Summary

Table of Content

In-flight Entertainment & Connectivity Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

In-flight Entertainment & Connectivity Market Size

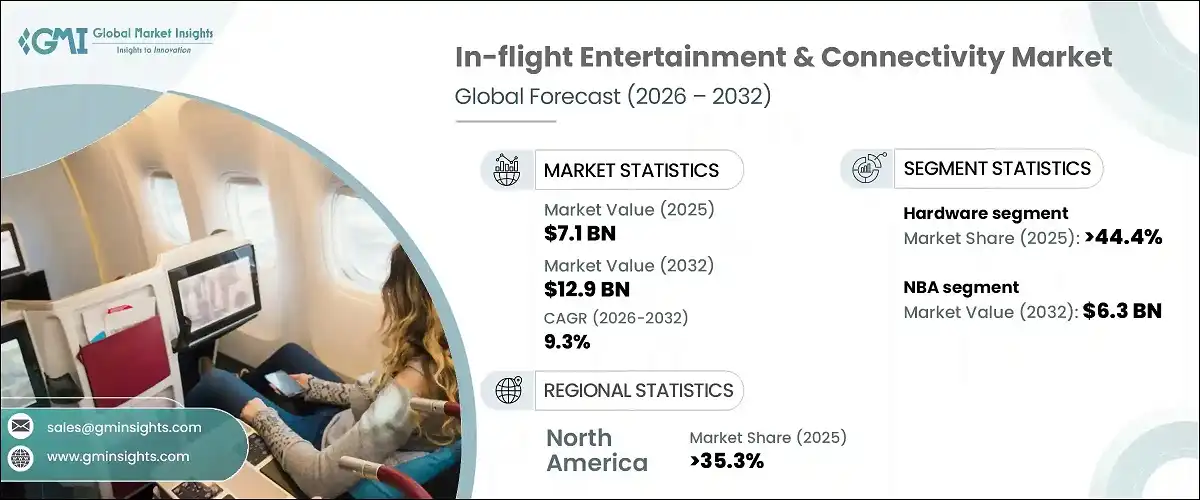

The global in-flight entertainment & connectivity market was valued at over USD 7.1 billion in 2025 and is estimated to register a CAGR of 9.3% between 2026 & 2032. The global in-flight entertainment and connectivity market is gaining momentum as air travelers increasingly expect consistent digital access throughout their journey. Airlines are responding by enhancing onboard systems that allow passengers to browse the internet, stream media, and remain connected during flights. The growing reliance on personal electronic devices has further strengthened demand across the broader in-flight entertainment market, as travelers prefer to use their own smartphones, tablets, and laptops for both entertainment and work.

To get key market trends

Expansion of long-haul and international routes is accelerating adoption within the in flight connectivity market. Longer flight durations heighten the need for reliable entertainment and communication services that improve comfort and engagement. To address this, airlines are investing in integrated platforms that combine content delivery and connectivity, positioning these systems as a core component of the passenger experience rather than an optional service offering.

Despite increasing adoption, the in-flight entertainment & connectivity market size is influenced by high deployment and lifecycle costs. Installing satellite antennas, onboard networking equipment, and digital infrastructure requires substantial capital, while maintenance and system upgrades add to operational complexity. Even so, industry assessments indicate continued in-flight entertainment and connectivity market growth, with long-term outlooks and the IFEC market size and forecast supported by rising passenger expectations and ongoing advancements in connectivity technology.

In-flight Entertainment & Connectivity Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 7.1 Billion |

| Forecast Period 2026 - 2032 CAGR | 9.3% |

| Market Size in 2032 | USD 12.9 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

In-flight Entertainment & Connectivity Market Trends

The growing adoption of the Bring-Your-Own-Device (BYOD) model is reshaping in flight entertainment, as airlines increasingly enable passengers to stream content directly to their smartphones, tablets, and laptops. This shift is accelerating demand for wireless IFEC systems that reduce reliance on traditional seat-back hardware while improving scalability and cost efficiency. At the same time, airlines continue to enhance premium cabins by deploying advanced display technologies such as OLED and 4K screens, responding to rising expectations for high-quality visual experiences supported by reliable in flight connectivity.

In parallel, aircraft connectivity systems are becoming more deeply integrated with onboard passenger services, including seat controls, lighting, and cabin management, allowing travelers to manage multiple functions through a unified digital interface. This evolution in aircraft cabin connectivity is complemented by a growing focus on sustainability, with airlines and system providers prioritizing lightweight, energy-efficient IFEC designs. Combined with ongoing advancements in satellite-based in-flight connectivity and emerging 5G in-flight connectivity, these developments are shaping a more connected, efficient, and environmentally responsible onboard experience.

In-flight Entertainment & Connectivity Market Analysis

Learn more about the key segments shaping this market

Based on the product, the market is divided into hardware, connectivity, and content. The hardware segment dominated the global market with a share of over 44.4% in 2025. Airlines are continuously upgrading & retrofitting older aircraft to meet the current passenger expectations for in-flight entertainment & connectivity. This involves installing new hardware components, such as satellite antennas, onboard servers, Wi-Fi access points, and seat-back screens, driving segment growth. As the global airline industry expands to meet the increasing passenger traffic, airlines are adding new aircraft to their fleets. These new aircraft require the latest IFEC hardware to provide passengers with high-quality entertainment and connectivity options from the outset.

Learn more about the key segments shaping this market

Based on the aircraft type, the in-flight entertainment & connectivity market is divided into narrow-body aircraft (NBA), wide-body aircraft (WBA), and very large aircraft (VLA). The NBA segment is expected to register a CAGR of 9.8% during the forecast period and reached a revenue of USD 6.3 billion by 2032. The rapid expansion of low-cost carriers (LCC), which primarily operate NBA, contributes significantly to this growth. LCCs are increasingly adopting IFEC solutions as a value-added service to enhance passenger experience and generate ancillary revenue, fostering growth in the NBA segment. Advancements in lightweight and compact IFEC technologies have made it more feasible and cost-effective to install these systems on NBA, which have less space and weight capacity compared to WBA. These advancements allow airlines to offer competitive IFEC options without compromising fuel efficiency or payload.

Looking for region specific data?

North America dominated the global In-flight entertainment & connectivity market in 2025, accounting for a share of over 35.3%. North American passengers, particularly business travelers, have a high expectation for continuous connectivity to stay productive and entertained throughout their flights. This demand encourages airlines to invest in IFEC systems that offer reliable, high-speed internet access. Regulatory bodies in North America, such as the Federal Communications Commission (FCC) and the Federal Aviation Administration (FAA), support the use of personal electronic devices and in-flight connectivity, facilitating the growth of the market by allowing airlines to expand their connectivity offerings.

In-flight Entertainment & Connectivity Market Share

Thales SA and Panasonic Avionics Corporation hold a significant share of over 20%. Thales Group’s lead can be attributed to its innovative, comprehensive solutions that enhance passenger experience. The company offers advanced entertainment systems, reliable connectivity options, and personalized services, making it a preferred choice for airlines globally.

Panasonic Avionics Corporation provides cutting-edge solutions that offer passengers a wide range of entertainment options, high-speed internet access, and seamless connectivity, thereby enhancing the overall travel experience and satisfaction. This helps the company get a competitive advantage in the market.

In-flight Entertainment & Connectivity Market Companies

Major players operating in the in-flight entertainment & connectivity industry are:

- Panasonic Avionics Corporation

- Thales SA

- Astronics Corporation

- Gogo LLC

- RTX Corporation

- ViaSat Inc.

- Honeywell International Inc.

In-flight Entertainment & Connectivity Industry News The in-flight entertainment & connectivity market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) from 2018 to 2032, for the following segments:

Market, By Product

- Hardware

- Non-portable

- Portable

- Connectivity

- Wired

- Wireless

- Content

- Stored

- Streamed

Market, By Aircraft Type

Narrow-body Aircraft (NBA)

- Wide-body Aircraft (WBA)

- Very Large Aircraft (VLA)

Market, By End-user

- OEM

- Aftermarket

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- ANZ

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

Frequently Asked Question(FAQ) :

What is the growth outlook for the narrow-body aircraft (NBA) segment from 2026 to 2032?

The narrow-body aircraft segment is expected to grow at a CAGR of 9.8% during the forecast period, reaching USD 6.3 billion by 2032. The expansion of low-cost carriers and advancements in lightweight IFEC technologies are key growth drivers.

What is the in-flight entertainment & connectivity market size in 2025?

The market size for in-flight entertainment & connectivity was valued at USD 7.1 billion in 2025. Increasing demand for uninterrupted digital access and reliance on personal electronic devices are driving market growth.

What is the market size of the in-flight entertainment & connectivity industry in 2032?

The market size for in-flight entertainment & connectivity is projected to reach USD 12.9 billion by 2032, growing at a CAGR of 9.3% during the forecast period.

What was the market share of the hardware segment in 2025?

The hardware segment accounted for over 44.4% of the market in 2025, driven by the installation of satellite antennas, onboard servers, Wi-Fi access points, and seat-back screens in both new and retrofitted aircraft.

In-flight Entertainment & Connectivity Market Scope

Related Reports