Summary

Table of Content

Food Coating Ingredients Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Food Coating Ingredients Market Size

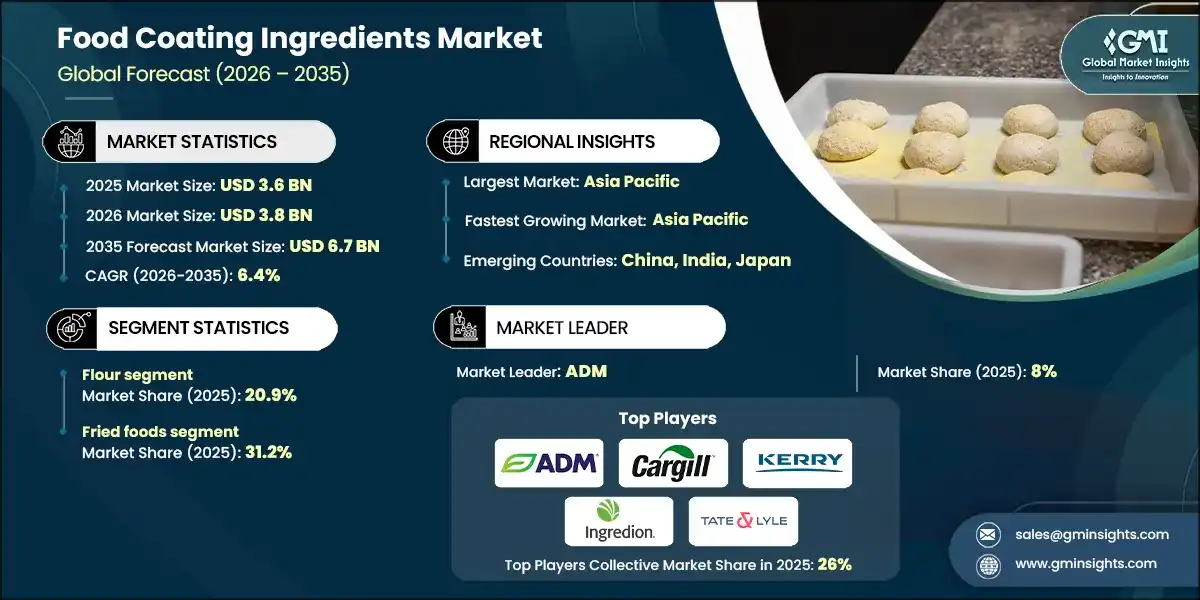

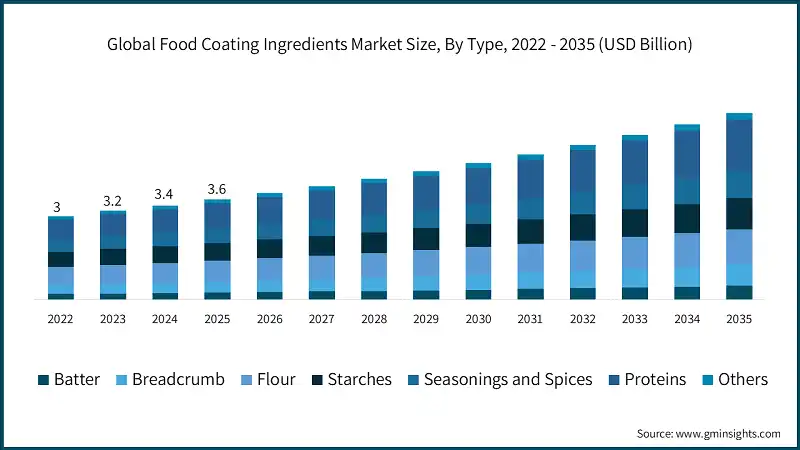

The global food coating ingredients market was valued at USD 3.6 billion in 2025 and is poised to expand from USD 3.8 billion in 2026 to USD 6.7 billion by 2035, reflecting a 6.4% CAGR over 2026 to 2035 according to the latest report published by Global Market Insights Inc.

To get key market trends

- Food coating ingredients are specialized formulations applied to food products to enhance appearance, texture, flavor, and shelf life. These ingredients include batters, breadcrumbs, flours, starches, seasonings, spices, and proteins that create protective and functional layers on various food items. The market encompasses diverse applications across fried foods, baked goods, snacks, confectionery, and processed foods, serving both industrial food manufacturers and foodservice operations. As consumer preferences shift toward convenience foods, clean-label products, and plant-based alternatives, the demand for innovative coating solutions continues to expand globally.

- The clean-label movement has evolved from a niche consumer preference to a mainstream market imperative, fundamentally altering ingredient selection and formulation strategies across the food coating ingredients sector. The clean-label additives market reached USD 45.3 billion in 2024 and is projected to expand to USD 79.4 billion by 2034 at a CAGR of 5.8%, demonstrating sustained consumer demand for transparency and natural formulations. Plant-based additives held 42.6% market share in 2024 with 6% CAGR, while natural flavors and colors commanded 22.2% of the clean-label segment, reflecting formulation shifts away from synthetic alternatives.

- Consumer research consistently identifies ingredient transparency, minimal processing, and recognizable components as primary purchase drivers, particularly among millennial and Generation Z demographics who scrutinize ingredient labels and research product formulations before purchase decisions. This behavioral shift has prompted major coating ingredient manufacturers to reformulate existing products and develop new platforms centered on natural, non-GMO, organic, and allergen-free ingredients. Companies are replacing synthetic emulsifiers with lecithin from sunflower or soy, substituting artificial colors with vegetable and fruit extracts, and eliminating preservatives through alternative preservation systems including natural antimicrobials and modified atmosphere packaging.

Food Coating Ingredients Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 3.6 Billion |

| Market Size in 2026 | USD 3.8 Billion |

| Forecast Period 2026 - 2035 CAGR | 6.4% |

| Market Size in 2035 | USD 6.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing Demand for Convenience and Ready-to-Eat Foods | Busy lifestyles fuel the need for quick, easy-to-consume products, boosting demand for coatings that improve taste, appearance, and preservation in ready-to-eat meals. |

| Expansion of the Snack and Confectionery Industry | Snacks and confectionery rely heavily on coatings for flavor and texture enhancement. The sector’s rapid growth globally creates significant opportunities for coating ingredient suppliers. |

| Growing Popularity of Plant-Based and Vegan Products | As plant-based diets rise, coatings must adapt to vegan formulations without compromising taste or functionality. This shift drives innovation in plant-derived coating ingredients |

| Pitfalls & Challenges | Impact |

| Volatility in Raw Material Prices | Fluctuating costs of key ingredients like cocoa, sugar, and oils impact profitability and pricing strategies, creating uncertainty for manufacturers |

| Regulatory Compliance and Labeling Requirements | Strict food safety standards and labeling norms across regions require continuous monitoring and adaptation, increasing operational complexity and compliance costs |

| Opportunities: | Impact |

| Rise of Clean Label and Natural Ingredients | Consumers increasingly demand transparency and healthier options, driving manufacturers to use natural, minimally processed ingredients in coatings. This trend emphasizes the removal of artificial additives and aligns with the growing preference for “clean label” products. |

| Market Leaders (2025) | |

| Market Leaders |

Market share of 8% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging country | China, India, Japan |

| Future outlook |

|

What are the growth opportunities in this market?

Food Coating Ingredients Market Trends

- Digital transformation and advanced material science are revolutionizing coating formulation methodologies, manufacturing processes, and quality control systems, enabling unprecedented precision, efficiency, and innovation velocity. Nanotechnology applications, including nanoencapsulation and nanocomposite reinforcement, enable controlled release of flavors, nutrients, and antimicrobial agents while improving barrier properties and mechanical strength. Nanostructured coatings can be engineered at molecular scales to achieve specific functional attributes including targeted bioactive delivery, enhanced adhesion, and improved moisture resistance.

- Artificial intelligence and machine learning platforms are optimizing formulation development, reducing development cycles from months to weeks while improving success rates and reducing material waste. Mondelez partnered with Thoughtworks to develop AI-driven recipe development systems that analyze vast datasets of ingredient interactions, processing parameters, and sensory outcomes to predict optimal formulations. Nestlé collaborates with AI firms on smart coating systems for real-time quality monitoring, using computer vision and sensor arrays to detect coating defects, measure thickness uniformity, and adjust process parameters dynamically. These AI systems continuously learn from production data, improving prediction accuracy and enabling predictive maintenance that reduces downtime and quality variability.

- Electrohydrodynamic atomization (EHDA) techniques, including electrospinning and electrospraying, create nanostructured coatings with enhanced functionality and novel properties. These processes use electric fields to atomize coating solutions into ultrafine droplets or fibers, creating high-surface-area structures with controlled porosity, enhanced adhesion, and tunable release characteristics. EHDA technologies enable coating of heat-sensitive bioactive compounds that would degrade under conventional thermal processing, expanding the range of functional ingredients that can be incorporated into coating systems.

Global Food Coating Ingredients Market Analysis

Learn more about the key segments shaping this market

Based on type the market is segmented as batter, breadcrumb, flour, starches, seasonings and spices, proteins, others.

- The flour segment captured roughly 20.9% of the market share in 2025. Flour serves as foundational ingredients across multiple applications including fried foods, baked goods, and processed foods. Wheat flour dominates this segment due to established supply chains, functional versatility, and cost competitiveness, though gluten-free alternatives including rice flour, chickpea flour, and specialty grain flours are gaining share driven by celiac disease awareness and gluten sensitivity concerns. World Bank projections show wheat prices declining 2% in 2025, though inventories remain tight, creating supply vulnerability. The gluten-free segment is growing at 3.5% CAGR, supported by FDA verification requirements below 20 parts per million and expanding consumer adoption beyond celiac sufferers. Flour functionality in coatings includes adhesion enhancement, moisture absorption, textural development, and browning characteristics that create appealing visual and sensory attributes. Innovation focuses on ancient grains, pulse flours, and functional flour blends that deliver clean-label positioning and nutritional enhancement.

Learn more about the key segments shaping this market

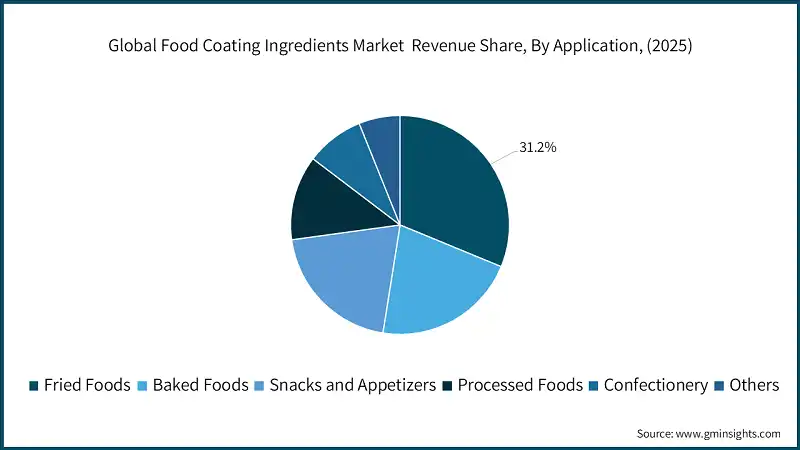

Based on application the market is segmented as fried foods, baked foods, snacks and appetizers, processed foods, confectionery, others.

- The fried foods represented about 31.2% of the market share in 2025, driven by quick-service restaurant expansion, frozen food category growth, and global appetite for fried chicken, french fries, onion rings, and breaded seafood. USDA data shows average ready-to-eat food purchases rose from 1.9 to 2.4 items per 30 days between 2007-08 and 2015-16, representing a 26% increase, with fried foods representing a significant portion of this consumption. Low-oil-absorption coating technologies have gained traction, with hydrocolloid-based systems like Caragum Fibrecoat® demonstrating significant fat uptake reduction, lowering calorie content while maintaining sensory appeal. McCain Foods' SureCrisp Max launch in April 2025 exemplifies innovation in fried food coatings, addressing foodservice operational efficiency and quality consistency requirements. The fried foods segment benefits from urbanization in Asia Pacific, where quick-service restaurant networks are expanding rapidly, and established consumption patterns in North America and Europe

- Baked foods is supported by artisan bakery trends, premium product positioning, and health-conscious consumer preferences for baked rather than fried alternatives. Coating applications in baked foods include glazes, egg washes, sugar coatings, and specialty toppings that enhance visual appeal, flavor, and textural contrast. Puratos opened a UHT bakery glaze facility in New Jersey in November 2025, producing plant-based, allergen-free alternatives to traditional egg washes

Looking for region specific data?

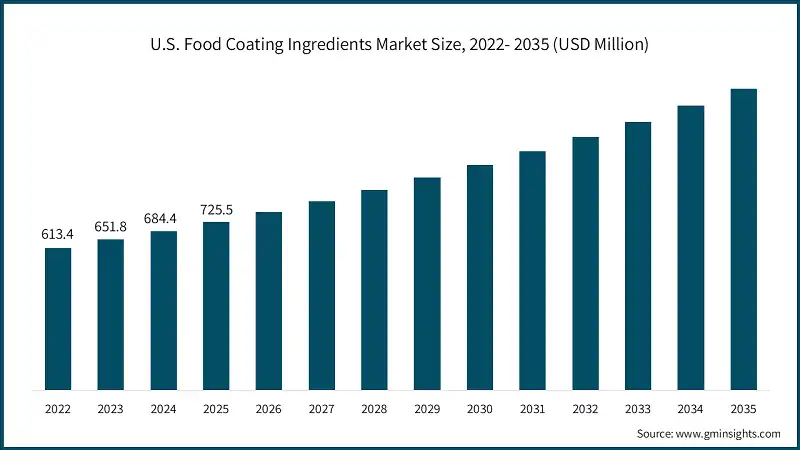

The U.S. food coating ingredients market was valued at USD 725.5 million in 2025 and estimated to cross USD 1.3 billion by 2035. North America holds around 24.1% of the market share in 2025.

- North America holds a significant share driven by quick-service restaurant dominance, frozen food category maturity, and consumer demand for natural and organic formulations. IFF announced a USD 70 million expansion in Cedar Rapids, Iowa in February 2025 for TAURA fruit pieces production, demonstrating continued manufacturing investment. Puratos opened a UHT bakery glaze facility in New Jersey in November 2025, incorporating heat recovery systems and reduced water consumption technologies. Paris Baguette is constructing a 37-acre manufacturing facility near Dallas-Fort Worth, reflecting capacity expansion in the baked goods segment. The region's regulatory framework, including FDA oversight and state-level requirements, drives formulation innovation and quality standards that often-set global benchmarks.

- Europe represents significant market share, characterized by rigorous regulatory standards, premium product positioning, and strong consumer preferences for traditional and artisan food products. IMCD acquired Tillmanns in Italy for EUR 143 million revenue in August 2025, demonstrating consolidation activity in European distribution. The European Food Safety Authority (EFSA) maintains more stringent toxicological assessment requirements compared to FDA GRAS standards, driving reformulation and creating market entry barriers. EFSA issued new guidelines in April 2024 limiting titanium dioxide in food coatings, requiring reformulation for EU market access. European consumers prioritize sustainability, ethical sourcing, and traditional production methods, creating opportunities for premium and specialty coating ingredients.

- Asia Pacific commands the largest regional market share, driven by rapid urbanization, rising disposable incomes, expanding food processing infrastructure, and growing quick-service restaurant networks across populous nations. China represents the highest country-level growth rate globally, supported by middle-class expansion, Western food adoption, and domestic food manufacturing modernization. India is driven by urbanization, health consciousness, and proliferation of organized retail and quick-service restaurants. Japan reflects a mature market with premium positioning, quality emphasis, and innovation in functional and health-oriented coatings. Cargill opened a cocoa production line in Gresik, Indonesia in October 2024, demonstrating multinational investment in Asia Pacific manufacturing capacity

Food Coating Ingredients Market Share

The food coating ingredients industry exhibits moderate fragmentation with the top five players (ADM, Cargill Incorporated, Kerry Group, Ingredion Incorporated, Tate & Lyle PLC) holding approximately 26% combined market share in 2025, indicating substantial opportunity for both established multinationals and specialized regional players. Archer Daniels Midland Company (ADM) leads the market with approximately 8% share, leveraging its extensive global ingredient portfolio, processing infrastructure spanning over 200 facilities worldwide, and innovation capabilities across starches, proteins, and specialty ingredients. ADM's market leadership stems from vertical integration across agricultural sourcing, ingredient processing, and technical application support, enabling cost competitiveness and consistent quality. Cargill Incorporated ranks among the top three players with significant market presence across proteins, starches, and specialty ingredients, supported by global manufacturing footprint and extensive customer relationships spanning food manufacturers and foodservice operators. Cargill opened a cocoa production line in Gresik, Indonesia in October 2024, expanding capacity in the Asia Pacific region.

Food Coating Ingredients Market Companies

Major players operating in the food coating ingredients industry are:

- Archer Daniels Midland Company (ADM)

- Cargill Incorporated

- Kerry Group

- Ingredion Incorporated

- Tate & Lyle PLC

- Ashland Global Holdings Inc

- PGP International, Inc (A Bunge Limited Company)

- Dohler Group

- Bowman Ingredients

- SensoryEffects (A division of Balchem Corporation)

- Bunge Limited

- Continental Mills, Inc

- Givaudan SA

- Kerry Taste & Nutrition

- ADM

- ADM is a global leader in food coating ingredients, offering a comprehensive range of emulsifiers, starch solutions, polyols, and hydrocolloids that enable ideal texture, viscosity, and stability in bakery, confectionery, snacks, and beverage products. Their clean-label portfolio—non?GMO, gluten-free, kosher—and strong North American soy lecithin heritage (since the 1940s) meet growing demand for transparent, plant-based ingredients. ADM supports innovation through consumer research, a global supply chain, and in-house formulation experts, tailoring functional texturants and coatings to customer needs.

- ADM is a global leader in food coating ingredients, offering a comprehensive range of emulsifiers, starch solutions, polyols, and hydrocolloids that enable ideal texture, viscosity, and stability in bakery, confectionery, snacks, and beverage products. Their clean-label portfolio—non?GMO, gluten-free, kosher—and strong North American soy lecithin heritage (since the 1940s) meet growing demand for transparent, plant-based ingredients. ADM supports innovation through consumer research, a global supply chain, and in-house formulation experts, tailoring functional texturants and coatings to customer needs.

- Cargill

- Cargill’s specialty food ingredients division includes a robust portfolio of coatings and enrobing systems, centered around cocoa, chocolate coatings, starch-based batters and breaders, and vegetable oils & fats essential for bakery, confectionery, snacks, and frozen foods. The company markets well-known coating continuums like Gerkens® cocoa powder and chocolate coatings, supported by integrated sustainability programs including the Cargill Cocoa Promise.

- Cargill’s specialty food ingredients division includes a robust portfolio of coatings and enrobing systems, centered around cocoa, chocolate coatings, starch-based batters and breaders, and vegetable oils & fats essential for bakery, confectionery, snacks, and frozen foods. The company markets well-known coating continuums like Gerkens® cocoa powder and chocolate coatings, supported by integrated sustainability programs including the Cargill Cocoa Promise.

- Kerry Group

- Kerry Group, under its Taste & Nutrition segment, provides advanced predusts, batters, and breaders for coatings—spanning indulgent to healthier clean-label profiles for fried and bakery applications. Their vertically integrated portfolio leverages flavor systems, savory extracts, and functional texturants to enhance crispiness, flavor, and mouthfeel in meat, seafood, snack, plant-based, and convenience foods. Backed by strong R&D, global production footprint (150+ countries), and expertise in flavor and texturant science, Kerry helps customers innovate coatings aligned with health, taste, and processing objectives.

- Kerry Group, under its Taste & Nutrition segment, provides advanced predusts, batters, and breaders for coatings—spanning indulgent to healthier clean-label profiles for fried and bakery applications. Their vertically integrated portfolio leverages flavor systems, savory extracts, and functional texturants to enhance crispiness, flavor, and mouthfeel in meat, seafood, snack, plant-based, and convenience foods. Backed by strong R&D, global production footprint (150+ countries), and expertise in flavor and texturant science, Kerry helps customers innovate coatings aligned with health, taste, and processing objectives.

Food Coating Ingredients Industry News

- In September 2025, Westfalia highlighted its partnership with AgroSustain, showcasing Afondo, a food-grade edible coating (bio vegetable oils + emulsifiers) designed to reduce water loss, extend storage and shelf life, and reduce fungicide use.

- In February 2025, Solina acquired Sokol, a producer of custom sweet & savory sauces (food manufacturing/retail/foodservice).

- In January 2025, Solina announced acquisition of AFS, a supplier of custom dry seasoning solutions and ingredient systems (meat/poultry, frozen foods, sauces, marinades).

The food coating ingredients market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Type

- Batter

- Breadcrumb

- Fine

- Medium

- Coarse

- Flour

- Wheat

- Rice

- Corn

- Others

- Starches

- Corn

- Potato

- Tapioca (cassava)

- Wheat

- Rice

- Seasonings and Spices

- Herbs

- Spices

- Blends

- Salt variants

- Proteins

- Animal

- Plant

- Others

Market, By Application

- Fried Foods

- Meat & Poultry

- Seafood

- Vegetables

- Cheese & Dairy

- Baked Foods

- Savory

- Sweet

- Snacks and Appetizers

- Processed Foods

- Confectionery

- Others

Market, By Distribution Channel

- Supermarkets/Hypermarket

- Retail stores

- Online retail

- E-commerce marketplaces

- Brand D2C

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Who are the key players in the food coating ingredients market?

Key players include Archer Daniels Midland Company (ADM), Cargill Incorporated, Kerry Group, Ingredion Incorporated, Tate & Lyle PLC, Ashland Global Holdings Inc, PGP International Inc, Dohler Group, Bowman Ingredients, SensoryEffects, Bunge Limited, Continental Mills Inc, Givaudan SA, and Kerry Taste & Nutrition.

Which region leads the food coating ingredients market?

The U.S. food coating ingredients market was valued at USD 725.5 million in 2025 and is projected to exceed USD 1.3 billion by 2035, with North America accounting for about 24.1% of the market share in 2025.

What are the upcoming trends in the food coating ingredients market?

Key trends include nanotechnology applications for controlled release, AI-driven recipe development systems, electrohydrodynamic atomization techniques, and clean-label formulations using natural emulsifiers and plant-based alternatives.

What is the valuation outlook for the U.S. market from 2025 to 2035?

The U.S. food coating ingredients market was valued at USD 725.5 million in 2025 and is estimated to cross USD 1.3 billion by 2035, supported by QSR dominance and clean-label demand.

What was the market share of the fried foods application segment in 2025?

The fried foods segment represented about 31.2% of the market share in 2025, driven by quick-service restaurant expansion, frozen food category growth, and global appetite for breaded products.

What is the market size of the food coating ingredients in 2025?

The market size exceeded USD 3.6 billion in 2025, with a CAGR of 6.4% expected through 2035 driven by demand for improved appearance, texture, flavor, and shelf life in food products.

What is the projected value of the food coating ingredients market by 2035?

The food coating ingredients market is expected to reach USD 6.7 billion by 2035, propelled by convenience food demand, clean-label trends, and expansion of the snack and confectionery industry.

What is the current food coating ingredients market size in 2026?

The market size is projected to reach USD 3.8 billion in 2026.

How much market share did the flour segment capture in 2025?

The flour segment captured roughly 20.9% of the market share in 2025, driven by its foundational role across fried foods, baked goods, and processed foods applications.

Food Coating Ingredients Market Scope

Related Reports