Summary

Table of Content

Light Car Trailer Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Light Car Trailer Market Size

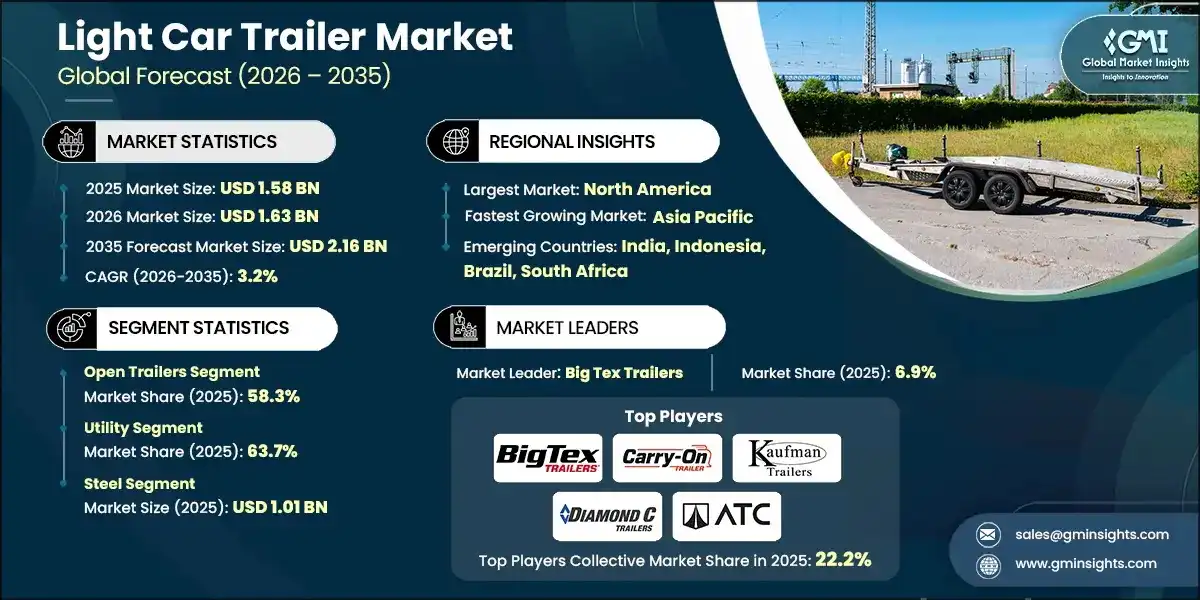

The global light car trailer market size was valued at USD 1.58 billion in 2025. The market is expected to grow from USD 1.63 billion in 2026 to USD 2.16 billion in 2035 at a CAGR of 3.2%, according to latest report published by Global Market Insights Inc.

To get key market trends

The market is experiencing growth mainly due to the expansion of logistics and intra-city delivery services around the world. Growth in small businesses and self-employed work has encouraged the use of light trailers for cost-effective goods transport.

For instance, in December 2025, Featherlite announced the expansion of its trailer lineup and continued its innovation with the launch of the new Model 4414 stacker trailer. The Featherlite Model 4414 stacker trailer builds on the Model 4410’s design and has an exterior smooth rivetless side sheet design, while adding an internal lift and more standard features into the stacker.

A few years back, the light car trailers specifically that are designed enclosed were a part of recreational activities in coastal and mountain areas. They were mainly used by travelers, campers, and adventure enthusiasts to transport sports equipment, camping gear, and personal belongings safely over long distances. These trailers offered protection from weather conditions such as rain, dust, and snow, making them suitable for rugged terrains.

Over time, their reliability, convenience, and secure storage features increased awareness and adoption beyond leisure use, gradually expanding their application into commercial and everyday transportation needs.

Geographically, the North America region is the leading one as it consists of a combination of lifestyle, infrastructure, and consumer preferences. Additionally, the region has a powerful outdoor recreation culture, consisting of camping, boating, and road trips, which leads to a demand for trailers to safely carry the equipment. The countries in the region with excellent road networks, high passenger vehicle ownership, and a preference for durable, easy-to-use, and enclosed trailer designs are also factors that support the market growth and make North America the most mature and largest market worldwide.

Light Car Trailer Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.58 Billion |

| Market Size in 2026 | USD 1.63 Billion |

| Forecast Period 2026-2035 CAGR | 3.2% |

| Market Size in 2035 | USD 2.16 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for recreational vehicles and travel trailers | This increases overall market sales as more consumers seek mobility and leisure solutions, boosting production, sales, and aftermarket services for light car trailers. |

| Growth in outdoor and adventure tourism | Growth in outdoor and adventure tourism |

| Increasing disposable income and lifestyle upgrades | Allows consumers to invest in recreational products, increasing purchases of premium and feature-rich light car trailers. |

| Expansion of E-commerce and last-mile delivery solutions | Growth in e-commerce enhances demand for trailers in logistics and delivery, boosting commercial adoption and supporting fleet expansions. |

| Pitfalls & Challenges | Impact |

| High initial investment and purchase cost | Expensive trailers limit adoption among cost-sensitive consumers and small businesses, slowing market growth in certain regions. |

| Limited road infrastructure in emerging markets | Limited road infrastructure in emerging markets |

| Opportunities: | Impact |

| Expansion in emerging markets | Entering new markets creates growth potential and allows manufacturers to capture untapped demand for light car trailers. |

| Growth of sustainable and lightweight trailer materials | Innovations in materials enhance fuel efficiency and attract environmentally conscious buyers, expanding market acceptance. |

| Expansion in tourism and outdoor recreational segments | Increasing tourism activities and adventure trends boost demand for trailers, encouraging new product development and niche market targeting. |

| Rising popularity of customizable and modular trailers | Customization options attract a broader consumer base, increase sales potential, and provide opportunities for premium offerings and differentiated products. |

| Market Leaders (2025) | |

| Market Leaders |

6.9% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Indonesia, Brazil, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Light Car Trailer Market Trends

A major trend among trailer manufacturers is emerging worldwide of using light materials such as aluminum, composites and lightweight steel in the manufacturing of car trailers. Consumers are highly conscious of fuel efficiency, thus, manufacturers are shifting towards lightweight materials.

Also, demand for trailers made of sustainable materials is increasing in areas where moisture dramatically increases corrosion (rust). Using sustainable materials for light car trailers will emerge as a potential growth opportunity that is currently a white space opportunity.

Applications of light car trailers are expanding in the commercial domain because many logistics companies are expanding their presence nearby to reach. These car trailers have made it easy for these companies to hire or utilize them for transporting goods despite using a big-sized truck. Overall, the growth of the market seems very fast in the commercial domain.

For instance, in February 2024, Featherlite Trailers announced a partnership with Superior Trailer Solutions, making them the newest Featherlite Authorized Transporter Service Center. Superior Trailer Solutions will be at the Daytona 500, along with the Featherlite NASCAR service trailer, to improve Featherlite’s trackside support for specialty transporters.

Moreover, these trailers were holding a major share in recreational applications. In regions with higher disposable income and recreational enthusiasts, the light car trailer market was in a very mature phase instead of commercial applications. But nowadays, these trailers are used mostly for commercial applications because of the increasing use of light materials, modular designs and expansion of logistics activities.

Expansion into emerging markets like India, Brazil, South Africa, Indonesia and many European countries will create potential opportunities for partnerships and expansion for light car trailer manufacturers. However, mature markets like the U.S. will continue to be a major market for light car trailers.

Light Car Trailer Market Analysis

Learn more about the key segments shaping this market

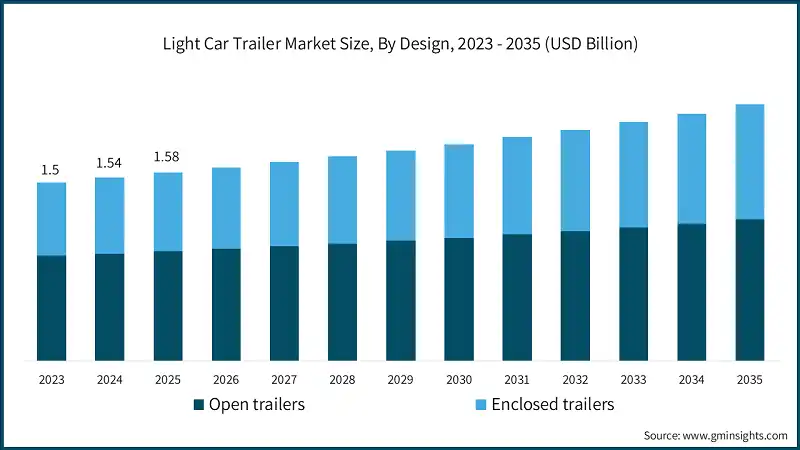

Based on design, the light car trailer market is divided into open trailers and enclosed trailers. The open trailers segment dominated the market with 58.3% share in 2025.

- Open-designed car trailers have shown their major impact in recent years because these types of trailers are now mostly used for commercial applications such as logistics and agriculture. These open-look design trailers provide these sectors with an easy way to transport goods that cannot fit in an enclosed-type trailer.

- Manufacturers expanding their position in the car trailer market are partnering and acquiring major part suppliers. One of the examples related to this is the acquisition of City Spring & Axle Ltd by DexKo Global, a leader in the trailer market. City Spring & Axle Ltd is a renowned supplier of truck & trailer parts and axle and spring manufacturing and also offers services for trucks & trailers.

- However, improved design and architecture of the enclosed-type trailers have fueled their demand within these sectors in recent years and are expected to show the highest demand with a CAGR of 3.9% between the projected period of 2026 and 2035.

Learn more about the key segments shaping this market

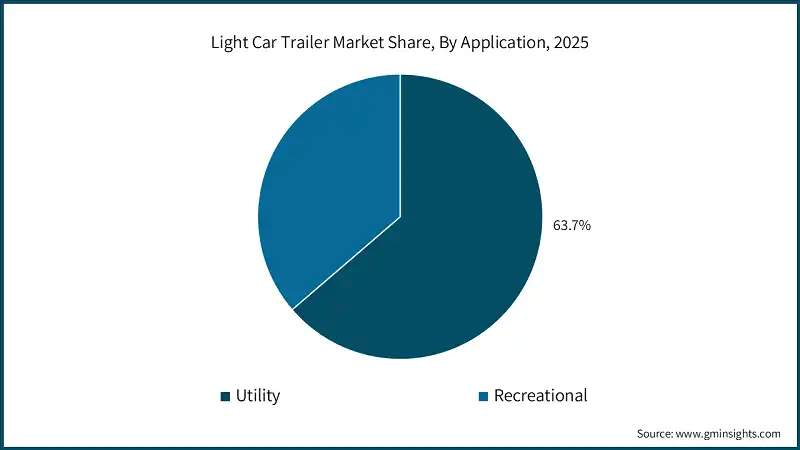

Based on application, the light car trailer market is divided into utility and recreational. The utility segment accounts for 63.7% in 2025 and is expected to reach USD 1.4 billion by 2035.

- Utility light car trailers are very useful and can handle many everyday hauling tasks. People use them to move things like construction materials, landscaping tools, furniture, and goods for small businesses or DIY projects. These trailers work well for both jobs and occasional personal use, making them more practical than trailers made just for recreation.

- They come in different sizes and designs, making it easy to load and unload items. They can carry many types of cargo, which makes them a good option for both personal and business needs. This flexibility makes them more popular than recreational trailers, which usually have fewer uses.

- Since they are used so often in daily work, utility trailers have a bigger share of the market compared to recreational trailers, which are more seasonal or hobby-focused.

- On the other hand, the recreational use of light car trailers, specifically enclosed-design, will also see growth in countries with higher disposable income and travel enthusiasts. Thus, the recreational applications for light car trailers are expected to grow at a CAGR of 2.8% during the projected period of 2026 and 2035.

Based on material, the light car trailer market is divided into steel, aluminum, composite/fiberglass and others. In 2025, the steel segment led the market, reaching a market value of USD 1.01 billion.

- Steel is the most popular material in the light car trailer market because it is strong, durable, and affordable. It can handle heavy loads and tough conditions, which is important for commercial and utility use.

- Steel is also easy to find and cheap to produce because its manufacturing process is well-established. This has made steel trailers a common choice for both personal and business purposes.

- Aluminum trailers are becoming more popular because they are lightweight and naturally resist rust. Since aluminum is lighter than steel, these trailers are easier to tow and improve fuel efficiency. Their rust resistance, even with little maintenance, makes them a good option for areas with moisture or road salt.

- The composite and fiberglass materials segment is expected to grow at the fastest CAGR of 5.9% from 2026 to 2035. These materials are lightweight, rust-resistant, and weatherproof. They are ideal for areas with harsh weather because they resist moisture and rot.

Looking for region specific data?

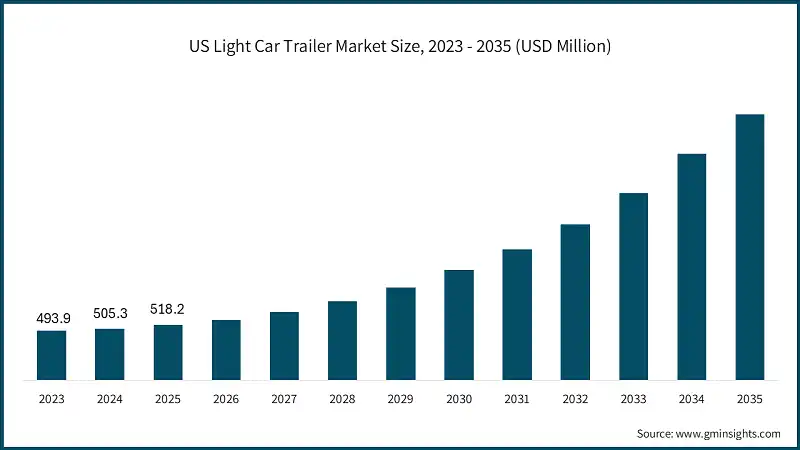

The US light car trailer market reached USD 518.2 million in 2025, growing from USD 505.3 million in 2024.

- The U.S. has been a long-time market leader and a major end user of light car trailers, specifically in recreational activities. In a report by the Outdoor Industry Association, there were more than 180 million Americans who went outside to recreate in 2024.

- This is not just limited to this number, the same report also stated that in 2023, 7.7 million Americans tried one or more outdoor recreation activities for the first time. This huge number of enthusiasts is the indication of how Americans invest and shows their interest in recreational activities.

- On the other side, the use of light car trailers in commercial activities has also increased in the U.S. For a long time, the U.S. has been maintaining its dominant position in the logistics sector. The rapid expansion of e-commerce in the U.S. has boosted demand for flexible, cost-effective local delivery solutions. Thus, small businesses, local services, and independent delivery operators are increasingly utilizing light car trailers for transporting goods and equipment, especially in suburban and rural areas.

The North America region is estimated to reach USD 768.7 million by 2035 and expected to grow at the CAGR of 2.8% between 2026 and 2035.

- The light car trailer market in countries such as the U.S. and Canada is growing steadily due to demand for recreational and utility purposes. In the U.S., high vehicle ownership and a passion for outdoor activities like boating, camping, motorcycling, and off-roading are driving this demand. People use light car trailers to carry gear, personal vehicles, and equipment.

- Also, the rising popularity of recreational vehicles (RVs) and towable gear has increased the need for towing solutions, making North America the largest region in the global market.

- Small businesses and contractors in the U.S. also rely on these trailers to transport tools and materials affordably, supporting both personal and business use. Strong dealership networks, financing options, and good road infrastructure in the region make it easier for people to buy and own trailers.

- In Canada, the market is smaller than in the U.S., but it is growing for similar reasons, like outdoor lifestyles and seasonal needs. Canadians often use trailers to move snowmobiles, boats, and recreational equipment, especially during the long winters when snowmobiling is popular.

The Europe light car trailer market accounted for USD 443.1 million in 2025 and is anticipated to grow at the CAGR of 3.5% between 2026 and 2035.

- The European market is growing because of both personal and business use. Western Europe is leading this growth, with Germany being the biggest market in the region. Germany’s strong car industry, high number of vehicle owners, and advanced logistics systems are driving this demand.

- The UK has a long history of making trailers, especially camping and caravan models. British manufacturers still supply both local and European markets. Even though its growth is slower than France’s, the UK is still important because of its strong dealer networks and how familiar people are with trailers.

- In France, the market is supported by government programs that promote eco-friendly transport and competitive prices from local manufacturers. Across Europe, trends like stricter safety and emissions rules, the use of lightweight and sustainable materials, and the demand for versatile trailer designs are shaping the markets in Germany, the UK, France, and other countries.

Germany's light car trailer market was valued at USD 112.6 million in 2025 and is expected to grow at a CAGR of 2.2% between 2026 and 2035.

- Germany’s market is growing because of country’s strong position in the automotive and logistics industries. The country is one of the biggest producers and users of light car trailers in Europe. Its strong industrial base supports both local sales and exports.

- Well-known manufacturers like Humbaur use Germany’s advanced manufacturing systems and high-quality standards to stay competitive in Europe and around the world.

- In recent years, demand for light car trailers has gone up for several reasons. Utility trailers are popular with small businesses, tradespeople, and farmers for moving goods and materials. This demand is supported by Germany’s large road network and its strong small and medium-sized business (SME) sector.

The Asia Pacific light car trailer market is estimated to reach USD 515 million by 2035, by growing at a CAGR of 4% during the analysis timeframe.

- Urbanization is one of the reasons that drives the market penetration and demand for light car trailers in the region. China is the largest market in Asia Pacific, supported by its large manufacturing base, strong infrastructure, and growing middle class. The country’s big automotive industry is driving demand for both utility and recreational trailers.

- In India, there is an opportunity for the light car trailer market as the country is expanding their transportation infrastructure and a fast-growing logistics ecosystem. The rapid growth of India’s last-mile delivery market is now creating a higher demand for light car trailers. While India’s trailer use per person is lower than China’s, its growth is significant.

- Moreover, countries like Thailand, Malaysia, and Indonesia are seeing steady growth in trailer use, often linked to expanding logistics networks. The booming e-commerce sector in the region is a major driver. As online shopping and last-mile delivery needs increase, businesses are using light trailers to move goods more efficiently.

China is estimated to grow with a CAGR of 4.5% in the projected period between 2026 and 2035, in the Asia Pacific light car trailer market.

- China is home to several manufacturers, ranging from small to large categories. The country’s dominance in the online marketplaces like Made in China and Alibaba are mainly supporting light car trailers to reach users for personal or commercial uses.

- In China, these trailers are being used more often to carry goods, equipment, and recreational items behind passenger vehicles. This trend reflects changes in how people travel and live.

- Also, the trend of buying sustainable and lightweight trailers is increasing where small businesses and individuals are concerned about fuel efficiency. Manufacturers are responding by using lighter materials and better designs, making these trailers suitable for a variety of vehicles, including compact cars and SUVs.

- Despite the growth, the market faces some challenges. Safety and environmental rules for making and using trailers can increase production costs and make it harder for smaller companies to enter the market.

Latin America light car trailer market accounts for USD 110.9 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- The region is holding a smaller share of less than 10% in 2025 in the light car trailer market compared to North America or Europe. The market is growing due to economic growth and rising logistics needs. Brazil and Mexico are the main players in Latin America, contributing a large share to trailer production and use. Mexico has seen strong growth in trailer use over the last decade, which has increased the market’s value even with changes in import volumes.

- In Brazil, the light car trailer market is supported by the country’s big automotive industry and growing interest in recreational vehicles and small-business hauling. With its large population and wide road network, Brazil has a steady demand for utility and multifunctional trailers.

- These trailers are mostly used in agriculture and commercial sectors for local transport and deliveries. Urbanization and better infrastructure also help by connecting production areas with consumer markets. However, Brazil’s market is growing slower than Mexico’s, which is expanding faster because of rising trailer exports.

Brazil is estimated to grow with a CAGR of 1.9% between 2026 and 2035, in the Latin America light car trailer market.

- In December 2025, Amazon plans to double its workforce from 18 to 36 and increase its distribution centers from 150 to 250 in Brazil. Online retail in Brazil is still at 16%, showing there is room for growth. Brazil has now become Amazon's main focus globally. The company is investing over R$ 55 billion to expand its distribution centers, which is expected to boost the light car trailers market.

- At the same time, more people in Brazil are enjoying outdoor activities like road trips, camping, and domestic tourism. This has increased the demand for personal trailers to carry equipment and gear. With more cars on the road and better infrastructure, owning and using light car trailers for daily needs is becoming more common.

The Middle East and Africa accounted for USD 98.8 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- The light car trailer market is growing steadily in the region. In the UAE, these trailers are commonly used for activities like desert trips, camping, and boating, making them popular with both locals and tourists. The country’s role as a transport hub also increases their use in construction and urban logistics.

- In South Africa, laws control trailer size and weight to keep roads safe, which affects how trailers are made and sold. Buyers and sellers must follow these rules. There is demand for both new and used trailers, serving small businesses and people using them for leisure. With better infrastructure being developed, the market in South Africa is expected to grow steadily over time.

UAE to experience substantial growth in the Middle East and Africa light car trailer market in 2025.

- The UAE's light car trailer market is on the rise as the use of trailers for traveling, recreational activities, and transportation become more popular. Demand is increasing again after a slowdown during the pandemic, mainly because of the growing interest in local tourism and outdoor activities.

- For instance, Dubai has set up a new RV route as an initiative to promote desert and mountain camping in December 2025. This is an indication that road trips and camping with trailers are getting more popular. The UAE’s market for leisure trailers is still lower than that of Western countries, but it is slowly drawing attention as people are discovering new ways to experience the beautiful landscapes of the UAE.

- Moreover, the market is heavily influenced by rules and regulations. Trailers need to be registered with the concerned authorities, such as Dubai’s Roads and Transport Authority (RTA) or Abu Dhabi’s Integrated Transport Centre (ITC). Owners are also required to comply with rules, such as weight limits, in order to avoid being fined or having their trailers impounded.

Light Car Trailer Market Share

- The top 7 companies in the light car trailer industry are Big Tex Trailers, Carry-On Trailer, Kaufman Trailers, Diamond C Trailer, ATC Trailers, Sylvansport and Pace American, contributing 24.6% of the market in 2025.

- Big Tex Trailers is a U.S. manufacturer of utility, car hauler, equipment, and specialty trailers, known for steel frame construction and varied GVWR ranges. Its products serve commercial and personal hauling applications with a broad dealer network in North America.

- Carry On Trailer produces a range of cargo, utility, and open trailers with steel and aluminum frame options. Its line emphasizes maneuverability and versatile configurations for hauling lighter payloads and general transport needs.

- Kaufman Trailers offers utility, flatbed, gooseneck, equipment, dump, and car hauler models, including various GVWR capacities and floor types. Its trailers are constructed with welded channel frames and conventional DOT compliant lighting systems.

- Diamond C Trailer manufactures a wide lineup of premium open and equipment trailers, including car haulers, utility trailers, and heavy duty flatbeds. Its products feature steel tube frames and aluminum exterior panels, tailored for secure hauling and protection of transported items.

- ATC Trailers produces allaluminum cargo, sport, commercial, and car hauler trailers. Its trailer frames and bodies are designed for durability and lighter weight, aimed at secure transport of varied cargo types.

- SylvanSport develops lightweight adventure oriented trailers and pop fup camper models designed to haul outdoor gear and provide basic accommodations. Its trailers are engineered for towing behind smaller vehicles and outdoor recreational use.

Light Car Trailer Market Companies

Major players operating in the light car trailer industry are:

- Big Tex Trailers

- Carry-On Trailer

- Kaufman Trailers

- Diamond C Trailer

- ATC Trailers

- Sylvansport

- Pace American

- Featherlite Trailers

- Aluma Trailers

- Futura Trailers

- Big Tex Trailers makes light car trailers with strong steel frames and different axle setups to handle various vehicle weights. Many models include adjustable tie-downs, ramps, and rust-resistant coatings, making them safe and long-lasting for everyday towing.

- Carry-On Trailer designs lightweight steel and aluminum trailers that are easy to tow and handle. They come with fold-down ramps, strong decks, and storage options, making them a good choice for small car transport with low maintenance needs.

- Kaufman Trailers builds light car trailers with steel frames and low decks to make loading vehicles easier. Their trailers include useful features like ramps, stake pockets, and durable flooring, focusing on simple and practical use rather than extra features.

- Diamond C Trailer makes light car trailers with strong steel frames and special suspension for safer towing. Their trailers often have adjustable ramps, heavy-duty tie-downs, and rust-resistant finishes, offering durability and stability for small vehicle transport.

- ATC Trailers uses all-aluminum construction for their light car trailers, making them lighter but still strong. Their designs resist rust and are easy to tow, with simple ramps and tie-downs for standard small vehicles.

- Sylvansport makes lightweight car trailers with simple and practical designs. They include basic tie-downs and easy-to-use ramps, making them a good option for people who need a low-maintenance trailer for occasional vehicle transport.

- Pace American offers both enclosed and open light car trailers. Their trailers often have strong floors and secure tie-down points, making them safe and reliable for transporting cars of different sizes and loading styles.

Light Car Trailer Industry News

- In May 2025, U-Haul launched a new Toy Hauler to help move cars and trucks. The 16-foot trailer can carry up to 6,800 pounds and connects to a 2-inch hitch ball. It is designed to transport motorcycles, ATVs, and even large SUVs like the Chevy Suburban and Cadillac Escalade.

- In October 2024, Ifor Williams Trailers introduced the Hbeco Horsebox. It is based on the HB/HBX506 dimensions and can carry two horses up to 16.2hh. The new model has a sleek design and a deeper GRP roof moulding, similar to the HBE.

- In March 2024, DexKo Global, a leader in trailer components, announced it had acquired City Spring & Axle Ltd. through its subsidiary, Dexter Axle Company LLC. City Spring & Axle Ltd. distributes truck and trailer parts, manufactures axles and springs, and provides services for trucks and trailers.

- In February 2024, DexKo Global’s AL-KO Vehicle Technology division completed its purchase of Toptron Elektronik. Toptron specializes in creating and selling custom electronic parts for caravans and motorhomes.

The light car trailer market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) and volume (units) from 2022 to 2035, for the following segments:

Market, By Design

- Open trailers

- Flatbed trailers

- Ramped trailers

- Dump-trailers

- Enclosed trailers

- Box Trailers

- Specialty enclosed trailers

Market, By Axle

- Single Axle

- Multi-Axle

- Tandem (Double)

- Triple (Tri-Axle)

Market, By Material

- Steel

- Aluminum

- Composite/Fiberglass

- Others

Market, By Payload

- Up to 750 kg

- 751 kg - 2,000 kg

- 2,001 kg - 3,500 kg

Market, By Application

- Utility

- Trade & Construction

- Agriculture

- Logistics/Parcel

- Others

- Recreational

Market, By End Use

- Fleet-Owned

- Private/Individual

- Leased/Rental

Market, By Sales Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Benelux

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Singapore

- Malaysia

- Indonesia

- Vietnam

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the light car trailer industry?

Key players include Big Tex Trailers, Carry-On Trailer, Kaufman Trailers, Diamond C Trailer, ATC Trailers, Sylvansports, Pace American, Featherlite Trailers, and Aluma Trailers.

What are the upcoming trends in the light car trailer market?

Key trends include lightweight aluminum and composite materials, increased use of sustainable corrosion-resistant materials, and growing adoption of modular designs for diverse commercial needs.

What was the valuation of the utility segment in 2025?

The utility segment accounted for 63.7% of the market in 2025 and is set to cross USD 1.4 billion by 2035.

What was the valuation of the steel segment in 2025?

The steel segment led the market with a valuation of USD 1.01 billion in 2025, owing to its strength, durability, and cost-effectiveness.

Which region leads the light car trailer sector?

The U.S. leads the market, with the market in the country valued at USD 518.2 million in 2025.

How much revenue did the open trailers segment generate in 2025?

The open trailers segment dominated the market with a 58.3% share in 2025, led by its widespread use in commercial applications such as logistics and agriculture.

What is the expected size of the light car trailer industry in 2026?

The market size is projected to reach USD 1.63 billion in 2026.

What was the market size of the light car trailer in 2025?

The market size was valued at USD 1.58 billion in 2025, with a CAGR of 3.2% expected through 2035. The growth is driven by the expansion of logistics and intra-city delivery services, along with the rise of small businesses and self-employment.

What is the projected value of the light car trailer market by 2035?

The market is poised to reach USD 2.16 billion by 2035, fueled by the adoption of lightweight materials, modular designs, and the increasing demand for cost-effective goods transport.

Light Car Trailer Market Scope

Related Reports