Summary

Table of Content

Glycol Ether Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Glycol Ether Market Size

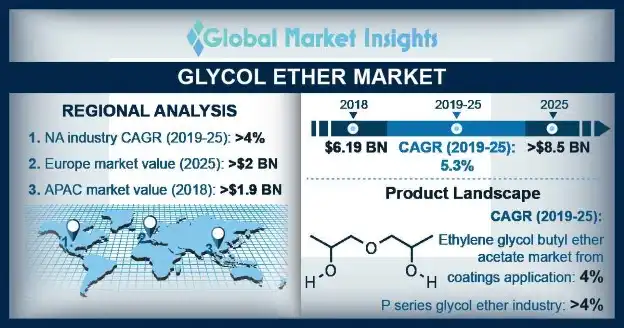

Glycol Ether Market size crossed USD 6 billion in 2018, registering a CAGR of 5.3% and may expect consumption at over 2.9 million tons by 2025. Increasing usage in personal care, cleaners, paints & coatings, pharmaceutical, and printing industries should drive the global market. Rise in water-based coatings demand will augment product requirement, as it is used as a coalescing agent in these coatings. This in consequence will drive industry growth from personal care and printing inks sectors.

To get key market trends

Glycol ether is widely used in personal care products and cosmetics in the formulation of skin & hair products, shampoos, personal cleanliness products, and bath products. Global cosmetics business may surpass $450 million by 2025, with gains at over 4.5%. Rise in per-capita disposable income along with change in lifestyle with increasing demand for skin care products owing to varying climatic conditions should boost industry growth. Rapid rise in personal care sector due to increasing consumer consciousness regarding health hygiene may accelerate the glycol ether market share.

Glycol Ether Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 6 Billion (USD) |

| Forecast Period 2019 - 2025 CAGR | 5.3% |

| Market Size in 2025 | 8.5 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Increasing economic growth of glycol ethers market will augment printing inks demand owing to its widespread usage in publishing print products such as books, newspapers, journals, technical printed material and magazines. Global printing inks segment demand is projected to reach $25 billion up to 2025 on account of growing demand from corrugated cardboards, and flexible packaging applications. Glycol ether is widely utilized in printing inks manufacturing owing to its quick drying nature and compatibility with high speed roll to roll yardage printing.

Rise in consumer consciousness and changing sociological perceptions towards environment sustainability will boost glycol ether market demand in automotive sector. In 2018, China accounted for about 30% of the global vehicle sales. Rising demand for nontoxic coatings & shifting consumer perceptions towards improved technological changes, vehicle color coupled with growing automobile business will stimulate the paints and coating business demand.

They are widely used in protection against external environmental factors such as UV radiation and acid rain which will further stimulate the market growth.

Glycol ether is restricted in consumer goods due to stringent regulations from FDA and EU. The complex nature of organic materials & its compatibility with inorganic substances with respect to toxicity, effervescence, & fume makes it difficult to conduct systematic research towards safety and efficiency, which is mainly hindering the glycol ether market growth. Low level and direct exposure of the product in humans can result in conjunctivitis, upper respiratory track irritation, headache, temporary corneal clouding, and nausea.

Glycol Ether Market Analysis

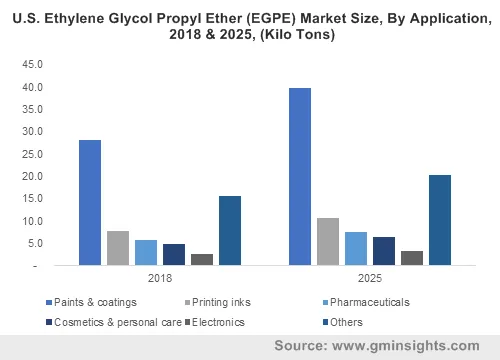

Global E series glycol ether market segment was valued at about $850 million in 2018. Increasing application usage in pharmaceutical, cleaners, and paints & coatings sectors due to its favorable properties including high water solubility, low volatility, and strong solvent strength are the factors accelerating the global market.

Ethylene glycol butyl ether acetate segment demand from coatings application is likely to witness significant growth up to 4% over the predictable timeframe. Rapid industrialization will increase product demand for coating industry where it improves coatings flow and gloss. It provides good tolerance for aromatic and aliphatic hydrocarbons and replaces these solvents to enhance characteristics such as roll application in high performance coatings or brushability.

P series glycol ether market may witness significant gains at over 4% through 2025. It is mainly utilized for metal and non-metal surface treatment, water treatment formulation and laboratory products. They are used with cleaners as they offer physical and performance properties for cleaning formulations on account of fast evaporation, surface tension reduction and low toxicity properties.

Tripropylene glycol methyl ether (TPM) demand from electronics applications is poised to exceed $85 million by 2025. They are utilized in electronics industry for diverse uses such as manufacturing positive photoresist formulations, cleaning & degreasing solvent systems in circuits boards and removing soldering flux.

North America, driven by Canada, and the U.S. may register significant growth over 4% through 2025. Growing consumer consciousness towards high quality, nontoxic, and biodegradable cosmetics may drive the regional market demand. Favorable regulations by FDA regarding GRAS approval for various glycol ether products along with changing consumer perceptions and rising consumer consciousness will stimulate the overall glycol ether market share.

Europe driven by UK, France and Germany may surpass $2 billion by 2025. Stringent environment & fuel regulations by Scandinavian countries including Sweden, Norway, Denmark and Finland will boost the glycol ether market for electric and hybrid vehicles. Glycol ether coatings are widely used in automotive industry for protection and decorative applications.

Asia Pacific led by Japan, India and China was valued at over $1.9 billion in 2018. Increase in construction & renovation activities will boost the market for paints & coatings demand which is likely to support the regional growth. Supportive government initiatives in constructing residences, schools, hospitals, and universities will increase the glycol ether market demand.

Learn more about the key segments shaping this market

Glycol Ether Market Share

Global glycol ether industry is fragmented with major players such as

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- SABIC

- Exxon Mobil Corporation

- Sasol

- Huntsman Corporation

- Shell

- LyondellBasell

- Matric Chemicals

- Biesterfeld AG

Companies are involved in mergers & joint ventures to increase their presence & broaden product portfolio and are also increasing research potential to gain competitive advantage. Furthermore, manufacturers are focusing on economically sustainable and high-quality products to foster overall industry growth.

Industry Background

Glycol ethers are a group of solvents based on alkyl ethers of propylene or ethylene glycol. These solvents have various characteristics such as low molecular weight, high boiling point, & miscibility with water and organic solvents. Growing concerns of tanning, hyperpigmentation, and melanoma will boost cosmetics sector in sunscreens owing to its humectant properties & ability to enhance the skin appearance by reducing flaking and restoring suppleness.

Glycol Ether Market report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in tons and revenue in USD from 2014 to 2025, for the following segments:

By Product

- E-Series

- By Product

- Ethylene Glycol Propyl Ether (EGPE)

- By Application

- Paints & Coatings

- Printing Inks

- Pharmaceuticals

- Cosmetics

- Electronics

- Others

- By Application

- Ethylene Glycol Butyl Ether (EGBE)

- By Application

- Paints & Coatings

- Printing Inks

- Chemical Intermediates

- Others

- By Application

- Ethylene Glycol Butyl Ether Acetate (EGBEA)

- By Application

- Coatings

- Chemical Intermediates

- Cosmetics & Personal Care

- Electronics

- Others

- By Application

- Other E-series

- By Application

- Paints & Coatings

- Printing Inks

- Pharmaceuticals

- Cosmetics

- Electronics

- Others

- By Application

- Ethylene Glycol Propyl Ether (EGPE)

- By Product

- P-Series

- By Product

- Tripropylene Glycol Methyl Ether (TPM)

- By Application

- Coatings

- Cleaners

- Electronics

- Printing Inks

- Others

- By Application

- Propylene Glycol Methyl Ether (PM)

- By Application

- Coatings

- Cleaners

- Chemical Intermediates

- Electronics

- Others

- By Application

- Dipropylene Glycol Methyl Ether (DPM)

- By Application

- Coatings

- Cleaners

- Electronics

- Adhesives

- Others

- By Application

- Other P-series

- By Application

- Coatings

- Cleaners

- Others

- By Application

- Tripropylene Glycol Methyl Ether (TPM)

- By Product

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Thailand

- Latin America (LATAM)

- Brazil

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Which product segment is expected to drive the market during the forecast period?

The E series glycol ether segment registered a major share in 2018 and is projected to record a remarkable growth rate throughout the forecast period.

Which are the top companies in the glycol ether industry?

BASF, The Dow Chemical Company, Eastman Chemical Company, SABIC, Exxon Mobil Corporation, Sasol, Huntsman Corporation, Shell, LyondellBasell Industries, Hannong Chemicals Inc, Matrix Chemicals, Biesterfeld AG are some of the top contributors in the industry.

What are the key factors driving the market?

Increasing inclination towards sun protection products, rising trends towards biodegradable products, and increasing focus on ecological construction & growing paints and coating industries are major factors expected to drive the growth of global market.

What will be the estimated worth of global glycol ethers industry by 2025?

Predicted revenue share of glycol ethers market is USD 8.5 by 2025.

How is the global glycol ethers industry size anticipated to grow over 2019-2025?

Glycol ethers market is likely to depict a CAGR of 5.3% over 2019-2025.

What will be the worth of global glycol ether market by the end of 2025?

According to the report published by Global Market Insights Inc., the glycol ether business is supposed to attain $8.5 billion by 2025.

Glycol Ether Market Scope

Related Reports