is expected to reach USD 3.8 billion by 2034.

- The U.S. market is experiencing steady growth, largely driven by the rising prevalence of dental disorders across the country and availability of high skilled dental professionals. According to CDC, between 2020 and 2022, the U.S. recorded an average of 1.94 million emergency department visits annually for tooth-related disorders, with the highest incidence among adults aged 25–34. These figures highlight the unmet need for timely and effective dental care, particularly restorative solutions such as implants.

- The availability of highly skilled dental professionals with specialization in implantology significantly contributing to the market growth in the country.

- For instance, in 2022, the American Dental Association reported around 200,000 licensed dentists in the U.S., with specialization in implantology.

- In addition, ongoing technological advancements in implantology, coupled with improvements in dental education across the country, are further contributing to the expansion of the market.

Canada dental implants and abutment systems market accounted for USD 202.3 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- The Canada market is witnessing steady growth, fuelled by key factors such as expanding dental insurance coverage and the increasing prevalence of dental disorders.

- According to the 2023–2024 Canadian Oral Health Survey (COHS), 63.5% of Canada population aged 12 and older had dental insurance, with 61.6% covered by private plans and only 3.0% by public plans. Notably, 80.8% of insured individuals visited an oral health professional in the past year, compared to just 56.0% of those without insurance.

- Additionally, 72.3% of Canada population reported a dental visit in the past year, an increase from 65.4% in 2022, indicating a rebound in oral healthcare engagement post-pandemic. With the Canadian Dental Association recommending biannual visits tailored to individual needs, the growing awareness and frequency of dental consultations are expected to further drive the adoption of advanced implant systems.

- Together, these trends underscore a favourable environment for market expansion, as improved access and rising oral health needs converge to boost demand for dental implant solutions across Canada.

North America Dental Implants and Abutment Systems Market Share

- The top 5 players, such as Institut Straumann, Envista Holdings Corporation, Dentsply Sirona, Henry Schein, and ZimVie, collectively held 85% of the total market share.

- Digital transformation is reshaping the dental implant ecosystem in North America. Companies are integrating AI-powered planning tools, intraoral scanners, and CAD/CAM workflows to enhance precision, reduce chair time, and improve patient outcomes. These technologies are becoming standard in both premium and value-based implant offerings.

- Material innovation is driving product differentiation. While titanium remains dominant, zirconia implants are gaining traction due to their aesthetic appeal and suitability for patients with metal sensitivities. Manufacturers are also exploring biomimetic bone graft substitutes to improve osseointegration and healing.

- Strategic partnerships with Dental Service Organizations (DSOs) and academic institutions help manufacturers expand their reach and standardize implant procedures across clinics. Training programs and continuing education initiatives are also boosting adoption among general practitioners.

- Companies like Straumann, Envista, and Dentsply Sirona are focusing on portfolio diversification, offering both premium and value-based solutions to cater to a broader demographic. Meanwhile, Osstem Implant and ZimVie are strengthening their presence in outpatient and community clinics through cost-effective systems and educational outreach.

- As consumer awareness of oral health rises, the market is expected to see increased demand for preventive and restorative solutions, with implants becoming a preferred choice over traditional dentures due to their durability, functionality, and aesthetic benefits.

North America Dental Implants and Abutment Systems Market Companies

Few of the prominent players operating in the North America dental implants and abutment systems industry include:

- A.B. Dental Devices

- Adin Dental Implant Systems

- Bicon

- BioHorizons

- BioThread Dental Implant Systems

- Cortex

- Dentium USA

- Dentsply Sirona

- Dynamic Abutment Solutions

- Envista Holdings Corporation

- Glidewell

- Henry Schein

- Institut Straumann

- Keystone Dental Group

- National Dentex Labs

- Osstem Implant

- ZimVie

- Dentsply Sirona

Dentsply Sirona stands out in the North America dental implants and abutment systems market for its integration of digital innovation with clinical precision. Its key strength lies in offering a fully connected digital workflow from diagnostics and implant planning to surgery and restoration. A notable example is the Astra Tech Implant System, which incorporates a conical connection and advanced surface technology to support bone preservation and long-term stability. When paired with tools like CEREC for chairside restorations, Dentsply Sirona enables clinicians to deliver efficient and predictable implant treatments.

Envista Holdings Corporation brings together several leading dental brands to offer a broad spectrum of implant solutions tailored to diverse clinical and economic needs. Its unique value lies in serving both premium and value segments through a unified digital ecosystem that enhances precision and workflow efficiency. The Nobel Biocare N1 implant system exemplifies this approach, featuring a biologically inspired design and digitally integrated workflow that simplifies surgery and improves patient outcomes. Envista also invests heavily in clinician education, ensuring users are well-equipped to maximize treatment success.

Institut Straumann maintains a robust presence in North America through its subsidiaries and strategic partnerships. Known for its commitment to research and innovation, Straumann’s BLX implant system is widely used across the region for immediate placement and high primary stability, even in challenging bone conditions. The company’s North American operations also include digital dentistry solutions and regenerative biomaterials, allowing clinicians to offer personalized, esthetic, and durable outcomes. Straumann’s training centers and educational programs further support its leadership in the U.S. and Canada markets.

North America Dental Implants and Abutment Systems Market News:

- In February 2025, Dentsply Sirona officially launched its latest innovation, the MIS LYNX Implant System, in the U.S. The system featured sterile single-use drills and a wet implant surface, aimed at enhancing procedural hygiene and promoting superior osseointegration. Designed as an all-in-one solution, it supported immediate implant placement and catered to a wide range of clinical scenarios, streamlining workflows for dental professionals. This launch reflected Dentsply Sirona’s commitment to delivering high-performance, patient-centric solutions and was expected to strengthen its position in the North American dental implant market.

The North America dental implants and abutment systems market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 – 2034 for the following segments:

Market, By Product

- Dental implants

- Tapered implants

- Parallel-walled implants

- Abutment systems

- Stock abutments

- Custom abutments

- Abutments fixation screws

Market, By Material

- Titanium

- Zirconium

- Other materials

Market, By End Use

- Hospitals

- Dental Clinics

- Other end use

The above information is provided for the following countries:

- U.S.

- Canada

Frequently Asked Question(FAQ) :

What is the current North America dental implants and abutment systems market size in 2025?

The market size is projected to reach USD 2.4 billion in 2025.

How much revenue did the abutment systems segment generate in 2024?

Abutment systems generated USD 338 million in 2024, accounting for 14.7% market share.

What was the valuation of zirconium segment in 2024?

Zirconium segment held 24.3% market share in 2024, led by demand for metal-free alternatives and aesthetic solutions.

What is the projected value of the North America dental implants and abutment systems market by 2034?

The North America dental implants and abutment systems market is expected to reach USD 4.2 billion by 2034, propelled by advancements in implant technologies, digital workflows, and increasing prevalence of dental disorders.

What is the market size of the North America dental implants and abutment systems in 2024?

The market size was USD 2.3 billion in 2024, with a CAGR of 6.3% expected through 2034 driven by rising dental disorders, cosmetic dentistry demand, and robust dental insurance adoption rates.

What is the growth outlook for hospitals segment from 2025 to 2034?

Hospitals segment accounted for 27.4% market share in 2024, supported by complex dental implant procedures, bone grafting, and full-mouth reconstructions.

Which country leads the North America dental implants and abutment systems market?

U.S. held the largest market share with USD 2.1 billion in 2024 and is expected to reach USD 3.8 billion by 2034, driven by high skilled dental professionals and advanced implantology technologies.

What are the upcoming trends in the North America dental implants and abutment systems market?

Key trends include adoption of robot-assisted implant placement (Yomi by Neocis), AI-powered diagnostics, CAD/CAM-based abutment customization, enhanced surface technologies, and digital integration for improved precision and outcomes.

Who are the key players in the North America dental implants and abutment systems market?

Key players include Institut Straumann, Envista Holdings Corporation, Dentsply Sirona, Henry Schein, ZimVie, A.B. Dental Devices, Adin Dental Implant Systems, Bicon, BioHorizons, BioThread Dental Implant Systems, Cortex, Dentium USA, Dynamic Abutment Solutions, Glidewell, Keystone Dental Group, National Dentex Labs, and Osstem Implant.

North America Dental Implants and Abutment Systems Market Scope

Related Reports