Download free PDF

LiDAR in Mapping Market Size - By Platform, By Ranging Principle, By Scanning Architecture, By Component, By Application, Growth Forecast, 2026-2035

Report ID: GMI4461

|

Published Date: February 2026

|

Report Format: PDF

Download Free PDF

Authors: Suraj Gujar, Ankita Chavan

Immediate Delivery Available

Premium Report Details

Base Year: 2025

Companies covered: 14

Tables & Figures: 365

Countries covered: 19

Pages: 180

Download Free PDF

LiDAR in Mapping Market

Get a free sample of this report

Get a free sample of this report LiDAR in Mapping Market

Is your requirement urgent? Please give us your business email

for a speedy delivery!

LiDAR in Mapping Market Size

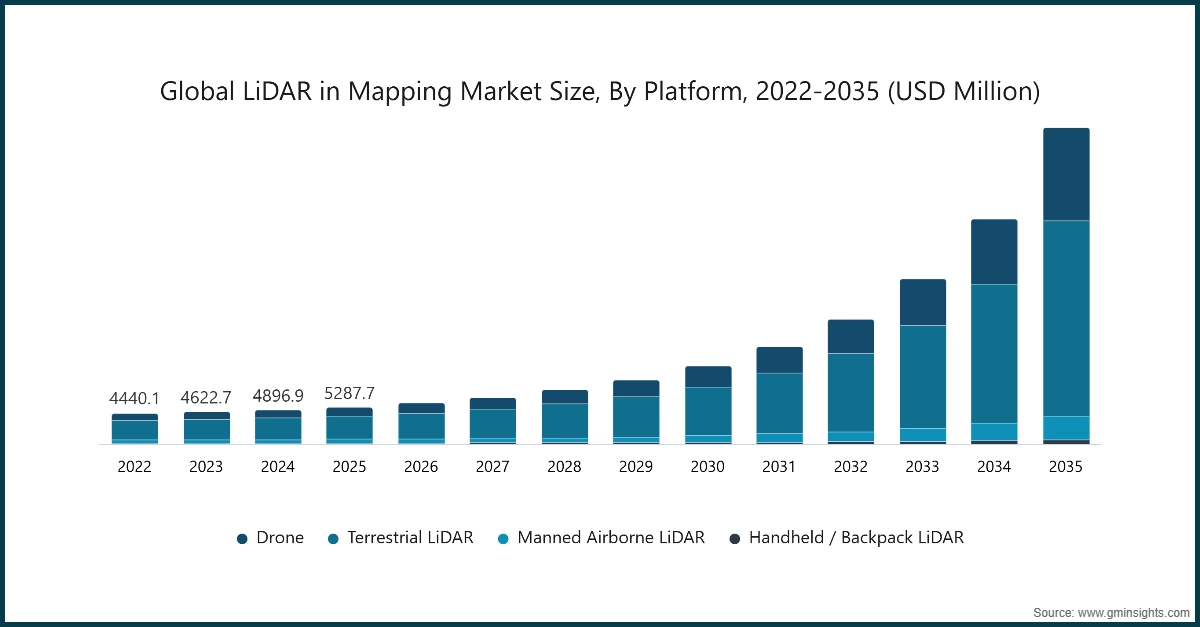

The global LiDAR in mapping market was valued at USD 5.3 billion in 2025. The market is expected to grow from USD 5.9 billion in 2026 to USD 45.8 billion in 2035, at a CAGR of 25.6% during the forecast period according to the latest report published by Global Market Insights Inc.

The market for LiDAR in mappings is expanding, owing to the growth driven by rising LiDAR’s integration with AI, GIS, and emerging digital twin platforms is transforming mapping workflows by enabling real‑time spatial analytics and automated feature extraction.

In context to smart city planners around the world, around 21% of urban planners and municipal authorities globally use LiDAR‑driven spatial data within smart infrastructure models for utilities and traffic analysis, enhancing decision‑making and operational efficiency. For instance, AI‑enhanced point‑cloud classification and predictive modeling are reducing manual processing bottlenecks of LiDAR or 3D spatial data, while digital twins built on LiDAR data support continuous asset management across infrastructure, utilities, and construction sectors in regions such as North America, Europe, and APAC. This convergence accelerates deployment of intelligent mapping solutions across various industries.

Moreover, the rise of subscription and mapping‑as‑a‑service (MaaS) offerings are making LiDAR mapping accessible to a broader range of users by removing upfront hardware costs. Cloud‑based platforms enable collaborative project management and real‑time data sharing across distributed teams, supporting geospatial workflows from capture to delivery.

The model is increasingly being adopted in North America and Europe, where small to mid‑sized enterprises leverage scalable LiDAR data processing without heavy capital expenditure. Furthermore, cloud infrastructure also facilitates large‑scale mapping projects and integration with enterprise GIS systems, increasing recurring revenues for providers and expanding the user base in utilities, urban planning, and environmental monitoring, thus overall increasing market adoption rate for LiDAR technology.

~11% Market Share

Topcon

Collective Market Share is ~31.3%

LiDAR in Mapping Market Trends

LiDAR in Mapping Market Analysis

Learn more about the key segments shaping this market

Download Free PDF

On the basis of platform, the market is segmented into Drone, Terrestrial LiDAR, Manned Airborne LiDAR, and Handheld / Backpack LiDAR.

The terrestrial LiDAR segment is anticipated to reach USD 13.4 billion by 2035. The segment is driven by growing adoption in infrastructure, construction, and urban planning. High-precision mapping of buildings, roads, and utilities allows engineers to reduce project errors, optimize material usage, and accelerate project timelines. Governments in North America, Europe, and Asia-Pacific increasingly mandate LiDAR for urban development and smart city initiatives.

On the basis of component, the lidar in mapping market is divided into hardware and software.

On the basis of application, the LiDAR in mapping market is divided into corridor mapping, construction & surveying, agriculture & forestry, mining & quarrying, education, environmental, transport, emergency services, and others.

North America LiDAR in Mapping Market

The North America LiDAR in mapping market accounted for 49.8% of the revenue share in 2025.

The U.S. LiDAR in mapping market was valued at USD 1.8 billion and USD 1.9 billion in 2022 and 2023, respectively. The market size reached USD 2.1 billion in 2025, growing from USD 2 billion in 2024.

Europe LiDAR in Mapping Market

Europe LiDAR in mapping industry accounted for USD 1.2 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

Asia Pacific LiDAR in Mapping Market

The Asia Pacific LiDAR in mapping industry is anticipated to hold significant share of 22.7% in 2025 and is expected to grow at the highest CAGR of 28.7 % during the forecast period.

Latin American LiDAR in Mapping Market

Middle East and Africa LiDAR in Mapping Market

UAE LiDAR in mapping industry to experience substantial growth in the Middle East and Africa LiDAR in mapping market in 2025.

LiDAR in Mapping Market Share

The LiDAR in mapping industry is moderately consolidated, led by key technology providers such as Trimble Inc., Hexagon AB, SICK AG, Topcon, and Ouster Inc., which together account for a significant 31.3% share of global demand. These companies benefit from strong expertise in geospatial technologies, long-standing relationships with government and enterprise clients, and comprehensive portfolios spanning airborne, terrestrial, and mobile LiDAR solutions. Continuous investments in sensor accuracy, software analytics, and system integration support high-precision mapping across infrastructure, construction, and surveying applications.

Despite the presence of dominant players, the market remains partially fragmented, with regional vendors and specialized firms addressing niche use cases such as corridor mapping, forestry, mining, and drone-based surveys. Smaller companies compete through cost-efficient systems, customized deployments, AI-enabled data processing, and localized service models. This competitive environment accelerates innovation in sensor miniaturization, real-time data capture, and cloud-based mapping platforms, supporting sustained global market growth.

LiDAR in Mapping Market Companies

Prominent players operating in the LiDAR in mapping industry are as mentioned below:

Trimble Inc. is a well-established leader in the LiDAR in mapping market, holding an estimated share of ~9%. The company offers advanced LiDAR sensors, positioning technologies, and integrated geospatial solutions widely used across surveying, construction, agriculture, and infrastructure mapping. Strong investments in R&D, proprietary software platforms, and long-term relationships with government agencies and enterprise clients strengthen its competitive position across terrestrial, mobile, and airborne mapping applications.

Hexagon AB is a leading global provider of advanced measurement, positioning, and reality-capture technologies, including high-performance airborne and hybrid LiDAR mapping solutions under its Leica Geosystems brand. Its portfolio features airborne sensors like TerrainMapper-3, CityMapper-2, and Coastal Mapper that deliver efficient, integrated LiDAR and imagery data for 3D city, topographic, and bathymetric mapping workflows. Hexagon’s solutions focus on comprehensive data capture, processing throughput, and scalable mapping productivity for infrastructure, environmental, and national-scale projects, reinforcing its competitive position in the global LiDAR mapping market.

SICK AG is a global leader in industrial sensor technology, offering robust 2D and 3D LiDAR sensors that provide precise real‑time detection, localization, and environment mapping for automation and mobile platforms. Its products, including the multiScan100 3D LiDAR, generate high‑resolution 3D point clouds for mapping, object detection, and navigation across industrial vehicles and autonomous systems. SICK’s LiDAR solutions are highly configurable, rugged, and designed for reliable integration in diverse industrial applications worldwide.

LiDAR in Mapping Industry News

In September 2022, FARO Technologies, Inc., a global provider of 4D digital reality solutions, strategically acquired GeoSLAM, a UK-based leader in mobile scanning solutions with proprietary high-efficiency simultaneous localization and mapping (SLAM) software. Established in 2012, GeoSLAM enhances FARO’s capabilities in generating 3D models for Digital Twin applications. This acquisition is expected to expand FARO’s addressable market in mobile scanning solutions and accelerate growth in the rapidly evolving geospatial and 3D mapping sector.

In September 2024, Teledyne Geospatial plans to highlight its comprehensive portfolio of geospatial solutions for inspection, maritime, and mapping applications at INTERGEO 2024 in Stuttgart, Germany. The company’s integrated hardware and software workflows deliver end-to-end mapping capabilities, providing real-time, actionable geospatial insights across diverse sectors. Key highlights include the Galaxy Edge airborne LiDAR system, featuring parallel scan lines with real-time processing and control, enabling direct plane-to-production workflows.

In April 2024, Marelli, a leading automotive mobility technology supplier, announced a strategic collaboration with Hesai Group, a global provider of automotive-grade LiDAR solutions, to integrate Marelli’s advanced headlamp systems with Hesai’s next-generation ATX LiDAR technology. This integration enables enhanced object detection and improved vehicle safety while maintaining aerodynamic and aesthetic design standards. The ATX LiDAR is a compact, long-range, and highly customizable sensor specifically engineered for automotive applications. The new generation ATX achieves a ~60% reduction in volume compared to its predecessor, facilitating seamless integration into headlamp assemblies. This collaboration positions both companies to meet growing demand for advanced driver-assistance systems (ADAS) and next-generation autonomous vehicle technologies.

The LiDAR in mapping market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion from 2022 – 2035 for the following segments:

Click here to Buy Section of this Report

Market, By Platform

Market, By Ranging Principle

Market, By Scanning Architecture

Market, By Component

Market, By Application

The above information is provided for the following regions and countries: