Summary

Table of Content

Latin America Over the Counter (OTC) Drugs Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Latin America Over the Counter (OTC) Drugs Market Size

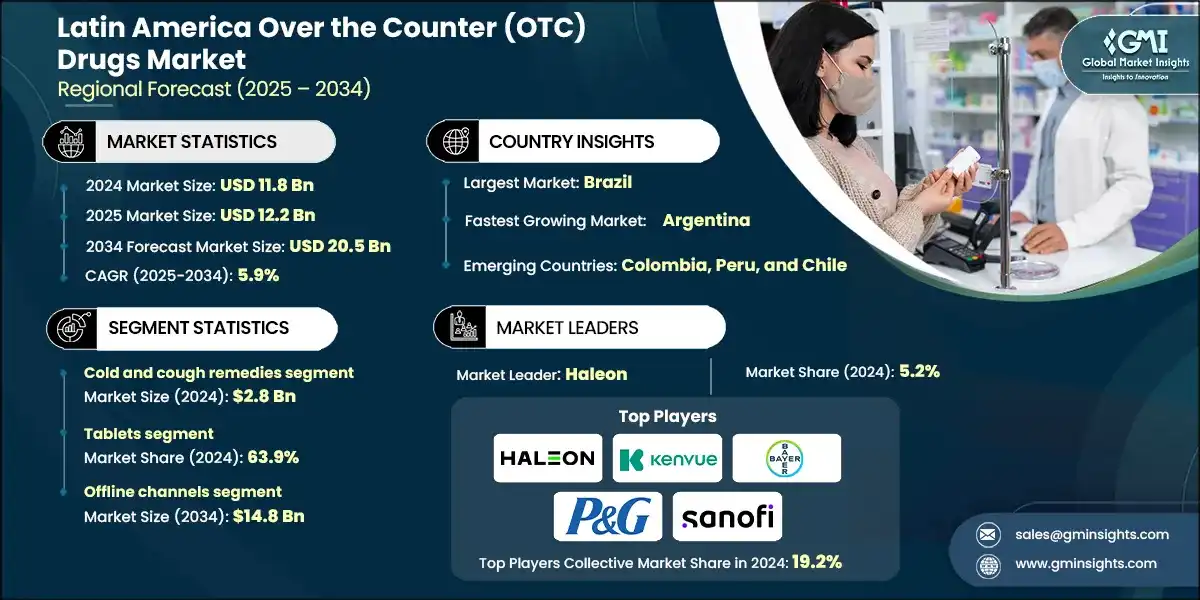

The Latin America over the counter (OTC) drugs market size was estimated at USD 11.8 billion in 2024. The market is expected to grow from USD 12.2 billion in 2025 to USD 20.5 billion in 2034, at a CAGR of 5.9% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

The rising aging population in the region coupled with the growing prevalence of chronic and age-related diseases, is a major factor driving the demand for OTC drugs. For instance, as per the Latin American and Caribbean Demographic Center (CELADE)-Population Division of ECLAC, in 2024, the number of individuals aged 65 and above was 65.4 million, which is estimated to increase to 138 million by 2050. This escalating geriatric population is more susceptible to chronic diseases such as digestive disorders, skin issues, joint diseases, and respiratory ailments, which increases the demand for OTC drugs.

Over the counter (OTC) drugs are medications that can be directly purchased without the need for a doctor’s prescription. These drugs are used for managing various conditions such as pain, allergy, digestive health, dermatological issues, and dietary requirements. The top 5 players in the Latin America OTC drugs market, including Haleon, Kenvue, Bayer, Procter & Gamble Company, and Sanofi, account for 19.2% of market share. These key players are focusing on developing a wide range of OTC drugs across different therapeutic categories. Further, manufacturers are leveraging product innovation, brand recognition, marketing strategies, and increased R&D expenditure to maintain a competitive edge in the market.

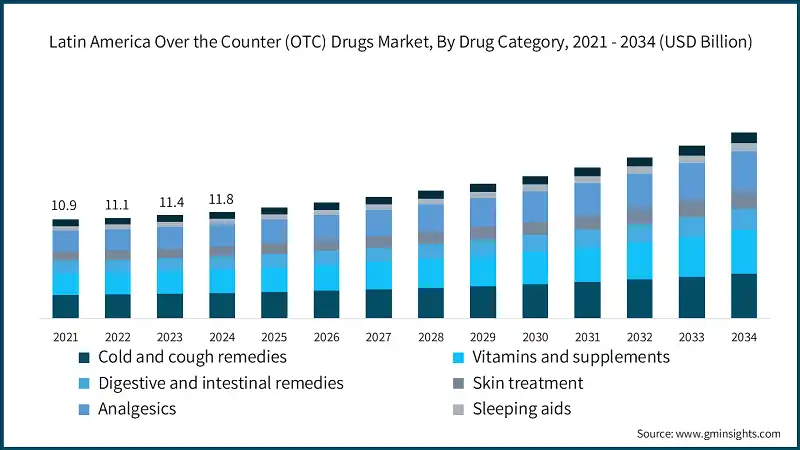

The Latin America OTC drugs market witnessed steady growth between 2021 - 2023. The market was valued at USD 10.9 billion in 2021 and increased to USD 11.1 billion in 2022 and USD 11.4 billion in 2023. This growth between 2021 to 2023 was mainly due to the growing trend towards self-medication driven by the COVID-19 pandemic. Increasing consumer preference for OTC drugs due to self-care trends has boosted the adoption of OTC drugs for cold and cough, flu, or other minor medical conditions during this period. Further, the growing penetration of e-commerce and online pharmacies has played a critical role in fostering market growth.

OTC drugs are non-prescription medications that can be purchased directly without a physician's prescription. Health authorities regulate these types of drugs to ensure safety, efficacy, and quality. They are available as tablets, ointments, solutions, sprays, and other dosage forms that can be conveniently self-administered by patients, thus eliminating the need for a doctor’s prescription.

Latin America Over the Counter (OTC) Drugs Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 11.8 Billion |

| Market Size in 2025 | USD 12.2 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.9% |

| Market Size in 2034 | USD 20.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising adoption of self-care practices among consumers | This cultural shift encourages proactive health management, boosting OTC demand and reducing dependency on formal healthcare services. |

| Rapid penetration of e-commerce and digital health platforms | The rapid penetration of online platforms enhances product accessibility, increases convenience, and accelerates market growth. |

| Growing geriatric population | The rising geriatric population creates sustained demand for OTC categories like pain relief, digestion, and vitamins to manage age-related issues. |

| Pitfalls & Challenges | Impact |

| Supply chain disruptions are affecting product availability | The disruption in the supply chain interrupts timely product delivery, creates shortages, and impacts consumer loyalty while raising operational costs significantly. |

| Increased concern towards misuse or drug abuse | The increased concern towards misuse or drug abuse raises regulatory scrutiny, limiting category expansion and product accessibility. |

| Opportunities: | Impact |

| Expansion into underserved rural and remote areas with localized distribution | This unlocks new growth by tapping into previously inaccessible consumers and strengthening regional presence. |

| Innovation in natural, herbal, and plant-based OTC product lines | It aligns with consumer preference for natural wellness, boosting adoption and differentiating products into crowded categories. |

| Market Leaders (2024) | |

| Market Leaders |

5.2% market share |

| Top Players |

Collective Market Share in 2024 is 19.2% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Brazil |

| Fastest growing market | Argentina |

| Emerging countries | Colombia, Peru, and Chile |

| Future outlook |

|

What are the growth opportunities in this market?

Latin America Over the Counter Drugs Market Trends

- The growing demand for self-medication is one of the significant trends shaping the growth of the Latin America OTC drugs market.

- Consumers are increasingly managing common health issues like headaches, colds, and digestive issues without visiting doctors. This shift is driven by the effectiveness, affordability, and convenience offered by the OTC drugs for managing mild symptoms.

- The rapid urbanization and sedentary lifestyle have led to an increased number of lifestyle-related health issues such as stress, insomnia, and obesity. For instance, as per the Global Nutrition Report, in Mexico, 35.7% of adult women (aged 18 years and over) and 27% of adult men are living with obesity. This high number of individuals underscores a large consumer base opting for OTC drugs for weight management or vitamins and supplements used for balancing nutrition.

- Additionally, pharmaceutical companies are increasingly investing in launching different OTC drug formulations such as gummies, sprays, and dissolvable tablets to attract diverse age groups. This trend is thus attracting a wide range of demographic preferences for innovative OTC drugs.

- Another trend supporting the growth of the Latin America OTC drugs market is the expansion of retail channels. Also, growing e-commerce and digital health integration trends are improving consumer access to these OTC drugs and thereby supporting the market growth.

- The expanding middle class in Latin America is driving demand for convenient and affordable healthcare solutions. The rising disposable income further drives the adoption of OTC drugs for everyday health needs like vitamins, pain relief, and digestive aids.

Latin America Over the Counter Drugs Market Analysis

Learn more about the key segments shaping this market

The Latin America OTC drugs market was valued at USD 10.9 billion and USD 11.1 billion in 2021 and 2022, respectively. The market size reached USD 11.8 billion in 2024, growing from USD 11.4 billion in 2023.

Based on the drug category, the Latin America market is segmented into cold and cough remedies, vitamins and supplements, digestive and intestinal remedies, skin treatment, analgesics, sleeping aids, and other drug categories. The cold and cough remedies segment accounted for USD 2.8 billion in 2024, due to the rising prevalence of cold and cough in the region linked to the seasonal changes, pollution, and urban lifestyles. On the other hand, the vitamins and supplements segment held second second-highest market share in 2024 and is expected to grow at a CAGR of 6.5% during the forecast period due to rising health awareness and a growing focus on preventive healthcare. The increased awareness about the role of vitamins and supplements in boosting immunity, improving energy levels, and managing nutritional deficiencies caused by lifestyle changes supports the growth of this segment.

- As per the National Health Institution, in 2022, there were more than 10 million acute respiratory infections reported in Mexico. This high prevalence of respiratory infection underscores the growing demand for OTC cold and cough remedies, thereby reinforcing their dominant share in the market.

- The OTC cold and cough remedies provide quick and affordable relief to mild respiratory symptoms at home. This fuels the consumer’s reliance on cold and cough remedies.

- Moreover, the post-pandemic behavioral changes have increased the awareness and importance of treating colds and coughs. This heightened awareness of respiratory health and increased access to these cold and cough remedies through various channels solidified their highest market share in the market.

Learn more about the key segments shaping this market

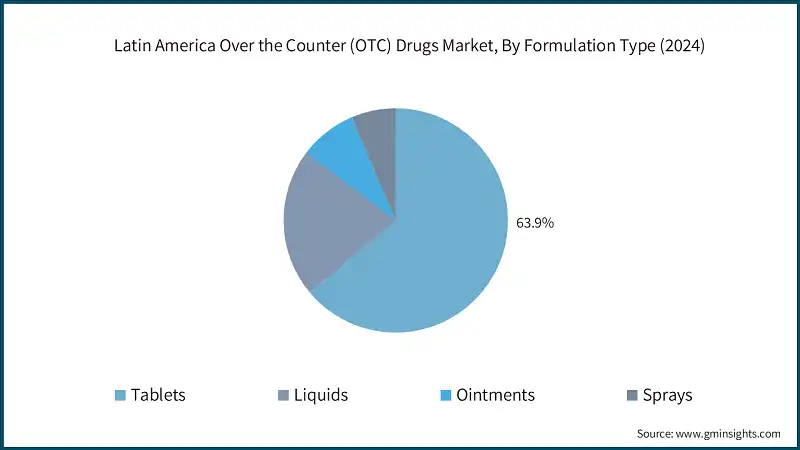

Based on the formulation type, the Latin America over the counter drugs market is classified into tablets, liquids, ointments, and sprays. In 2024, the tablets segment dominated the market with 63.9% market share and is anticipated to grow at a 6.1% CAGR over the analysis period.

- The tablets segment dominated the market due to its practicality and increased consumer convenience. Tablets are portable and easy to store, making them suitable for daily use.

- Tablets benefit from their extended shelf-life and stability across different climates compared to liquids, thereby contributing to the growth of this segment.

- Moreover, the versatility of tablets in addressing various health conditions, including digestive aids, sleeping aids, vitamins and supplements, and others, further drives the growth of the tablet segment.

- On the other hand, the liquids segment is expected to showcase growth at a 5.7% CAGR during the forecast period, driven by its strong appeal among the elderly population and children with swallowing issues.

- Liquid formulations provide faster action as they are more rapidly absorbed into the bloodstream, leading to increased consumer preference for liquid formulations.

- The availability of different flavors in syrups and improved packaging innovations such as single-use sachets, droppers, and ready-to-drink products are expected to further drive the adoption of liquid formulations.

Based on the distribution channel, the Latin America over the counter drugs market is segmented into online channels and offline channels. The offline channels segment dominated the market in 2024 and is expected to reach USD 14.8 billion by 2034. The offline channels segment is sub-segmented into hospital pharmacies, retail pharmacies, and other offline channels. On the other hand, the online channels segment accounted for USD 3.1 billion in 2024, primarily due to the rising adoption of digital health and increased internet penetration across the region. Consumers are increasingly shifting towards e-commerce for healthcare purchases. This trend is expected to boost the adoption of online distribution channels.

- The offline channels, including hospital and retail pharmacies, serve as a primary point of purchase for OTC drugs, as these channels provide professional guidance from pharmacists. This increased consumer trust and confidence in offline channels supports the growth of this segment.

- The strong penetration of offline channels across both urban and rural areas is another factor driving the growth of this segment. The significant presence of offline channels accelerates the availability and accessibility of OTC drugs where digital infrastructure or online delivery services are limited, thereby supporting the expansion of this segment.

Looking for region specific data?

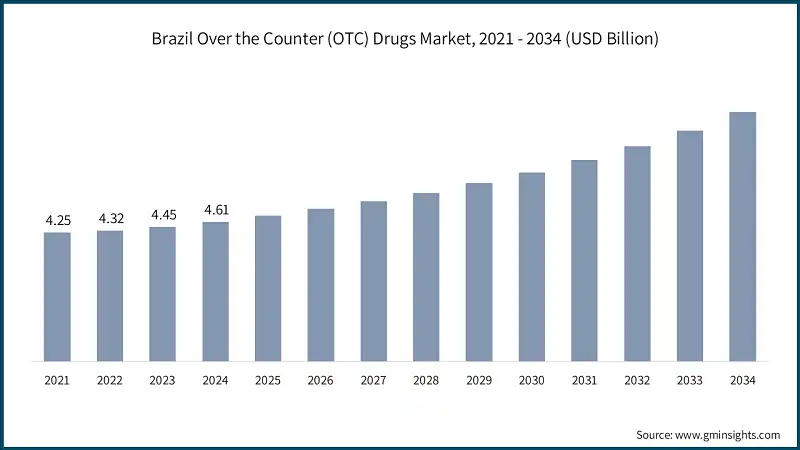

Brazil over the counter (OTC) drugs market was valued at USD 4.25 billion and USD 4.32 billion in 2021 and 2022, respectively. The market size reached USD 4.61 billion in 2024, growing from USD 4.45 billion in 2023.

- The country has one of the largest and most advanced pharmacy networks in the region, with the presence of both independent and chain drugstores. This strong distribution network ensures widespread availability and accessibility of different OTC drugs across different regions, reinforcing the dominance of this country.

- Brazilian consumers are increasingly adopting the trend of self-medication, particularly for common conditions like cold, cough, digestive issues, and pain relief.

- Additionally, the increasing healthcare expenditure and adoption of a preventive care culture in Brazil have further contributed to the significant growth of Brazil OTC drugs market.

Mexico OTC drugs market accounted for second second-highest market share and was valued at USD 2.8 billion in 2024.

- The growth of Mexico's OTC drugs market is due to its large population, rising middle class, and greater acceptance of self-medication culture.

- The consumers in the country prefer OTC products for common conditions such as pain, cold and cough, gastrointestinal issues, and allergies rather than visiting the hospitals.

- Combined with supportive regulatory frameworks and the presence of both local and multinational players in the country further supports the growth of country level market.

Argentina OTC drugs market is expanding rapidly in the overall Latin America OTC drugs market with a 6.4% CAGR during the forecast period.

- In Argentina, the increasing awareness about health is boosting demand for vitamins, supplements, and herbal medicinal products is driving the market growth.

- According to the Pan American Health Organization, the prevalence of overweight and obesity was 68.4% in 2022. This high prevalence of obesity highlights the increased consumer base opting for OTC drugs to manage weight and balance nutritional requirements.

- The increasing elderly population is susceptible to various chronic health conditions such as diabetes, chronic pain, digestive issues and cardiovascular health, seeking affordable long-term treatment such as OTC drugs, further fueling market growth in the country.

Latin America Over the Counter Drugs Market Share

Latin America OTC drugs market is highly competitive and is characterized by the presence of multinational players as well as domestic players, shaping the growth and consumer preferences. Top 5 players such as Haleon, Kenvue, Bayer, Procter & Gamble Company, and Sanofi accounted for ~19.2% of the market share. These players are actively investing diversifying their product portfolio, expanding therapeutic areas and novel formulations to cater to a diverse population. The players also focus on various strategies such as business expansion, mergers and acquisitions, collaborations, and partnerships to consolidate their market presence.

Many companies emphasize developing safer and more effective OTC products with fewer side effects. Efforts to expand access in underserved regions and improve affordability further underscore the market’s shift toward global inclusivity, preventive care, and personalized wellness.

Latin America Over the Counter Drugs Market Companies

Few of the prominent players operating in the Latin America OTC drugs industry include:

- Abbott Laboratories

- Alkem Laboratories

- Bayer

- Cipla

- Dr. Reddy’s Laboratories

- Eurofarma

- EMS

- Glenmark Pharmaceuticals

- Haleon

- Himalaya Wellness Company

- Kenvue

- Laboratorios Bagó S.A.

- Procter & Gamble Company

- Reckitt

- Sanofi

- Stada Arzneimittel

- Sun Pharma

- Teva Pharmaceutical

- Haleon

Haleon holds a leading position with a share of 5.2% in the Latin America OTC drugs market, leveraging its broad portfolio of trusted brands across pain relief, respiratory health, digestive care, and vitamins and minerals. In 2024, the company reinforced its leadership by expanding its presence in high-growth regions such as Asia-Pacific and Latin America, while maintaining strong positions in North America and Europe.

Kenvue holds a growing position in the Latin America OTC drugs market, driven by its portfolio of iconic brands such as Tylenol, Motrin, and Zyrtec. The company also introduced next-generation OTC formulations, such as Tylenol+ with added immune support, and expanded its product line to include natural alternatives.

Bayer is one of the leading players in the Latin America OTC drugs market, driven by trusted brands and a commitment to advancing self-care. With a portfolio that includes widely recognized names such as Aspirin, Claritin, and Canesten, Bayer has positioned itself as a leader in key therapeutic areas, including pain relief, allergy management, dermatology, digestive health, and cardiovascular support.

Latin America Over the Counter (OTC) Drugs Industry News:

- In April 2025, Opella became an independent global consumer healthcare leader. Sanofi announced the completion of the sale of a 50% controlling stake in Opella to Clayton, Dubilier & Rice (CD&R), while retaining a significant 48.2% ownership interest. This move strengthens Sanofi’s financial position and allows it to sharpen its focus on core biopharmaceutical innovation.

- In September 2024, Haleon introduced Eroxon, an OTC gel, in the sexual health category, helping men with erectile dysfunction, addressing a key unmet need in ED treatment.

- In June 2024, Dr. Reddy’s Laboratories announced an agreement to acquire Haleon’s global Nicotine Replacement Therapy (NRT) portfolio outside the U.S., including brands such as Nicotinell, Nicabate, Thrive, and Habitrol. The acquisition covers lozenge, patch, gum formats and pipeline products across over 30 countries.

The Latin America over the counter (OTC) drugs market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Drug Category

- Cold and cough remedies

- Vitamins and supplements

- Digestive and intestinal remedies

- Skin treatment

- Analgesics

- Sleeping aids

- Other drug categories

Market, By Formulation Type

- Tablets

- Liquids

- Ointments

- Sprays

Market, By Distribution Channel

- Online channels

- Offline channels

- Hospital pharmacies

- Retail pharmacies

- Other offline channels

The above information is provided for the following countries:

- Brazil

- Mexico

- Argentina

- Colombia

- Peru

- Chile

Frequently Asked Question(FAQ) :

Who are the key players in the Latin America OTC drugs market?

Key players include Haleon, Kenvue, Bayer, Procter & Gamble Company, Sanofi, Abbott Laboratories, Dr. Reddy’s Laboratories, Eurofarma, EMS, Glenmark Pharmaceuticals, Reckitt, and Teva Pharmaceutical.

What is the growth outlook for the vitamins and supplements segment from 2025 to 2034?

The vitamins and supplements segment is expected to grow at a 6.5% CAGR during 2025–2034, driven by preventive health awareness and increasing adoption of immunity-boosting products.

What was the valuation of the tablets segment in 2024?

The tablets segment accounted for 63.9% of the market and generated USD 7.5 billion in 2024, favored for convenience, portability, and long shelf life.

Which country is the fastest-growing in the Latin America OTC drugs market?

Argentina is projected to grow at 6.4% CAGR through 2034, fueled by rising demand for vitamins, supplements, and affordable OTC treatments for chronic health conditions.

What is the projected value of the Latin America OTC drugs market by 2034?

The market is expected to reach USD 20.5 billion by 2034, growing at a CAGR of 5.9% due to e-commerce expansion, an aging population, and rising demand for preventive healthcare

What is the market size of the Latin America OTC drugs in 2024?

The market size was USD 11.8 billion in 2024, driven by self-medication trends, rising health awareness, and strong retail pharmacy penetration.

How much revenue did the cold and cough remedies segment generate in 2024?

Cold and cough remedies generated USD 2.8 billion in 2024, making it the leading category due to high prevalence of respiratory infections and seasonal illnesses.

What is the market size of the Latin America OTC drugs market in 2025?

In 2025, the market is projected to be valued at USD 12.2 billion, supported by digital health adoption and increasing consumer reliance on OTC solutions for minor conditions

Latin America Over the Counter (OTC) Drugs Market Scope

Related Reports